Despite what the movie 'There Will Be Blood'* may have you think, there is a great deal more to successful oil production than finding some ground seepage, drilling a hole, and being Daniel Day-Lewis.

These days, there are numerous stages of drilling, each with its own set of risks, purposes, and costs. Investors must be aware of these before making any financial decisions on the back of well-related news and results. Here, we run through the most widely used types of well, outlining what each aims to achieve and where it sits on the eventual road to production.

#Before Drilling

Oil & gas companies must complete several critical exploration activities before even thinking about where to put a well. First-of-all, geologists identify areas that are likely to contain hydrocarbons based on things like existing nearby production and favorable geological conditions. Once a decision is made to enter an area, the firm must then obtain a license to search for oil and gas. A government-controlled licensing authority typically grants this, usually as part of a licensing round.

After getting the green light, the business will complete seismic surveys to map out geological structures and provide an early indication of the size of any potential accumulation present. At this point, the organization will either 'drill or drop' its location. If it chooses to drill, it will use the information it has gathered to scout out drilling locations before the well phase can finally begin.

It is worth noting that the duration of each of these initial stages, like any of the activities discussed in this article, should not be underestimated. When governments, regulatory bodies, and complex geologies are involved, firms always risk delays, cost overruns, and – unfortunately – being forced to drop their projects.

#Types of Oil Wells

When it comes to types of oil wells, we encounter a range of options. There are production wells, used for extracting oil, and injection wells, used for injecting water or gas to maintain pressure in an oil reservoir. Additionally, there are multilateral wells, which have multiple branches radiating from the main well, and smart wells, equipped with sensors and hydraulic valves to control the extraction process remotely.

The term "different types of wells" doesn't limit itself to oil and gas. In agriculture, irrigation wells provide essential water supply for crops. In residential settings, people often use water wells for their daily needs. Each type of well serves a specific purpose, and the technology behind each continues to evolve, making resource extraction and utilization more efficient than ever before.

However, when it comes to oil and gas there are also different types of wells.

#Exploration Well

Often referred to as 'wildcat wells,' exploration wells represent the first stage of a company's drilling efforts. These tend to be the highest-risk wells in terms of failure versus success. While the rewards can be huge, the number of wildcat wells that lead to commercial discoveries can be fewer than 1 in 15.

Wildcat wells are usually drilled to find out if any oil or gas is present in an unproven location. However, they can also be used to extend the limits of a known pool. As such, these wells can often attract the most investor interest in the small-cap world as speculators chase vast profits on the next big oil strike.

The wells, which are used in both new areas and untested sites within areas with existing hydrocarbon output, are not used for production. Instead, they are used to make a discovery and build on existing groundwork in areas like rock and fluid properties, initial reservoir pressure, and reservoir productivity. It typically takes around five years for a petroleum discovery made by an exploration well to reach production.

#Appraisal Well

An oil and gas company will typically go on to drill an appraisal well once a discovery has been made. The wells, which have a higher chance of success and are more expensive than exploration wells, are used to determine the size of an oil gas field (both physically and in terms of its reserves) and its expected production rate. They are also used by a company when looking at the most efficient way of developing a discovery or whether it makes economic sense to drill at all.

Appraisal wells can offer the best risk/reward ratios when speculating on drill outcomes.

#Development Well

Once a hydrocarbon accumulation has been discovered, analyzed, and deemed economical, a business will move into the final phase – drilling a development well. These wells typically have a much higher chance of success than those previously mentioned. However, they are also very expensive, costing anywhere from $1m to $9m each. This is because they are broader and deeper than exploration or appraisal wells, and their life cycle and operational period is significantly longer.

Simply put, development wells are drilled for the production of oil or gas. A business will attempt to maximize its wells' economic production by using all of the data collected from its previous work to drill to depths it considers likely to be most productive.

In the energy sector, development wells play a crucial role in the extraction of oil and gas. Unlike exploratory wells, which aim to discover new reserves, development wells target known reservoirs. These wells optimize the production process, ensuring that companies can extract resources efficiently and economically.

#Types of Drilling Wells

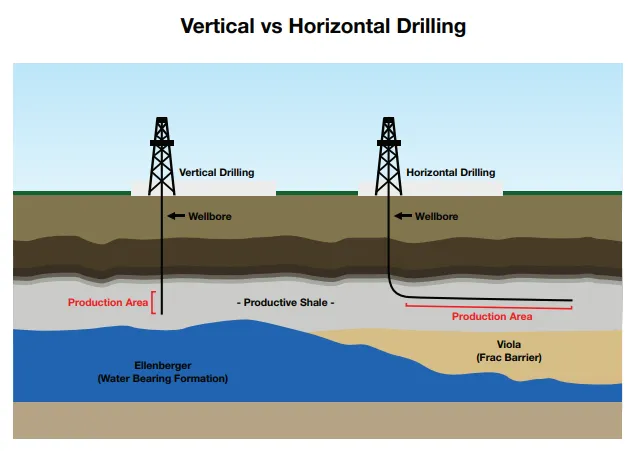

Vertical drilling remains the traditional method, where the drill goes straight down into the earth.

Horizontal drilling, on the other hand, allows for a lateral approach, reaching reservoirs that vertical drilling can't access. This innovation has revolutionized the way companies tap into oil and gas reserves.

#Other Types of Well

Exploration, appraisal, and development wells are the industry's most commonly discussed types of wells.

However, the unpredictability associated with drilling for oil means has resulted in the creation of many other types of specialist wells. These allow firms to work around particular geological issues in their projects as they arise. Here are several examples:

Sidetrack wells are used when a well has already been drilled or part-drilled, but there is a need to drill out of one side of a well to a different target. There are many reasons for doing this. For example, a section of the original well may have been rendered unusable by an irretrievable object such as a fish or collapsed wellbore.

Another reason could be that all the hydrocarbons present at the original wellbore have now been depleted, making it necessary for a business to deviate from its well's casing and head towards a new target.

Relief wells are used to stem oil or gas flow from a separate, damaged well. Firms will often base these wells at some distance from the damaged well before using directional drilling to intersect the damaged well at a great depth. Specialized liquid like heavy drilling mud or cement is then pumped into the damaged well to stem any unwanted flow.

Injection wells are used to place fluid or gas underground into porous geologic formations. Anything from water to carbon dioxide can be injected into anything from deep sandstone to shallow soil layers for purposes such as enhancing oil production, waste disposal, and the prevention of saltwater intrusion.

Horizontal wells are becoming an increasingly popular alternative to traditional vertical wells. Rather than terminate drilling once its well has reached its desired depth, a firm operating a horizontal well will rotate its drill bit by 90 degrees and continue to drill along its target horizon horizontally for up to 10,000 feet.

Horizontal drilling is often combined with hydraulic fracturing – or 'fracking' – a process in which vast amounts of fracturing fluid are pumped into a well at very high pressure. This pressurized mixture cracks the rock and widens existing fractures so contained oil and gas can flow freely to the surface.

#Benefits of Horizontal Drilling

The benefits of horizontal drilling in combination with hydraulic fracturing are perhaps best thought of relative to vertical drilling. First of all, it is essential to understand that most oil and gas reservoirs are more extensive in their horizontal dimensions than in their vertical. So, when a vertical well enters directly into a 100ft-thick, hydrocarbon-bearing formation, any recovery will be limited solely to the oil and gas that flows into that minimal area of penetration.

A horizontal drill, on the other hand, penetrates the formation horizontally from this point, providing the wellbore with exposure to thousands of feet of the additional reservoir rock. In areas with low permeability, this additional exposure can lead to a horizontal well's total recovery rate being as much as ten times that of a vertical well. In most cases, this increased productivity is more than enough to mitigate the additional costs of drilling a horizontal well, which can be up to 300 times more expensive.

When scaled up, this concept brings numerous additional cost benefits. For example, as the diagram above shows, multiple vertical wells would be required to cover the same amount of a target horizon as one horizontal well.

Not only would vertical wells end up being more expensive and worse for the environment in this situation, but they would still be less effective. This is because the horizontal well can also add production from the spacing between the vertical wells and enjoy higher levels of pressure due to the presence of just one hole.

In areas of stacked pay like the Permian Basin, producers can also drill multiple horizontal wells in one area to target individual formations at different depths. As well as compounding the resource potential of each acre of surface ground, it allows for massive economies of scale as multiple wells from a single pad can target different zones while sharing infrastructure and services. Today, this enables producers to draw resources from multiple rock layers above and below those from which they have been pulling conventional oil for decades.

#Complex Drilling

Extended Reach Drilling (ERD) is a long, deviated horizontal well. ERD, also known as long-reach drilling, is a technique used in the oil and gas industry to increase the reach of drilling equipment. It involves using specially designed drilling rigs and equipment to drill horizontally for longer distances, allowing for the exploration and production of oil and gas deposits that would otherwise be inaccessible.

This technique can help to increase the efficiency of oil and gas operations, as well as reduce the environmental impact of drilling by reducing the number of wells needed to access a particular deposit.

Managed Pressure Drilling (MPD) is where constant pressure is applied to the well using a pump and specialist equipment. It makes for a very technical operation as a huge rig up is required.

The MPD pressure that is applied is essential to maintain well control. These formations tend to be on balance. Therefore, it's very each to have a kick or total losses.

High Pressure, High Temperature (HPHT) is similar to MPD. It is also complex and challenging to maintain control of formation stability.

Then there are also complicated geological conditions, salt domes, and brine flows to consider.

The Zechstein area of the Southern North Sea is very tricky, where there are unstable high pressurized zones/pockets where sometimes flows have to be controlled or fingerprinted, and an accepted flow rate will be measured. The well will continue to be drilled while the brine is flowing, but this complicates everything as the drilling fluid, and its properties get washed out.

Variation in drilling complications is endless.

#The Value of Offset Data

An established drilling area, like the North Sea, where there is abundant data from previous years of drilling, increases its chances of successful drilling. Whereas a wildcat well being drilled in a far-flung location with limited offset data makes for a far riskier prospect.

However, highly established pay zones/reservoirs can still have nothing there and could present a sign that established reserves are depleting.

#Rounding up

As can be seen, different wells should be treated in different ways. For example, a successful exploration well may be exciting, but many barriers still stand in the way of eventual production.

Likewise, the news that a development well has come up dry, while unlikely, is far more devastating than news of a failed exploration well from an economic perspective. Resource investors need to be aware of the significance and context of any drilling update before handing over or withdrawing their cash.

#Next Steps

We hope that you found our guide on the different types of wells used by oil & gas companies informative. The challenge of finding high-quality oil and gas reserves makes investing in this sector an exciting opportunity. Focusing on exploration and production (E&P) stocks can be particularly rewarding, as they are directly involved in locating and extracting these valuable resources.

Furthermore, investing in oil and gas midstream stocks is often attractive to investors seeking steady income streams, as they typically offer higher dividend yields than other sectors.

To further expand your knowledge and enhance your investment strategies, we recommend delving into one of our other informative investing guides. Topics include The Challenge of Finding High-Quality Oil and Gas Reserves and our guide to investing in oil and gas stocks.

#There Will Be Blood Movie Reference

*There Will Be Blood is a 2007 American drama film written and directed by Paul Thomas Anderson. The film stars Daniel Day-Lewis as a ruthless oil prospector named Daniel Plainview, who will stop at nothing to achieve his goals.

The story is set in the early 20th century and follows Plainview as he becomes increasingly wealthy and powerful but also more isolated and paranoid. As he drills for oil in California, he clashes with a local religious leader, and the film explores themes of greed, family, religion, and power.