The momentum investors looking to buy high and sell higher will ideally seek a low P/E ratio as it indicates the trend still has room to run.

Momentum investors believe an established trend is likely to continue in that direction until something sends it off course. Pinpointing stocks with upward momentum to buy is not easy as the markets fluctuate rapidly.

#How do you know if a stock has high momentum?

Traders look at various chart indicators to help guide them to momentum-driven stock picks. Some of these include the rate of change, trading volume, and relative strength.

A rate of change (RoC) above zero can indicate upward momentum in the stock.

An increase in trading volume shows us interest in the equity is real.

The relative strength index (RSI) compares the size of recent gains to recent losses. When RSI moves higher, crossing from under 30 to above 30, it is generally considered a buy signal.

None of these should be used in isolation, but they can help predict stocks that are gaining momentum when considered together.

Here are a few stocks recently enjoying upward momentum that we have on our radar:

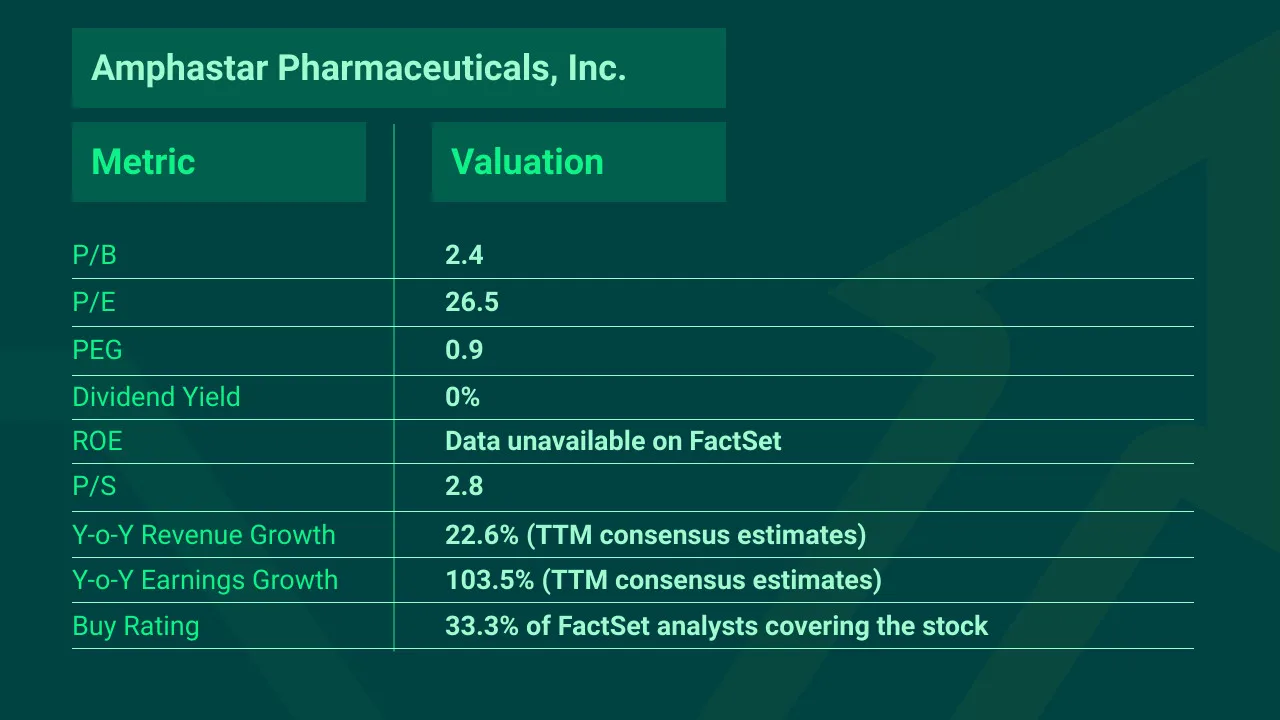

#Amphastar Pharmaceuticals, Inc. (NASDAQ: AMPH)

Amphastar Pharmaceuticals is a publicly-traded American specialty pharmaceutical company. Its focus is on injectable, inhalation, and intranasal products. At the end of 2021, the US FDA tentatively approved Amphastar’s Abbreviated New Drug Application (ANDA) for its Vasopressin injection.

Meanwhile, Piper Sandler recently upgraded AMPH stock to Overweight from Neutral. They reason that the company is improving its visibility in the complex generics/brand pipeline and the insulin biosimilars pipeline. It’s also recently launched products with little-to-no competition.

This is a stock that has picked up considerable pace since November. The share price has grown from around $18 to over $25 at the time of writing. This is due to Amphastar’s impressive performance during the last twelve months showing tremendous year-over-year revenue and earnings growth. With a PEG of 0.9, it looks like the share price still has room to grow, and momentum is on its side.

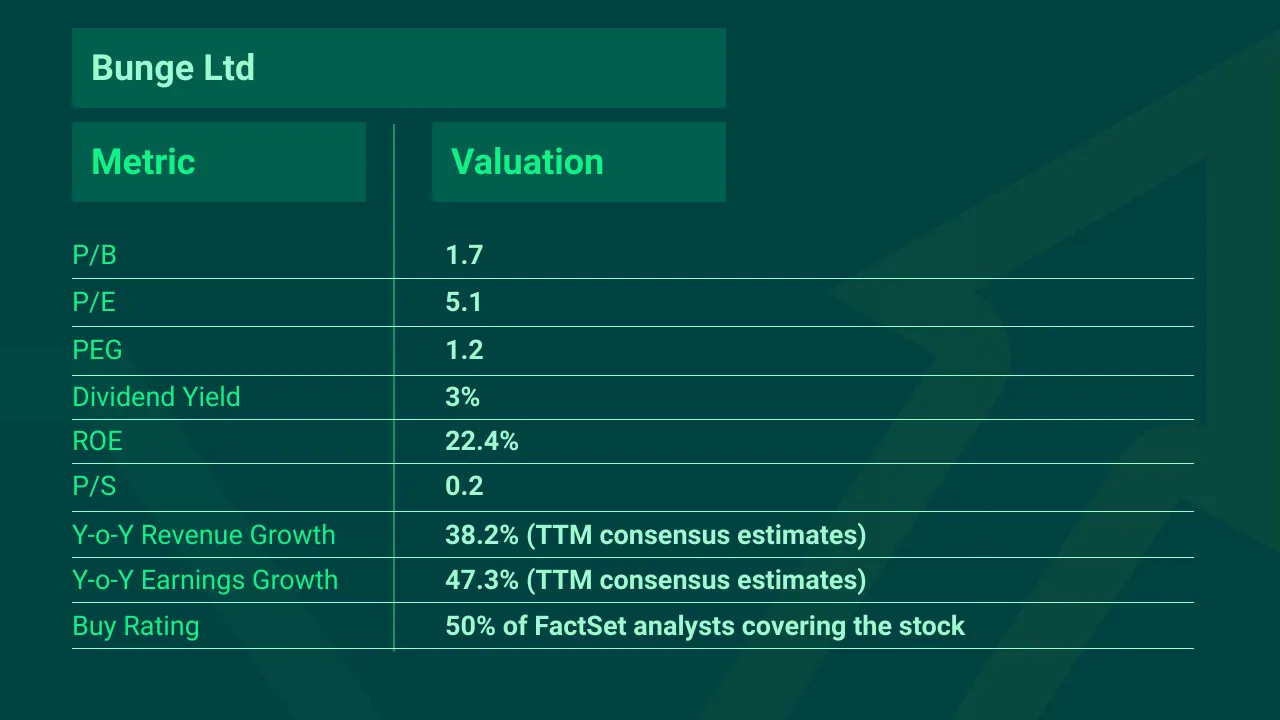

#Bunge Limited (NYSE: BG)

Bunge Limited is an American agribusiness and food company. As well as being an international soybean exporter, it is also involved in food processing, grain trading, and fertilizer. Over the past three years, Bunge has turned its fortunes around with improved operations across its business divisions. Furthermore, Bunge has committed to eliminating deforestation in its supply chains by 2025.

Since September, BG stock has seen extremely bullish activity, growing from around $76 to $96 a share. It did endure a slight pullback in December but appears to be taking off again. Even at the current share price, the stock has a low P/E of 5.1, showing that it has room to grow and valuation is well below the average of the S&P 500.

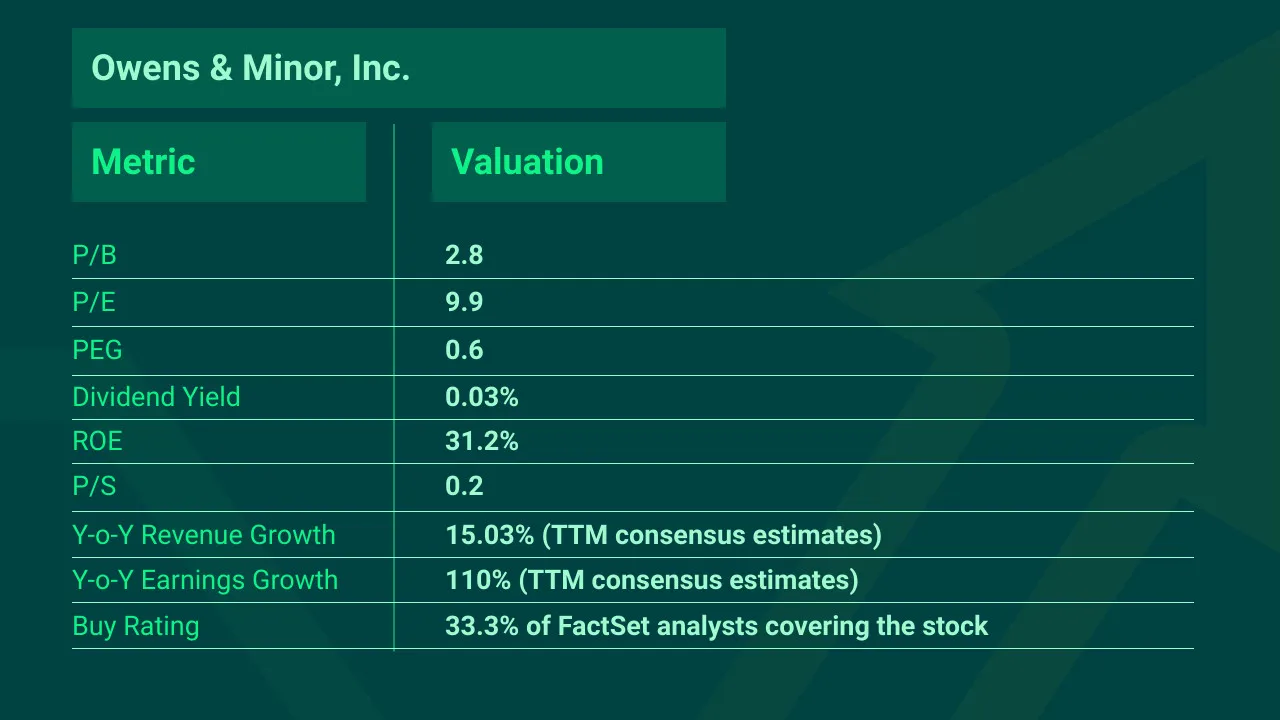

#Owens & Minor, Inc. (NYSE: OMI)

Owens & Minor, Inc. is a global healthcare logistics company employing 15,000 people in 70 countries. The FORTUNE 500 company recently announced its planned acquisition of Apria, a sleep apnea device and home respiratory therapy provider. This acquisition should help extend its presence in the fast-growing home healthcare services market. Owens & Minor already offers products assisting the management of diabetes, wound care and personal protective equipment (PPE).

From July 2020 to August 2021, the company enjoyed a spectacular bull run. During this time, it soared from around $7 to over $46. It then took a pullback but is now back trading above $47. If it maintains its position above the $47 resistance level, the stock could easily enjoy another bull run. Looking at the valuation metrics in the short term, there is no reason why it shouldn’t continue on its bull run.

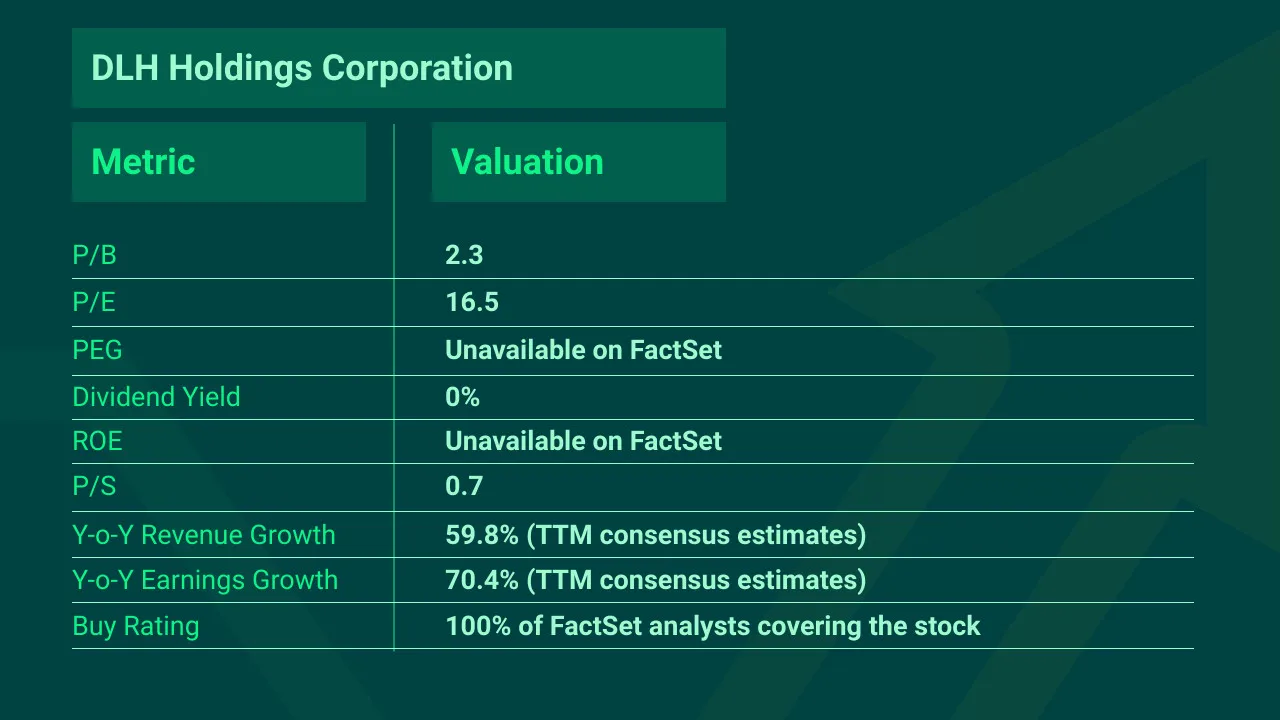

#DLH Holdings Corp. (NASDAQ: DLHC)

DLH provides healthcare, logistics and technical support services. These are primarily to improve and better deploy large-scale Federal health, Department of Defense and human service initiatives. In Q4 2021, the company displayed exceptional results. It reported sales of $65.2m closed fiscal 2021 with revenue of $246.1m, up nearly 18% year-over-year.

In the past six months, DLHC stock has risen over 90%. This could be down to investors noticing its consistent financial performance year-over-year. The low P/S ratio suggests we could see the share price continue to grow as long as the company continues its operating performance.

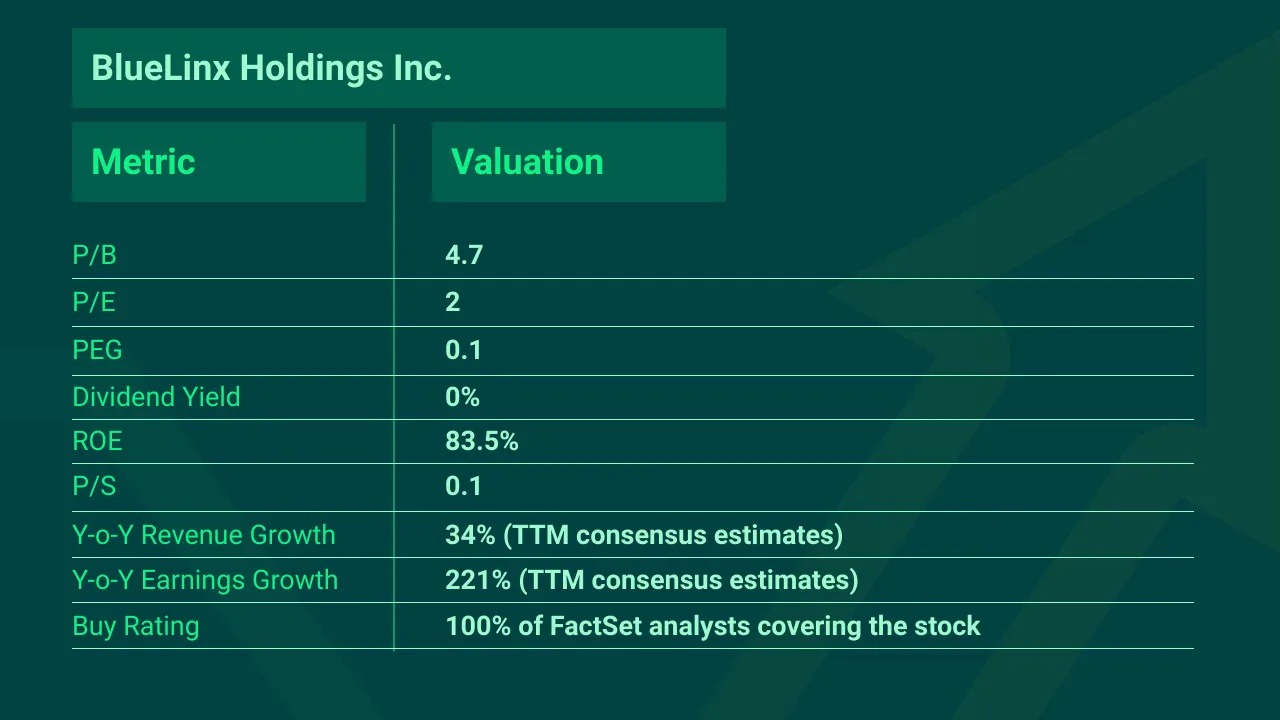

#BlueLinx Holdings Inc. (NYSE: BXC)

BlueLinx Holdings is a wholesale distributor of building and industrial products in the United States. Rising homebuilder activity should help buoy this stock, but inflation poses a risk.

The company has seen its share price grow 83% in the last six months. This is undoubtedly due to its impressive earnings and sales growth during the last year. And it could, in part, be driven by BlueLinx’s return on equity which is 83.5%. The company has an extremely low P/E of 2 and a PEG of 0.1, which shows it has the potential to keep growing in 2022.