Investing in the technology sector can be a lucrative investment area and has become very popular in recent years. Traditionally, technology companies were those that manufactured a wide range of computer hardware and software products such as electronic components, semiconductors, and computer software packages.

Nowadays, major US technology stocks include the social aspect of technology through e-commerce and social interaction. Moreover, this is rapidly being extended to incorporate artificial intelligence, machine learning, 5G, virtual reality, self-driving cars, robotics, drones, internet security, and much more.

Some big-name technology stocks include

Microsoft (NASDAQ: MSFT)

Facebook(NASDAQ: FB)

Google (Alphabet (NASDAQ: GOOGL))

Amazon (NASDAQ: AMZN)

IBM (NYSE: IBM).

According to market intelligence consultancy IDC, the technology sector is the most significant stock market sector. It has an estimated global market value of around $5 trillion.

#Q4 Technology momentum stocks

Momentum refers to the speed or rate of change in stock price. Healthy price trends tend to exhibit strong momentum, and price weakens when momentum subsides. The following stocks have been enjoying a rise in momentum in recent weeks. Can their streak continue in Q4?

Alpha And Omega Semiconductor (NASDAQ: AOSL)

Alpha and Omega Semiconductor designs and supplies power semiconductor products for computing, consumer electronics, communication, and industrial applications. It operates in Hong Kong, China, South Korea, the United States, and internationally.

This stock has a price to earnings ratio (P/E) of 14, and it doesn’t offer shareholders a dividend yield. AOSL stock appears in 36 ETFs.

Alpha and Omega has a 3-year Compound Annual Growth Rate (CAGR) for Sales of 15.9% and EPS of 65%.

Its sales growth for its latest interim period vs. the prior period is 44.8%. Analysts 12-Month average share price target is $44.67, 43% above the current share price.

Napco Security Technologies Inc (NASDAQ: NSSC)

Napco Security Technologies, Inc. develops, manufactures, and sells electronic security products in the United States and internationally. The Company offers access control systems, door-locking products, intrusion and fire alarm systems, and video surveillance systems for commercial, residential, institutional, industrial, and governmental applications.

NSSC has a P/E of 54, and its Price/Book value is 8.6x. The NSSC share price has risen 86% in the past year. Napco stock appears in 31 ETFs.

Napco Security Technologies has a 3-year Compound Annual Growth Rate (CAGR) for Sales of 7.5% and EPS of 24.5%.

Its sales growth for its latest interim period vs. the prior period is 54%.

Analyst estimates indicate a buy with a 12-month average target price of $48.20 and a potential 10% upside.

Paltalk Inc (NASDAQ: PALT)

Paltalk and its subsidiaries operate as a communications software provider developing multimedia social applications and secure communication solutions worldwide. Its consumer applications include Paltalk, Camfrog, Tinychat for live video chat, and Vumber.

This telecommunications application enables users to have multiple phone numbers in any area code through which calls can be forwarded to a user’s existing cell phone or landline telephone number.

PALT has a P/E of 19, and its Price/Book value is 6.1x. The Paltalk share price has risen 662% in the past year. PALT stock does not appear in any ETFs.

Its sales growth for its latest interim period vs. the prior period is 1% and EPS growth for its latest interim period vs. the preceding period is 92%.

Paltalk is a highly speculative micro-cap stock with a market cap of $69m. Analysts have not covered the stock.

#Q4 Technology growth stocks

Growth in sales and/or earnings per share indicates a business that is growing. Growth stocks can make very lucrative investments when the share price rises in time with the business expansion. But growth stocks are also risky as investment analysis is based on future price action rather than historical price performance.

Famous growth investors include Philip Fisher, T. Rowe Price, and Jim Slater.

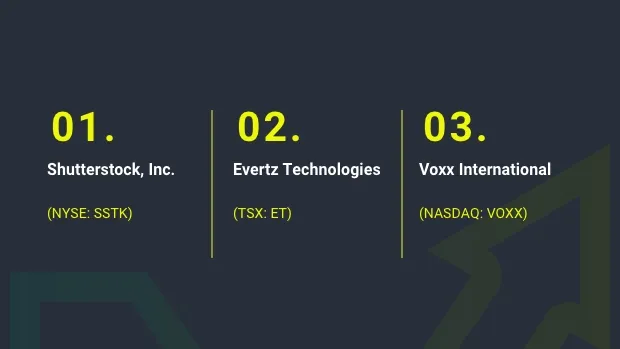

Shutterstock, Inc. (NYSE: SSTK)

Shutterstock is a global technology company that operates a two-sided marketplace for professionals to license content. The Company’s library of content includes digital imagery, consisting of licensed photographs, vectors, illustrations, and video clips.

Shutterstock has a P/E of 39 and a dividend yield of 0.73%. It has a $4bn market cap, $38m in debt, and $411 in cash on the balance sheet. 102 ETFs hold SSTK stock.

The SSTK share price is up 119% in a year.

Analysts 12-Month average share price target is $126. That’s a potential upside of 10%.

Evertz Technologies (TSX: ET)

Evertz Technologies designs, manufactures, and distributes video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications markets industries in Canada, the United States, and internationally.

ET has a P/E of 19, and its Price/Book value is 3.7x. The ET share price has risen 25% in the past year. ET stock appears in 4 ETFs.

Evertz Technologies has a 3-year Compound Annual Growth Rate (CAGR) for Sales of -5% and EPS of -7%.

Its sales growth for its latest interim period vs. the prior period is 72%.

Analyst estimates indicate a buy with a 12-month average target price of $16.83 and a potential 17% upside.

Voxx International (NASDAQ: VOXX)

VOXX International, together with its subsidiaries, designs, manufactures and distributes automotive electronics, consumer electronics, and biometric products internationally. Products include satellite radios, smartphone applications, a wide array of automotive security and vehicle electronics systems, automotive sensing and camera systems, speakers, streaming music systems, and much more.

VOXX has a P/E of 7.7, and its Price/Book value is 0.7x. The VOXX share price has risen 51% in the past year. VOXX stock appears in 22 ETFs.

Voxx International has a 3-year Compound Annual Growth Rate (CAGR) for Sales of 3.5% and EPS of 243%.

Its sales growth for its latest interim period vs. the prior period is 90%.

Analyst estimates indicate VOXX stock is a buy with a 12-month average target price of $21 and a potential 75% upside.

#Q4 Technology value stocks

Value investing is a prevalent type of stock market investing advocated by Billionaire investor Warren Buffett. When growth stocks are in favor, value stocks tend to be less popular and vice versa. Value stocks should be trading for less than their intrinsic or book value.

Scansource Inc (NASDAQ: SCSC)

ScanSource distributes technology products and solutions in the United States, Canada, and internationally. It operates in two segments, Worldwide Barcode, Networking & Security, and Worldwide Communications & Services.

ScanSource has a P/E of 20, and its Price/Book value is 1.3x. The SCSC share price has risen 81% in the past year. SCSC stock appears in 72 ETFs.

ScanSource has a 3-year Compound Annual Growth Rate (CAGR) for Sales of -0.15% and EPS of 16%.

Its sales growth for its latest interim period vs. the prior period is 333%.

Analyst estimates indicate SCSC stock is a buy with a 12-month average target price of $39.33 and a potential 9% upside.

Vipshop Holdings (NYSE: VIPS)

Vipshop Holdings operates as an online discount retailer for various brands in the People’s Republic of China. It operates in Vip.com, Shan Shan Outlets, and Others segments. The Company offers women’s and men’s apparel and household goods, foodstuffs, cosmetics, and more.

Some investors are wary of investing in China just now due to regulatory crackdowns. But for those willing to take the risk, there may be value stock bargains to be found.

Vipshop has a P/E of 7.9, and its Price/Book value is 1.6x. The VIPS share price has fallen 29% in the past year. VIPS stock appears in 81 ETFs.

Vipshop has a 3-year CAGR for Sales of 11.7% and EPS of 38%.

Its sales growth for its latest interim period vs. the prior period is 22%.

Analyst estimates indicate VIPS stock a buy with a 12-month average target price of $19.81 and a potential 80% upside.

Hello Group (NASDAQ: MOMO)

Hello Group provides mobile-based social and entertainment services in the People’s Republic of China. It operates its Momo platform that includes its Momo mobile application and various related properties, features, functionalities, tools, and services.

Hello Group has a P/E of 7.2, and its Price/Book value is 0.9x. The MOMO share price has fallen 24% in the past year. MOMO stock appears in 59 ETFs.

MOMO has a 3-year Compound Annual Growth Rate (CAGR) for Sales of 19% and EPS of -3.7%.

Its sales growth for its latest interim period vs. the prior period is -5%.

Analyst estimates indicate a 12-month average target price of $16.59 with a potential 58% upside.

The stocks in this article were selected based on quantified analysis. This can give investors sector insight and a starting point from which to make investment decisions. This should not be construed as financial advice.