Gold and copper-development company SolGold (LSE & TSX:SOLG) is entering a transformational phase.

There is already a great deal of fundamental value underpinning this Ecuador-focused firm’s £528 million market cap, and this could be about to increase substantially if the company secures its US$150 million royalty financing with Franco Nevada.

Announced on 11 May, this financing package could prime SolGold for exciting growth over the coming years.

With its strong leadership, the world-class Alpala copper-gold project on its books, and potentially over US$200 million in working capital in its war chest, SolGold will present an extremely enticing investment opportunity in this exceptionally bullish climate.

It is no wonder the company has also secured backing from the likes of BHP Billiton and Newcrest.

SolGold is set to take Alpala through to definitive feasibility at the perfect time, with impressive expected metallurgical recovery rates pushing the project’s value to all-time highs.

With plenty of third parties already showing interest in financing the project through to production, CEO Nick Mather believes SolGold still has much further to run following an impressive rise in the company’s stock to 25.7p since March (as at 01/09/2020).

Maximising value at Alpala

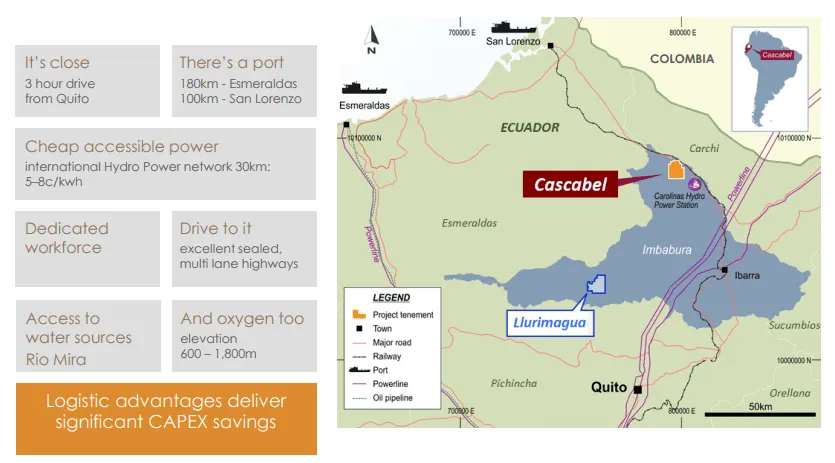

Alpala is a tier-one gold-copper-silver property surrounded by cities and roads, cheap power, and a skilled local workforce in Ecuador, a country working to shift the focus of its economy away from oil and into mining.

As well as its prime location, Alpala boasts some of the world’s highest-grade porphyry copper-gold intersections, with highlights including 1,344m at 2.1% copper and 3.5g/t gold and 821m at 18% copper and 1g/t gold with a long mine-life predicted.

These encouraging figures have already attracted large backing from mining institutions like BHP Billiton and Newcrest – who both own 13.6% of SolGold – and asset managers like BlackRock, a 5.2% stakeholder.

However, thanks to major market and company developments, Mather says the investment case for both Alpala and SolGold now looks better than ever.

Gold prices now sit far above prices used in previous estimations for the Alpala project, this thanks to one of the strongest precious metal bull markets in recorded history. Not only did gold break through US$2,000/oz for the first time in August, but analysts believe sustained global uncertainty will drive spot prices even higher – Goldman sees gold running up to US$2,300/oz in the next year.

Mather says these favourable conditions increase Alpala’s value enormously, placing more and more fundamental value under SolGold’s market valuation. Speaking exclusively to ValueTheMarkets.com, he adds that the production of gold at these prices would be so lucrative that it would even cover the production of copper in full:

“We’ve got some 23Moz of gold in this project, and the higher the gold price goes, the more lucrative that gold production will be. There’s also obviously a very good outlook for the copper price. You’re getting to the stage where you can produce one metal, and it’ll pay for the free production of the other one in this project, which is a very handy thing from a financing point of view.”

Expanding on this, Alpala received a game-changing update last October when SolGold announced significantly enhanced rates of gold and copper recovery through new metallurgical testing.

Mather tells us the net effect of these two factors is to boost Alpala’s attractiveness greatly. He went on to say:

“Using better metal price inputs and better recoveries for gold should really enhance this project, there are few, if any, investible mining opportunities of this scale and stage on the global market.”

Triggering a substantial value event

So, with Alpala’s potential value at record highs, what might drive further market interest in SolGold moving forward?

Mather believes the key lies in the project’s financing and development.

Through March and May, SolGold soared from 10.4p to higher than 28p after updating the market on the encouraging progress it was making in financing discussions for an Alpala definitive feasibility study (“DFS”). This reached a head with news of a US$100 million royalty financing package million (with the potential to upscale to US$150 million) agreed with world-renowned royalty and streaming company Franco-Nevada.

Mather tells us that he expects financing to complete with Franco-Nevada imminently. At this point, SolGold will have in place the funds needed to take Alpala right through to development distribution, updating investors on the way.

Following this, the chief executive is very confident that SolGold can maintain the momentum built up by its DFS by moving quickly into project development. Not only has Franco-Nevada already indicated an interest in financing mine development at Alpala via a gold stream, but the firm has received ten qualifying bids for the offtake of metal concentrate from the project:

“We are encouraged by Franco-Nevada’s enthusiasm, and we’re very confident that the offtake parties will be very interested in providing forward funding for us – those discussions are ongoing and developing. The higher the metal prices go, the bigger our margins and the more confident bankers will be about doing a lot more of this project with debt and offtake related instruments than us having to rely on equity,” he explains.

“We’ve got the perfect project, we’ve got gold going up, we’ve got copper mining increasing globally, we’ve got a country that’s determined to build a mining industry, and we’ve got a location where there’s tremendous logistics support. It’s a perfect set of circumstances.”

The next months and years will be very exciting for SolGold and its shareholders if Mather is correct.

Thanks to the underlying strength of its flagship project and its hefty institutional support, the firm already presents an attractive investment proposition.

However, the closer SolGold can take this world-class asset to production (especially in this perfect macro environment) the more promising the potential for a significant positive rerate in the company’s stock.