#Quantum Computing in the Real World: Who’s Earning, Who’s Exploring

Quantum computing is often described as “the future,” but some companies are already generating revenue from it today. Others are years away from proving commercial value. If you're a retail investor trying to understand where quantum computing stands now and where it's headed, there's a clearer way to think about the timeline. Breaking it into near, mid, and long-term horizons reveals which companies are already monetizing quantum computing, and which ones are still in research mode.

Methodology

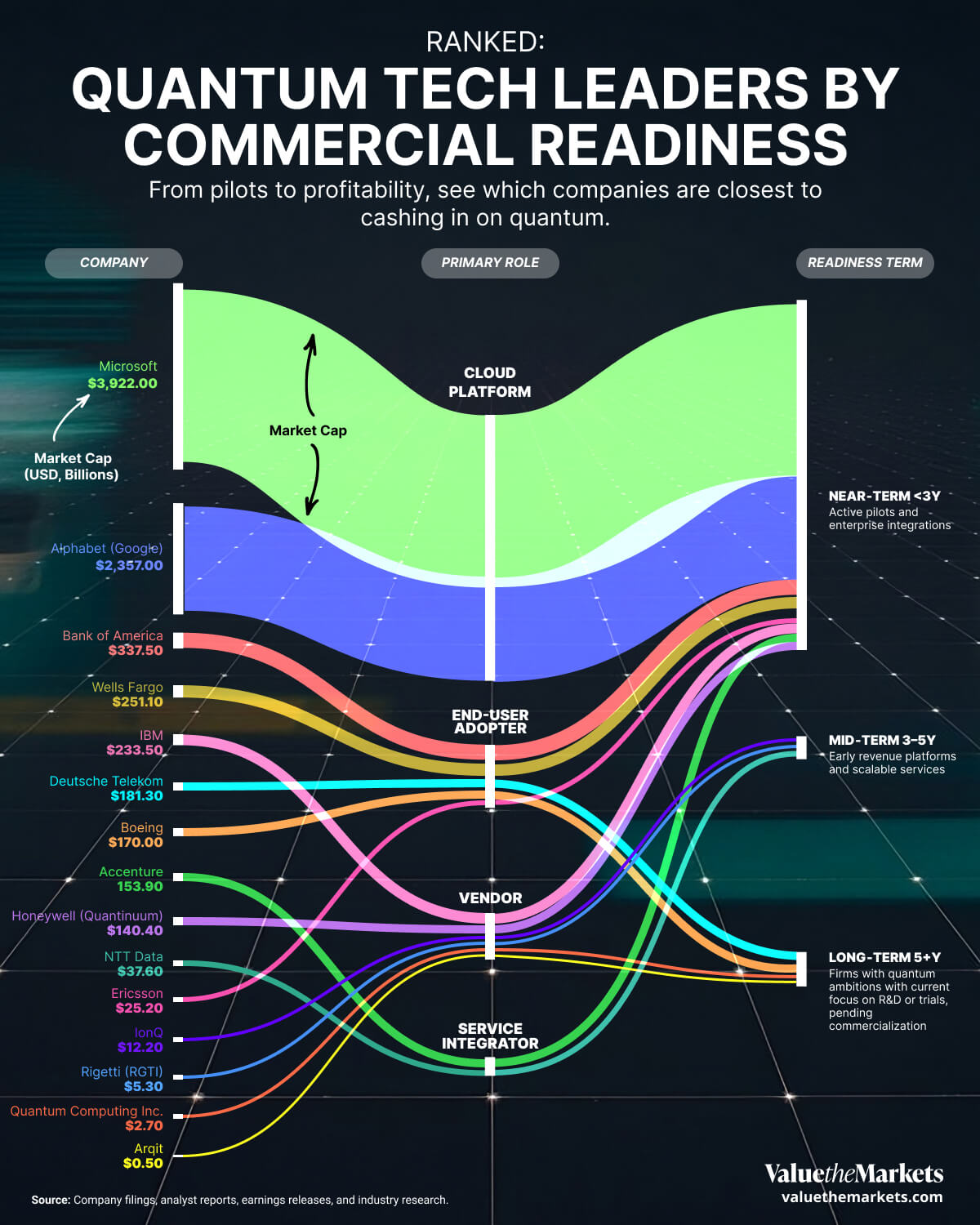

To identify which companies are turning quantum computing into a real business, we analyzed 16 major players by market cap, role in the quantum ecosystem, and commercial readiness. Each company was classified by its primary role (such as cloud platform, vendor, service integrator, or end-user adopter) and assigned a readiness term, Near, Mid, or Long, based on its proximity to generating revenue from quantum.

| Company | Market Cap (USD, Billions) | Primary Role | Readiness Term |

| Microsoft (NASDAQ: MSFT) | $3,922 | Cloud Platform | Near-Term (<3Y) |

| Alphabet (Google) (NASDAQ: GOOGL) | $2,357 | Cloud Platform | Near-Term (<3Y) |

| Bank of America (NYSE: BAC) | $337.5 | End-User Adopter | Near-Term (<3Y) |

| Wells Fargo (NYSE: WFC) | $251.1 | End-User Adopter | Near-Term (<3Y) |

| IBM (NYSE: IBM) | $233.5 | Vendor / Cloud Platform | Near-Term (<3Y) |

| Deutsche Telekom (OTC: DTEGY) | $181.3 | End-User Adopter | Long-Term (5+Y) |

| Boeing (NYSE: BA) | $170 | End-User Adopter | Long-Term (5+Y) |

| Accenture (NYSE: ACN) | $153.9 | Service Integrator | Near-Term (<3Y) |

| Honeywell (NASDAQ: HON) | $140.4 | Vendor | Near-Term (<3Y) |

| NTT Data (OTC: NTDTY) | $37.6 | Service Integrator | Mid-Term (3–5Y) |

| Ericsson (NASDAQ: ERIC) | $25.2 | End-User Adopter | Near-Term (<3Y) |

| IonQ (NYSE: IONQ) | $12.2 | Vendor | Mid-Term (3–5Y) |

| Rigetti (NASDAQ: RGTI) | $5.5 | Vendor | Mid-Term (3–5Y) |

| D-Wave Quantum (NYSE: QBTS) | $5.31 | Vendor | Mid-Term (3–5Y) |

| Quantum Computing Inc. (NASDAQ: QUBT) | $2.7 | Vendor | Long-Term (5+Y) |

| Arqit Quantum (NASDAQ: ARQQ) | $0.5 | Vendor | Long-Term (5+Y) |

Market cap figures are as of August 6, 2025, sourced from Google Finance.

#What Investors Need to Know About Quantum Computing

Quantum computing is moving from theory to commercial reality, opening new tech investment opportunities.

Some companies are generating revenue now, offering clearer paths to returns in the short term.

Understanding where companies sit on the adoption timeline helps manage risk.

Quantum computing ties directly into AI, cybersecurity, and 5G, major themes that drive long-term portfolio growth.

Early clarity helps avoid hype traps around unproven quantum tech plays.

#Near-Term: Companies Already Making Quantum Pay

Companies like Accenture, Honeywell, and Wells Fargo aren’t just exploring quantum computing; they’re putting it to work. These firms are part of a select group actually delivering or piloting quantum use cases with real business potential.

Accenture, a service integrator, is applying quantum platforms from IBM and IonQ in client consulting projects. This makes it one of the few firms already monetizing quantum services. While Accenture offers quantum advisory and POC services, it has not disclosed standalone quantum revenue; quantum remains embedded in broader consulting engagements.

Honeywell, acting as a vendor through its stake in Quantinuum, is selling quantum software and cybersecurity tools, proof that quantum computing revenue isn’t just theoretical. Quantinuum enjoys a multibillion‑dollar valuation and strategic investors, but has not released standalone revenue figures or turned a profit as a separate entity.

Banks like Wells Fargo and Bank of America, both end-user adopters, are piloting quantum algorithms for risk modeling and asset optimization. These are currently pilot implementations, quantum‑safe key generation and algorithmic models, not yet monetized products.

And Ericsson, an end-user adopter in telecom, is weaving quantum-safe encryption into its 5G and 6G efforts, preparing for a world where data security must evolve. Ericsson is exploring quantum‑safe encryption for future telecom standards, but commercial rollouts remain experimental.

IBM, serving as both a vendor and cloud platform, offers enterprise-grade quantum access through its IBM Quantum platform, with over 200 partners using it to explore applications in finance, materials, and logistics.

Large-cap cloud platforms Microsoft and Alphabet’s Google also feature in the near-term category when it comes to monetizing quantum computing.

Microsoft, a cloud platform and vendor, enables quantum application development through Azure Quantum, integrating multiple quantum hardware providers and tools like Azure Quantum Elements for materials and drug discovery.

Google, also a cloud platform and vendor, is focused on real-world applications such as chemical simulation and optimization, with breakthroughs in quantum error correction shaping the roadmap for scalable use cases.

These near-term firms not only hold the largest market caps in the quantum ecosystem, they also provide the safest entry points. For retail investors, they offer real quantum exposure today, with risk balanced by diversification across broader business lines.

Discover why copper is key to scaling quantum computing.

#Mid-Term: Quantum-Native Companies Building Revenue Models

This group includes pure-play quantum computing firms like IonQ, D-Wave, Rigetti, and Japan’s NTT. They’ve moved beyond research and are building early revenue, mainly through cloud access and government contracts. But full commercial scale is still several years out.

IonQ, a vendor in quantum hardware and cloud services, stands out with growing revenue from its cloud quantum services, but wide adoption of its technology is still likely years away. D-Wave is a vendor of commercial quantum systems focused on optimization problems, yet its customer base is niche. Rigetti, another vendor building hardware and software stacks, is in early government-backed deployments.

NTT Data, primarily a service integrator and secondarily an end-user adopter, is researching quantum networking for Japan’s public sector, though confirmed commercial deployment is not expected before the end of the decade.

These companies may offer higher potential upside, but with far more volatility. For retail investors with long-term conviction and risk tolerance, they offer speculative quantum computing exposure.

#Long-Term: Still In R&D Mode

The final group includes Arqit, Quantum Computing Inc, Boeing, and Deutsche Telekom. These companies are years from showing commercial traction, if ever.

Arqit, a vendor in quantum cryptography, and Quantum Computing Inc., a vendor selling quantum-inspired solutions, have pivoted strategies multiple times, with little evidence of paying customers. Boeing, an end-user adopter applying quantum to aerospace R&D, and Deutsche Telekom, an end-user adopter experimenting with quantum-safe networks, are investing in quantum computing research for aerospace design and telecom security, but real-world applications remain theoretical.

Retail investors should approach this group with caution. Without revenue or product traction, it’s hard to value these names beyond speculative interest.

To sum it up, Microsoft and Google lead as near-ready cloud platforms, putting themselves at the front of the quantum race. Banks like Bank of America and Wells Fargo are early adopters, though their path to revenue is further out. Vendors and service integrators such as IBM and Accenture show mid to long-term readiness.

For retail investors, the most balanced strategy is exposure through diversified cloud platforms like Microsoft, Google, and IBM, while treating pure-plays such as IonQ and D-Wave as higher-risk, speculative opportunities.

Uncover why investing in quantum computing stocks is gaining popularity.

#FAQs

Is quantum computing already making money for companies?

Yes, some firms like Accenture and Honeywell are generating revenue from quantum consulting and products today.

Are there any pure-play quantum companies worth investing in now?

IonQ and D-Wave are the furthest along, but still speculative. Their commercial success is tied to future market adoption.

How do traditional companies like Wells Fargo use quantum computing?

Mostly through pilots and research projects in areas like risk modeling and encryption.

Can I get quantum exposure without betting on startups?

Yes. Large firms like Honeywell, Accenture, and Ericsson offer safer exposure to quantum computing progress while generating revenue from other business areas.

What should I watch to track quantum's commercial progress?

Look for customer wins, commercial contracts, and partnerships with enterprise clients as signs that a company is moving from R&D to revenue.