TikTok has been all over the news in recent months both for its lockdown friendly content and its controversial potential US ban and subsequent takeover plans. It’s a relatively new brand to the US, having only launched here in 2017 but its success has passed all expectations and the app is wildly popular among millennials and Gen-Z users. Now there are rumours it might go public via an initial public offering (IPO), but if so, when will it happen and what will it be worth?

#What is TikTok?

TikTok is a Chinese mobile app that has found worldwide fame. Although we know it as TikTok, its brand name in China is Douyin, where it launched back in September 2016. By 2019 TikTok was in the top 5 of the world’s most downloaded non-gaming apps.

The infectious popularity of TikTok is in its fun and easy way to create and share ultra-short videos, usually lasting between three and 15 seconds. The videos are mostly accompanied by a music soundtrack and very often feature dancing, lip syncing, pranks or comedy sketches. They are usually altered in some way with special effects.

Meme culture is popular on the app, with easily edited media clips creating viral content for laughs. Much of the TikTok content bears a similar resemblance to that which rose to prominence on the discontinued Vine app, but it’s far surpassed Vine in the popularity stakes.

Its videos are not exclusively shared within the TikTok app. The popular ones are widely shared across other social networks too including Facebook, Instagram, Snapchat, Twitter and YouTube.

TikTok offers paid advertisement services to brands for product promotion within the app which accounts for a large proportion of its revenue. It also offers in-app purchases of coins which users can ‘gift’ to their friends, followers or favourite creators. These coins can be exchanged for digital gifts.

Image taken from Entrepreneur website

#Controversies

In its short life span TikTok has seen its fair share of controversies. There have been safety concerns for children, accusations of censorship and unsolicited data collection. The safety concerns for children stemmed from the presence of explicit and pornographic content and predatory behaviour. Consequently, this led to a temporary ban in India for morality issues and many parents remain wary of their children using the app. Data privacy has been another concern, which led to ByteDance (BDNCE), TikTok’s Chinese owner, being fined $5.7m by US authorities for illegally collecting children’s data.

More recently we’ve seen endless media coverage of the intensifying national security dispute between President Trump and ByteDance. President Trump, not averse to shock tactics, made an extraordinary move in August, issuing an executive order against any US firms from conducting business with TikTok. While this caused outrage in the US, China has never allowed Facebook, Instagram, Snapchat or Twitter to operate in its country for the same reason, so it can be argued that Trump is simply considering national security concerns from the same viewpoint as the Chinese authorities.

In response to the executive order, ByteDance is spinning TikTok off from the rest of its operations in an attempt to meet US ownership requirements. ByteDance recently confirmed that TikTok Global, a new entity fully based in the US, will have its own IPO in due course. This will be separate from ByteDance’s own IPO, which is also rumoured to be in the pipeline.

As tensions between India and China have intensified this summer, TikTok has again been banned in India, along with several other Chinese owned apps. This is unfortunate as it enjoys extreme popularity in India with its content resonating deeply with youngsters living there. It had even launched an educational program via the platform, to bridge the learning gap, and bring educational content to the masses. This was the first TikTok launch of its kind anywhere in the world and covered a range of educational content from science, math and languages to health, motivational encouragement and mental wellbeing.

Image taken from TikTok website

#Ownership

TikTok is owned by private Chinese company ByteDance and it’s had a somewhat complicated arrival in the West.

In late 2017 ByteDance reportedly paid $1 billion for rival app Musical.ly which already had a large US user base. The two apps were merged the following summer but late last year the US government launched a national security review of the acquisition. The grounds for the review were ByteDance may be censoring politically sensitive content and there were also questions over its personal data storage methods. In addition, there are ongoing worries that TikTok could be targeted by foreign influence campaigns.

This has resulted in many hoops for ByteDance to jump through in order to ensure TikTok can continue operating in the US. At one-point Microsoft (NASDAQ:MSFT) was expected to take ownership of TikTok Global, but it was pipped to the post by long-time nemesis Oracle (NYSE:ORCL) in a deal thought to be worth over $7 billion to Oracle. Now Oracle is considered a bit of a dinosaur in the modern tech world, so this came as a surprising move. Nevertheless, it’s now looking at a 12.5% ownership, with grocery magnate Walmart (NYSE:WMT) acquiring a 7.5% stake. Together it gives the US a 20% ownership of TikTok Global, leaving ByteDance with the other 80%. But is that enough to appease the senate? Well, considering ByteDance is actually half owned by US private equity firms, it can be argued that in effect, the US does have more than a 50% ownership in TikTok.

Larry Ellison, CEO of Oracle, and vocal supporter of Trump, personally lobbied the President to get him to sign off on a preliminary agreement in regard to Oracle obtaining its TikTok Global stake. Oracle has committed to guarantee the security of TikTok users’ data. The White House backed the bid and Oracle will reportedly earn $1 billion annually for managing TikTok’s cloud-computing business. Meanwhile Walmart will become its official ecommerce partner.

However, the ownership stakes are still being contested by people at Oracle and Walmart, who claim that they don’t want ByteDance to have any majority ownership of TikTok Global. In the aftermath of the confusion both Oracle and ByteDance released statements contradicting one another’s view of the situation. ByteDance said that after the IPO it would retain its 80% ownership, while Oracle stated the American shareholders would own the company through their various investment companies and ByteDance would have no ownership stake in TikTok Global.

The complexities of this potential deal are going to take time to iron out. Meanwhile, a London based investment company called Centricus Asset Management is also still hoping for a shot at taking US control of TikTok Global, over Oracle and Walmart. Though Centricus may not be a household name, they are recognised as previously helping set up Softbank Group Corp $100 billion Vision Fund.

In the summer, Centricus laid out a plan to acquire several of TikTok’s international operations and merge them with another social media app called Triller (an American version of TikTok). So far it hasn’t made headway, but it still holds out hope and continues to revise its proposition. According to a Wall Street Journal report explaining its plan, it would include a mix of US companies and international investors to purchase ByteDance’s stake and oversee US and non-Chinese operations. The deal is thought to be worth $20 billion ($10bn in cash and $10bn in profit-sharing).

Until the Oracle and Walmart stakes are finalised the Centricus management team believes it still has a shot at the TikTok prize. However, ByteDance says it has never been in any discussions with Centricus, shooting down the likelihood of this path being taken. However today the Wall St Journal reports seeing evidence of Centricus having discussions with Zhang Yiming, the CEO of ByteDance.

All-in-all the situation remains unclear and could be disputed for some time to come.

#TikTok’s Popularity

A key factor in TikTok’s rapid rise and success is its extreme approach to advertising. It doesn’t hold back and ever since the Musical.ly merger, its ad revenue spend has risen with a big focus on advertising through its rivals.

Last year, The Wall Street Journal reported TikTok to be Snapchat’s biggest advertiser, with an app-install campaign worth $1 billion. When Facebook’s growth began to decline, it coincided with a drop in advertising spend, so it appears TikTok is learning from Facebook’s mistakes.

TikTok uses artificial intelligence (AI) and machine learning in its algorithms to create content feeds that are customized to users tastes. This helps retain users and aids in boosting its popularity.

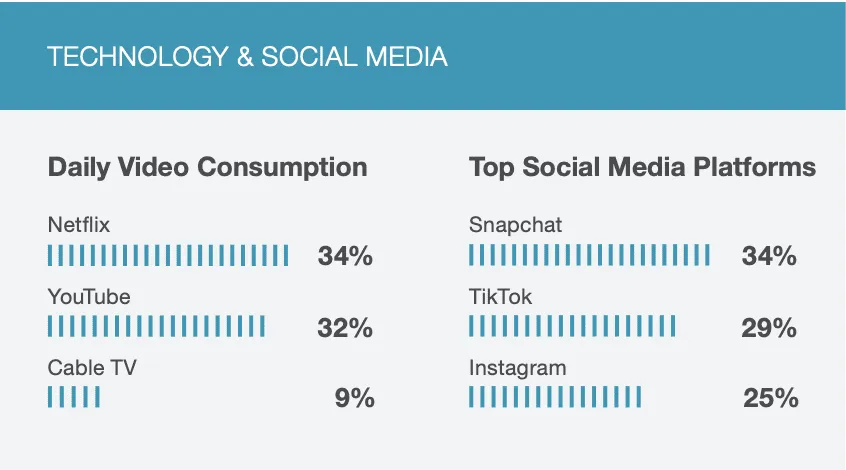

A recent survey of US teens by Piper Sandler showed TikTok behind Snapchat, but ahead of Instagram.

Image taken from Piper Sandler PDF

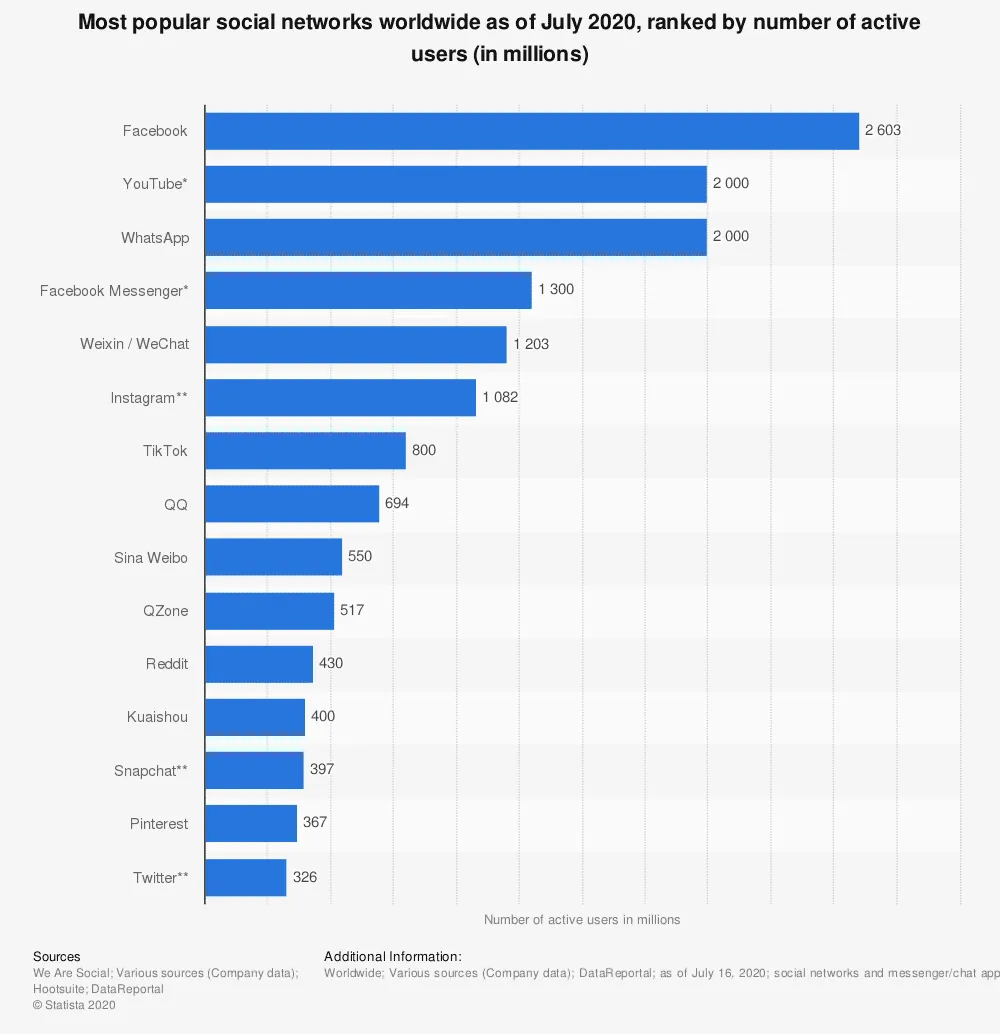

However, the Statista evidence below shows TikTok to have three times as many active users as Snapchat.

Image taken from Statista website

This shows TikTok’s main competitors to be Snap Inc, YouTube (owned by Google) and Facebook, each of which is already publicly listed and has a considerable foothold in the video creation and sharing space. Despite being new to the scene, the TikTok IPO is expected to generate considerable interest and popularity.

#What are TikTok and ByteDance really worth?

Back in 2018 Japan’s richest man, Masayoshi Son, invested in ByteDance via his SoftBank venture fund. This took ByteDance’s valuation to $75 billion. ByteDance is 40% owned by US venture capital firms. According to Crunchbase, ByteDance has 25 high profile investors, some of which include Goldman Sachs, GGV Capital, Sequoia Capital China, General Atlantic and Tiger Global Management.

Silicon Valley’s 48-year-old venture capital firm Sequoia Capital is one of ByteDance’s most prominent US investors. Sequoia has a base in China and is helping ByteDance with its US government negotiations. Sequoia is known for investing in lucrative start-ups including Snowflake, Unity and Airbnb.

In July Reuters reported that some ByteDance investors have valued TikTok in its own right at around $50 billion. This is a 50-fold increase on its 2020 revenue of $1 billion. Yet, TikTok’s management expects 2021 revenues to exceed $6 billion. Meanwhile ByteDance’s projected 2020 revenue is around $29 billion.

In the same report Reuters said ByteDance had been valued at $140 billion earlier this year when its shareholder Cheetah Mobile Inc (NYSE:CMCM), sold a small stake in a private deal. A sum less than 5 times its annual revenue.

Exactly how much either entity is worth is unclear and highly speculative. Still, in a May 2020 report, ByteDance was reported to be worth over $100 billion, an enviable amount confirming its status as the most valuable start-up in private markets.

However, removing TikTok from its books is expected to put a serious dent in that valuation even though TikTok only accounts for a tiny fraction of its current revenue. This is because much of its valuation was based on speculation of its future revenue potential by reaching an extensive user base throughout the US and India. With India no longer playing ball and the US being spun into a separate entity, ByteDance stands to lose all that potential market growth.

Image taken from ByteDance website

#Is ByteDance profitable?

In 2019 ByteDance was reported to have generated profits exceeding $3 billion from revenues of $17 billion. This was an impressive improvement on 2018, where it reported a loss of $1.2 billion from estimated revenues of around $7.4 billion.

In addition to TikTok, ByteDance owns several mobile apps and content platforms, including its personalised news aggregation site Toutiao.

Despite ByteDance relying heavily on advertising to generate revenue, it’s always on the lookout for other ways to increase cash flow, such as developing new products. Therefore, it does have several revenue streams, however, for now, none appear to have the popularity and potential expansion possibilities of TikTok.

#Conclusion

Neither a TikTok Global nor a ByteDance IPO has been confirmed, but both are rumoured to be intending a 2021 flotation. A TikTok Global IPO would most likely happen in the US, whereas a ByteDance IPO is expected to list in Hong Kong or Shanghai. It seems the TikTok IPO would be the more lucrative of the two, with its far-reaching valuation and promise of astronomical growth potential. Nevertheless, ByteDance shouldn’t be underestimated as its founder, Zhang Yiming, is known for his ambition. Considering the success and growth ByteDance has successfully achieved in its short lifespan it may well continue to generate more of the same.