Disseminated on behalf of Canterra Minerals Corp. ValueTheMarkets, a trading name of Digitonic Ltd., was compensated by Canterra Minerals Corp. ten thousand US dollars starting 9th June 2025 until 20th June 2025 to produce and disseminate this. Digitonic Ltd. does not own a position in Canterra Minerals Corp.

Explorer Drilling Now in a Established Copper-Gold Region of Canada

Canterra Minerals Corp. | Listed on: (TSX-V. CTM) | (OTCQB: CTMCF)

Why This Opportunity Stands Out

Canterra Minerals Corp (TSX-V: CTM) (OTCQB: CTMCF) is unlocking a fully consolidated copper-gold district in Newfoundland. With active projects and early-stage positioning, it’s targeting high-grade resource discoveries in a resurging mining hotspot. Canterra Minerals controls one of the only fully consolidated copper-gold districts in central Newfoundland. It adjoins the Valentine Gold Mine, which is on track to become the largest gold operation in Atlantic Canada.

The company’s projects, anchored by Buchans and Wilding, are all road-accessible, which keeps exploration costs low and progress fast. Early results have outlined multiple mineralized zones, giving investors a mix of near-term updates and long-term upside.

Canterra’s strategy is straightforward: define the resource, attract a buyer, and exit. They’re not looking to build a mine themselves. Instead, they focus on making a discovery big enough to interest major players. That reduces complexity and keeps capital working toward growth.

A 10,000-meter drill campaign is already underway. It’s fully funded, backed by nearly $4 million in cash and no debt. Results are expected every two weeks from June 2025.

If you’re looking for exposure to copper and gold in a mining-friendly region, Canterra is a story with momentum and one that’s just getting started.

Retail investors often worry about drill risk, financing, and permitting. Canterra mitigates these with an experienced technical team, strong financial backers, and an ultra-permissive jurisdiction. Newfoundland’s permitting process takes under 30 days, and the company maintains strong community relations, thereby easing operational risks associated with social license and regulation.

And when it comes to backing, respected names like Eric Sprott and Michael Gentile bring serious credibility.

Reasons to Invest

-

Impressive District Control

Canterra Minerals has consolidated 100% of the copper-gold deposits (excluding the adjacent Valentine mine) in central Newfoundland, a first in the district’s history. Management believes this gives the company leverage over future discoveries in a historically prolific but fragmented mining camp.

-

Prime Location, Low-Cost Exploration

Canterra Minerals operates in one of Canada’s most mining-friendly and cost-effective jurisdictions. Newfoundland offers rapid permitting, strong local support, and low drill costs, maximizing capital efficiency and shortening the time from discovery to value realization.

-

Backed by Top Resource Investors

Canterra Minerals is supported by notable mining investors Michael Gentile and Eric Sprott, who have a strong track record of identifying and backing companies that go on to major discoveries and profitable exits.

-

Growth Potential

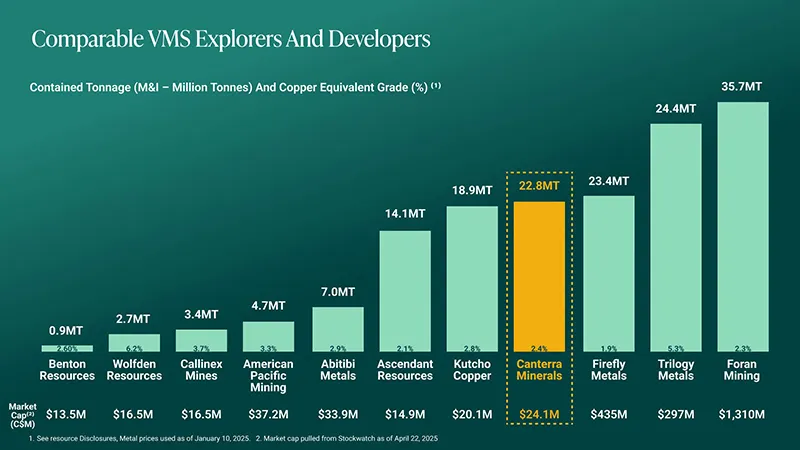

With a current market capitalization of $24 million, Canterra Minerals trades at a fraction of the market capitalization of peers like Firefly Metals ($500 million), despite having similar copper-gold resource potential. This valuation gap presents clear rerating potential, subject to exploration success and market conditions. Equinox Gold's recent CAD$2.6 billion all-stock acquisition of Calibre Mining underscores the growing interest in Newfoundland, where Canterra holds strategic ground. Its gold projects lie directly on trend with Equinox's Valentine mine, now under construction, spanning a 60 km extension of the same mineralized corridor.

-

Proven Discovery Team

The leadership has repeatedly built and sold exploration-stage companies to major miners. Over 60 years of combined exploration success in Newfoundland and globally gives Canterra Minerals strong technical and strategic credibility. Their track record of value creation through discovery-led M&A reflects a clear playbook: advance high-potential assets, attract interest from major producers, and deliver exits in active acquisition markets.

-

Strong Sector Tailwinds

Copper demand is on the rise, driven by growth in electrification, renewable energy, and data infrastructure. Gold is benefiting from central bank buying, concerns over currency devaluation, and heightened geopolitical risk. These dual tailwinds are driving capital back into the resource sector, creating a favorable backdrop for discovery-stage companies like Canterra with exposure to both metals.

About Canterra Minerals

Canterra Minerals Corp (TSX-V: CTM) (OTCQB: CTMCF) is a diversified exploration company focused on discovering tier-one copper and gold deposits in the central Newfoundland mining district1. The company has uniquely consolidated all known copper-gold mineralization in this prolific but historically fragmented region. Its projects are located near historic mines that produced copper, zinc, lead, silver, and gold. Its gold assets lie along a 60 km trend connected to Equinox Gold’s Valentine Mine, currently under construction. Canterra’s position in this emerging district places it early in the exploration cycle, as Newfoundland experiences renewed interest driven by recent high-grade gold discoveries.

Robust Financial Position

No Debt

$4M cash on hand

The company is well-capitalized, with nearly $4 million in the bank and no debt, confidently funding its 2025 exploration program. Notable backers include resource-focused investors, like Michael Gentile and Eric Sprott, who have previously led successful juniors through to high-value acquisitions.

Lead Asset: Buchans Project

Canterra’s primary focus is the 100% owned Buchans project in Newfoundland, where it hosts the historic Buchans mine. It is located 50km north of Equinox Gold’s Valentine Gold Mine and 34km northwest of Teck Resources’ past-producing Duck Pond Mine. Extensive data analysis, 3D modeling, and a partnership with global miner Boliden have revealed several high-grade targets that remain untested, highlighting the strong potential for new discoveries near past-producing zones.

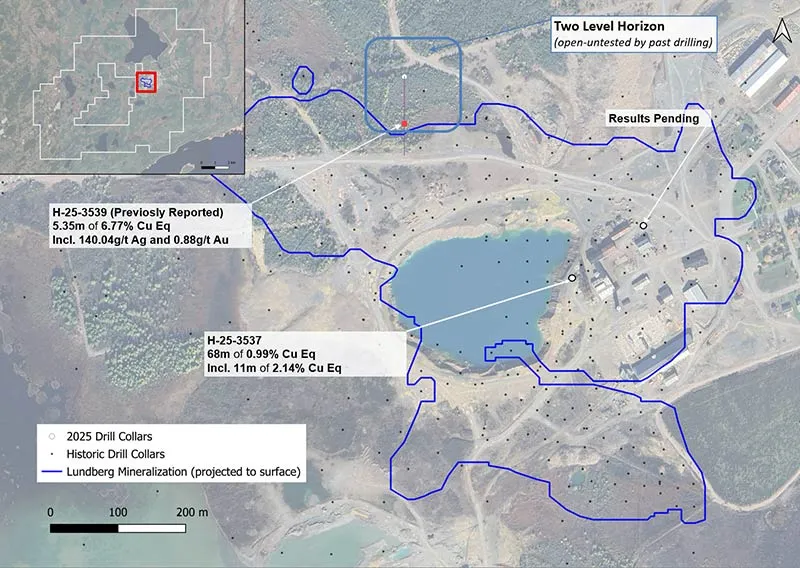

At Buchans, Canterra is focused on expanding the Lundberg deposit, which already hosts a sizable historical resource and is situated next to the former high-grade Lucky Strike mine. Phase 1 of its 10,000m 2025 drill program is underway, and recent drilling of the Two Level Horizon target has delivered consistently strong results, including wide intervals of high-grade mineralization that extend beyond the current resource envelope.

Lundberg contains copper, lead, silver, gold, and zinc deposits, and recent results show the metal-rich Two Level Horizon is larger than originally thought. A past producer at Buchans operated from 1928 to 1984.

Drilling is targeting high-grade, near-surface, underexplored areas with standout intercepts including 6.77% copper equivalent (CuEq) over 5.35m, 8.88% CuEq over 2.00m, and 2.25% CuEq over 60.25m, highlighting strong open-pit potential.

Recent drilling results from its ongoing 10,000 metre drill program at its 100% owned Buchans Project provides further validation to its efforts.

The consistency and grade of this intersection reinforces our belief that Buchans represents one of the most compelling undeveloped critical minerals opportunities in Atlantic Canada.

To guide the next phase of drilling, Canterra is conducting 3D geophysical surveys across the Buchans property. The program includes AI-powered analysis from VRIFY AI, aiming to refine drill targets to depths of 800 meters.

Assays (lab analysis of samples) are pending from additional Phase 1 holes at the Lundberg deposit and the nearby Pumphouse target, located 1.5 km northeast of Lundberg. Pumphouse is a promising zone believed to be a repeat of the mineral-rich Oriental Mine horizon. It is situated 500 meters northwest of the old Oriental Mine, which operated from 1935 to 1983.

Canterra’s broader project portfolio in the Central Newfoundland Mining District, including Buchans, hosts a combined 26 million tons (Mt) of Indicated and Inferred resources across 7 deposits, with the goal of increasing this to 40Mt.

As it stands, Canterra has the second-largest critical minerals resource base in Newfoundland, and it aims to become the largest critical minerals resource holder in Newfoundland in 2025.

Competitor Analysis

Compared to peers like Firefly Metals and Kodiak Copper, Canterra presents at a much lower valuation. Canterra’s complete consolidation of copper-gold assets in the region gives it strategic control that management believes is unmatched by competitors.

Growing Market Opportunity

Copper’s role in electrification and grid expansion makes it a critical mineral for Canada’s economic future. As federal policies boost support for domestic supply chains, explorers like Canterra Minerals are well-positioned.

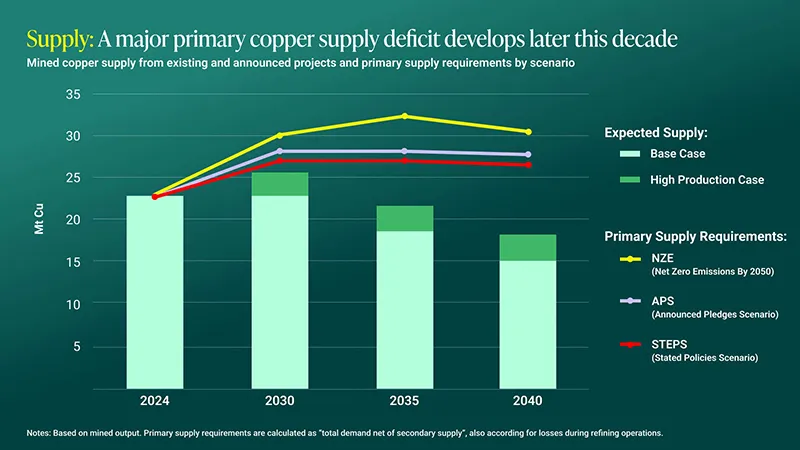

In the long term, copper demand is expected to grow by over 40% by 20402, driven by its critical role in electric vehicles, renewable energy, data centers, and digital infrastructure. This increase in demand has highlighted a significant forecasted supply deficit.

Based on the pipeline of existing and announced copper mining projects, there is set to be a 30% supply deficit by 2035 in the STEPS scenario (Stated Policies Scenario). This supply gap widens to 35% in the APS (Announced Pledges Scenario) and over 40% in the NZE Scenario (Net Zero Emissions by 2050) in the same year3.

The copper price on the London Metals Exchange (LME) is up approximately 8.3% year-to-date. U.S. tariffs and supportive Chinese demand have increased volatility, but the big picture for demand remains strong, with the IEA projecting the world is heading toward a major copper shortage as demand accelerates3.

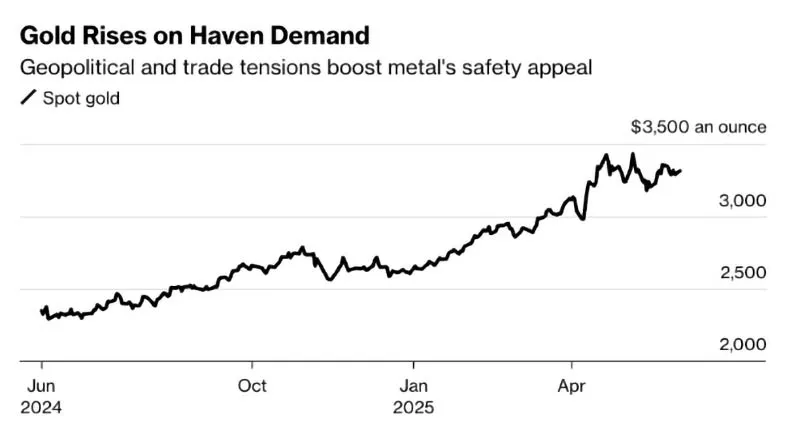

Gold demand reached a nine-year high4 in Q1 2025, totaling 1,206 metric tons, the strongest start to a year since 2016. Gold prices have reached record levels in 2025, passing $3,500/oz and are forecast by Goldman Sachs to climb to US$3,700/oz by year-end5.

Gold’s role as a hedge against global instability remains a key attraction for investors. The surge is fueled by global economic uncertainty, geopolitical tensions, and concerns about inflation and recession, prompting both institutional and retail investors to seek gold as a safe haven.

Canterra’s exposure to both metals gives it strong thematic relevance.

Expansion Plans

The company fully owns its deposits and exploration potential and is focused on delivering a discovery through its own drilling program. Recent developments and early 2025 drill results have attracted industry attention. Management expects to continue pursuing these opportunities and will announce any significant progress as it materializes.

CEO Chris Pennimpede and board members such as Josh Serfass have helped guide previous companies to successful exits, including Underworld Resources (Kinross), Northern Empire Resources (Coeur Mining), and Integra Gold (Eldorado Gold).

Experienced Leadership Team

Canterra Minerals is led by an accomplished management team and board with deep expertise across geology, finance, corporate development and capital markets. From advancing early-stage exploration projects to executing major mining transactions, the team brings decades of hands-on experience in building value in the resource sector. The team also has a proven M&A track record in resource exploration.

Their combined backgrounds span successful roles at leading exploration companies, global mining firms, investment banks and entrepreneurial ventures, positioning Canterra to execute on its strategic growth in critical minerals and gold exploration. Some of the management and board members include:

President and CEO Christopher Pennimpede, P.Geo, is a professional geologist with deep expertise in mineral exploration and mining business development. He has worked extensively with early-stage companies and previously served as VP of Corporate Development at Contact Gold Corp. His earlier roles include exploration geology positions at Underworld Resources, which was later acquired by Kinross Gold Corp (NYSE: KGC), and Northern Empire Resources, which was acquired by Coeur Mining Inc (NYSE: CDE).

Vice President of Exploration, Paul Moore, has over 25 years of experience in mineral exploration and mining across Canada. He has advanced multiple projects to the Resource Estimation and Preliminary Economic Assessment stages and managed large-scale, remote exploration programs with annual budgets exceeding $9 million and teams of up to 60 people.

Chairman and Director Andrew Farncomb, B.Comm. is a merchant banker and M&A advisor with extensive capital markets experience, formerly a partner at Paradigm Capital.

CFO, Sara Hills, CPA, CA is a senior finance executive with over 20 years in mining accounting and leadership roles, including with KGHM International and Teck Resources.

Josh Serfass, Director, is a corporate development executive known for driving innovation in mining and helping lead Integra Gold through a C$600M acquisition by Eldorado Gold Corp (NYSE: EGO).

To learn more about the team leading Canterra Minerals, download our detailed research report.

Canterra Is Drilling Now. Discovery News Is Imminent.

Canterra is entering a catalyst-rich period, with a 10,000-meter drill program already in motion. Given the favorable jurisdiction, strong financial backing, and a proven team driving discovery, investors seeking early-stage leverage in copper and gold should be watching closely.

Sources:

1. Canterra Minerals Corporation. Corporate Website. Accessed May 2025. https://canterraminerals.com/

2. UN Trade & Development. Global Trade Update (May 2025): Focus on critical minerals – copper in the new green and digital economy. May 2025. https://unctad.org/publication/global-trade-update-may-2025-critical-minerals-copper

3. IEA. Global Critical Minerals Outlook 2025. Overview of outlook for key minerals. May 2025. https://www.iea.org/reports/global-critical-minerals-outlook-2025/overview-of-outlook-for-key-minerals

4. Scottsdale Bullion & Coin. Gold Demand Reaches 9-Year High in Q1 2025. May 2, 2025. https://www.sbcgold.com/blog/gold-demand-reaches-9-year-high-in-q1-2025/

5. Goldman Sachs. Why gold prices are forecast to rise to new record highs. May 15, 2025. https://www.goldmansachs.com/insights/articles/why-gold-prices-are-forecast-to-rise-to-new-record-highs

6. Bloomberg. Gold Climbs as Rising Geopolitical and Trade Tensions Aid Havens. June 02, 2025. https://www.bloomberg.com/news/articles/2025-06-02/gold-climbs-as-rising-geopolitical-and-trade-tensions-aid-havens

Important Notice And Disclaimer

PAID ADVERTISEMENT

This communication is a paid advertisement. ValueTheMarkets is a trading name of Digitonic Ltd, and its owners, directors, officers, employees, affiliates, agents and assigns (collectively the “Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Canterra Minerals Corp. to conduct investor awareness advertising and marketing and has paid the Publisher the equivalent of ten thousand US dollars starting 9th June 2025 until 20th June 2025 to produce and disseminate this and other similar articles and certain related banner advertisements. This compensation should be viewed as a major conflict with the Publisher’s ability to provide unbiased information or opinion.

CHANGES IN SHARE TRADING AND PRICE

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to adversely affect share prices. Frequently companies profiled in our articles experience a large increase in share trading volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in share trading volume and share price may likely occur.

NO OFFER TO SELL OR BUY SECURITIES

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security.

INFORMATION

Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position.

This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher does not guarantee the accuracy or completeness of the information. Further, the information in this communication is not updated after publication and may become inaccurate or outdated. No reliance should be placed on the price or statistics information and no responsibility or liability is accepted for any error or inaccuracy. Any statements made should not be taken as an endorsement of analyst views.

NO FINANCIAL ADVICE

The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser or a financial adviser. The Publisher has no access to non-public information about publicly traded companies. The information provided is general and impersonal, and is not tailored to any particular individual’s financial situation or investment objective(s) and this communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor or a personal recommendation to deal or invest in any particular company or product. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR+ and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results.

FORWARD LOOKING STATEMENTS

This communication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. Statements in this communication that look forward in time, which include everything other than historical information, are based on assumptions and estimates by our content providers and involve risks and uncertainties that may affect the profiled company’s actual results of operations. These statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results and performance to differ materially from any future results or performance expressed or implied in the forward-looking statements. These risks, uncertainties and other factors include, among others: the success of the profiled company’s operations; the size and growth of the market for the company’s products and services; the company’s ability to fund its capital requirements in the near term and long term; pricing pressures; changes in business strategy, practices or customer relationships; general worldwide economic and business conditions; currency exchange and interest rate fluctuations; government, statutory, regulatory or administrative initiatives affecting the company’s business.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading this communication, you acknowledge that you have read and understand this disclaimer in full, and agree and accept that the Publisher provides no warranty in respect of the communication or the profiled company and accepts no liability whatsoever. You acknowledge and accept this disclaimer and that, to the greatest extent permitted under applicable law, you release and hold harmless the Publisher from any and all liability, damages, injury and adverse consequences arising from your use of this communication. You further agree that you are solely responsible for any financial outcome related to or arising from your investment decisions.

TERMS OF USE AND DISCLAIMER

By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here https://www.valuethemarkets.com/terms-conditions/ and acknowledge that you have reviewed the Disclaimer found here https://www.valuethemarkets.com/disclaimer/. If you do not agree to the Terms of Use, please contact valuethemarkets.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY

All trademarks used in this communication are the property of their respective trademark holders. Other than valuethemarkets.com, the Publisher is not affiliated, connected, or associated with, and the communication is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks other than valuethemarkets.com.

AUTHORS: VALUETHEMARKETS

valuethemarkets.com and Digitonic Ltd and our affiliates are not responsible for the content or accuracy of this article. The information included in this article is based solely on information provided by the company or companies mentioned above. This article does not provide any financial advice and is not a recommendation to deal in any securities or product. News and research are not recommendations to deal, and investments may fall in value so that you could lose some or all of your investment. Past performance is not an indicator of future performance.

ValueTheMarkets do not hold any position in the stock(s) and/or financial instrument(s) mentioned in the above piece. ValueTheMarkets have been paid to produce this piece by the company or companies mentioned above. Digitonic Ltd, the owner of valuethemarkets.com, has been paid for the production of this piece by the company or companies mentioned above.