#What can investors learn from Apple's iPhone business strategy?

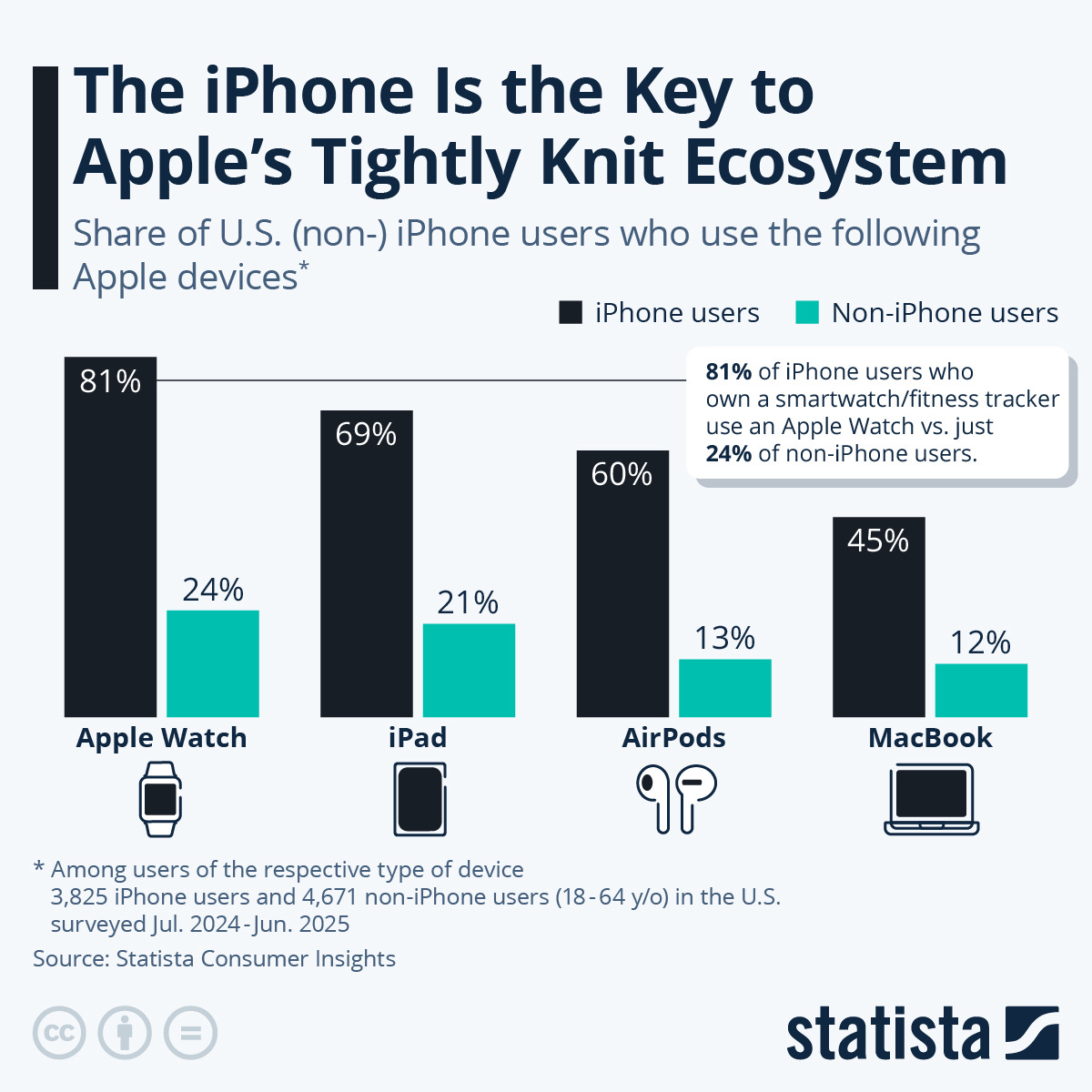

Apple’s new iPhone 17 lineup is more than just a product refresh. With a sleeker ultra-thin model and a $100 price increase on the Pro version, Apple is reinforcing its strategy of using the iPhone as a gateway into its tightly woven ecosystem. As data from Statista highlights, owning an iPhone dramatically increases the likelihood of consumers adopting other Apple products, from AirPods to Apple Watch, and layering on services such as iCloud, Music, and Fitness+.

Source: Statista

For investors, the lesson is clear: the most valuable companies build ecosystems, not standalone products. These ecosystems create customer lock-in, recurring revenues, and powerful pricing advantages. Apple may be the most visible example, but it is far from alone. Understanding this model can help investors identify other businesses with similar long-term potential.

#The Gateway Product

The iPhone is Apple’s cornerstone. Once a customer enters through this “gateway,” they are far more likely to purchase additional devices and services that sync seamlessly. The convenience and integration discourage switching to competitors, even when alternatives are cheaper.

Investor Lesson: Look for companies with a gateway product that naturally leads to broader adoption of services. Examples include:

Microsoft (NASDAQ: MSFT): Windows and Office subscriptions anchor users into Teams, Azure, and LinkedIn.

Amazon (NASDAQ: AMZN): Prime subscriptions tie together shopping, streaming, and cloud services.

Sony (NYSE: SONY): PlayStation consoles funnel users into exclusive games and PS Plus subscriptions.

#Subscription and Service Attach Rates

Apple has steadily shifted from relying on hardware sales to growing higher-margin services. Each iPhone sale represents not just immediate hardware revenue but also a stream of recurring income from apps, subscriptions, and cloud storage.

Investor Lesson: Seek companies that use hardware or core products to drive recurring revenue through subscriptions and services. Consider companies like:

Tesla (NASDAQ: TSLA): Vehicles lead to software upgrades, autopilot packages, and charging fees.

Peloton (NASDAQ: PTON): Fitness equipment connects customers to recurring training subscriptions.

Sony (NYSE: SONY): Console sales underpin digital game sales and recurring subscription revenue.

#Switching Costs and Stickiness

Switching from iPhone to Android isn’t just about the phone; it means losing seamless integration with the Apple Watch, AirPods, and iCloud. This creates high switching costs that keep users loyal.

Investor Lesson: Investigate businesses where leaving the ecosystem is difficult, costly, or disruptive.

Adobe (NASDAQ: ADBE): Creative Cloud dominates digital media, making it hard for professionals to move elsewhere.

Intuit (NASDAQ: INTU): Tax and accounting tools connect with payroll and lending, discouraging churn.

Oracle (NYSE: ORCL): Enterprise software becomes deeply embedded in customer operations.

#Consumer Loyalty and Pricing Power

Apple’s ability to raise the price of its premium iPhone models while maintaining demand illustrates strong pricing power. Customers stay loyal because the ecosystem enhances perceived value.

Investor Lesson: Target companies with brands and ecosystems that allow for premium pricing without losing customers. Here are some good examples:

LVMH (EPA: MC): Luxury houses with timeless appeal across fashion, beauty, and jewelry.

Nike (NYSE: NKE): Combining physical products with digital communities and apps builds loyalty.

Starbucks (NASDAQ: SBUX): Daily habits and rewards programs give Starbucks room to adjust pricing.

#Emerging Ecosystem Builders

Apple’s ecosystem took decades to perfect, but new entrants are trying to replicate this playbook. Investors should track younger companies where a core product could evolve into a platform with multiple revenue streams.

Investor Lesson: Identify early-stage or fast-growing companies constructing ecosystems around a core product. Some examples include:

Rivian (NASDAQ: RIVN): EVs serve as the entry point to software services and charging networks.

Spotify (NYSE: SPOT): Music subscriptions expand into podcasts, audiobooks, and creator monetization.

Sea Limited (NYSE: SE): Gaming (Garena) feeds into e-commerce (Shopee) and fintech (SeaMoney).

#The Bigger Picture for Investors

Apple’s story highlights a critical shift: companies that rely only on one-off sales face pressure, while those with integrated ecosystems create compounding customer lifetime value. Each new iPhone sold strengthens Apple’s services revenue, enhances loyalty, and increases switching costs.

For investors, this model provides a framework for investigation. When evaluating potential investments, ask:

What is the company’s gateway product?

Does it lead naturally to recurring services or add-ons?

How difficult is it for customers to switch away?

Does the brand command loyalty and pricing power?

Is the company still early in building out its ecosystem?

The answers can reveal whether a company has the potential to replicate the stickiness and profitability that have made Apple one of the most valuable firms in the world.