We are entering the fifth week of stock market panic in the wake of the coronavirus pandemic and there is still no bottom in sight.

The question we are now being asked most consistently is: how much worse can it really get? The temptation is to say that UK share prices have fallen so far that -surely- they cannot go any lower. In my view, that would be a big mistake.

For anyone with exposure to equity markets, these past two months have felt like a lifetime.

UK investors were treated to a brief rally on Friday 20 March with some riskier retail and travel equities gaining traction. JD Sports (LSE:JD) and British Airways owner Intercontinental Airlines Group (LSE:IAG) both climbed 10%.

But these gains are now proven to be a false dawn.

The FTSE 100 fell another 5% at open to slip below 5,000 and Dow Jones futures dropped 30% ahead of the opening bell on Monday 23 March.

Covid-19 is now certain to push developed economies into recession. The main hope now is that deletion of years of share price growth does not turn into stagflation or sustained depression.

Capitulation and recession

The point of no return for stock pickers is the moment at which fear and panic selling turns from a flight to safety into a full-blown market exit.

This is the capitulation point.

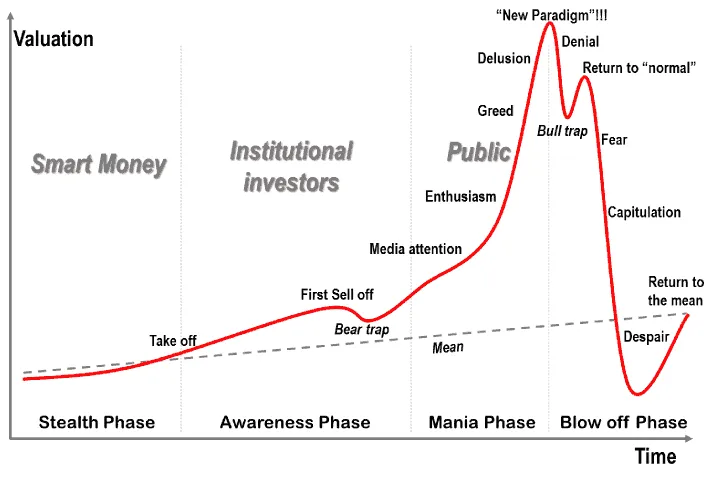

One chart that springs to mind was widely shared during the 2008 financial crisis, where Canadian economist Dr Jean Paul Rodrigue analysed the main stages of asset bubbles. I believe we are still in the Fear phase now and there is much further for markets to fall before we are anywhere close to Capitulation and Despair.

The chart is a vast oversimplification, of course, but it provides a useful reference point.

For at least the past five years, equity values have been in a bubble-like expansion. Share price-to-earnings ratios have skyrocketed even for relatively unprofitable companies.

Businesses large and small loaded up on extremely cheap debt to make vast acquisitive expansions and stocks have become wildly overvalued. That bubble is now bursting before our eyes. Would it have happened without the coronavirus-induced economic stop? Few can say. But it is happening. And I would say it is going to get a lot worse before it gets any better.

Undue optimism

Once in a lifetime events seem to be coming at us with frightening regularity now. Thursday 19 March saw the new governor of the Bank of England Andrew Bailey slash interest rates to 0.1%, their lowest level in the 300-year history of the institution.

And a report by the OECD out today suggests that investors are still too optimistic about the chances of market recovery.

KMPG’s latest quarterly economic outlook pegs UK GDP growth to fall to negative 2.6% in 2020, before returning to 1.7% growth in 2021. That is its most optimistic prediction.

A more pessimistic outlook, if the coronavirus pandemic persists into the second half of next year, says that UK GDP will contract by 5.4% in 2020 and fall another 1.4% in 2021, representing a more severe recession than the 2008-2009 downturn.

Yael Selfin, KPMG UK’s chief economist, said: “We expect the weakness in demand to pull consumption down by 2.5% in 2020, as social distancing measures take their toll on consumer confidence and limit spending opportunities,”

“Until we know how and when the Covid-19 outbreak will end, the scale of the negative economic impact will be difficult to quantify.”

“It is now almost certain that the UK is slipping into its first significant downturn in over a decade,” she added.

Hundreds of billions of pounds has already been wiped from the market caps of the UK’s top 350 largest companies. We have witnessed some of the largest one-day falls in history. And yet I believe the signs are clear that there is far further to fall.

Until we see some kind of good news about a potential vaccine for coronavirus, the market will not rebound.

Let’s not forget that there is currently no treatment for SARS-Cov-2, the disease caused by Covid-19. Modelling by UK health officials predicts widespread infections peaking by late May at the earliest. And that is if the population can resist cabin fever and stay at home for weeks on end.

US falls

Across the pond, the President of the St Louis Fed James Bullard admitted on Sunday 22 March that US joblessness may hit an unprecedented 30% with GDP cratering by a record 50%.

While a sensible investor might look at these numbers and think that companies cutting jobs will need those workers back when the economy stabilises, the simple fact is this: companies will go bankrupt before they get a chance to open up and attempt a return to the norm.

Any company who has not deleveraged and derisked its balance sheet — I’m looking at you, Cineworld (LSE:CINE) — will be first on the chopping block.

Five weeks of market panic and we still have not reached the capitulation stage, where investors lose all hope. We have not yet seen business collapse of the kind we predicted. Nobody wants to see people out of work but the fact is that it will happen and we are nowhere near the bottom yet.