IT tech superstar Microsoft (NASDAQ: MSFT) reports its FY21 Q4 Earnings on Tuesday, July 27.

Microsoft returned phenomenal earnings in Q3, which ended March 31. It achieved double-digit revenue growth across all its primary segments, which is not typical behavior.

Microsoft owns its Office 365 software, Cloud service Azure, Xbox, and LinkedIn, all of which are thriving entities in their own right.

LinkedIn revenues rose 25% in the quarter, while Azure saw revenue growth of 50%.

Q3 revenue came in at $41.7bn, increasing 19% year-over-year. While operating income was $17bn, a rise of 31%.

Meanwhile, net income was $15.5bn GAAP, a rise of 44% year-over-year, and $14.8bn non-GAAP, up 38% year-over-year.

Diluted earnings per share (EPS) came in at $2.03 GAAP, rising 45% year-over-year. While non-GAAP came in at $1.95 non-GAAP, increasing 45%.

Furthermore, the company returned $10bn to shareholders in Q3 through share repurchases and dividends.

Photographer: Mohammad Rezaie | Source: Unsplash

#Bullish sentiment prevails

There is clearly bullish sentiment thriving around MSFT as millions of dollars worth of call options are stacking up against the stock. This means derivatives traders (hedge funds and savvy investors) are going long.

Meanwhile, bearish sentiment does exist but to a lesser degree. The bears believe the MSFT share price has already hit all-time highs, and it’s downhill from here, whereas the bulls still see significant upside.

Analyst 12-month average price target comes in above $299, 5% higher than its current share price.

Microsoft continues to innovate and transition, experiencing accelerated growth across several aspects of its platform.

#Shareholder risks

Economic slowdown worries continue, as does the fear of inflation and the rapidly spreading coronavirus Delta variant. This could all cause the MSFT share price to slip.

Meanwhile, growth could slow as rising competition eats at its market share. Google-owned Alphabet (NASDAQ: GOOGL) is gaining ground with its Cloud offering, and Amazon’s (NASDAQ: AMZN) AWS is also highly revered.

As it’s an IT business, security is at the heart of Microsoft products. This was further confirmed by its recent acquisition of security software firm RiskIQ for around $500m.

While hopefully unlikely, high-profile hacks have become more prominent in recent years. Such an attack on Microsoft would cause considerable damage to its reputation and service image.

#MSFT Financial Fundamentals

Microsoft has been growing its dividend for the past 17 years. But the yield has fallen as the share price has risen. It currently offers a yield of 0.78%.

To calculate the dividend yield you divide the dividend per share by the stock price per share.

The MSFT share price remained on a steady trajectory from the mid-90s to 2015. Since then, it has rocketed, which explains the lower yield.

0.78% is better than nothing, and more than its peers, but relatively low for such a long-established money-generating machine.

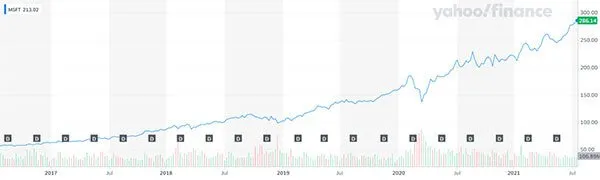

The MSFT share price has risen 404% over the past 5 years. It’s up 41% in the past year and 31% year-to-date.

Microsoft share price chart five-years – Source: Yahoo Finance

This soaring investor confidence could be, in part, thanks to the current CEO, Satya Nadella, who has been in the role since 2014.

After exceptional returns in Q3, Nadella said:

“Over a year into the pandemic, digital adoption curves aren’t slowing down. They’re accelerating, and it’s just the beginning,”

Microsoft’s price-to-earnings ratio is considered high at 37, but its earnings have grown considerably in the past five years, which helps justify it.

#Q4 Predictions

For fiscal Q4, Wall Street expects adjusted EPS of $1.90 and revenues of $44.1bn.

The company has provided preliminary revenue forecasts for its individual segments:

Productivity and Business Processes Unit: $13.8bn to $14.05bn

Intelligent Cloud: $16.2bn to $16.45bn

Personal Computing: $13.6bn to $14bn

Office Commercial: revenue growth driven by Office 365

On-premises business: revenue decline in high teens

Office consumer: mid-to-high teens revenue growth, driven by Microsoft 365 consumer subscriptions.

LinkedIn: revenue growth in mid-30% range

Dynamics: revenue growth similar to Q3

Azure: revenue driven by strong growth in consumption-based business.

On-premises server business: revenue growth in mid-single digits

Enterprise Services: revenue growth roughly in line with Q3

Windows: revenue should grow mid-single digits

Surface: revenue decline in mid-teens (supply chain issues)

Search ex Traffic acquisition costs (TAC): revenue growth in the mid-40s, driven by improvements in advertising

Gaming: revenue growth in the mid-to-high single digits.

Company Guidance:

Cost of goods sold (COGS): $13.7bn to $13.9bn

Operating expense: $13.1bn to $13.2bn (benefiting from Covid savings)

Other income and expense: interest income and expense should offset each other. Q4 effective tax rate: approximately 16%

All-in-all, MSFT stock could potentially be overvalued at its current level, but Wall Street remains bullish.