President Joe Biden said the Kremlin is exploring options for carrying out cyber-attacks against the United States. He urged American businesses to strengthen the security of America's private sector. This comes amid the chaos of the Russian war on Ukraine.

The warning has raised interest in cybersecurity stocks as a potential investment.

Here are some US-listed cybersecurity stocks to have on your radar.

Company | Ticker | Market Cap | P/E | P/BV | P/S | Analyst Consensus |

|---|---|---|---|---|---|---|

Microsoft Corp | (NASDAQ: MSFT) | $2.2tn | 33.6 | 14.3 | 12.3 | Buy |

Palo Alto Networks | (NASDAQ: PANW) | $56.8bn | 61.2 | 9 | Buy | |

Fortinet | (NASDAQ: FTNT) | $50.5bn | 99 | 74.5 | 18 | Overweight |

CrowdStrike Holdings | (NASDAQ: CRWD) | $47.1bn | 40.6 | 28.3 | Buy | |

Zscaler | (NASDAQ: ZS) | $31.1bn | 61.8 | 47.5 | Overweight | |

CloudFlare | (NYSE: NET) | $33bn | 52.4 | 62.6 | Overweight | |

OKTA | (NASDAQ: OKTA) | $26.5bn | 5.2 | 22.5 | Buy | |

Check Point Software | (NASDAQ: CHKP) | $18.1bn | 19 | 7.2 | Hold | |

NortonLifeLock | (NASDAQ: NLOK) | $15.8bn | 17 | 5 | Hold | |

CyberArk Software | (NASDAQ: CYBR) | $6.3bn | 9.6 | 13.7 | Buy | |

Tenable Holdings | (NASDAQ: TENB) | $6.1bn | 27.9 | 10.8 | Buy | |

SentinelOne | (NASDAQ: S) | $5.1bn | Buy | |||

Varonis Systems | (NASDAQ: VRNS) | $4.7bn | 8.8 | 13.2 | Buy | |

Arqit Quantum | (NASDAQ: ARQQ) | $1.9bn | ||||

Telos Corp | (NASDAQ: TLS) | $670m | 5.7 | 4.2 | Overweight | |

Cipherloc | (OTCMKTS: CLOK) | $9m | 3 | 672.6 |

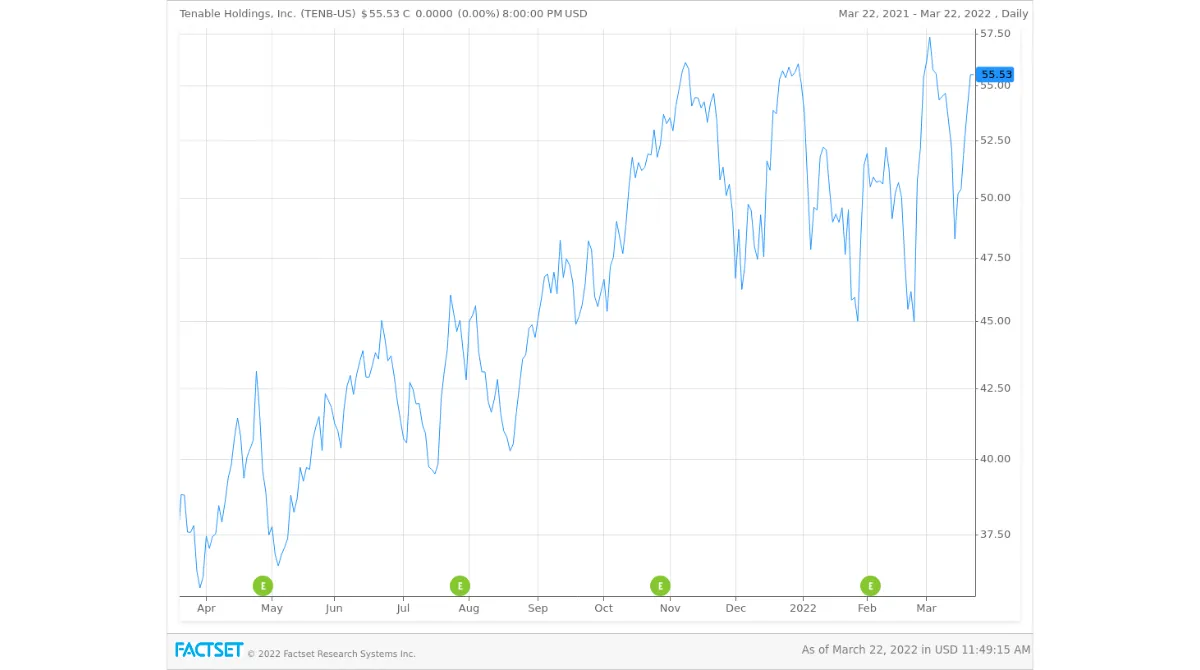

#Tenable Holdings Inc (NASDAQ: TENB)

Tenable Holdings Inc (NASDAQ: TENB) helps companies see the connectivity of their digital landscape and pinpoint any potential vulnerabilities. Its cloud-based software helps security professionals check their domains are adequately secured.

Tenable supports around 40,000 organizations around the world.

Tenable protects its clients from more than 68k known vulnerabilities, thereby beating its rivals in the space. The company offers a suite of management solutions to fight cybercrime in the cloud covering all software-based endpoints from web applications, internet of things devices, industrial use cases and much more.

Tenable solutions are rapidly gaining acceptance in the market and recently won the 2022 Technology Innovation Leadership Award. Frost & Sullivan presents this award to companies demonstrating outstanding achievement. Tenable's lead in providing real-time visibility to secure entire operations from threats helped its case.

#NortonLifeLock Inc (NASDAQ: NLOK)

NortonLifeLock Inc (NASDAQ: NLOK) focuses on consumer cyber safety. The Norton antivirus products have been around for years and are familiar to many computer users. Nowadays, the company offers a range of cloud-based solutions at varying price points depending on the number of devices being protected.

The company also offers protection for virtual private networks (VPN), PC gaming, mobile security and small business solutions.

NortonLifeLock now supports and protects around 80 million users in more than 150 countries.

The company was getting set to merge with Avast after several months of regulatory challenges to sort out. Unfortunately, this has now been put on hold as the UK Competition and Markets Authority believes it will reduce competition in the marketplace.

NLOK stock fluctuates and is down -10.7% over the past five years. It's up 27% over the last 12 months and 3% year-to-date.

The company enjoyed a strong Q3 with revenue and bookings up 12% and 11%, respectively.

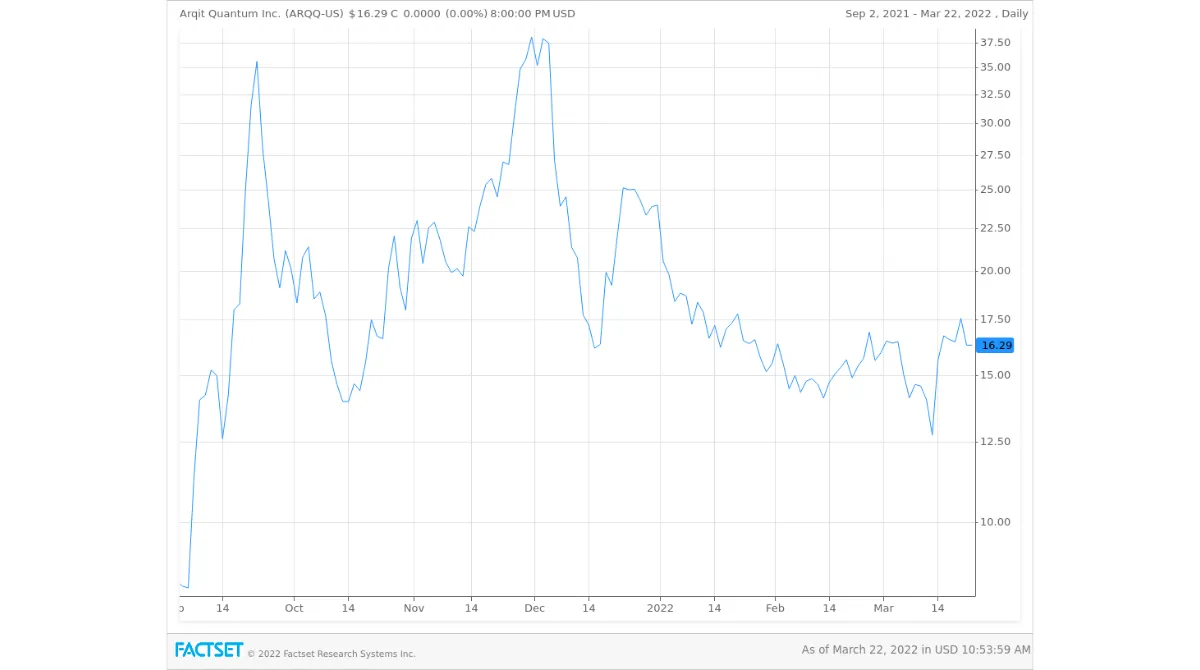

#Arqit Quantum Inc (NASDAQ: ARQQ)

Arqit Quantum Inc (NASDAQ: ARQQ) is a leader in quantum encryption technology. Arqit offers quantum encryption in the cloud to customers worldwide. It differs from peers because it protects communication links from hacking attempts, even in the event of an attack from a quantum computer.

Last month Arqit signed a cooperative research and development agreement with the United States air force. This is a prestigious opportunity for the company to showcase its capabilities on an impressive level. Arqit's QuantumCloud platform will be upgraded to include quantum satellites. And the space-to-ground quantum encryption links will be closely examined to prove the viability of high bit-rate global quantum encryption to the air force and the Department of Defence (DoD) endpoints.

This is a big responsibility, but the company hopes it will lead to further use cases if it goes well.

The US air force is involved in directed energy, cyber warfare and Joint All-Domain Command and Control, so Arqit's CEO David Williams sees this as an opportunity to develop applications for US Government users and other intelligence partners in the future.

Meanwhile, Captain Steven Long for the Air Force Research Laboratory said:

“This opportunity provided by Arqit gives us the ability to demonstrate a quantum communications channel with a commercial partner and conduct various scientific research experiments at the same time… By forming a relationship, we hope to remain at the cutting-edge of quantum technology, and highlight the important relationships we have with our international partners and allies.”

ARQQ stock came public via SPAC IPO in September 2021. The blank-check company that took it public was Centricus Acquisition Corporation.

Adam Aron, CEO of famed meme stock AMC Entertainment (NYSE: AMC), was a Director on the board of Centricus at the time of the merger but left a few days later. Meanwhile, Centricus was created by the former owner of Silversea Cruises Manfredi Lefebvre d'Ovidio, with Citadel and Ken Griffin major shareholders.

ARQQ stock has doubled since its IPO but is down over 20% year-to-date.

#Check Point Software Technologies (NASDAQ: CHKP)

Check Point Software Technologies (NASDAQ: CHKP) is an American-Israeli multinational provider of software and combined hardware and software products, offering various security solutions.

It serves cyber security solutions to governments and corporate enterprises globally.

CHKP stock has risen 17% year-to-date. This is mainly in response to decent Q4 earnings. The company offers a subscription business displaying strong signs of growth. Indeed, Maestro helps companies scale their network security, and this service is proving popular.

Check Point also has an industry-leading catch rate of malware, ransomware and other types of attacks.

Cases of ransomware rose 1,100% in the year following the mass migration to home working. That's because it's much harder for organizations to secure home networking environments than securing an office.

Check Point's software solutions protect over 100k organizations of all sizes. The company has a 6% to 10% revenue growth target for the year ahead.

#Fortinet (NASDAQ: FTNT)

Fortinet (NASDAQ: FTNT) stock has risen over 75% in the past year. Year-to-date has been more volatile with a 5% drop.

The company provides cybersecurity solutions to a variety of businesses, including enterprises, communication service providers and small businesses, as well as state and local government agencies, schools and healthcare providers.

Fortinet's offerings include network, infrastructure and cloud security, IoT and operational technology solutions. It was founded in 2000 in California.

Nation-states targeting public-sector organizations is a real concern that companies like Fortinet are trying to address.

The company recently suspended its operations in Russia in response to the war. However, Ukraine and Russia account for around 2.5% of Fortinet's revenues, so this shouldn't cause too much disruption.

Mubaraka Ibrahim, IT Director at the UAE Ministry of Health, said:

Fortinet’s solutions have allowed us to be able to put our patients first as always and focus on satisfying their needs.

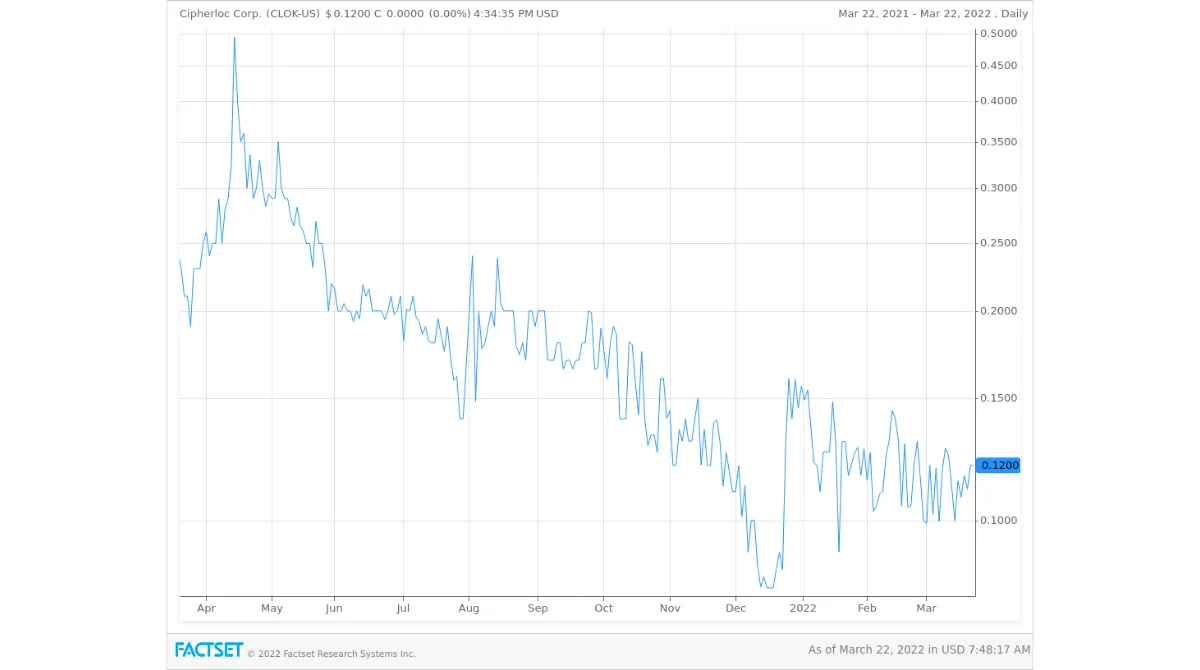

#Cipherloc (OTCMKTS: CLOK)

Cipherloc (OTCMKTS: CLOK) is an advanced data security company. It uses a patented and certified polymorphic encryption technology. This provides clients with a next-level layer of protection. With cyber threats looming large, businesses seek security solutions that can scale.

Cipherloc offers that scalability across a variety of applications and systems.

In mid-February, Cipherloc launched Cipherloc Enclave, its newest commercial-ready product. This is designed to control which devices can communicate with each other within an organization. It fully encrypts the traffic using the latest and most powerful encryption techniques.

Cipherloc is listed on the OTCQB stock exchange under the trading symbol CLOK.

Cipherloc trades as a penny stock. It has a $9m market cap and is, therefore, a highly speculative and risky investment.

#Is there a Cybersecurity ETF?

Exchange-traded funds (ETFs) are often deemed a safer way of investing in a sector than investing directly in individual stocks. That's because when you invest in an ETF, you buy shares in a basket of stocks related to that sector or index being tracked.

There are a few ways to invest in cybersecurity stocks via an ETF.

ETFMG Prime Cyber Security ETF (NYSEARCA: HACK)

Some of the most popular cybersecurity stocks can be found in the ETFMG Prime Cyber Security ETF (HACK). For instance, CrowdStrike (CRWD), Cloudflare (NET), and Zscaler (ZS) are included.

HACK is the first ETF on the market that focuses on cybersecurity. The fund splits the industry into 2 segments: developers of cybersecurity hardware or software and providers of cybersecurity services.

HACK tracks a tiered, equal-weighted index that targets companies actively involved in providing cybersecurity technology and services.

Evolve Cyber Security Index Fund (TSX: CYBR)

CYBR ETF is Canada’s first cybersecurity ETF. It includes Crowdstrike, SentinelOne, Darktrace (LON: DARK), Kape Technologies (LON: KAPE) and Arqit Quantum.

#Risks to Investing in Cybersecurity Stocks

Cybersecurity is a niche sector that is likely to continue to enjoy growth even if the broader technology sector is suffering. That's because the world continues to face many threats and we are going through an unprecedented period of geopolitical turmoil.

Nevertheless, all stocks carry investment risk and investors should carry out due diligence before investing in cybersecurity stocks.

These companies themselves become targets for hackers and cybercriminals. Therefore, any breach of their services is sure to be detrimental to the share price. OKTA is a case in point.

It's wise to look for signs of sustainable revenue growth and an undervalued share price.

While the pandemic and geopolitical uncertainty brings additional business to the cybersecurity sector it can also squeeze margins.

Supply chain disruption is a problem for cybersecurity firms that rely on semiconductors and vital components for their hardware to function. COVID-19 caused problems for many companies trying to operate on a reduced workforce.

Finally, competition is rife in the cybersecurity space and consolidation is also something to watch out for.