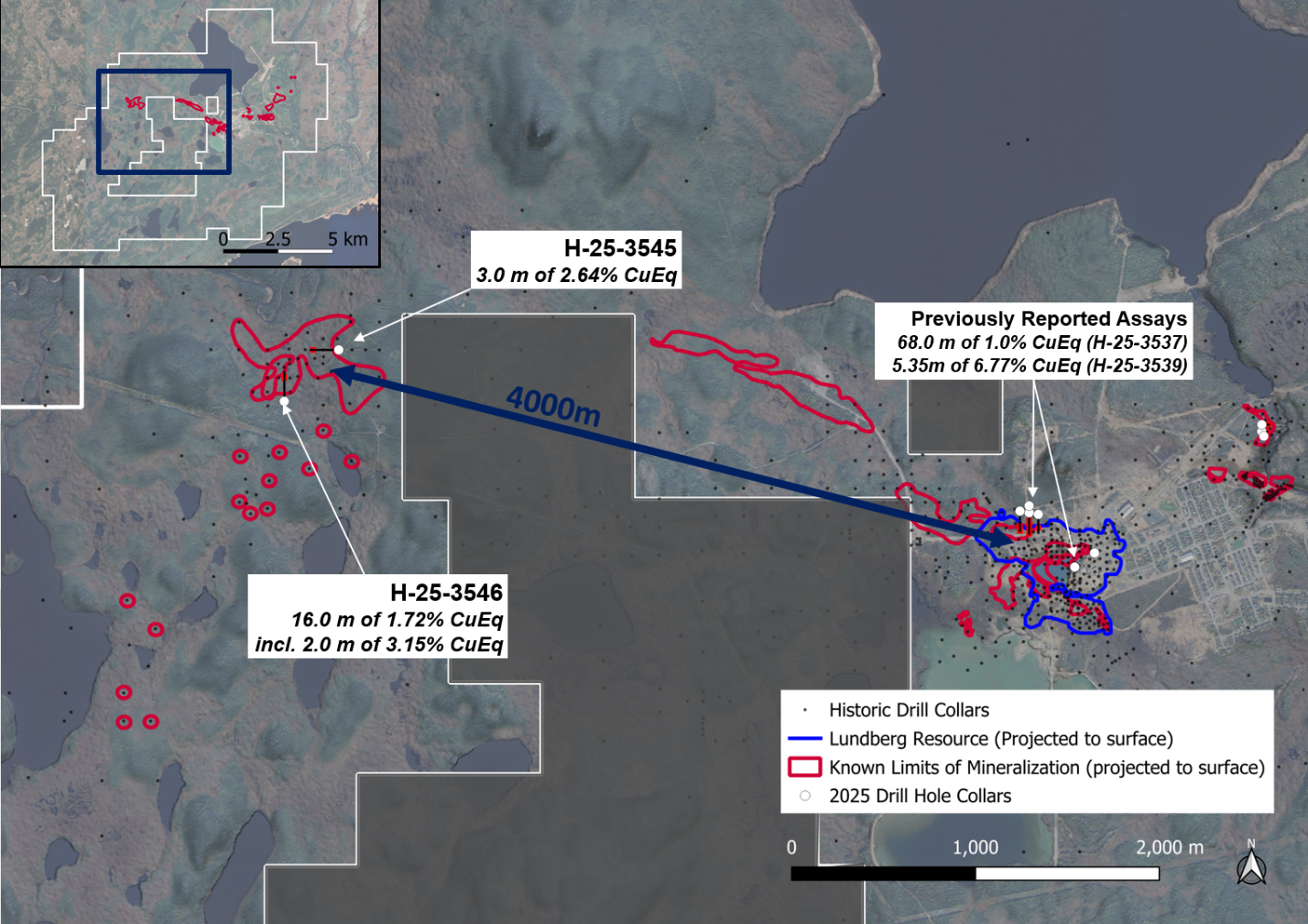

Canterra Minerals Corp. (TSX-V: CTM) (OTCQB: CTMCF) has provided investors with an update on high-grade success at its Clementine prospect. Undertaking first-pass drilling at Clementine, it intersected 16 meters of 1.72% CuEq, including higher-grade zones up to 3.15% CuEq over 2 meters at one hole. At the second hole, it returned 2.64% CuEq over 3 meters, including 4.02% CuEq over 1 meter. These results confirm the presence of classic Buchans-style mineralization, only 4km northwest of the Lundberg Deposit and the past-producing Buchans Mine.

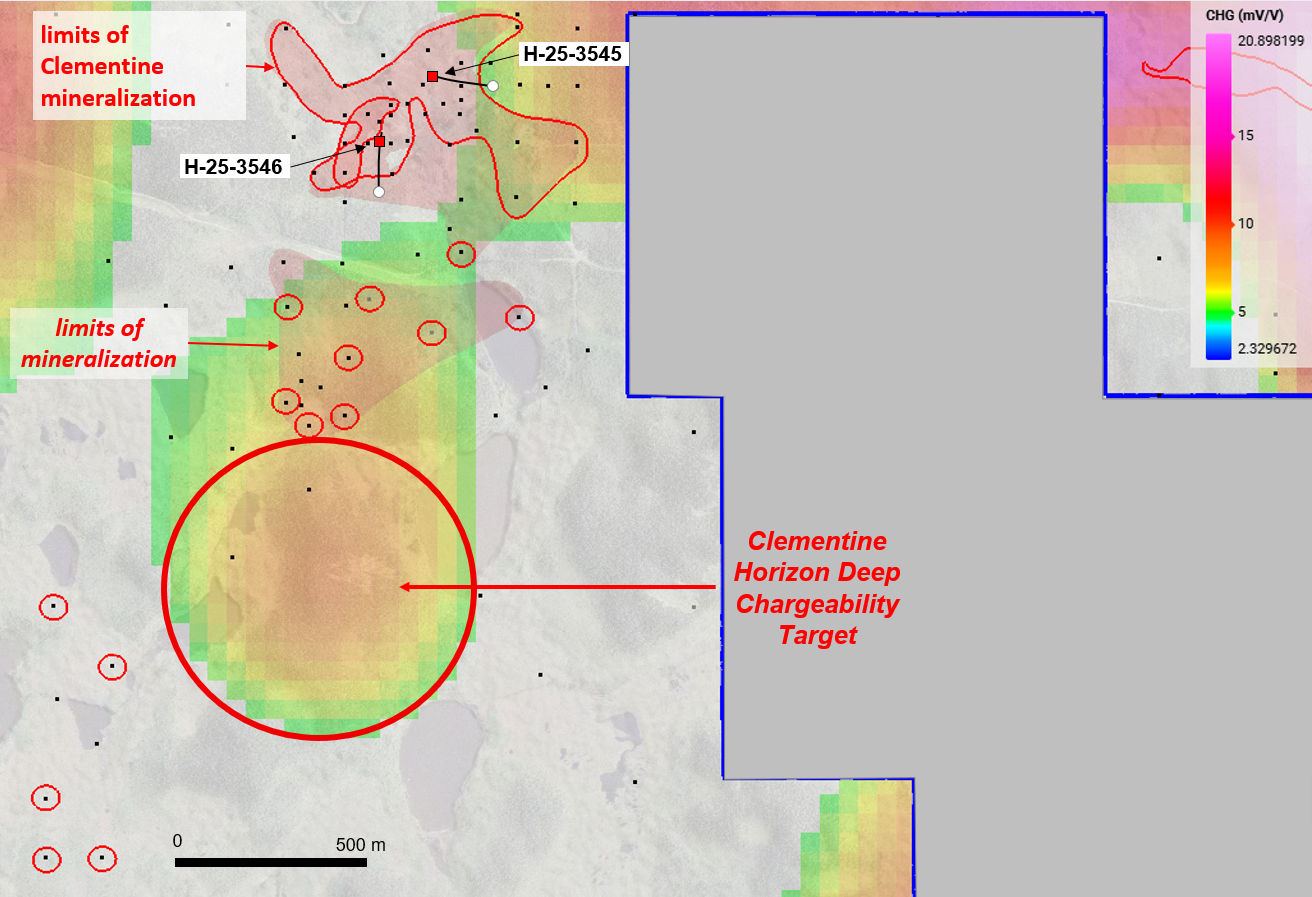

Strengthening the case for scale and boosting the team’s enthusiasm for further discovery, these results coincide with a large, untested chargeability anomaly from Canterra’s recently completed deep-penetrating 3D IP survey. A chargeability anomaly is a geophysical signal that indicates where rocks retain an electrical charge longer than usual, often suggesting the presence of metal sulphides, such as copper or zinc. Because these signals are frequently associated with mineralization, the anomaly immediately south of Clementine points to the potential for a larger zone of mineralization.

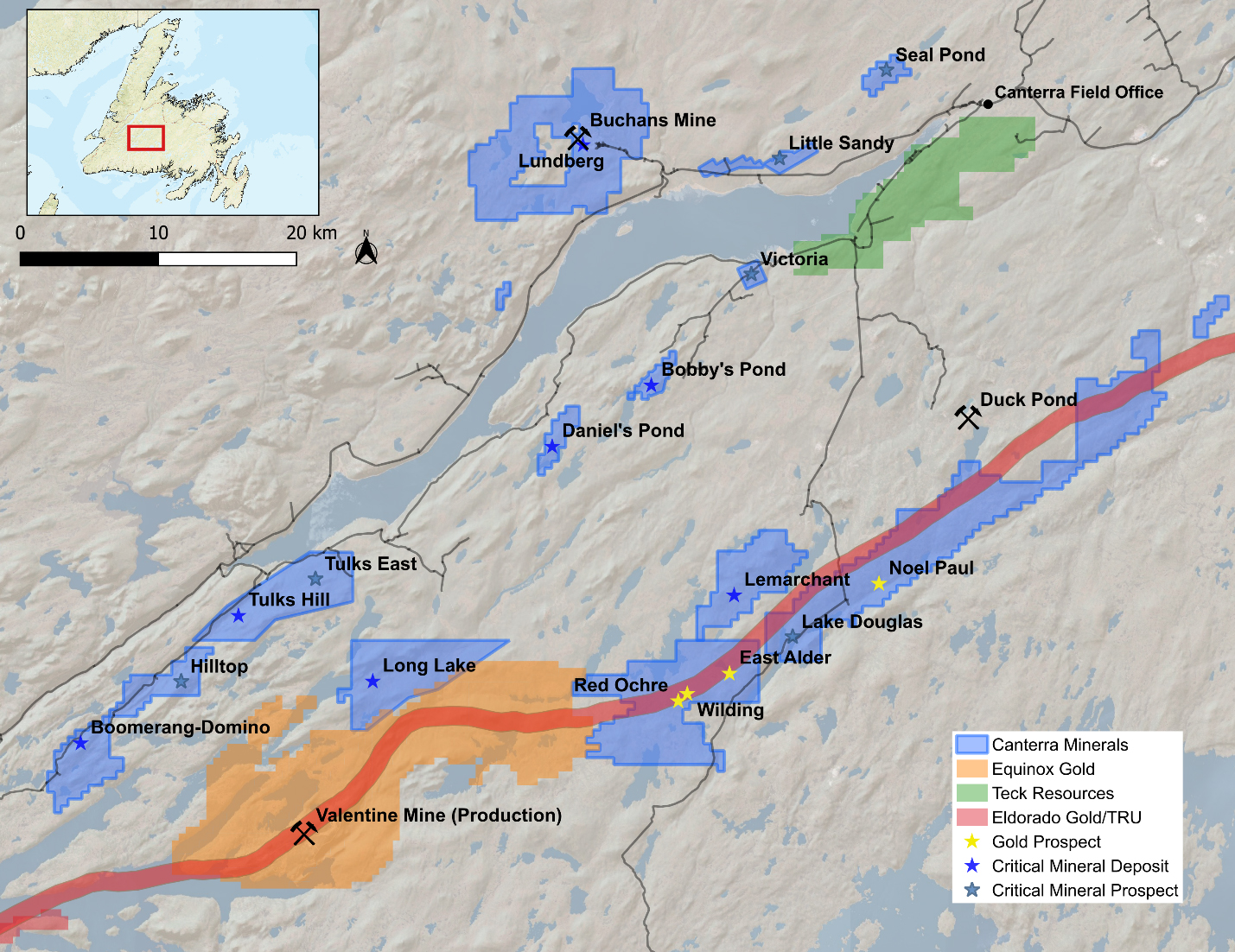

In response to these positive results, Canterra has elevated Clementine to a top-priority target, mobilized a second drill rig to the site, and is carrying out immediate follow-up drilling to test extensions of the discovery. These efforts form part of the company’s 10,000-metre 2025 drill program at the Buchans Project, strategically located near Equinox Gold’s Valentine Gold Mine and Teck’s past-producing Duck Pond Mine.

Chris Pennimpede, CEO of Canterra Minerals, stressed the significance of the Clementine discovery, stating:

These first results from Clementine validate our exploration model and belief that our Buchans Project has the potential to host multiple high-grade mineralized zones. We have confirmed thick, high-grade Buchans-style mineralization at the edge of the known system, with the potential for more continuous zones. Just as importantly, the correlation with a large IP anomaly to the south gives us a compelling large-scale target to test. This elevates Clementine on our priority list, and we are moving quickly to test the anomaly in the current phase of 2025 drilling.

Learn more about Canterra Minerals’ exploration activities.

Clementine Prospect Initial Highlights Include:

1.72% CuEq over 16m, including 3.15% CuEq over 2m

2.64% CuEq over 3m, including 4.02% CuEq over 1m

Confirms high-grade, classic Buchans-style mineralization in an underexplored area

Results include gold and silver credits, which are common in Buchan-style mineralization

Expands prospectivity south of the prospect where newly generated 3D IP geophysical anomalies identify priority targets for follow-up drilling.

Figure 1. Plan Map of Clementine Prospect, showing 2025 drillhole locations and assay highlights. Red line - limits of known mineralization. Blue outline – Lundberg Mineral Resource outline.

Building on these results, Canterra has outlined immediate follow-up drilling to test the continuity and scale of mineralization at Clementine, with particular emphasis on the Clementine South area. Recent 3D IP surveys have highlighted several positive, untested targets here, showing chargeability responses similar to those linked with the mineralization in the first hole H-25-3546. At the same time, the company’s 10,000-metre drill program remains active across the broader Buchans Project, targeting other high-priority areas for discovery.

Figure 2. Plan Map Highlighting Clementine Drill Locations relative to deep 3D IP Geophysical Anomalies targeted in the ongoing 2025 drill campaign. Limits of known mineralization projected vertically to surface. Map shows chargeability response at ~700m below surface.

The Buchans Project covers 95 km² near the town of Buchans and is anchored by the undeveloped Lundberg deposit, a significant near-surface stockwork sulphide resource with strong potential for open-pit development. Together with new discoveries like Clementine, the project offers considerable scale and growth potential in a proven mineral district.

#About Canterra Minerals

Canterra Minerals has consolidated 100% of the copper-gold deposits (excluding the adjacent Valentine mine) in central Newfoundland, a first in the district’s history. Management believes this gives the company leverage over future discoveries in a historically prolific but fragmented mining camp.

Its projects are located near historic mines that produced copper, zinc, lead, silver, and gold. Its gold assets lie along a 60 km trend connected to Equinox Gold’s Valentine Mine. Canterra’s position in this emerging district places it early in the exploration cycle, as Newfoundland experiences renewed interest driven by recent high-grade gold discoveries.

Recent highlights include record gold samples of up to 535 g/t Au, with expanded mineralization, at Canterra’s Wilding Gold Project on September 8, 2025, and the identification of large new drill targets with the start of Phase 3 discovery drilling at the Buchans Project on September 3, 2025.

Figure 3. Map of Canterra’s Central Newfoundland Mining District properties.

With two active drill programs, multiple new targets, and discoveries that continue to validate its exploration model, Canterra is positioned to advance some of Newfoundland’s most prospective copper-gold assets. The combination of high-grade results, large-scale anomalies, and district-wide consolidation sets the stage for strong news flow in the months ahead.

Explore the Canterra Minerals stock report now.

#FAQs for Retail Investors

What makes the Clementine discovery significant?

Clementine has delivered high-grade, Buchans-style copper-gold mineralization in an underexplored area, highlighting the opportunity to uncover additional zones near one of the world’s most historic base metal camps.

How does this connect to the Buchans Project as a whole?

Clementine is one of several targets within the 95 km² Buchans Project, which also hosts the undeveloped Lundberg deposit. Together, they demonstrate both discovery momentum and development scale within the project.

What is the importance of the 3D IP survey?

The deep-penetrating 3D IP survey has outlined several strong chargeability anomalies, including one immediately south of Clementine. A chargeability anomaly is a geophysical signal showing where rocks hold an electrical charge longer than usual, often indicating the presence of metal sulphides such as copper or zinc. Because these signals are frequently associated with mineralization, they represent high-priority drill targets that may expand the known system.

Why add a second drill rig now?

A second drill rig has been mobilized to advance the 10,000-metre program, allowing Canterra to test more targets quickly and generate steady exploration results.

What other assets does Canterra hold?

Alongside Buchans, Canterra owns the Wilding Gold Project, where record samples up to 535 g/t Au were recently reported, as well as district-scale ground along the Valentine Mine trend, offering further discovery opportunities.

What’s the investment case for Canterra?

Canterra controls a consolidated copper-gold district in central Newfoundland, anchored by high-grade results from Clementine and supported by the Lundberg deposit. This provides investors with exposure to both near-term discovery potential and district-scale growth.

What are the near-term catalysts for shareholders?

Near-term catalysts include ongoing drilling at Clementine and the Phase 3 program, which is now testing several large, untested 3D IP anomalies across the Buchans Project, including Clementine South, Sandfill Deep, West Clementine, and the Nu Area. These high-priority targets lie below the depth of historic drilling and display strong geophysical signatures commonly linked to sulphide mineralization. In parallel, recent record gold sample results at Wilding add confidence to the company’s broader exploration portfolio.