The communications services sector is vast. It encompasses network service providers, web-based software companies, social media giants and more. This emphasis on tech is evident because some companies in the industry, such as Facebook, were formerly classified as information technology outfits.

Even before COVID-19 hit, the sector was designated as “critical infrastructure” by the US government. However, the pandemic period made it clear just how much the world relies on communication services companies. Millions of people spent months locked away in their homes, isolated from family and friends. This has made a good internet connection and web-based entertainment essential for many of us.

It can be a flashy and exciting sector to invest in. The sector is packed with innovative ideas from Silicon Valley and giant corporations with tens of millions of customers. Even so, there are risks associated with this sector. Perhaps chief among these is regulatory risk, which has been particularly relevant in recent years due to concern about companies’ handling of users’ personal data.

Some of the major players in the US communication services sector are:

AT&T

Verizon

T-Mobile

Facebook

Comcast

Netflix

Alphabet

Q4 Communications momentum stocks

Momentum refers to the speed or rate of change in stock price. Healthy price trends tend to exhibit strong momentum, and price weakens when momentum subsides. The following stocks have been enjoying a rise in momentum in recent weeks. Can their streak continue through Q4?

Belden Inc. operates as a signal transmission solutions company in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. Sales and EPS growth have been displaying significant growth, and BDC stock is showing momentum.

Napco Security Technologies, Inc. develops, manufactures, and sells electronic security products in the United States and internationally. NSSC stock has been enjoying momentum since beating earnings and revenue estimates in its Q4 results.

Clearfield, Inc. manufactures, markets, and sells standard and custom passive connectivity products to the fiber-to-the-premises enterprises and original equipment manufacturers markets in the United States and internationally. CLFD stock has been enjoying strong price momentum over the past year, along with sales and EPS growth.

Q4 Communications growth stocks

Growth in sales and/or earnings per share indicates a business that is growing. Growth stocks can make very lucrative investments when the share price rises in time with the business expansion. But growth stocks are also risky as investment analysis is based on future price action rather than historical price performance. Famous growth investors include Philip Fisher, T. Rowe Price, and Jim Slater.

Ituran Location and Control Ltd., together with its subsidiaries, provides location-based services and wireless communications products. ITRN stock is showing solid price momentum along with significant growth in sales and EPS.

Calix, Inc., together with its subsidiaries, provides cloud and software platforms and systems and services in the United States, the Middle East, Canada, Europe, the Caribbean, and internationally. CALX stock is showing momentum and sales growth. Calix is a quality company.

ADTRAN, Inc. provides networking and communications platforms and services for service providers, cable/multiple system operators, small- to medium-sized businesses, and distributed enterprises in the United States, Germany, Mexico, and internationally. ADTRAN is a quality company with a low price-to-sales ratio, EPS growth, and 1.9% dividend yield.

Q4 Communications value stocks

Value investing is a very popular type of stock market investing advocated by Billionaire investor Warren Buffett. When growth stocks are in favor, value stocks tend to be less popular and vice versa. Value stocks should be trading for less than their intrinsic or book value.

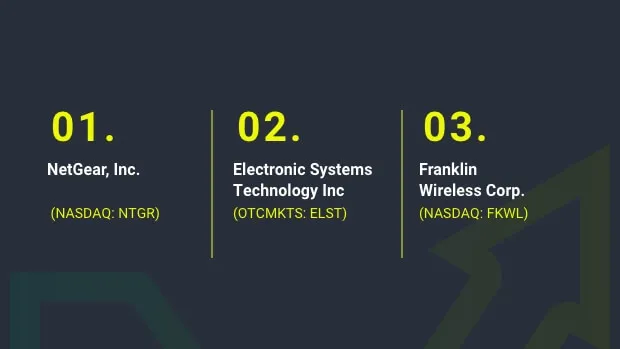

NETGEAR, Inc. designs, develops, and markets networking and Internet-connected products for consumers, businesses, and service providers. Hamed Khorsand, Wall Street Analyst at BWS Financial, recently marked NTGR stock as Overweight.

Electronic Systems Technology, Inc., doing business as ESTeem Wireless Modems, designs, develops, manufactures, and markets industrial wireless products and accessories in the United States and internationally. ELST stock has been enjoying a burst in momentum over the past year. It also has low price-to-book (P/B) and price-to-sales (P/S) ratios.

Franklin Wireless Corp. provides intelligent wireless solutions. The company’s products include mobile hotspots, routers, trackers, and other devices, which integrate hardware and software enabling machine-to-machine (M2M) applications and the Internet of Things (IoT).

FKWL stock has low price-to-earnings (P/E), price-to-book (P/B), and price-to-sales (P/S) ratios. This is a quality company with a potentially undervalued share price but is undoubtedly a risky investment.