#Copper Demand Rising Fast as Clean Tech Expands

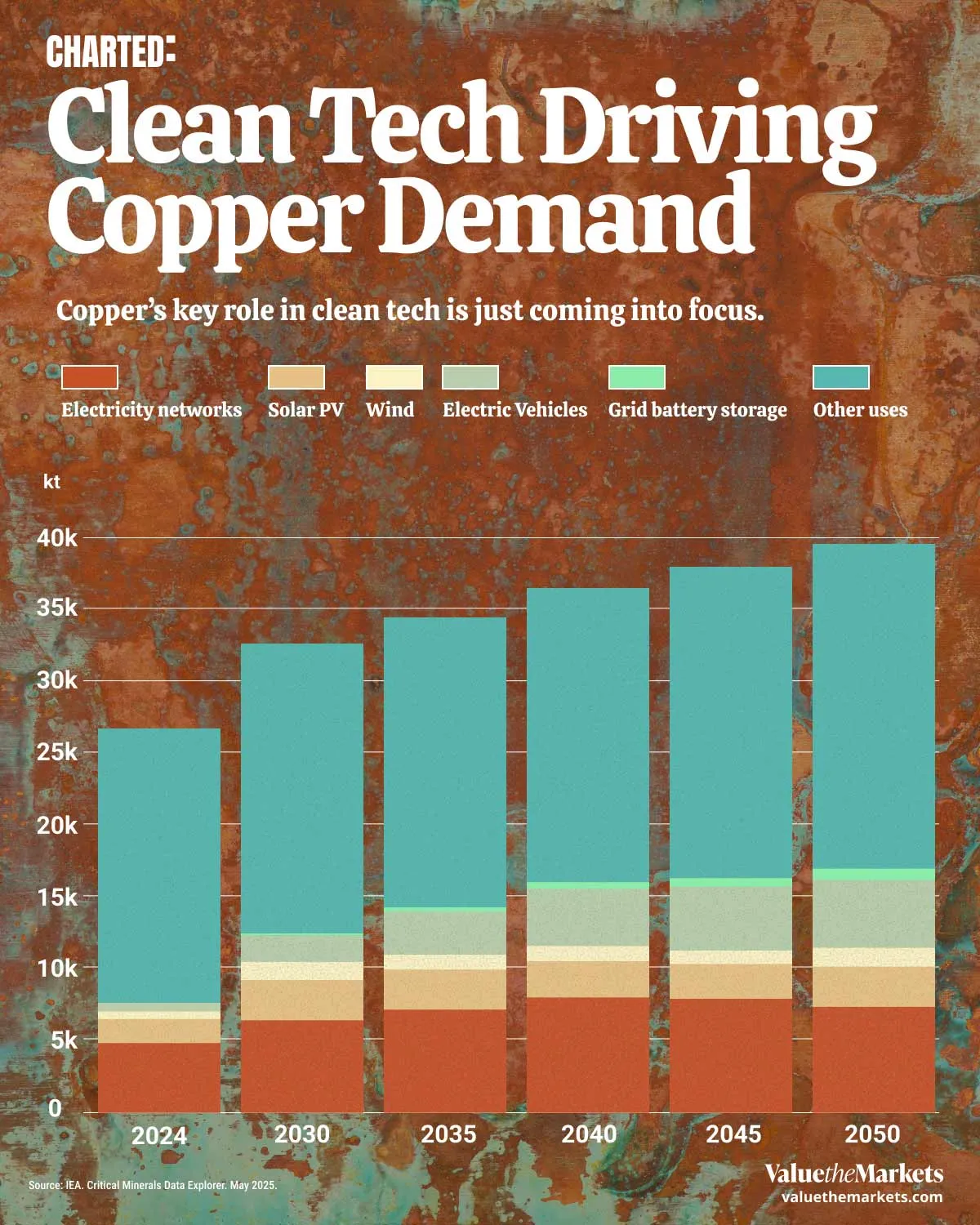

The global push toward clean energy is triggering a major shift in copper demand. Based on the International Energy Agency’s Announced Pledges Scenario (APS)1, data shows that by 2050, clean technologies could account for 43% of total copper demand, up from just 29% in 2024.

That shift isn’t just about solar panels and wind turbines. Electric vehicles, grid storage, and electricity networks are driving rapid and sustained growth, with total copper demand forecast to rise nearly 50% over the next 25 years.

| Announced Pledges Scenario | ||||||

| 2024 | 2030 | 2035 | 2040 | 2045 | 2050 | |

| Copper | ||||||

| Solar PV | 1657 | 2803 | 2726 | 2626 | 2448 | 2758 |

| Wind | 534 | 1172 | 1038 | 919 | 968 | 1314 |

| Other low emissions power generation | 76 | 166 | 155 | 135 | 137 | 121 |

| Electric vehicles | 497 | 1789 | 3018 | 3976 | 4372 | 4743 |

| Grid battery storage | 76 | 244 | 366 | 567 | 645 | 806 |

| Electricity networks | 4929 | 6543 | 7266 | 8073 | 7970 | 7479 |

| Total clean technologies | 7737 | 12578 | 14579 | 16352 | 16624 | 17176 |

| Other uses | 18980 | 20042 | 20005 | 20388 | 21504 | 22465 |

| Total demand | 26717 | 32620 | 34584 | 36740 | 38127 | 39641 |

| Share of clean technologies in total demand | 29% | 39% | 42% | 45% | 44% | 43% |

#What Investors Need to Know About Rising Copper Demand

Copper demand from clean tech is projected to grow 122% by 2050, significantly impacting long-term supply dynamics.

Clean energy now represents the fastest-growing segment of copper consumption, creating new investment angles in mining and infrastructure.

Companies that dominate copper mining or recycling could see revenue expansion as clean tech adoption scales globally.

High copper intensity in electric vehicles and grid upgrades ties demand directly to government climate pledges and consumer behavior.

Investors in copper-focused ETFs, miners, or industrial tech firms should reassess portfolio allocations based on these long-range trends.

#About the Sector

Copper is essential in energy transmission, electronics, and construction. But it's becoming increasingly central to the clean energy transition. Solar, wind, EVs, and grid storage require much more copper than fossil fuel systems. This makes copper not just a traditional industrial metal but a strategic material for decarbonization.

Global demand for copper has historically been driven by the construction and manufacturing sectors. Now, clean energy technologies are shifting the balance. By 2050, these uses could make up nearly half of total demand.

#Clean Technologies Are Changing the Copper Story

From 2024 to 2050, copper demand from clean tech is forecast to increase from 7.7 million tonnes to 17.2 million tonnes, according to the IEA. Here's where the growth is expected to come from:

Electric Vehicles (EVs) will be the largest single contributor, growing nearly tenfold from 0.5 to 4.7 million tonnes. EVs use up to four times more copper than traditional cars, including for motors, batteries, and charging infrastructure.

Electricity Networks will also see a sharp rise. Copper is key to building out transmission lines and smart grid systems needed for decentralized energy.

Grid Battery Storage is expected to jump from 76,000 to 806,000 tonnes. As intermittent renewable energy sources expand, storage becomes increasingly important.

Solar PV and Wind will continue to grow, but are already in a more mature phase. Copper use here peaks around 2030 and then levels off.

This mix signals not just rising demand but shifting demand types. The copper supply chain is dominated by mining companies with operations in Chile, Peru, China, Africa, Australia, and the United States. Copper investment opportunities include equities, ETFs and exposure through diversified mining or commodities funds. Investors should watch which firms are best positioned to supply copper where it's needed most.

#Other Uses Are Still Growing

Copper demand from non-clean tech sectors is also set to rise, from 18.9 million tonnes in 2024 to 22.5 million tonnes by 2050. This includes traditional sectors like construction, electronics, and industrial machinery. While clean energy is the driver of growth, these sectors provide a floor for total copper demand, helping to buffer price swings.

From physical copper to mining stocks and ETFs, this retail investor guide breaks down the main ways to gain exposure.