Sponsored by: Canterra Minerals. Download the company’s latest investor overview.

Canadian mining stocks have quietly emerged as some of the strongest performers in global equity markets this year. While gold itself has pushed to new highs, it's the miners, especially those in Canada, that have delivered notable upside.

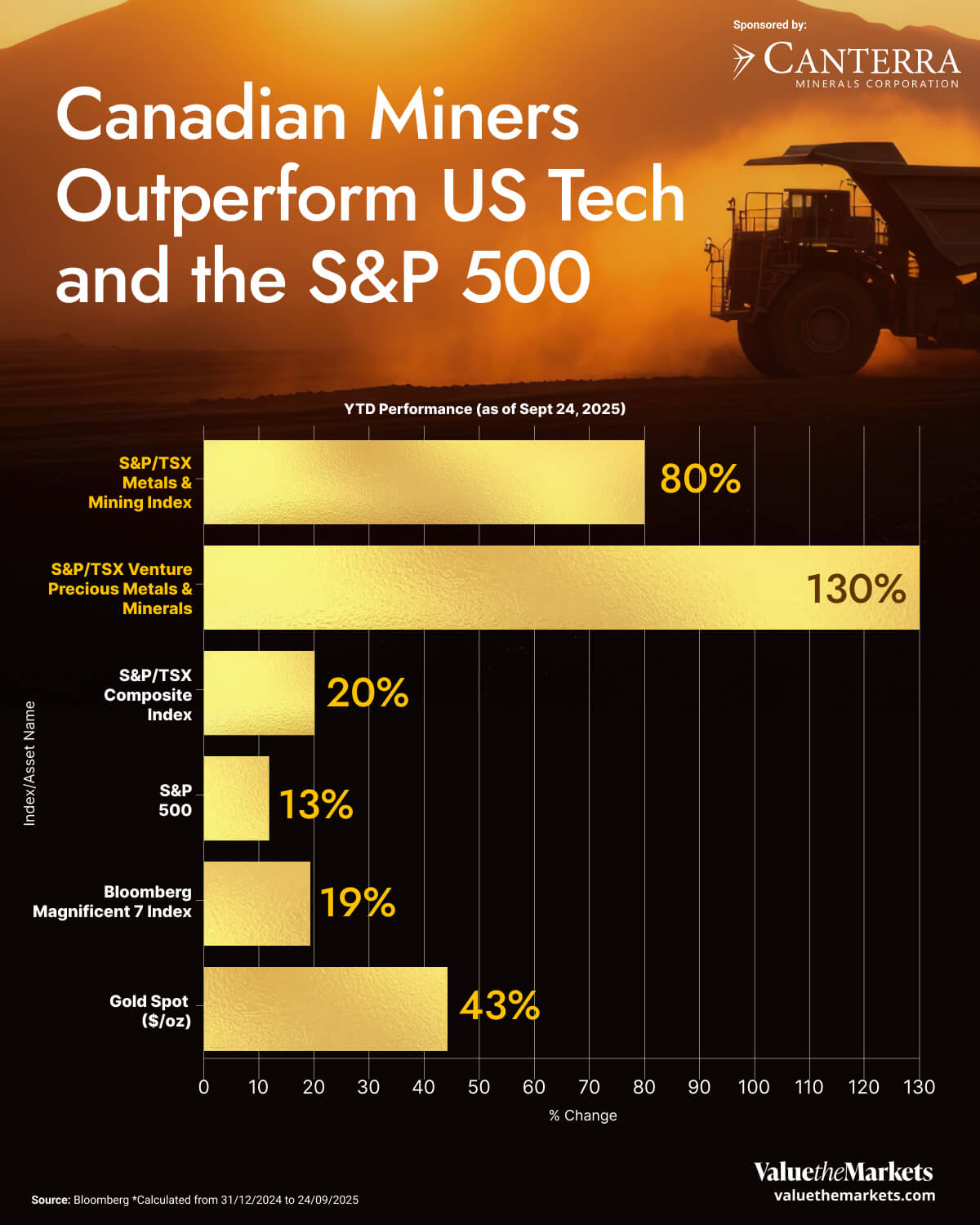

The S&P/TSX Composite Metals & Mining Index is up 80% year-to-date, far ahead of the S&P/TSX Composite Index, the S&P 500, and even the much-hyped Magnificent Seven US tech stocks. With gold prices hovering near record levels, retail investors seeking leveraged exposure to the metal may find more opportunities in Canadian miners than in gold itself.

| Index / Asset | YTD Performance (as of Sept 24, 2025) |

| S&P/TSX Composite Metals & Mining Industry GICS Level 3 Index | +80% |

| S&P/TSX Venture Precious Metals & Minerals (Sub Industry) Index (CAD) | +130% |

| S&P/TSX Composite Index | +20% |

| S&P 500 INDEX | +13% |

| Bloomberg Magnificent 7 Price Return Index | +19% |

| Gold Spot ($/oz) | +43% |

Source: Bloomberg *Calculated from 31/12/2024 to 24/09/2025

#Why This Matters for Retail Investors

Miners Amplify Gold Moves: Mining stocks tend to move more aggressively than gold prices, offering higher upside during rallies.

Canada’s Market Offers Gold Leverage: Miners make up a substantial portion of the Canadian market, giving investors indirect exposure to gold through broad index ETFs or individual stocks.

Diversification Beyond US Tech: Canadian miners are outperforming major US tech names, providing a diversification option for growth-focused portfolios.

Performance Isn’t Just Gold-Driven: Canadian miners are also benefiting from broader demand for precious and industrial metals.

Economic Hedge Potential: In uncertain macro environments, gold and miners offer defensive characteristics while still providing growth potential.

#Canadian Mining Stocks Are Leading the Pack

As of September 24, 2025, the S&P/TSX Composite Metals & Mining Index is up 80% since the start of the year. This dwarfs the returns of the S&P/TSX Composite Index (up around 20%), the S&P 500 (around 13%), and even the Bloomberg Magnificent 7 Price Return Index (around 19%), which tracks high-performing US tech giants.

Gold miners are driving this surge. According to Bloomberg data, eight of the top ten contributors to the TSX’s gains this year are mining companies. These include Lundin Gold, SSR Mining Inc, New Gold Inc, Kinross Gold Corp, OceanaGold Corp, Dundee Precious Metals Inc, Sandstorm Gold Ltd, and NovaGold Resources Inc.

The S&P/TSX Composite Index also hit an all-time closing high of 29,958.98 on September 22, 2025, highlighting the broad strength of Canadian equities.

#Small-Cap Miners Are Keeping Pace

The S&P/TSX Venture Precious Metals & Minerals Index, which tracks smaller-cap mining names, has also rallied sharply, up 130% YTD. This suggests the strength isn’t limited to large-cap names.

For investors looking for more aggressive gold exposure, these smaller miners can offer even more upside, but they come with higher volatility. This tier of the market often moves earlier and more forcefully in response to shifts in gold prices.

#What Retail Investors Should Watch

Gold’s continued strength has already driven strong returns in mining stocks, but there may still be room to run, especially among Canadian small caps. These companies are earlier in the exploration cycle and can respond more dramatically to new discoveries or rising gold prices.

Canada’s mining sector also benefits from a stable regulatory environment, strong legal protections for resource development, and growing interest in underexplored regions like Newfoundland. As more exploration projects advance, early investors could benefit from both operational milestones and rising valuations.

That said, small-cap miners do come with more volatility and less liquidity than large-cap peers. Success can depend on drilling results, funding access, and broader commodity sentiment. But for those willing to accept the risk, the upside potential can be substantial, especially in a bullish gold environment like we’re seeing now.

#Canterra Minerals Expands Exploration in Newfoundland Copper-Gold Belt

Canterra Minerals Corp. (TSX-V: CTM) (OTCQB: CTMCF) is excited to report the latest prospecting results from its Wilding Gold Project and an update on high-grade copper success at its Clementine prospect. Wilding adjoins Equinox Gold's Valentine Mine, encompassing 55 km of the gold-bearing corridor that hosts Equinox’s new mine in the central Newfoundland Mining District.

Wilding Gold Project Highlights include:

Exceptionally high-grade results, exceeding 500 g/t Au, were found around the original discoveries. These are the highest-grade gold results ever reported on the project, confirming the strength of the Wilding gold system and comparing favourably with top intercepts from adjacent deposits at Valentine during its exploration phase.

6 g/t Au 14km from the original discoveries

1 g/t Au 4km further demonstrates strong gold mineralization across the 55km strike length Wilding covers

Clementine Prospect Initial Highlights Include:

1.72% CuEq over 16m, including 3.15% CuEq over 2m

2.64% CuEq over 3m, including 4.02% CuEq over 1m

Confirms high-grade, classic Buchans-style mineralization in an underexplored area

Results include gold and silver credits, which are common in Buchan-style mineralization

Expands prospectivity south of the prospect where newly generated 3D IP geophysical anomalies identify priority targets for follow-up drilling.

Canterra’s position in this emerging district places it early in the exploration cycle, as Newfoundland experiences renewed interest driven by recent high-grade gold discoveries. With backing from known mineral investors Eric Sprott and Michael Gentile, Canterra Minerals is consolidating Newfoundland’s copper-gold potential.