Canterra Minerals Corp. (TSX-V: CTM) (OTCQB: CTMCF) has secured a dominant land position in what is potentially one of Canada's most exciting mineral belts, the central Newfoundland Valentine Lake Shear Zone1. Its properties sit adjacent to Equinox Gold’s Valentine Mine, soon to be Atlantic Canada’s largest gold operation.

Canterra has acquired and consolidated all known copper-gold deposits and exploration ground across a 60 km mineralized corridor, a move management believes gives it unmatched strategic control.

Equinox Gold’s recent CAD$2.6 billion all-stock acquisition of Calibre Mining, the original developer of the Valentine project, underscores the strategic value of this district and the opportunity Canterra now controls.

#Copper Supercycle Meets Gold Momentum

Canterra recognized that two powerful global trends were converging to create a unique opportunity.

Long-term, copper demand is expected to grow by over 40% by 20402, driven by its critical role in electric vehicles, renewable energy, data centers, and digital infrastructure.

Meanwhile, Newfoundland has seen increased gold exploration activity in recent years. Multiple factors, including the discovery of new high-grade gold zones, the expansion of existing mineralization areas, and the identification of significant gold concentrations through effective soil sampling techniques fuel this surge. This momentum is strengthened by record gold prices in 2025, reaching above $3,500/oz, with Goldman Sachs, in a March 2025 note, projecting $3,700/oz by year-end3.

#Why Canterra Minerals Deserves Your Attention

What sets Canterra apart is its total district control. For the first time in the region’s history, one company holds 100% of the known copper-gold deposits in central Newfoundland, outside of the Valentine Mine itself. This gives Canterra a first-mover advantage and significant leverage over any future discoveries in what has historically been a prolific but fractured mining camp.

It’s not just about geology, it’s about jurisdiction. Newfoundland is generally recognized for rapid permitting, strong local support, and competitive exploration costs compared to other Canadian regions. That means Canterra can move quickly and efficiently, as it aims to maximize every exploration dollar and potentially shorten the path from drilling to discovery-driven value creation.

Of course, there are no certainties in exploration, and outcomes remain speculative, but for investors seeking higher risk/reward opportunities, the junior exploration space is where they can be found.

Well-known resource investors Michael Gentile and Eric Sprott are among Canterra’s backers, both known for spotting early-stage opportunities in the mining sector. Their involvement signals interest in Canterra’s exploration plans, though like any early-stage story, success is never guaranteed. Still, when experienced investors take a position, it tends to get attention.

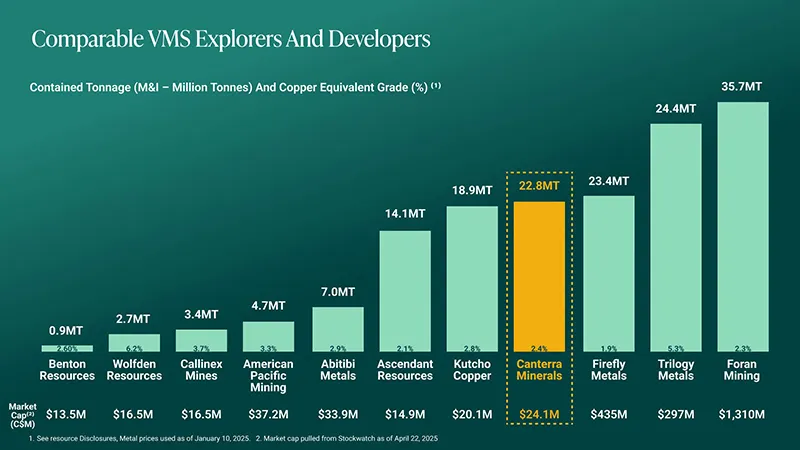

Despite its early-stage progress, Canterra trades with a modest market cap of around $27 million. For context, some companies with comparable resource-stage attributes, like Firefly Metals, are currently valued in the hundreds of millions. While each project and jurisdiction is different, such comparisons may offer useful perspectives for investors evaluating a stock’s potential.

Quiet Progress, Big Potential

Exploration is already underway, and with the right land package in hand, Canterra is quietly advancing its exploration efforts. The company fully owns its deposits and exploration potential and is focused on delivering a discovery through its own drilling program.

The market is being regularly updated on drill progress, with recent results demonstrating continuous mineralization that has the potential to expand existing open-pit mineral resources at Buchans, its flagship project.

The company’s latest drill results at Buchans have confirmed that three additional holes at its Pumphouse target intersected impressive high-grade copper and base metal mineralization. These holes are situated 800 metres northeast of its Lundberg Deposit, further supporting its thesis that the district hosts multiple high-grade zones waiting to be discovered.

Phase II drilling is now underway to test high-priority geophysical anomalies from a 3D IP survey, targeting new high-grade sulphide zones across the project, which hosts the past-producing Buchans mine and lies near Equinox Gold’s Valentine mine and Teck’s Duck Pond mine.

The team behind Canterra knows how to create value. With over six decades of combined success, the leadership has built and exited multiple exploration companies.

CEO Chris Pennimpede and board members, such as Josh Serfass, have helped guide previous companies to successful exits, including Underworld Resources, which was acquired by Kinross, Northern Empire Resources, which was acquired by Coeur Mining, and Integra Gold, which was acquired by Eldorado Gold.

What also matters are the macro forces aligning behind this story. Copper powers the energy future. Gold shields against financial risk4. Canterra offers exposure to both.

#Reasons to Invest in Canterra Minerals Stock

Impressive District Control

Canterra Minerals has consolidated 100% of the copper-gold deposits (excluding the adjacent Valentine mine) in central Newfoundland, a first in the district’s history. Management believes this gives the company leverage over future discoveries in a historically prolific but fragmented mining camp.

Prime Location, Low-Cost Exploration

Canterra Minerals operates in one of Canada’s most mining-friendly and cost-effective jurisdictions. Newfoundland offers rapid permitting, strong local support, and low drill costs, maximizing capital efficiency and shortening the time from discovery to value realization.

Backed by Top Resource Investors

Canterra Minerals is supported by notable mining investors Michael Gentile and Eric Sprott, who have a strong track record of identifying and backing companies that go on to major discoveries and profitable exits.

Growth Potential

With a current market capitalization of around $27 million, Canterra Minerals trades at a fraction of the market capitalization of peers like Firefly Metals ($500 million), despite having similar copper-gold resource potential. This valuation gap presents clear rerating potential, subject to exploration success and market conditions.

Equinox Gold's recent CAD$2.6 billion all-stock acquisition of Calibre Mining underscores the growing interest in Newfoundland, where Canterra holds strategic ground. Its gold projects lie directly on trend with Equinox's Valentine mine, spanning a 60 km extension of the same mineralized corridor.

Proven Discovery Team

The leadership has repeatedly built and sold exploration-stage companies to major miners. Over 60 years of combined exploration success in Newfoundland and globally gives Canterra Minerals strong technical and strategic credibility. Their track record of value creation through discovery-led M&A reflects a clear playbook: advance high-potential assets, attract interest from major producers, and deliver exits in active acquisition markets.

Strong Sector Tailwinds

Copper demand is on the rise, driven by growth in electrification, renewable energy, and data infrastructure. Gold is benefiting from central bank buying, concerns over currency devaluation, and heightened geopolitical risk. These dual tailwinds are driving capital back into the resource sector, creating a favorable backdrop for discovery-stage companies like Canterra with exposure to both metals.

If you're looking for early-stage exploration with room to grow, Canterra Minerals offers exposure to a copper-gold project in a well-known mining region. Drilling is underway, the stock trades at modest levels compared to some peers, and the company is entering its next phase of exploration. Like all resource plays at this stage, the risks are real—but that’s often where the biggest upside begins.