Canterra Minerals Corp. (TSX-V: CTM) (OTCQB: CTMCF) has reported exceptional high-grade gold drill results from its fall 2025 diamond drilling program at the 100%-owned Wilding Gold Project in central Newfoundland. The project is strategically located adjacent to Equinox Gold’s Valentine Mine, Atlantic Canada’s largest gold operation.

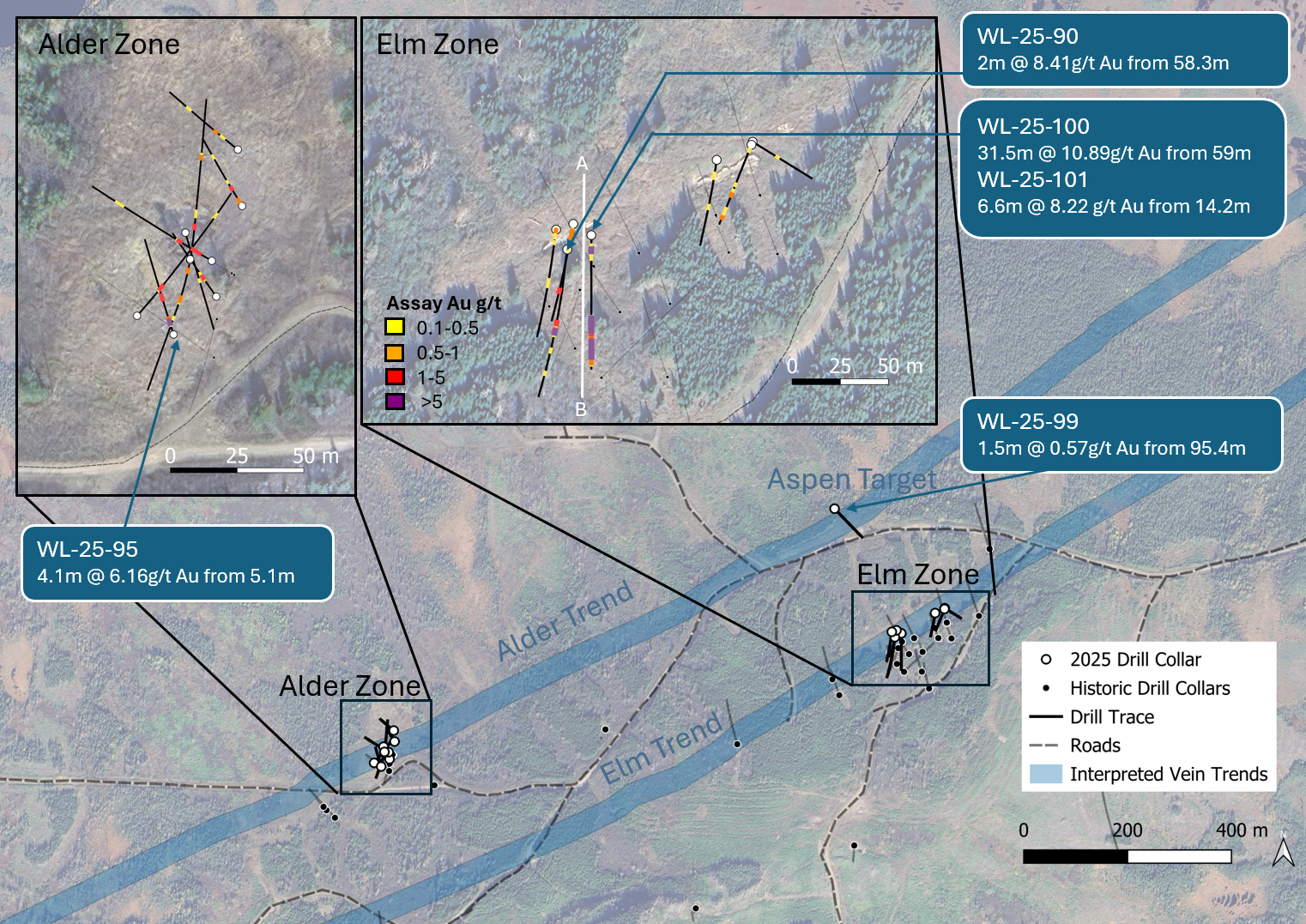

In fall 2025, the company drilled 1,243 m across 18 holes, focusing on the Elm and Alder Zones and testing Aspen, a new target area. The headline intercept of 31.5 metres averaging 10.89 g/t Au confirms the presence of a robust, high-grade quartz-sulphide vein system at the Elm Zone. Shallow intercepts at the Alder Zone and anomalous gold at the new Aspen Target further expand the mineralized footprint, reinforcing the interpretation of a district-scale hydrothermal gold system.

These results suggest Wilding could evolve into a multi-zone, high-grade gold system rather than a single-zone discovery, a key distinction for potential scale. The combination of strong grades, near-surface mineralization, and expanding targets supports the potential for meaningful scale next to an operating gold mine.

Chris Pennimpede, President and CEO of Canterra, commented:

“These results demonstrate that Wilding has the potential to host a high-grade, district-scale gold system in one of Canada’s most attractive mining jurisdictions. As global uncertainty continues to drive interest in secure North American gold assets, we believe Canterra is well positioned to create long-term value through disciplined exploration next door to Atlantic Canada’s largest gold producer.”

#Learn more about Canterra Minerals’ exploration activities →

The fall 2025 drill program at Wilding focused on areas with the potential to add meaningful ounces, not just confirm known mineralization. By targeting stacked quartz-gold-tourmaline-pyrite veins along established shear zones, the company aimed to identify multiple gold-bearing zones in the same footprint, which can significantly increase gold potential per drill hole. The program also shifted toward untested orientations and new targets generated from 2025 fieldwork and prospecting, as outlined in September and November, 2025.

Latest Drilling Campaign Highlights Include:

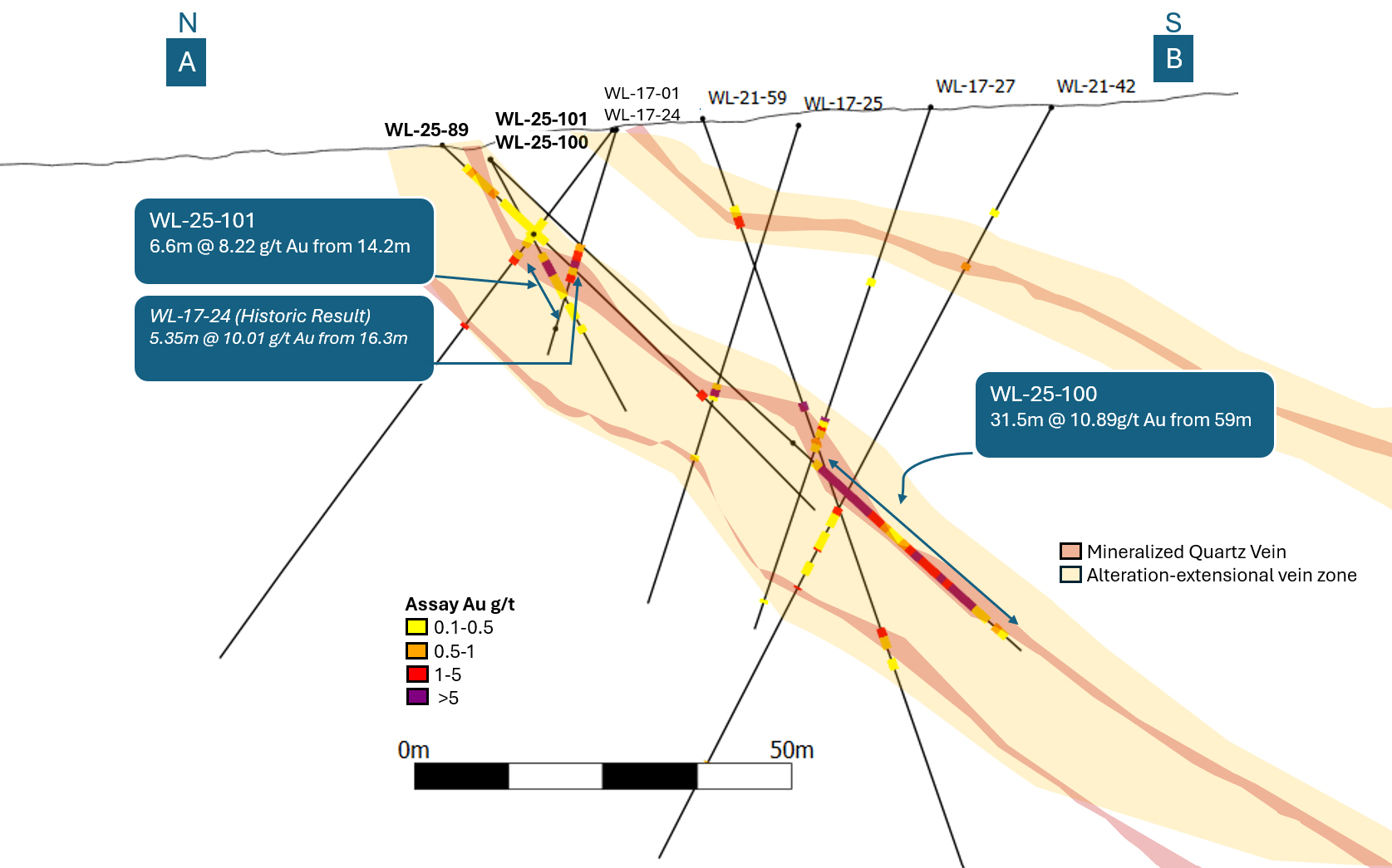

- Exceptional high-grade intercept of 10.89 g/t Au over 31.5 metres core length, including 41.0 g/t Au over 5.4 m, from 59.0 metres depth in hole WL-25-100 (Elm Zone).

- Shallow high-grade intercepts including 6.16 g/t Au over 4.1 metres from 5.1 metres depth, including 20.96 g/t Au over 1 metre, highlighting near-surface gold mineralization in hole WL-25-95 (Alder Zone).

- Elm Zone prospect now interpreted as an approximately 300 metres along-strike by 100 metres down-dip mineralized gold corridor, demonstrating meaningful scale and resource potential.

- Drilling confirms continuity of high-grade quartz-sulphide gold veins, with alteration halos suggesting a larger hydrothermal system.

- Successful first-pass drill test at new Aspen Target returned anomalous gold values up to 0.57 g/t Au in hole WL-25-99, expanding the known extent of mineralized veining.

Plan view of Wilding Project 2025 Drill Program

Cross Section of Elm Zone

With multiple zones now confirmed, the company plans to prioritize step-out drilling at Elm and Alder while advancing follow-up work at Aspen to test the broader system. The next phase of drilling is designed to better define vein orientation, true thickness, and continuity by intersecting mineralized structures at higher angles and testing down-plunge and along-strike extensions.

Management believes this approach will help map the full extent of the hydrothermal system between the Alder, Elm, and Aspen zones and support future resource delineation as confidence in geometry and scale improves. Located next to the Valentine Mine, Wilding also benefits from established infrastructure and reduced development risk. As with all early-stage exploration, results remain preliminary and continued drilling will be required to define size, continuity, and economic potential.

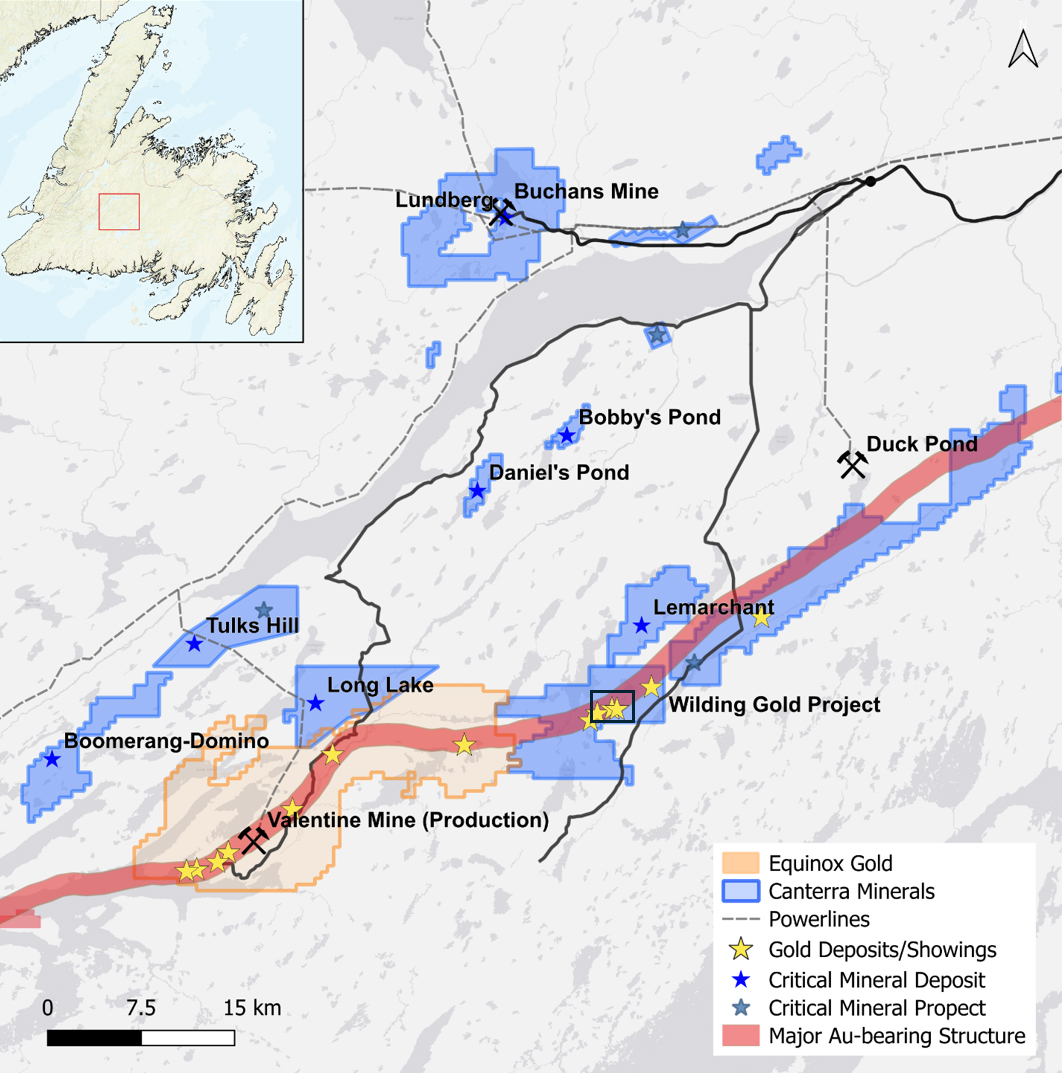

#About Canterra Minerals

Canterra Minerals has consolidated 100% ownership of a district-scale portfolio of copper and gold deposits in central Newfoundland, excluding the adjacent Valentine Mine. Management believes this unified land position provides strategic leverage in a historically prolific but previously fragmented mining camp.

Map of Canterra Newfoundland Central Mining District Projects

Its projects are located near historic mines that produced copper, zinc, lead, silver, and gold. Its gold assets lie along a 55 km gold-bearing corridor connected to Equinox Gold’s Valentine Mine, which is expected to become Newfoundland's largest gold mine and one of Canada's top gold producers. Canterra’s position in this emerging district places it early in the exploration cycle, as Newfoundland experiences renewed interest driven by recent high-grade gold discoveries.

Recent highlights include impressive drilling results from Canterra’s Wilding Gold Project reported on January 21, 2026, following previously reported record gold samples of up to 535 g/t Au. Canterra also revealed high-grade copper results from its Phase 3 discovery drilling program at its 100 % owned Buchans Project, on November 19, 2025, as well as additional high-grade copper intercepts at the Clementine target near Buchans on September 23, 2025.

With active drill programs, multiple emerging targets, and discoveries that continue to validate its exploration model, Canterra is well positioned to advance a portfolio of highly prospective copper and gold assets in central Newfoundland. The combination of high-grade results, expanding target footprints, and a consolidated district-scale land position sets the stage for continued news flow in the months ahead.

#FAQs for Retail Investors

What makes the Wilding Gold Project a focus for Canterra?

Wilding sits along the same gold-bearing corridor as Equinox Gold’s producing Valentine Mine, Newfoundland’s largest gold operation. The project covers 55 km of highly prospective ground where Canterra has identified multiple high-grade zones sharing similar structures and host rocks to Valentine.

How significant are the new high-grades identified?

High-grade gold intercepts at Wilding, led by 31.5 m at 10.89 g/t Au, confirm a robust and expanding gold system next to Equinox Gold’s Valentine Mine. Multiple zones, emerging scale, and planned follow-up drilling point to strong discovery momentum and continued news flow.

How do the latest drill results compare to previously reported record gold samples at Wilding?

The 535 g/t Au samples proved Wilding hosts an exceptionally rich gold system but were selective grab samples. The new 31.5 m at 10.89 g/t Au is drill-confirmed, continuous mineralization, a far stronger indicator of scale, continuity, and potential economic value.

How does proximity to Equinox Gold’s Valentine Mine matter?

Being next to a producing mine validates the geology, infrastructure, and permitting environment, while increasing Wilding’s strategic value as a potential high-grade satellite in an established gold district.

What does “low-angle intersection” mean for investors?

Low-angle drilling can overstate apparent widths, but it often points to strong vertical continuity and stacked veins, which can significantly increase scale as follow-up drilling targets true thickness.

Why is the Aspen Target important?

Aspen is a newly tested area showing the same alteration and vein styles as Elm and Alder. Early anomalous gold confirms the system extends beyond known zones, adding meaningful exploration upside.

What are the next catalysts to watch?

Follow-up drilling focused on true widths, down-plunge continuity, and linking Elm, Alder, and Aspen could rapidly expand scale and move the project closer to an initial resource estimate.