Tesla’s Q4 earnings are in sight, with the call taking place on January 26. Q3 earnings were a beat with record revenues and EPS of $1.86 beating estimates, so expectations for more of the same are running high.

Annual electric vehicle deliveries surged 87% in 2021, to more than 936,000. That was almost double the 2020 figures of 499,550 EVs.

Wall Street analysts forecast Tesla EPS for Q4 to come in at $2.24 a share. They remain bullish on its Q4 results.

Nevertheless, competition from legacy carmakers is ramping, and a Bank of America research report states that Tesla will lose EV market share in the United States in the coming years.

To justify its lofty share price, Tesla must up its sales considerably. The target lies between 16 million and 46 million, depending on the average selling price of each EV.

Meanwhile, Morgan Stanley analyst, Adam Jonas, projects Tesla will sell 8.1 million vehicles in 2030.

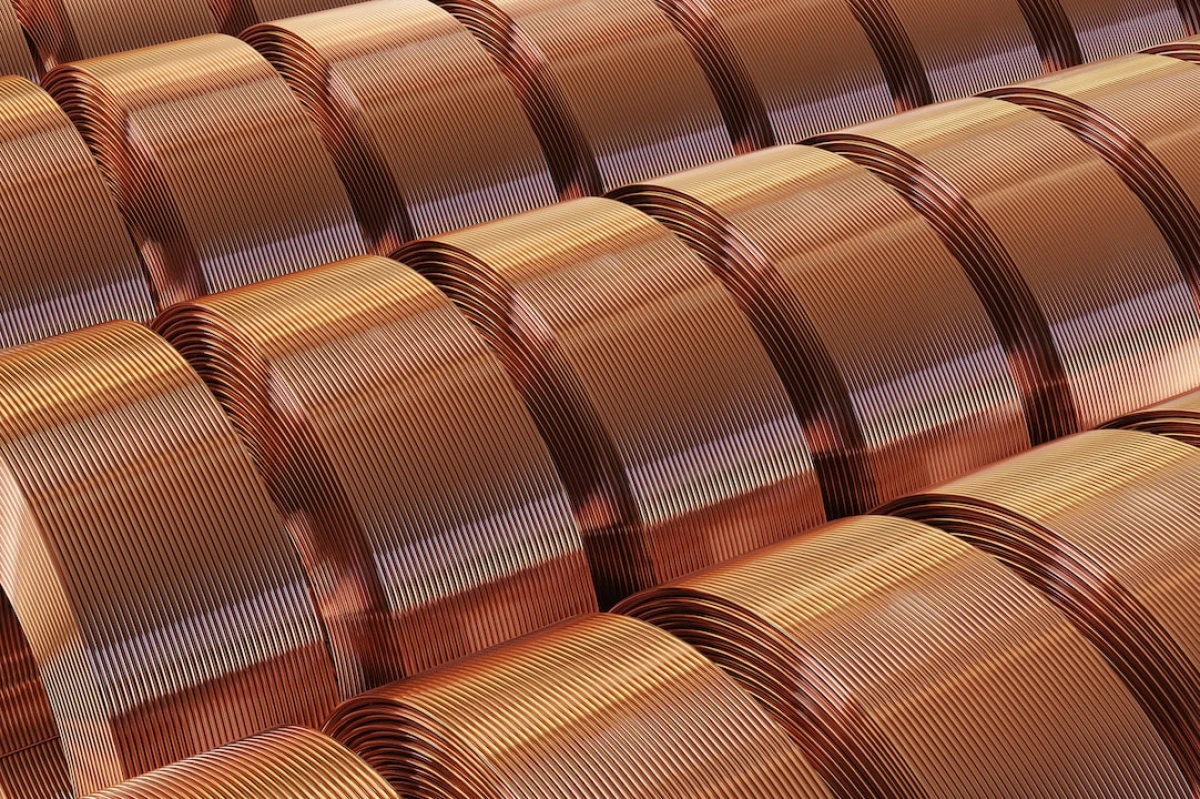

Meanwhile, Panasonic is reportedly investing $700m to produce Tesla’s 4680 battery cell at a factory in Japan by 2023.

Will TSLA stock plummet below $800? At this point, no one knows. The bears and bulls are still battling it out. At the moment, the anticipation of an upbeat Q4 earnings report makes a sub $800 share price seem unlikely. But if ARK Invest begins substantially offloading TSLA shares, look out.