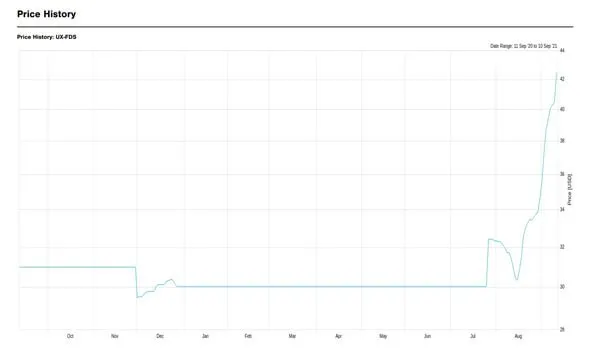

The price of Uranium has skyrocketed this past week. So, can the uranium price keep climbing?

Uranium near term spot price chart – one year – Source: FactSet

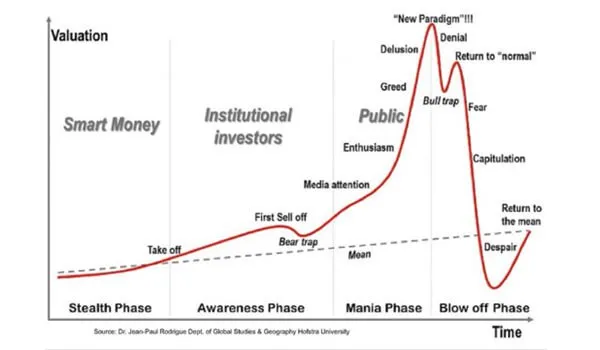

Reddit traders on WallStreetBets say Yes. In fact, if this nicely illustrated chart is believed, we are currently in the Media attention phase, and upside should continue for a while.

Phases of a typical market cycle

Of course, there are no guarantees when it comes to commodity investing, and it could all come crashing down without warning.

Uranium prices are now at 6-year highs, but they’re still too low to make mining for it economical. Therefore logic dictates it could still go higher.

When I see a bubble forming, I rush to buy, adding fuel to the fire – George Soros.

Nuclear energy is carbon neutral. It is currently the cheapest operating source of baseload power in the United States – it also powers one in five homes in America.

Near-term, a rise in uranium prices won’t affect fuel prices. Long-term, it could inflate electricity prices.

#Why the high?

The price of uranium after a 10-year bear market is still not economical to mine. Therefore, the price is being manipulated upwards as trading houses buy it up.

Sprott Asset Management is the leader of the pack in buying up the physical asset.

TheGlobal commodity investment company’s Sprott Physical Uranium Trust ($SPUT) is buying uranium in the spot market after issuing equity to raise $300m, which has now been increased to $1.3bn.

Considered one of Canada’s most successful brokerage firms, Sprott Asset Management has been buying up low-cost uranium on the spot market to hold long-term. Being an illiquid market, this has dramatically raised uranium spot prices.

So far, the nuclear power industry is unperturbed, but there is a concern if the fund continues at pace, it could push up nuclear fuel costs long term.

Sprott’s actions are not a regular occurrence, so the long-term effects are unclear.

After releasing the latest edition of the World Nuclear Association’s Nuclear Fuel Report on 8 September, several significant figures discussed the uranium price run.

Brandon Munro, CEO of Bannerman Resources, said:

“One thing that’s certainly in full gear in the uranium end of the fuel cycle right now is the role of investment funds, and new vehicles that have been set up to raise funds to accumulate for the long term or sequester U3O8 holdings,”

Meanwhile, Riaz Rizvi, a partner at Rice Capital Partners, commented:

“Really, the big story here is how funds are shaping the spot market, this is an unprecedented level of demand in the spot market – something we haven’t really seen before.”

The SPUT began trading on the Toronto Stock Exchange in July and last week reached $1 billion in assets under management.

Meanwhile, other uranium companies are also jumping on the bandwagon, issuing shares to generate the funds to buy up the resource – not to mine for it.

However, once the uranium price reaches a point it makes economic sense to mine, miners can get back in the game and start producing.

It’s not just the amateurs that see the uranium price rise continuing. Investment strategist Lyn Alden has also been airing her views:

It benefits Sprott, and benefits the uranium producers and developers that support the utilities, to keep the lights on.

Uranium has been below the cost of production for a long time, and so little production has come online. Higher prices are needed to get it online.

— Lyn Alden (@LynAldenContact) September 10, 2021

Higher prices are needed to get it online.

#Uranium stocks

Sprott Physical Uranium Trust (TSE: U.UN)

Cameco Corp (NYSE: CCJ)

Paladin Energy (ASX: PDN)

Energy Fuels (TSE: EFR)

Uranium Energy Corp (NYSEAMERICAN: UEC)

Ur-Energy Inc (TSE: URE)

Lotus Resources (ASX: LOT)

#A clean energy source

Interest in nuclear energy is enjoying a revival as the pressure for meeting net-zero obligations heightens. Nuclear has its obvious disadvantages, with the Chernobyl and Fukushima disasters still fresh in many minds.

But, since Bill Gates outlined many reasons it could prevent climate change, a drum has been beating in its favor.

Just last week, a candidate for Japan’s next prime minister announced he’s supportive of nuclear power, which helped boost Japan’s utility stocks.

However, there are many barriers to building nuclear reactors, and many are still being decommissioned. Plus, the overwhelming opposition is unlikely to allow this to be a viable option anytime soon.

Uranium, like many commodities, is a volatile asset to own.