Bitcoin, Ethereum, and other cryptocurrencies are slipping once again. But elsewhere in the capital markets, concerns are rising that a crash or correction could be imminent. September is always a slow month for stocks and crypto, so is it all a fuss about nothing or time to get cash at the ready?

#Is a stock market crash coming soon?

Volatility in crypto is commonplace, but stock market investors prefer stability. Since Covid-19 arrived, the US stock market has also endured volatility, but mainly to the upside.

Now, however, warning signals are flashing that a correction is increasingly likely.

#Scary stuff

There are many signs the US stock market is heading for a crash or at least a 15% to 20% correction.

Deja vu from the run-up to the 2008 financial crash is loud and clear.

Back then, shipping rates spiked, as did CPI and commodity prices – all of which are happening now.

(The cost of shipping a container from China to California was $3,500 in August 2020, a year later, it hit $18,500.)

Technology has helped drive deflation in the past, but a serious lack of computer chips and rising shipping costs mean this is no longer the case.

Moreover, in an extremely bearish narrative, there is concern that the Mu version of Covid-19 is vaccine-resistant. If it mutates with Delta, the global situation will get much worse again.

With or without a worst-case scenario, many US stocks have reached unsustainable prices, and the S&P 500 is around an all-time high. This means a correction would be a natural progression in the order of things.

Wall Street worries

It’s not just bearish traders and doomsayers voicing concerns. Nerves are rattled among top Wall Street banks too.

Photographer: lo lo | Source: Unsplash

Payroll data from the US came in weaker than expected, leading several investment banks to cut their growth targets for this year.

Citigroup set the ball rolling in early August when it downgraded the US stock market to neutral. Its reason being the US stock market’s dependence on Big Tech stocks, which are increasingly under pressure.

Morgan Stanley followed on September 8, when it downgraded US equities to underweight and global equities to equal weight. Morgan Stanley predicts a pullback of 10% to 15% by the end of this year.

Lisa Shalett, Morgan Stanley’s Wealth Management chief investment officer, said a correction is likely based on mounting factors, including profit-taking, a decline in consumer confidence, rising interest rates, ongoing Covid-19 infections, and major geopolitical shifts.

Furthermore, high equity valuations, indexes near all-time highs, and weak seasonality are also causing concern.

Meanwhile, Deutsche Bank equity strategists said:

“The risk that the correction is hard is growing, valuation corrections don’t always require market pullbacks, but they do constrain returns.”

#Dip, dip, dip… crash!

Last month Bloomberg noted that the S&P 500’s most significant dips occur mid-month. This is because it coincides with the expiration of monthly options. Afterward, the S&P 500 resumes its upward trajectory in a fairly consistent trend.

Ever since the pandemic’s arrival, the US stock market has performed against the odds.

Back in March 2020, the S&P 500 entered a brief bear market, dropping around 34%. It then proceeded to recover (and then some!) ever since.

It did endure a brief correction during election season when it fell around 7%, but it’s only endured short-lived dips since then.

This past week, however, things are taking a turn for the worse.

On September 3, the US jobs report came in far below expectations. While analysts expected nonfarm payroll growth to increase by 720k jobs, the actual figure was 235k. Since then, The S&P 500 and the Dow have been taking a daily tumble.

Investors are also worried about the Federal Reserve’s plans to ease fiscal stimulus (tapering) despite employment numbers slowing.

#Recent Wall Street commentary

Equity strategist at Deutsche Bank (NYSE: DB), Binky Chadha, stated:

“Equity valuations at the market level are historically extreme on almost any metric. Trailing and forward price-earnings ratios, as well as valuation metrics based on enterprise value and cash flow, are all in the 90th percentiles,”

Canaccord Genuity

Co-head of research division Quest at Canaccord Genuity (TSE: CF), James Congdon, commented:

“Global stock markets may be entering a period of turmoil. Investors should favor stronger businesses with robust cash flows over weaker and more speculative companies.”

Goldman Sachs

Goldman Sachs (NYSE: GS), economics research strategist, Dominic Wilson said:

“While the broad U.S. market outlook is solid in our central case, we think peak cyclical optimism in the U.S. may be behind us.”

AJ Bell

AJ Bell (LON: AJB), Investment Director, Russ Mould said:

“Investors on the whole have enjoyed a fairly decent run this year, but now attention is turning from the post-lockdown spending splurge to how corporate earnings might fare next year. There is a sense that some of the market forecasts have been too optimistic and so there could be some share price disappointment unless we see GDP figures pick up and the COVID delta variant stops causing so much trouble.”

Morgan Stanley

Morgan Stanley (NYSE: MS), cross-asset strategist Andrew Sheets commented:

“We are going to have a period where data is going to be weak in September at the time when you have a heightened risk of delta variant and school reopening.”

Bank of America

Bank of America (NYSE: BAC), head of U.S. equity and quantitative strategy, Savita Subramanian, said:

“The S&P 500 has essentially turned into a 36-year, zero-coupon bond, if you look at the duration of the market today, it’s basically longer duration than it’s ever been. This is what scares me. The threat is that any move higher in the cost of capital via interest rates, credit spreads, equity risk premia, that’s basically going to be a huge knock on the market relative to the sensitivity we’ve seen in the past,”

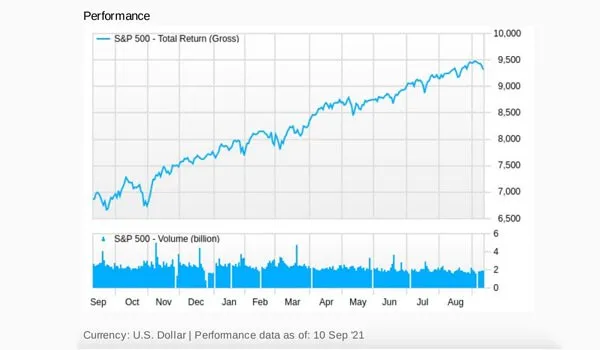

S&P 500 one year chart – Source: FactSet

#Preparing a portfolio for a stock market crash

The main thing investors should remember is a crash or correction are short-lived. Never sell at the bottom. If anything, it can be a great buying opportunity. That’s why having cash at the ready gives you the upper hand during a correction.

However, quality cyclical stocks are often favored to crash-proof your portfolio, along with strong dividend payers. Popular sectors include healthcare, consumer staples, insurance, and utilities.

#Reasons a US stock market crash or correction could be on the cards:

Many unprecedented events have been going on in the capital markets over the past 18-months. While the Reddit-fuelled meme craze of January is hard to beat, many other anomalies have been occurring, and it helps drive the narrative that this weird and wonderful world of stock market pandemonium could be heading for a crash.

Photographer: Pawel Czerwinski | Source: Unsplash

Most of these unusual activities are unassuming or even laughable on their own but accumulatively could cause problems. Some of them look like mini bubbles in their own right.

Anomalies in the markets

Now many US stocks have reached unsustainable prices (Hundreds of stocks trading like Tesla (NASDAQ: TSLA))

Crypto volatility continues

Retail investors supercharged – Reddit’s WallStreetBets community continues to wreak havoc in targeted areas of the equity markets.

Gamification – Robinhood, Coinbase, and peers have made fractional trading accessible to the masses.

NFTs – Apes, penguins, kids artwork, photography, paint splashes, scribbles, and even digital rocks are selling for millions of dollars.

Trading cards – Pokemon, NFL, and all manner of trading cards are being exchanged for astronomical sums.

A flood of self-styled investment gurus and furus yelling “You’re not too late!” – reminiscences of the dot com bubble and the crypto bubble of 2017.

Insider trading – House Speaker Nancy Pelosi’s husband, Paul Pelosi, has been handsomely profiting from winning stock options trades. Meanwhile, after the media discovered Dallas Fed president Robert Kaplan held 27 stocks, funds, and alternative asset holdings valued at over $1 million each, he liquidated.

Tesla is a law unto itself. Tesla bears have been predicting its downfall for years, and it has continued to rise. Now it is a member of the S&P 500, it holds more sway in the financial markets. If Tesla were to crash, it would have a knock-on effect on pension funds, ARK Invest ETFs, and much more.

Supply chain disruption

Meanwhile, pandemic lockdowns have led to supply chain disruption, causing many commodity prices to rocket.

September has seen a lot of hype around the Uranium market. Canadian investment fund Sprott Asset Management LP has been buying up low-cost uranium on the spot market to hold long-term. Being an illiquid market, this has dramatically raised uranium spot prices. So far, the nuclear power industry is unperturbed, but there is a concern if the fund continues at pace, it could push up nuclear fuel costs long term. Near-term, a rise in uranium prices won’t affect fuel prices. Long-term, it could inflate electricity prices.

Other commodities making headlines are Aluminum, Steel, Oil, Natural Gas, Lithium, Wheat.

Geopolitical stresses – America’s withdrawal from Afghanistan and pulling missile defenses in Saudi Arabia is rocking international relations. The US is on shaky ground with Russia and China too. Many of the natural resources in demand are mined or sourced from areas of conflict.

According to the Wall Street Journal – the US Ports see shipping logjams extending far into 2022. Shipping volumes are already up 20% over last year’s record level. Volumes in August set a record for a single month. Low inventories and production caused by Covid don’t help.

Shortages in consumer goods are apparent and likely to get worse.

When metals and mineral prices go up, so do manufacturing costs. The Baltic Dry Index (BDI) tracks the cost of shipping bulk dry goods. It is showing global transportation costs at record highs.

Wall of worry

Monetary stimulus, record debt, and talk of Inflation, Stagflation, Reflation, are all adding to a wall of worry.

After Covid-19 hit in early 2020, the US government sent the money printer into overdrive. It needs to claw that money back, and tapering* is expected to begin soon. From tapering, it should move on to reducing its debt.

* When the FED tapers, it means slowing its asset purchases. The aim is to end monetary stimulus.

When US futures are trending lower, it indicates a pullback in the markets. There’s been a slight decline in September.

Concerns over a slower than expected economic recovery.

Raise the debt ceiling or default!

From mid-October, it’s expected the federal government will hit the national debt ceiling. Without a plan to raise it, the country may default. Republicans and Democrats are once again at loggerheads in how to handle it. The US defaulting on its debt would be a historical disaster. Any uncertainty will cause volatility in the markets. The consensus is on it being raised, but neither is a good look.

Finally, there are also the usual international worries out with fiscal control:

Natural disasters linked to climate change

Climate change pressures and the rise of ESG, which is not always as virtuous as it should be. This is creating an imbalance in certain areas of the market.

Rising Covid-19 infections

#Reasons the bull run may continue

The dominance of deflation may well continue.

Many quality businesses are trading at reasonable valuations.

Tesla could continue to thrive.

Bitcoin, Ethereum, and crypto prices could steady.

NFTs could go mainstream as businesses adopt them as an added marketing tool and promotional prop.

According to National Geographic, laboratory studies show the Mu variant of the coronavirus may be better at avoiding the immune system but lags Delta when it comes to transmission and infecting cells.

Commodity price increases may be short-lived.

Investing is a long-term pursuit, and it’s important to step back and view the bigger picture. For the most part, businesses are expected to continue to run. Therefore, choosing strong companies to invest in long-term is a good strategy.

Technological breakthroughs may solve all our carbon worries, and Covid-19 may soon disappear.

If there is a major market crash or correction, we can rest assured it will be followed by a recovery. So, don’t forget to buy the dip.