Growth in sales and/or earnings per share indicates a growing business. Growth stocks can make very lucrative investments when the share price rises in time with the business expansion. But growth stocks are also risky as investment analysis is based on future price action rather than historical price performance.

Here are some stocks we think have growth potential.

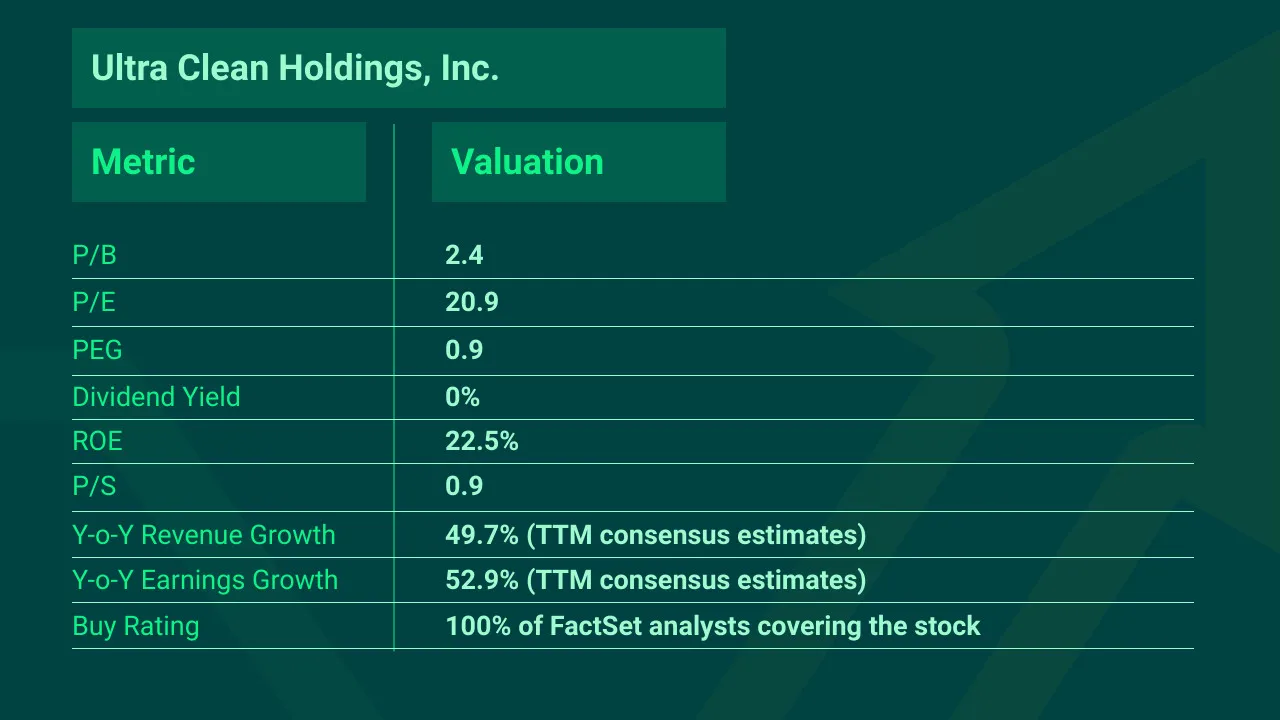

#Ultra Clean Holdings, Inc. (NASDAQ: UCTT)

Ultra Clean Holdings serves the semiconductor industry as a leading developer and supplier of critical subsystems, components and parts. It also provides ultra-high purity cleaning and analytical services.

Ultra Clean Holdings is a company serving a growing industry. It has recurring and growing revenue as well as earnings. Better still, the company has decreased its debt over the years. This means it's free to acquire more debt to grow further if required. Meanwhile, the company has a decent cash position which should protect it against unforeseen events in the market.

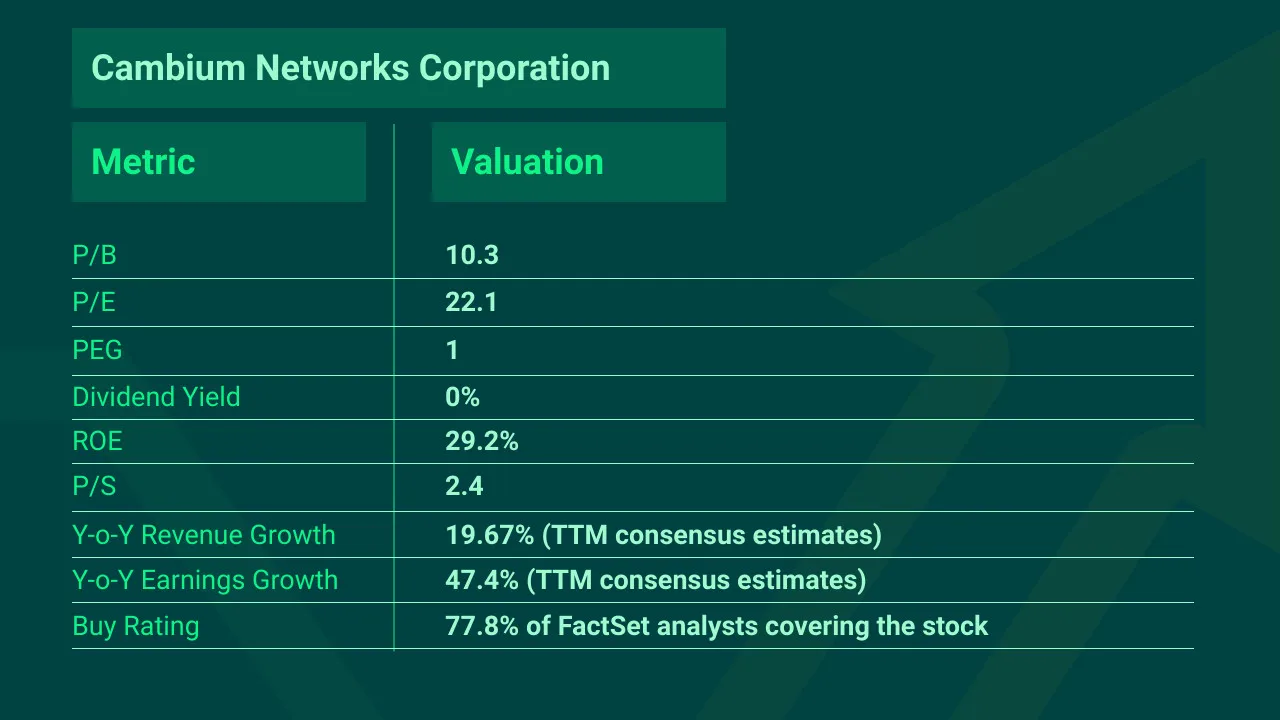

#Cambium Networks Corporation (NASDAQ: CMBM)

Cambium Networks engages in providing wireless broadband networking infrastructure solutions for network operators. Its products include point-to-point, enterprise Wi-Fi and switching, CCTV, software, and point-to-multipoint.

Cambium recently announced new Wi-Fi 6E solutions for the enterprise. Wi-Fi 6E triples the available spectrum for Wi-Fi usage by adding support for the 6 GHz band. Qualcomm (NASDAQ: QCOM) is a driving force delivering Wi-Fi 6E and collaborates with Cambium to deliver powerful solutions based on Networking Pro Series platforms.

Stocks comparable to CMBM include Cisco Systems (NASDAQ: CSCO), General Electric (NYSE: GE), Nokia (NYSE: NOK) and Hewlett Packard (NYSE: HPQ).

Cambium Networks is a growing company with consistent revenue and earnings growth year-over-year. The company has reduced its debt levels, significantly improving its financial position.

Cambium has around $50m in cash and total debt of $35.89m. 77.8% of brokers have a buy rating on CMBM stock, suggesting the market is beginning to take note of its growth potential. However, since April 2021, the CMBM share price has declined. Given its positive results, is Wall Street asleep?

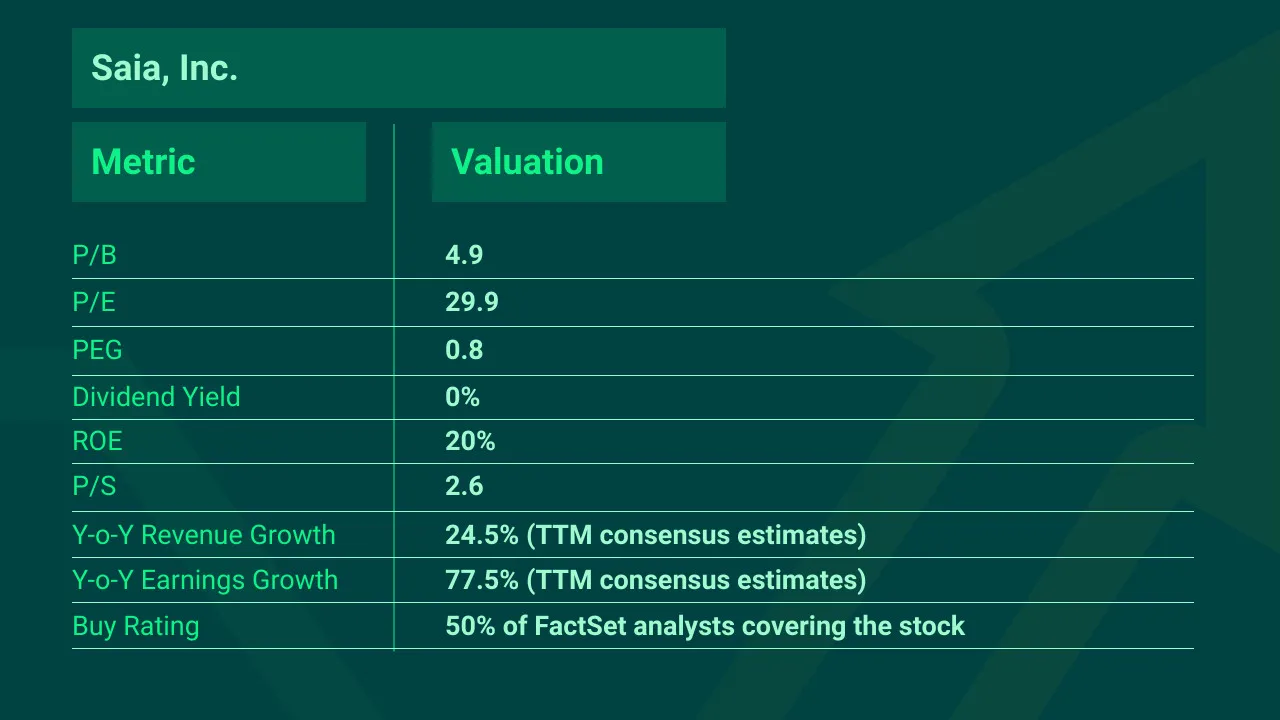

#Saia, Inc. (NASDAQ: SAIA)

Saia is a leading transportation provider of multi-regional less-than-truckload (LTL), non-asset truckload, expedited and logistics services.

Although some of Saia's financial metrics (P/B, P/E and P/S) seem pretty high, the company does have a PEG ratio of 0.8, signaling that it has room to grow. Furthermore, its consistent revenue and earnings growth tell us the company is expanding operations and is doing so effectively due to a 20% return on equity. Interestingly, the company recently signed a letter of intent to buy or lease up to 100 of Nikola's (NASDAQ: NKLA) Tre heavy-duty battery-electric trucks.

This is a company that looks like it is set to continue to grow.

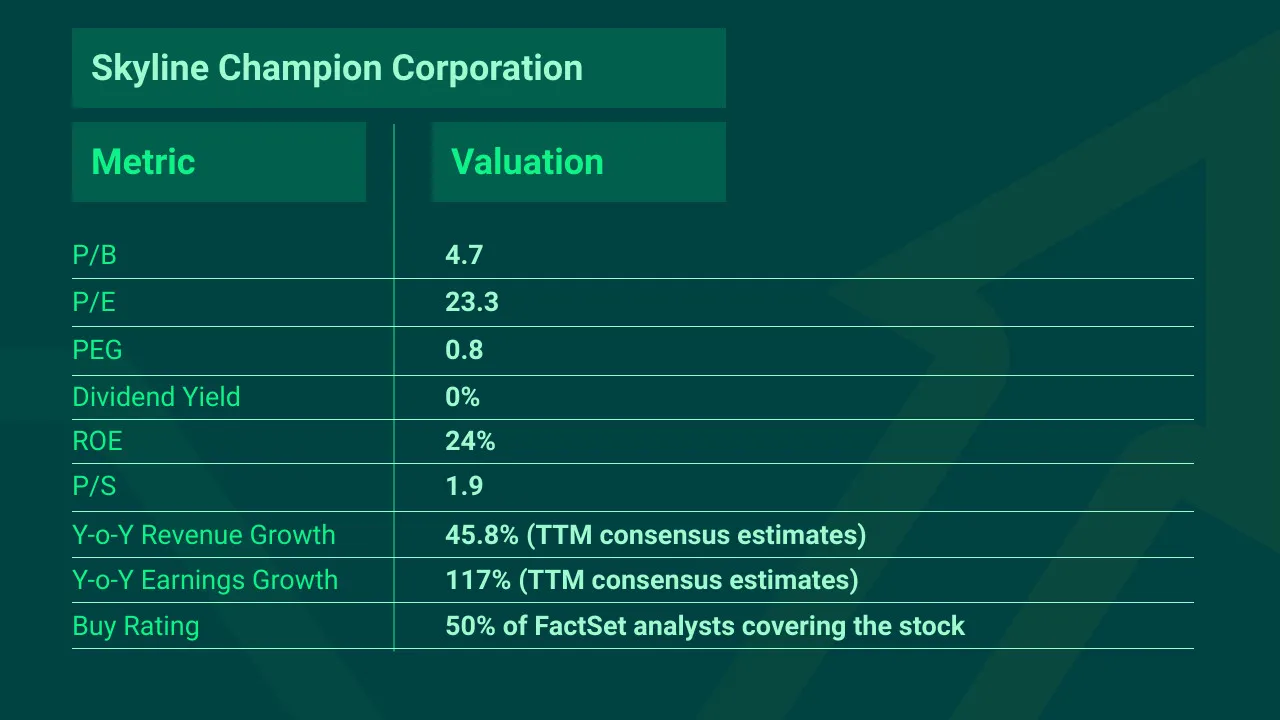

#Skyline Champion Corporation (NYSE: SKY)

Skyline Champion is one of the largest homebuilders in North America. It specializes in affordable factory-built homes.

The company boasts impressive year-over-year revenue growth and earnings, which has been reflected in the share price. Indeed, the SKY stock price has grown by 33% over the last six months. The company also sports a strong ROE of 24%.

Over the years, the company has managed to decrease its debt. It now has around $310m in cash and $43m in debt. This suggests management is taking care of the finances, and it's positioned well for further growth. However, as a homebuilder, there is always the risk of another housing crisis. Therefore this is a speculative stock as its success ultimately depends on demand for housing continuing.

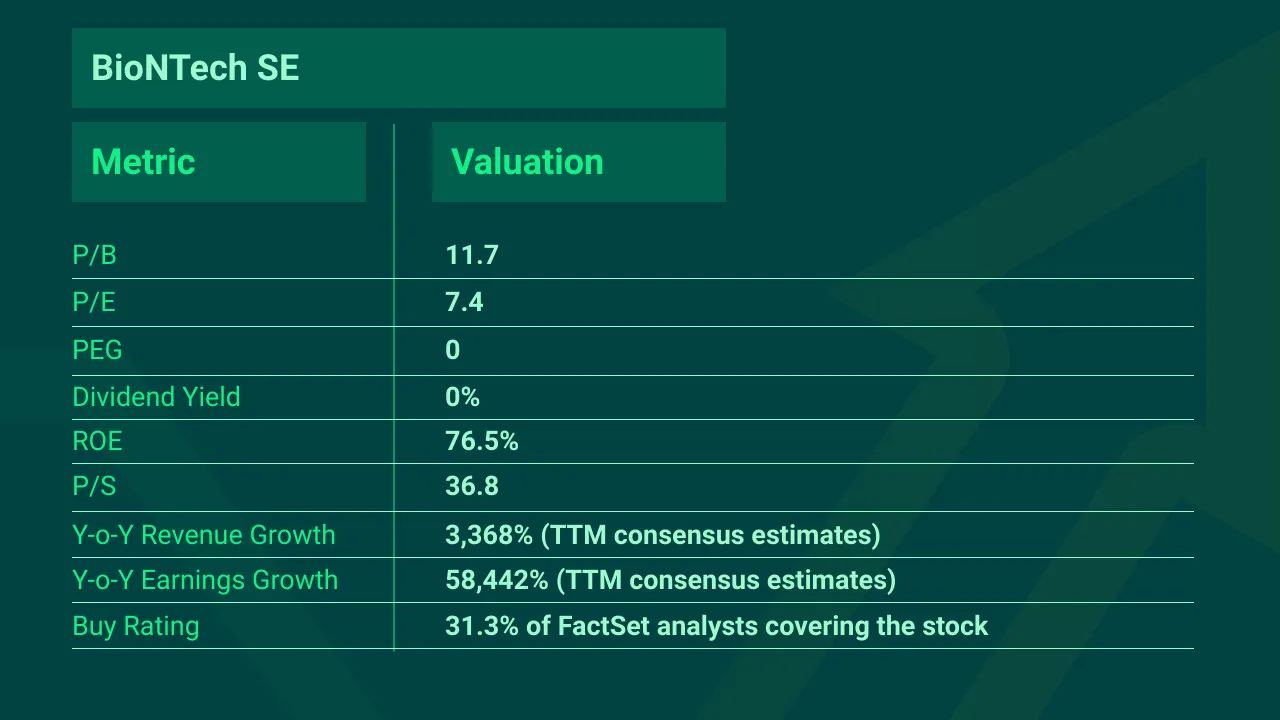

#BioNTech SE (NASDAQ: BNTX)

BioNTech is a German biotechnology company based in Mainz that develops and manufactures active immunotherapies for patient-specific approaches to treating diseases. BioNTech's mRNA technology is behind the Pfizer COVID vaccine.

The BNTX share price soared during the first eight months of 2021 as the Pfizer COVID vaccine was rolled out worldwide. But the stock has since lost half its value.

Nevertheless, investors may be interested to learn about BioNTech's non-COVID products in development. For instance, it is heavily focused on cancer treatments. Indeed, the company started with the vision to harness the immune system's power and find new ways to fight cancer. With the massive success its Pfizer collaboration has brought during the past two years, the company can now boast impressive revenue and earnings growth. It's also now focusing on both fighting cancer and human diseases.

While BioNTech is unlikely to be beating its recent success in the coming years, it's now sitting on a significant cash position of over $2bn with just over $200m in debt. Therefore, BioNTech is in a prime position to continue growing.

The company expects 2022 to be a year of tremendous expansion and maturation of its pipeline as its ramps investment. This includes continuing its global leadership in COVID-19 vaccines with multiple new product launches and label expansions, new formulations, pediatric dosage forms, and potentially variant-specific vaccines.