Disseminated on behalf of Harena Rare Earths PLC ValueTheMarkets, a trading name of Digitonic Ltd., was compensated by Harena Rare Earths PLC nine thousand one hundred twenty british pounds starting 15 December 2025 to 20 February 2026 to produce and disseminate this. Digitonic Ltd. does not own a position in Harena Rare Earths PLC

A Strategic Rare Earths Project Aligned With US Demand

Materials

Harena Rare Earths PLC | Listed on: (OTCQB: CRMNF) (LSE: HREE)

Why This Opportunity Stands Out

Harena Rare Earths (OTCQB: CRMNF) (LSE: HREE) offers investors access to a large-scale ionic-clay rare earth asset1 at a time when the US is intensifying efforts to secure diversified magnet-metal supply2. The company’s 100% ownership, advancing technical work, and institutional support provide a clear structure as it moves through resource evaluation and development programs.

The Ampasindava Project in Madagascar adds meaningful weight to Harena’s proposition. The deposit contains an independently verified 699 million tonne resource, assessed under the Joint Ore Reserves Committee (JORC) code of practice3, and ranks among the larger known clay-hosted rare earth resources outside China. Harena’s presence in Madagascar aligns the operation with allied-market priorities to broaden and stabilise rare earth supply chains4.

Taken together, Ampasindava’s scale, geology, jurisdiction, and policy relevance position Harena as an increasingly visible participant in the emerging field of non-Chinese rare earth development.

Get Exclusive Insights with our Free Harena Rare Earths Investor Report

Go deeper with exclusive analyst-style insights that highlight the investing opportunity.

Reasons to Invest

-

699Mt JORC Resource

Harena offers exposure to a large, independently verified 699Mt ionic-clay rare earth resource, a geological profile that is uncommon outside China. The size and classification help reduce early-stage uncertainty and position the project closer to advanced development than greenfield exploration.

-

Premium Magnet-Metal Basket

The Ampasindava resource contains meaningful concentrations of dysprosium, terbium, neodymium, and praseodymium, the high-value metals essential for EV drivetrains, defence systems, wind turbines, and robotics. This mix aligns Harena’s operation with segments of the rare earth market where demand has shown sustained growth.

-

Low-Capex, Fast-Track Development Potential

Clay-rich rare earth element (REE) systems can enable simpler near-surface extraction and potentially lower processing complexity compared with hard-rock deposits, which may also support lower-impact operating footprints that align better with modern ESG expectations. Management has indicated that, subject to licensing and development progress, the project could target initial concentrate production within 12 to 18 months, reflecting the relative simplicity associated with this deposit type.

-

Strategic US Market Alignment

With the US actively working to diversify rare earth supply chains, Harena’s non-Chinese asset is well-positioned. Its OTCQB listing, dialogue with US agencies, and offtake engagement support the company’s intent to become a relevant future supplier to the US market.

-

Full Ownership and Institutional Backing

The company holds 100% of the Ampasindava Project, giving it full control over development and future partnerships. Support from established institutional investors and a non-binding offtake letter with United Rare Earths add external validation of Ampasindava’s potential.

-

Clear Milestone Path

Harena’s near-term roadmap includes an upcoming pre-feasibility study, mining-license process, feasibility work expected in 2026, and continued US engagement. Progress across these steps may help investors track how project advancement aligns with the company’s stated strategy and reported resource base.

About Harena Rare Earths

Harena Rare Earths is a London-based critical minerals company developing the Ampasindava Ionic Clay Rare Earth Project in Madagascar. With a 100% interest in a JORC-compliant 699Mt mineral resource, the company aims to support long-term demand for magnet metals across the energy-transition, defence, and advanced-manufacturing sectors. Harena is currently undertaking its pre-feasibility study and maintains a commitment to low-impact extraction methods associated with clay-hosted rare earth systems.

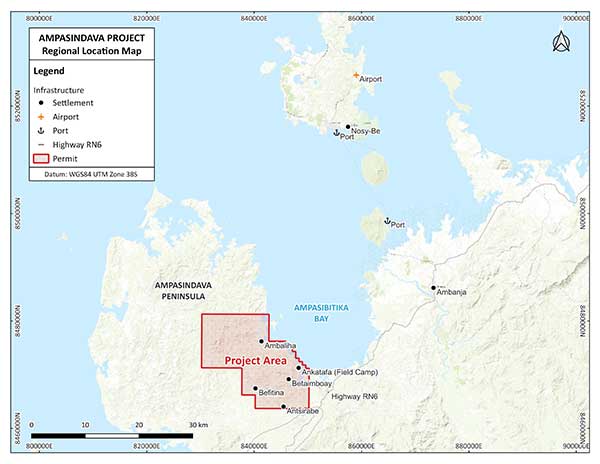

Project Location and Infrastructure

The Ampasindava Project is located on the eastern side of the Ampasindava Peninsula in Antsiranana Province on Madagascar’s northwest coast, approximately 500 km north of Antananarivo. The area benefits from access to enabling infrastructure including semi-industrial ports, the international airport at Nosy Be Island, and the regional town of Ambanja, supporting longer-term development planning.

Operating Environment

Madagascar has an established mining sector with clear permitting frameworks and a history of hosting major international mining developments. This context is important as Harena advances technical work and engages with regulatory processes that support the progression of mining operations in the country.

CEO Ivan Murphy has developed strong ties with key officials in the country through ongoing outreach and coordination. As part of Harena management’s strategy to expand government engagement and support US objectives for a secure, non-Chinese rare earth supply, he met with US officials and held discussions with the US International Development Finance Corporation (DFC), the government’s development finance institution that plays a central role in critical minerals strategy.

Murphy noted,

It was a privilege to engage with the DFC. We look forward to continuing discussions as the US seeks to diversify #REE supply chains.

Get Exclusive Insights with our Free Harena Rare Earths Investor Report

Go deeper with exclusive analyst-style insights that highlight the investing opportunity.

Credibility

Harena brings several layers of third-party and institutional validation that strengthen its credibility as a development-stage rare earth company.

Independent technical work conducted under the JORC framework underpins Harena’s development path, ensuring that all ongoing work is built on a credible and externally validated base.

Commercial traction is evident through a non-binding offtake term sheet with United Rare Earths, while engagement with relevant US government stakeholders highlights the project’s strategic relevance. The company’s management team adds further strength through deep experience across African resource development, rare earth operations, and mine engineering.

Financial Outlook and Economics

As a development-stage company, Harena Rare Earths is assessed on the progress of its asset rather than revenue, with technical studies, licensing steps, and strategic partnerships shaping near-term value drivers. Recent capital raises have funded Pre-Feasibility Study (PFS) work and early-stage development, while period-end figures show continued investment into advancing the asset5. These funds enhance liquidity and provide visibility over near-term funding needs as the company progresses its technical studies.

Harena completed a £1.23m institutional placing in July 2025 and a further £450k strategic investment led by RAB Capital in October 2025. Together, these financings strengthen the company’s ability to meet near-term costs and maintain momentum toward feasibility and the mining-licence process.

The company is also building downstream engagement through a non-binding offtake term sheet with United Rare Earths Inc.6, ongoing dialogue with US agencies, and support from investors including RAB Capital, Fondren LLP, and Wexford Capital.

Harena Rare Earths gives investors access to a development-stage critical minerals opportunity that is moving through a structured set of derisking milestones.

Strategically Relevant US-Aligned Rare Earth Asset

Harena’s edge is twofold. First, its project is outside China, a timely edge as the US and its allies accelerate efforts to reduce reliance on Chinese rare earths, while China continues to dominate global supply7. Second, its clay-hosted rare earth deposits contain loosely bonded minerals that can be more easily leached, a setup that may enable cheaper, faster, and less capital-intensive extraction than hard-rock systems. Heap leaching supports a lighter environmental footprint because it avoids the energy intensive crushing and grinding needed for hard rock deposits, lowering emissions and water use. It also eliminates permanent tailings facilities, since residues can be backfilled, which reduces long term land disturbance and legacy risks. These attributes can support more efficient operating assumptions and may help shorten the development path to commercial production if future technical results confirm the company’s expectations.

Because Harena Rare Earths owns 100% of the Ampasindava asset, it has full flexibility to shape future offtake, funding, and strategic partnerships, particularly with US-linked groups seeking reliable, non-Chinese rare earth supply. This combination of scale, geology, and jurisdiction positions Harena as one of the development stories investors may watch as new magnet-metal supply chains take shape.

Competitive Analysis

Positioning Harena alongside recognised rare earth producers and developers provides helpful context for investors assessing its potential role in the supply chain. The companies compared operate at different scales and with different mineral systems, but these differences showcase where Harena’s resource, ownership structure, and strategic direction set it apart.

| Company | Resource Profile | Key Advantage | Harena’s Edge |

| Lynas Rare Earths | Hard-rock rare earths | Established global producer | Harena’s clay-hosted geology offers a different extraction profile from Lynas’s hard-rock operations, with potential for simpler processing routes and lower overall complexity. |

| MP Materials | Hard-rock, US-based operations | US supply chain integration | While MP Materials anchors US-based hard-rock supply, Harena provides non-Chinese feedstock that aligns with US diversification priorities and broadens the range of potential secure supply options. |

| Iluka Resources Ltd | Mineral sands & rare earths | Large-scale assets, Integrated processing capabilities | Harena’s single, continuous clay-rich REE resource supports the potential for long-life development and scale-driven efficiencies within one integrated area. |

Competitive Edge

Harena’s competitive edge comes from its large-scale, near-surface clay-hosted rare earth element (REE) resource, its presence in a recognised mining jurisdiction, full ownership of the asset, a defined US-facing strategy, and support from recognised institutions that reinforce confidence in its development pathway.

This alignment of geology, jurisdiction, ownership structure, and strategic positioning gives the company development momentum and a differentiated place within the emerging non-Chinese rare earth landscape.

Source: Harena Rare Earths Corporate Presentation December 2025

Get Exclusive Insights with our Free Harena Rare Earths Investor Report

Go deeper with exclusive analyst-style insights that highlight the investing opportunity.

Growing Market Opportunity

Global demand for magnetic rare earth elements continues to accelerate as electrification, advanced manufacturing, and defence modernisation reshape industrial supply chains. Independent industry forecasts indicate that demand for neodymium, praseodymium, dysprosium, and terbium may triple by 20358 as electric vehicle adoption grows, grid-scale wind deployments expand, and automation spreads across logistics, aerospace, and industrial robotics. These applications rely heavily on neodymium-iron-boron (NdFeB) permanent magnets, which remain the strongest commercially available magnets and are difficult to substitute at comparable performance-to-weight ratios.

At the same time, supply growth outside China remains constrained. Reports over the past year highlight China’s continued dominance9 across extraction, processing, metal making, and magnet production. Periodic export and licensing adjustments have demonstrated how concentrated and sensitive the downstream chain remains. Even short-term disruptions have affected global manufacturers, reinforcing the importance of diversified supply.

This backdrop has shifted policy priorities in the US, Europe, Japan, Australia, and other aligned economies. Governments are placing greater emphasis on secure and transparent mineral sourcing, investing in new capacity, and supporting early-stage upstream projects as part of broader industrial and national security strategies. Similar dynamics are evident across other critical minerals, drawing increased institutional interest to assets that can support long-run diversification.

Clay-hosted rare earth deposits, although uncommon outside southern China and parts of Southeast Asia, have attracted growing attention due to their potential for lower-impact mining and simpler metallurgy relative to hard-rock systems. This has elevated interest in clay-rich deposits located in jurisdictions aligned with western supply-chain objectives.

Source: Harena Rare Earths Corporate Presentation December 2025

Macro Tailwinds and Trends

Several forces are shaping the long-term outlook for rare earths:

Supply Reshoring: Efforts to reduce reliance on a single processing hub.

Federal Backing: Government programs supporting feasibility studies and processing capacity.

Defence Priorities: Rising defence spending and strategic focus on magnet metals used in aircraft, naval platforms, and advanced electronics.

Electrification Surge: Continued growth in EVs, wind, grid-storage technologies, and automation.

Magnet Demand: Sustained expansion in NdFeB magnet use across mobility, clean energy, medical technology, and robotics.

ESG Preference: Stronger preference for transparent, ESG-aligned mineral development.

Clay-Hosted Interest: Rising focus on non-Chinese clay-hosted REE systems for their strategic and operational advantages.

Global policy shifts are reinforcing these trends. Several countries have increased restrictions or oversight on critical-mineral trade linked to China, while China has expanded administrative controls on products containing rare earths10. These shifts have heightened corporate awareness of supply-chain risk and intensified the search for alternative, geographically diversified magnet-metal sources.

In this environment, large-scale clay-rich REE systems located outside China have drawn greater attention from institutional investors, governments, and downstream manufacturers seeking longer-term security of supply.

Investment Considerations

As with all development-stage mining opportunities, outcomes depend on future technical, regulatory, and financial milestones. Timelines, costs, and project advancement remain subject to permitting results, study outcomes, funding conditions, and operational execution.

Harena Rare Earths’ development-stage asset in Madagascar, combined with its 100% ownership position and JORC-classified 699Mt Mineral Resource, places it among the emerging assets that may become increasingly relevant to US-aligned diversification efforts. While advancement depends on future results, the alignment of resource scale, geology, and market timing positions Harena within a strategic segment of the tightening global rare earth landscape.

Get Exclusive Insights with our Free Harena Rare Earths Investor Report

Go deeper with exclusive analyst-style insights that highlight the investing opportunity.

Experienced Leadership, Entrepreneurial Execution

Harena’s leadership team blends technical depth, operational know-how, and capital markets experience directly relevant to rare earth project development. The board has previously advanced similar assets through feasibility, financing, and construction phases, bringing insight into project delivery, regulatory engagement, and strategic partnerships.

Ivan Murphy – Executive Chairman

Ivan has over 25 years of experience in natural resource finance, including senior roles across investment banking and asset management. He has sourced, structured, and raised public and private capital for companies across the sector. His past positions include Director at GazpromBank Invest (MENA), Partner at Fairfax Investment Bank, Managing Director of Aberdeen Asset Management (Ireland) Limited, and Executive Chairman of Tantalus Rare Earths AG, the previous owner of the Ampasindava asset. During his prior tenure with Tantalus, he introduced the opportunity to potential development partners in the US and Europe. Ivan was also a founder director of Cove Energy PLC, which was acquired for $1.5 billion, and secured $20 million in private equity for Aladdin Middle East, a Turkish oil exploration and production company.

Allan Mulligan – Executive Technical Director

Allan is a mining engineer with extensive experience in operating, exploring, and developing mines in Africa. He is a co-founder of Walkabout Resources and previously helped manage an ionic-clay rare earth project in Uganda, contributing rare earth specific technical expertise.

Board Strength

The wider board adds complementary experience across mining finance, project execution, governance, and rare earth sector strategy.

Timothy Morrison (Non-Executive Director)

Founder of ASX-listed Galena Mining Limited, where he worked with the team to secure project finance and bring a mine into production within five years of listing. He has more than twenty years of experience across private and public markets.

Stephen Weir (Non-Executive Director)

Stephen has over 25 years of experience in equity capital markets, including as CEO of ASX-listed Magnetite Mines. His background includes senior corporate advisory roles, project finance, and construction management. He is a member of the Australian Institute of Company Directors and sits on the GBA Capital Advisory Board.

Paul Richards (Non-Executive Director)

Paul is a qualified Solicitor and experienced investment banker with over 35 years in capital markets. He has worked on numerous IPOs and private fundraisings across sectors including natural resources. Paul previously served as an Executive Director of Tantalus Rare Earths AG, the former owner of the Ampasindava Project, giving him detailed knowledge of the asset, its site, and the regulatory regime under which it operates. He is currently the Executive Chairman of TES Holdings Limited, a waste oil and water treatment business in Colombia.

A Strategic Rare Earth Asset Positioned for US Demand

Harena Rare Earths (OTCQB: CRMNF) (LSE: HREE) gives investors access to one of the larger ionic clay rare earth opportunities outside China at a time when US demand for secure magnet metal supply is accelerating. Backed by institutional investors, guided by a defined development pathway, and supported by meaningful near-term milestones, Harena is moving into a pivotal phase. With geopolitical pressure driving new interest in diversified rare earth sources, the company’s positioning has never been more relevant.

Sources

1. Harena Rare Earths. Ampasindava Rare Earths Project. Accessed November 2025. https://harenaresources.com/ampasindava-rare-earths-project/

2. U.S. Department of Energy. Critical Minerals and Materials Program. Accessed November 2025. https://www.energy.gov/cmm/critical-minerals-and-materials-program

3. FCA Data. Independent Specialist Report – 2024 Ampasindava Rare Earths Project, Madagascar. Accessed November 2025. https://data.fca.org.uk/artefacts/NSM/Portal/NI-000113586/NI-000113586.pdf

4. European Commission. Critical raw materials. Accessed November 2025. https://single-market-economy.ec.europa.eu/sectors/raw-materials/areas-specific-interest/critical-raw-materials_en

5. Harena Rare Earths. Annual Results and Notice of AGM. 30 October 2025. https://www.londonstockexchange.com/news-article/HREE/annual-results-and-notice-of-agm/17304246

6. Mining Weekly. Harena secures US offtaker for rare earth products from incoming Madagascar project. 16th May 2024. https://www.miningweekly.com/article/harena-secures-us-offtaker-for-rare-earth-products-from-incoming-madagascar-project-2024-05-16

7. Resources for the Future. The Strategic Game of Rare Earths: Why China May Only Be in Favor of Temporary Export Restrictions. October 2025. https://www.rff.org/publications/issue-briefs/the-strategic-game-of-rare-earths-why-china-may-only-be-in-favor-of-temporary-export-restrictions/

8. McKinsey & Company. Powering the energy transition’s motor: Circular rare earth elements. July 24, 2025. https://www.mckinsey.com/industries/metals-and-mining/our-insights/powering-the-energy-transitions-motor-circular-rare-earth-elements

9. Financial Times. China ‘made a real mistake’ by ‘firing shots’ on rare earths, says Scott Bessent. 31 October 2025. https://www.ft.com/content/399ad440-ecd3-4fb0-b97d-a0d8e0a8a22c

10. China Briefing. How Will China’s Rare Earth Export Controls Impact Industries and Businesses? November 10, 2025. https://www.china-briefing.com/news/chinas-rare-earth-export-controls-impacts-on-businesses/

Important Notice And Disclaimer

PAID ADVERTISEMENT

This communication is a paid advertisement. ValueTheMarkets is a trading name of Digitonic Ltd, and its owners, directors, officers, employees, affiliates, agents and assigns (collectively the “Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Harena Rare Earths PLC to conduct investor awareness advertising and marketing and has paid the Publisher the equivalent of nine thousand one hundred twenty british pounds starting 15 December 2025 to 20 February 2026 to produce and disseminate this and other similar articles and certain related banner advertisements. This compensation should be viewed as a major conflict with the Publisher’s ability to provide unbiased information or opinion.

CHANGES IN SHARE TRADING AND PRICE

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to adversely affect share prices. Frequently companies profiled in our articles experience a large increase in share trading volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in share trading volume and share price may likely occur.

NO OFFER TO SELL OR BUY SECURITIES

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security.

INFORMATION

Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position.

This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher does not guarantee the accuracy or completeness of the information. Further, the information in this communication is not updated after publication and may become inaccurate or outdated. No reliance should be placed on the price or statistics information and no responsibility or liability is accepted for any error or inaccuracy. Any statements made should not be taken as an endorsement of analyst views.

NO FINANCIAL ADVICE

The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser or a financial adviser. The Publisher has no access to non-public information about publicly traded companies. The information provided is general and impersonal, and is not tailored to any particular individual’s financial situation or investment objective(s) and this communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor or a personal recommendation to deal or invest in any particular company or product. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR+ and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results.

FORWARD LOOKING STATEMENTS

This communication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. Statements in this communication that look forward in time, which include everything other than historical information, are based on assumptions and estimates by our content providers and involve risks and uncertainties that may affect the profiled company’s actual results of operations. These statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results and performance to differ materially from any future results or performance expressed or implied in the forward-looking statements. These risks, uncertainties and other factors include, among others: the success of the profiled company’s operations; the size and growth of the market for the company’s products and services; the company’s ability to fund its capital requirements in the near term and long term; pricing pressures; changes in business strategy, practices or customer relationships; general worldwide economic and business conditions; currency exchange and interest rate fluctuations; government, statutory, regulatory or administrative initiatives affecting the company’s business.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading this communication, you acknowledge that you have read and understand this disclaimer in full, and agree and accept that the Publisher provides no warranty in respect of the communication or the profiled company and accepts no liability whatsoever. You acknowledge and accept this disclaimer and that, to the greatest extent permitted under applicable law, you release and hold harmless the Publisher from any and all liability, damages, injury and adverse consequences arising from your use of this communication. You further agree that you are solely responsible for any financial outcome related to or arising from your investment decisions.

TERMS OF USE AND DISCLAIMER

By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here https://www.valuethemarkets.com/terms-conditions/ and acknowledge that you have reviewed the Disclaimer found here https://www.valuethemarkets.com/disclaimer/. If you do not agree to the Terms of Use, please contact valuethemarkets.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY

All trademarks used in this communication are the property of their respective trademark holders. Other than valuethemarkets.com, the Publisher is not affiliated, connected, or associated with, and the communication is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks other than valuethemarkets.com.

AUTHORS: VALUETHEMARKETS

valuethemarkets.com and Digitonic Ltd and our affiliates are not responsible for the content or accuracy of this article. The information included in this article is based solely on information provided by the company or companies mentioned above. This article does not provide any financial advice and is not a recommendation to deal in any securities or product. News and research are not recommendations to deal, and investments may fall in value so that you could lose some or all of your investment. Past performance is not an indicator of future performance.

ValueTheMarkets do not hold any position in the stock(s) and/or financial instrument(s) mentioned in the above piece. ValueTheMarkets have been paid to produce this piece by the company or companies mentioned above. Digitonic Ltd, the owner of valuethemarkets.com, has been paid for the production of this piece by the company or companies mentioned above.