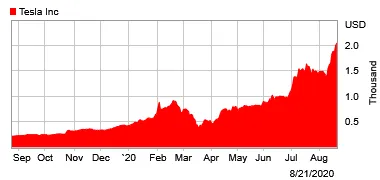

Tesla, the trailblazing electric vehicle maker, has been enjoying a whirlwind summer with its share price skyrocketing and market cap exploding. With positive news coming thick and fast, there is now wide speculation that Tesla will be added to the S&P 500 (SPX) in the coming weeks. Precisely when is unknown and until it is confirmed there is always the chance, it may not happen at all. So why is this a big deal and what would it mean for existing shareholders and the wider investment community at large?

Image is taken from the southcentralus1-mediap website

Image is taken from Tesla Website

A milestone on route to world domination

Firstly, the S&P 500 is generally considered to give the best representation of the United States stock market at any given time. It is market cap weighted and contains the 500 largest companies in the US. Being admitted is seen as a milestone in any dominant company’s history and often a stepping stone to greater things. It contains industry titans such as Apple, Microsoft, Amazon, Alphabet, Facebook, and Berkshire Hathaway. The only way to add a new company is for an existing one to leave, and that usually happens through acquisition. The process is shrouded in secrecy to try to keep a fair playing field in the financial markets.

S&P 500 Eligibility Criteria

The company must be US based

It must already be listed on the NYSE, Nasdaq or CBOE

It must have a market cap above $8.2 billion

It will have reported 4 straight quarters of profit in accordance with GAAP

In recent weeks Tesla has met all the requirements to become a member, which includes both quantitative and qualitative measures. But admission is not automatic and when this will happen depends on a committee making the final decision. Two companies tipped to leave soon are Tiffany & Co. (TIF US) and E*Trade Financial Corp (ETFC). Tiffany is being bought by French luxury goods group LVMH (Louis Vuitton Moet Hennessy) (MC FP), while E*Trade is being acquired by Morgan Stanley (MS).

Image is taken from nyse website

The Tiffany deal is expected to conclude mid-August. Although this could technically be an opportune moment to admit Tesla, the S&P committee may choose to delay it until September, when it is due to meet for an index rebalance.

#Posing a dilemma for fund managers

The addition of Tesla to the index is not as simple as it sounds. For ETF and index fund managers that run index funds on behalf of their clients, it is vital that the weighting of the fund is always closely matched to that of the index. Never has such a massive company been admitted. Now if it is going to replace Tiffany for example, it is far from a like-for-like swap on a market cap basis, Tiffany has a market cap of $15 billion, and E*Trade, $11 billion, while Tesla’s is over $380 billion. It is not only that Tesla would be the biggest ever stock to be admitted, but it is also notoriously volatile.

This poses several problems for the index fund managers. Estimates show that passive S&P 500 trackers would need to buy between 15-25 million Tesla shares. At $2000 per share, that amounts to as much as $50 billion worth of stock. According to the S&P Dow Jones, around $4 trillion in capital is allocated to S&P 500 trackers.

In addition to this, active managers and individuals tracking the index will also be looking to buy. This makes it highly likely a surge in buying will continue up until the announcement is made. This has no doubt begun, and it fogs the view of whether Tesla stock is fundamentally strong or simply being inflated by speculation and panic buying. Either way, index trackers trying to keep pace could end up paying more than they bargained for in order to keep their portfolios balanced. There is concern they will be left holding surplus stock after admission has been made, when many speculators sell out for a profit.

Historically, a change of admittance is announced between 4 and 10 days prior to taking effect. For investors looking to take advantage of the transition, getting in early before the announcement could give them the best boost. However, this is a bone of contention among Vanguard’s traders and analysts. Deciding the best strategy to take is by no means easy as it involves selling some stock in the other 499 companies to keep their index trackers balanced. Meanwhile, estimating the effect it will have on Tesla’s share price and that of its peers, must also be considered. Finally, they must strive to keep transaction costs to a minimum.

Image is taken from the Thomson Reuters website

#What if Tesla does not get added to the S&P 500?

It is up to the S&P 500 committee when they decide to admit a new member and there is no set rule that they must. If it does not get added to the US’s most respected index, then index funds will be left holding more Tesla stock than they would have otherwise wanted and there will be questions as to why such a prominent and financially stable company was not admitted.

Image is taken from the southcentralus1-mediaap website

The coronavirus pandemic may have halted traditional auto sales, but evidence shows that sales of electric vehicles are on the rise. On the other side of its business, climate change is putting pressure on its energy offerings to become affordable sooner rather than later. To which end Tesla is accelerating its mission to transition the world to sustainable energy and could very well see many more years of growth for its business and shareholders alike.