Applied Blockchain is seeking to raise $75m through an uplisting to the NASDAQ. This is not technically an IPO, but you might not have heard of the stock before, so we are going to analyse it as one just the same. There’s no concrete date for the company to join the NASDAQ yet, but it currently trades on the Pink Market under the symbol APLD.

B. Riley Securities is acting as book-running manager for the proposed offering.

#What is Applied Blockchain?

Applied Blockchain was founded in 2015 by enterprise software veteran Adi Ben-Ari, who now serves as CEO. Shortly afterwards, the firm's other primary figurehead, chief technology officer Francesco Canessa, joined the company.

At the start of its lifespan, Applied Blockchain was focused on cryptocurrency mining, before a change in circumstances led the team to pursue a slightly different opportunity. More on this shift in direction later.

At the time of writing, the share price stands at $3.72.

The company’s current major investors include Shell, QBN Capital and Calibrate Management.

#How does Applied Blockchain make money?

The company initially sought to make money by quickly attempting to create a large scale business that focused on mining Bitcoin and Ethereum. For a while, this plan progressed well and without difficulty.

However, Applied Blockchain encountered a bump in the road.

In mid-2021, Chinese authorities cracked down on cryptocurrency mining and transactions, forcing the business to move its operations. This led the company to enter a co-hosting agreement with Coinmint in July 2021.

This proved to be a source of inspiration for Applied Blockchain, as the company’s management noted there would be advantages to developing its own co-hosting sites.

Indeed, the company has even stated that it now expects to exit its mining operations in the future. In December 2021, Applied Blockchain even began selling some of the mining equipment it had purchased from Bitmain.

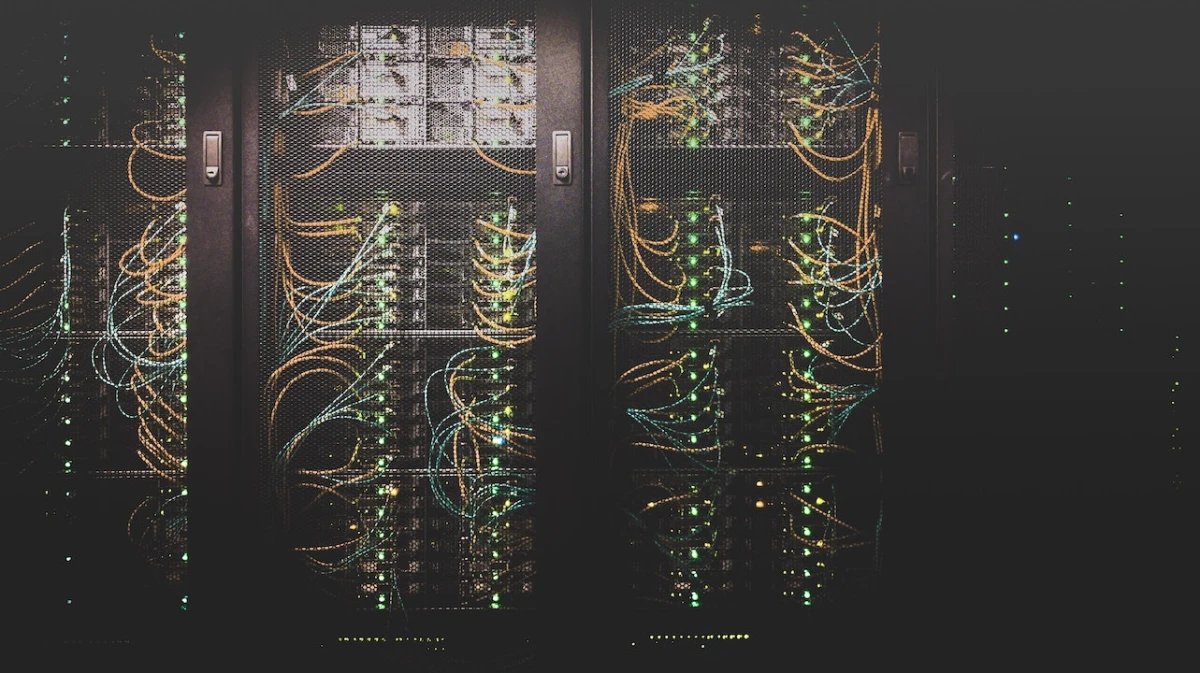

As such, the company is now largely focused on the construction of its next-generation data centers. These are designed to provide massive computing power, initially to crypto miners but eventually to hardware for applications such as artificial intelligence, machine learning and other blockchain networks.

In short, Applied Blockchain seeks to offer long term fixed rate contracts to customers looking for a hosting company which will provide full operational and maintenance services.

It has commenced construction on a facility in North Dakota and has entered into an agreement with four miners who will seek to use a total of 185MW of energy in their operations.

The company’s current target is to bring 780MW online in 2022, 1.5GW over the next two years and 5GW over the next five.

#How does Applied Blockchain stand out?

One of the company’s most touted advantages is its access to low-cost power through long-term agreements. This has been secured through its Amended and Restated Electric Service Agreement.

In turn, this allows the company to commit to longer term hosting agreements, which can last up to five years.

Next, there is the issue of equipment. Securing the best crypto mining margins can be highly dependent on having access to top-of-the-line equipment. As such, Applied Blockchain’s assertion that it can leverage its strategic partnerships to ensure it receives timely access to the highest quality equipment is a bold one.

If this does prove to be the case, then the company will have an easier time staying ahead of the game.

Then there’s the type of revenue being brought in by the hosting aspect of Applied Blockchain’s business. This gives the company reliable revenues that complement the more volatile income seen from its mining operations. This means the company enjoys steady cash flows that are not available to many competitors in the crypto mining space.

Additionally, the company is avoiding receiving payment for its services in the form of cryptocurrency, further limiting its exposure to crypto volatility.

#APLD risk factors

As with all companies, Applied Blockchain does face certain risks.

The company is, to a certain extent, exposed to the volatility of cryptocurrencies. Though it is less exposed than many of its peers due to its hosting services, the company is still reliant on cryptocurrency mining continuing to be a profitable endeavour.

Additionally, Applied Blockchain is heavily reliant on third parties for the sourcing of additional cryptocurrency mining equipment. A breakdown in the company’s relationship with these third parties could affect its ability to scale, especially given the current difficulties associated with sourcing crypto miners.

There is also the issue that the advanced data centers, which are the key to the company’s business, are not yet operational. This remains an idea, rather than something tangible which we know works well in practice.

#APLD’s financials

It is important to note that the company’s shares, listed on the Pink Market, have seen their price increase by over 7,000% in the past 12 months. However, this astronomical growth in share price is not exactly backed up by strong financials.

Indeed, Applied Blockchain was technically classed as a shell company until the end of November 2021, with the company having reported no revenue.

#Should you invest in APLD?

APLD might seem like a great way to invest in the crypto boom without having the fear of losing a chunk of your savings through a crypto crash. While investors might be shielded from this a bit, it’s worth noting that the company’s success is still heavily reliant on the popularity of crypto mining, as this is intrinsically linked to demand for its services.

Additionally, the company’s business plan seems smart, but speculative. Its advanced data centers could be a fantastic way to make money, but without a constructed facility in place there is still a lot that could go wrong and disrupt Applied Blockchain’s success.

Especially considering the current volatility of cryptocurrency, investing in APLD would be a big risk and you should not sink money you can’t afford to lose into the company’s shares.