Touchstone Exploration (LSE:TXP) is fully-funded to complete drilling on two exploration wells in Trinidad, the company’s chief executive has told ValueTheMarkets in an exclusive interview.

Paul Baay said the firm has enough financial firepower to finish drilling Chinook-1 – the hotly-anticipated, third well on its hugely prospective Ortoire exploration block that spudded earlier this week.

What’s more, he said the firm will have enough funds to follow up with a fourth well called Cascadura Deep later this year.

With a current cash balance of US$11 million, boosted by a recent US$2.8 million VAT repayment and US $9 million placing, Baay added that no plans are in place for Touchstone to raise money in the foreseeable future.

“It makes no sense to dilute investors through an equity placing,” he said. “Not when we already have the cash to complete this work ourselves.”

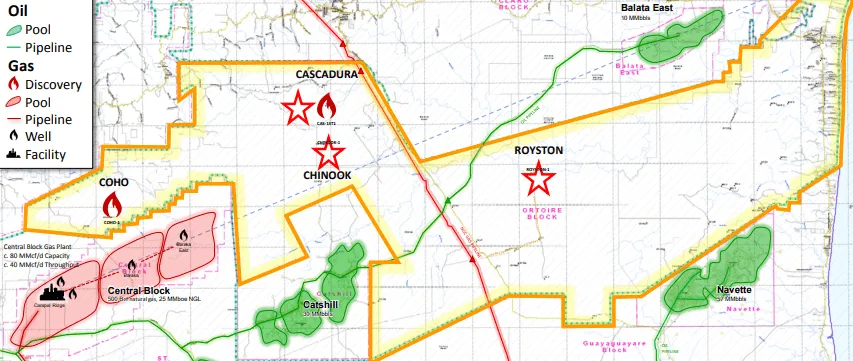

Chinook-1 and Cascadura Deep follow two transformational Ortoire discoveries that have pushed Touchstone’s share price more than 440% higher over the past year despite harsh commodity market conditions.

The stock has hit record highs of 76.6p and currently has a market cap of close to £140 million.

The first of these discoveries – Coho-1 – was made towards the end of 2019 and vastly exceeded the firm’s expectations, with modelling supporting initial production rates of 10-12 million cubic feet a day.

Baay told us that Touchstone expects to tie the discovery into the local pipeline and begin production and revenue generation towards the end of Q4 2020.

Once again, he said existing cash will cover this, and in its recent quarterly results the firm said facilities construction and pipeline preparation were already underway.

Meanwhile, Touchstone shot up some 16% in a day last month when it announced a highly positive reserves evaluation for its second discovery – Cascadura-1ST1.

The work found that this structure could hold between 241.2 and 571.5 billion cubic feet of natural gas. However, it was the discovery’s Net Present Value (“NPV”) that really caught the market’s attention.

The total proved (1P) reserves for Cascadura alone give rise to an NPV of $287.7 million.

Adding probable reserves (2P) to this tally raises the NPV to $519.2 million. And if we include Cascadura’s possible reserves (3P), this figure rises to a stunning $802.9 million.

That’s just for a single well on this highly-rated Ortoire block.

As announced in its recent update, Touchstone has now spudded its third Ortoire exploration well – Chinook-1 – with drilling operations anticipated to take around 40 days.

At Chinook, the firm is targeting hydrocarbon prospects to an expected total depth of nearly 10,000 feet in a separate structure along the same geological trend as Coho and Cascadura – known as the Herrera formation.

Chinook-1 offsets two wells drilled by Shell Trinidad in the 1950s, and is targeting the same zones in which hydrocarbons were previously observed.

“We are shooting for a 40-day drill in a very similar fashion to Cascadura, but this time we are aiming to go deeper,” Baay told us. “The Chinook well is being drilled in proximity to the original 1959 well and will further evaluate the turbidite concept eastward from the original Coho discovery.”

Immediately following this, the company plans to drill Cascadura Deep – a fourth exploration well targeting a deeper target at Cascadura after the first well stopped at 6,500ft.

“We want to see how thick this target really is because we had to stop before we through the sand in the first well,” added Baay.

Should Touchstone repeat the success of its first two wells at either of these opportunities, then Baay is once again highly confident that equity investors will not bear the brunt of development costs.

This comes down tothe firm’s recent closure of a seven-year, US$20 million term with Republic Bank – one of the Caribbean’s leading financial institutions.

Touchstone has already withdrawn US$15 million to satisfy obligations relating to its previous US$20 million credit facility with a Canadian lender from which it has now switched.

But Baay sees the relationship with Republic as a much more long-term arrangement that will open up increasingly as Touchstone grows, providing headroom that other explorers can only dream of:

“This is a real bank – there are no sweeteners, no warrants, no royalties, and no covenants until 2023. Republic is capable of lending up to US$50 million without syndication, so this means we can go back to them as we grow and make more discoveries on Ortoire, and they can grow with us.

It’s a super simple story right now; we’re going to drill the next two exploration wells, and away we go.”

The case for a material fundamental re-rate from Touchstone’s current market cap is clear.

On 22 June 2020, broker finnCap raised its price target for the company from 51p to 68p. However, the Canadian producer has already smashed that share price level, currently sitting at 73.4p, and the target was subsequently raised to 91p.

Given Touchstone’s strong cash balance, financing headroom, the multi-million-dollar value of its existing discoveries, and the potential offered by its next two wells, even this could soon end up looking conservative.