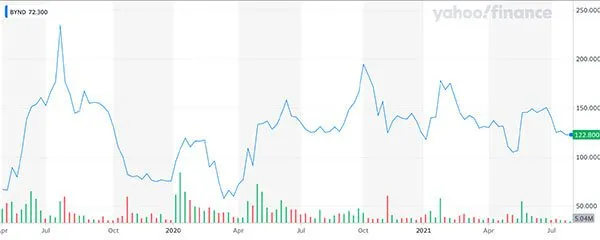

Fake meat company Beyond Meat (NASDAQ: BYND) has had a tough year. Its stock price has endured extreme volatility, with an overall decline of 7.4%. It’s up 83% since its May 2019 IPO and down 27% in the past six months.

Now Beyond Meat is due to report its Q2 earnings after hours on August 5.

#$BYND Q2 estimates

Consensus estimates are expecting average sales of $142.62m, up 25.8% year-over-year. Analysts are also forecasting a loss of 23 cents per share.

Meanwhile, in Q2, Beyond Meat management expects net revenues to come in between $135m and $150m. This would mark a year-over-year increase of between 19% and 32%.

So, with climate change high on global agendas, is the shift to plant-based foods still as prominent as it was before the pandemic? Or is interest waning?

Traditional meat consumption is carbon-intensive, driving the plant-based narrative. But whether it’s enough to get individuals to make the switch remains to be seen.

#Competition and mounting costs

Beyond Meat surged in popularity thanks to its first-mover advantage and successful product launches, but it’s since facing rising competition and mounting costs.

Major competitors include private companies Impossible Foods, Eat JUST, and Cargill, along with publicly traded entities Kellogg (NYSE: K), Nestle (SWX: NESN), Plant & Co Brands (CNSX: VEGN), and Tattooed Chef (NASDAQ: TTCF), to name a few.

Plant-based protein is manufactured, so costs include the manufacturing process, distribution, warehouse storage, marketing, and of course, all the individual ingredients.

Ingredients such as mung beans or pea protein, fruit and vegetable extracts, and canola and coconut oils are not cheap.

#Does it have what it takes to keep shareholders happy?

Beyond Meat has been nurturing further restaurant deals and partnerships. This year it joined forces with PepsiCo (NASDAQ: PEP), Pizza Hut in the UK, Panda Express, and now Hopdoddy’s.

The company is also introducing plant-based protein-derived chicken nuggets to nearly 1,000 A&W Canada (TSX: AW-UN) fast-food restaurants. This is a limited promotional activity to test customer reaction to the product.

Deanna Jurgens, Chief Growth Officer, Beyond Meat, said:

“We’ve doubled down on plant-based chicken this summer, just as consumer demand for chicken is skyrocketing. Following the success of our partnership on the Beyond Burger, we’re proud to be working with A&W Canada to debut Beyond Meat Nuggets in Canada.”

Retail channels are rising as Beyond Meat penetrates global markets through supermarket and grocery store distribution and restaurants.

But the restaurant closures over the past year have led to losses. That makes the ongoing Covid-19 uncertainty a persistent threat to profits.

For Beyond Meat to be more than a fad, consumers need to love the product and commit to repeat purchasing.

So far, it would seem consumers do indeed respond well to its growing range of product offerings. Plus, the reopening and vaccine rollout could help it thrive in busy fast food venues.

However, with a market cap knocking on $8bn, it’s a lot to live up to. It’s been hyped by Reddit’s wallstreetbets traders in the past, which has many believing it’s now trading far above fair value.

According to Koyfin data, analysts have a consensus 12-Month average target of $122.79 on the Beyond Meat share price. That’s close to where it is today.

Those taking a more bullish stance see it soaring above $200, while the bearish analysts see a downward trend to $70.

Beyond Meat stock is present in 78 ETFs indicating that institutional investors do like it.

The company is on a mission to grow, and it’s battling several challenges along the way. As long as consumers continue to respond well to the product, it has a shot at a bright future ahead.

Nevertheless, considering its ongoing volatility, this is not a stock for the faint of heart.