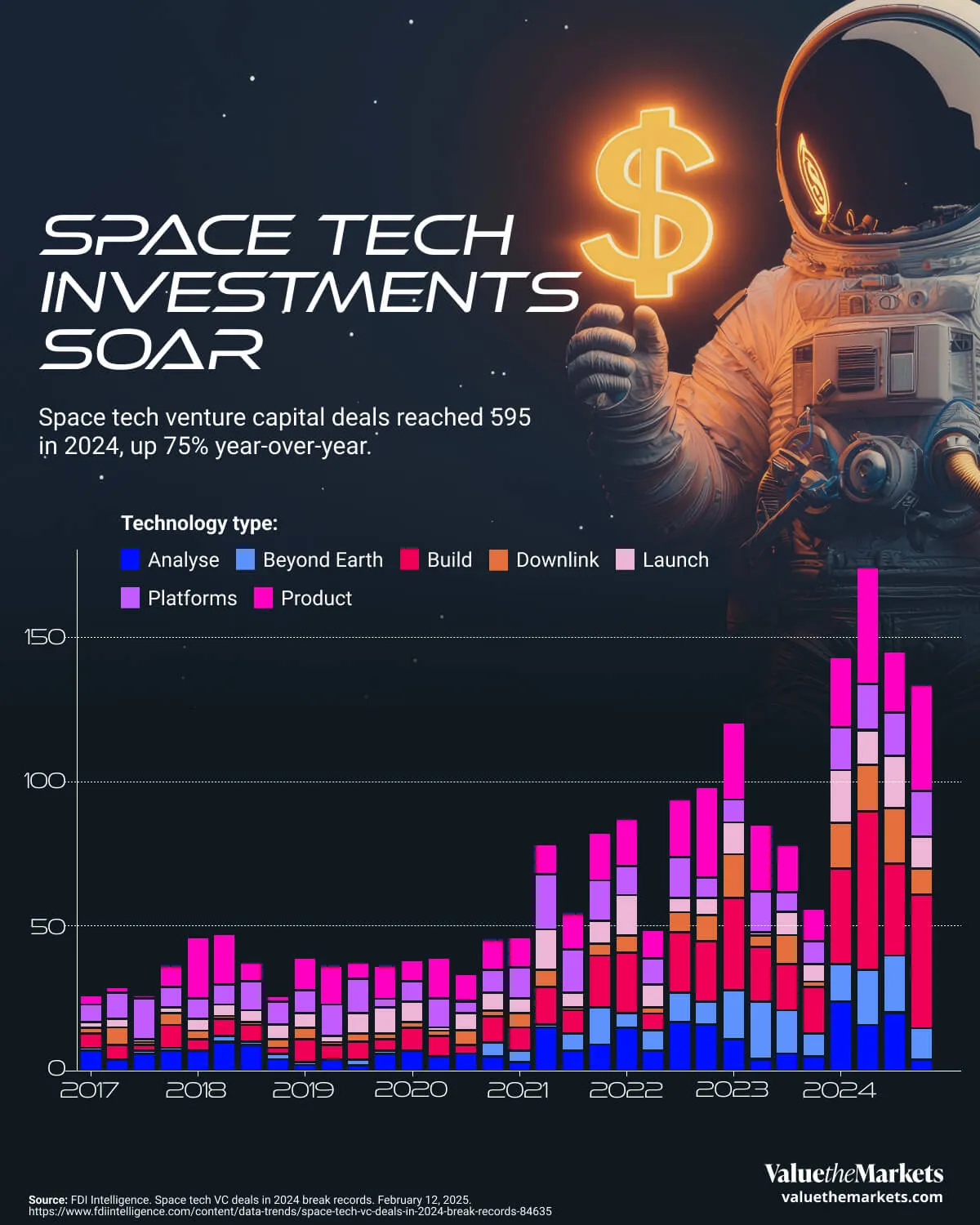

Space tech companies are attracting record levels of venture capital (VC) as falling launch costs and increasing government budgets create new opportunities. In 2024, VC investments in space startups surged to $8.6 billion, with 595 deals, reflecting a 75% year-over-year increase1. The industry is expanding beyond traditional government contracts, integrating with the broader tech ecosystem and offering commercial applications in communications, defense, and earth monitoring.

Increased government funding for national defense and climate change monitoring, along with declining launch costs, has fueled renewed interest in the sector. Private companies like Blue Origin and SpaceX are driving commercial space growth.

#Why It’s Happening Now

Cheaper Launches: Getting to space used to cost over $60,000 per kilogram. It now costs under $1,500. That changes everything.

Bigger Budgets: Governments are spending more on climate tracking and national defense. The 2024 global space budget reached $135 billion.

Private Momentum: SpaceX and Blue Origin are building out reusable launch systems and setting the pace for private expansion.

This combination is pulling private capital off the sidelines. VCs are chasing not just satellites but deep tech space companies building infrastructure for tomorrow’s economy.

#Investing in Space Exploration

You’re no longer just betting on rockets. You’re investing in global connectivity, defense systems, and earth monitoring tech.

Investing in space exploration has become a strategic priority for both governments and private enterprises, with global government space budgets reaching $135 billion in 2024. Commercial ventures are driving the development of low-earth orbit (LEO) satellite constellations, space tourism, and asteroid mining. The long-term potential lies in creating a sustainable space economy, with companies vying for leadership in satellite internet, resource utilization, and interplanetary logistics.

#Venture Capital in Space

Space technology venture capital (VC) deals surged between 2017 and 2024, shifting from niche investments to commercial funding. Early investments were smaller and spread across multiple categories. Post-2021, investment priorities shifted toward large-scale projects, particularly in Launch technologies, which focus on rockets, propulsion systems, and reusable launch vehicles, and Beyond Earth, which includes deep-space exploration, lunar missions, and interplanetary travel. This reflects both growing commercial interest and the increasing role of space in geopolitical strategy.

From 2022 onward, substantial growth in Platforms (integrated satellite platforms, space-as-a-service solutions, and modular satellite technology) and Downlink (satellite broadband and space-based 5G connectivity) highlights the rising demand for satellite-based communication and earth observation services. The expansion of these categories indicates a strong push toward global connectivity, data transmission, and secure communications.

By 2024, space VC deals had surged over 75% year-over-year, with significant growth in Beyond Earth and Launch, reflecting rising investment in deep-space infrastructure and reusable spaceflight technologies. Additionally, the Build sector (which includes spacecraft and satellite manufacturing) and Product sector (covering space tourism, asteroid mining, and satellite-based commercial services) also saw significant expansion.

This diversification underscores the broader commercialization of space, as investment shifts from purely government-backed initiatives to private-sector-driven innovation and long-term infrastructure development.

#Deep Tech Space

The rise of deep tech in space is reshaping the industry, with advancements in autonomous spacecraft, AI-powered satellite analytics, and next-generation propulsion systems. Government and private investors are funding high-risk, high-reward innovations, particularly in areas such as space manufacturing, quantum communications, biomedical research, and off-Earth resource extraction.

As geopolitical competition intensifies, deep tech space initiatives are driving innovation in defense, satellite communications, and commercial space applications, making them vital to national security and economic growth.

#Moon Space Investment

Meanwhile, a renewed focus on Moon space investment is driving a new wave of innovation in lunar infrastructure, resource extraction, and long-term habitation. With multiple nations and private firms planning lunar missions in the next decade, funding is flowing into technologies such as lunar landers, autonomous mining systems, and sustainable energy solutions. As competition between the U.S., China, and private enterprises intensifies, securing a foothold on the Moon is increasingly seen as a stepping stone for further deep-space exploration and economic expansion.

For instance, NASA's Artemis program aims to land astronauts on the Moon by 2026 and establish a sustainable human presence, partnering with private companies to develop lunar landers and infrastructure2.

Key companies involved include:

Aerojet Rocketdyne (private company) – Propulsion systems

Axiom Space (private company) – Spacesuit and habitat development

Bechtel (private company) – Infrastructure and spaceport construction

Blue Origin (private company) – Human landing systems and propulsion

Boeing (NYSE: BA) – Space Launch System (SLS) core stage and upper stage

Jacobs (NYSE: J) – Engineering and technical support

Lockheed Martin (NYSE: LMT) – Orion spacecraft development

Maxar Space Systems (private company) – Power and propulsion for Gateway space station

Northrop Grumman (NYSE: NOC) – Gateway space station habitat module and SLS boosters

SpaceX (private company) – Lunar Starship human landing system

In addition to these major contractors, thousands of suppliers, including small businesses, contribute to the technologies needed to support human exploration and operations on the Moon.

#Low-Earth Orbit Satellite Constellations

The rapid expansion of low-earth orbit (LEO) satellite constellations is reshaping global communications, defense, and earth observation industries. Companies like SpaceX’s Starlink, Amazon’s Project Kuiper, and China’s SpaceSail are deploying thousands of small satellites to deliver high-speed internet, remote sensing, and secure data transmission worldwide.

The number of satellites in orbit has grown exponentially, with Starlink alone operating nearly 7,000 satellites. Governments are also investing in independent LEO networks to reduce reliance on foreign systems, reflecting the strategic importance of LEO satellite infrastructure in national security and commercial applications.

Heavy payload launch costs have dropped dramatically, from $65,400/kg in the 1960s to as low as $1,500/kg today1. As launch costs continue to decline and technology advances, LEO constellations are expected to accelerate global connectivity and drive new business opportunities across various industries.

#Space Tourism

Space tourism has transitioned from science fiction to commercial reality, with private companies leading the charge toward suborbital flights and future orbital stays. Blue Origin, SpaceX, and Virgin Galactic have already launched paying customers on brief spaceflights, marking the beginning of a new industry catering to affluent adventurers.

With advancements in reusable rocket technology and declining launch costs, the market for luxury space travel, orbital hotels, and even lunar tourism is gaining traction. While ticket prices remain high, continued innovation and competition could make space tourism more accessible in the coming decades.

Beyond leisure, these missions provide valuable insights for long-duration space travel and deep-space exploration, further integrating tourism into the broader space economy.

#Asteroid Mining

Asteroid mining is emerging as a potential solution to global resource shortages, with companies exploring ways to extract valuable minerals from space. Rich in rare metals like platinum, gold, and nickel, asteroids could provide an alternative to Earth’s depleting reserves, reducing the environmental impact of terrestrial mining.

NASA, China’s CNSA, and private firms like AstroForge are actively researching autonomous mining technologies, robotic extraction, and in-space refining processes to make asteroid mining commercially viable. While asteroid mining remains in early-stage development, successful missions could provide abundant raw materials for space infrastructure, manufacturing, and deep-space missions. As competition in space intensifies, asteroid mining is increasingly seen as a long-term investment with vast economic potential.

#Expanding Space Frontiers

When it comes to venture capital investing in space exploration, there is significant funding growth in Beyond Earth, Launch, and Build that indicates a shift toward long-term lunar and interplanetary exploration. More deals across multiple technology types suggest that private companies are playing a bigger role, reducing reliance on government funding.

Overall, this graph confirms that venture capital funding in space tech is experiencing exponential growth, driven by advancements in launch cost reductions, space commercialization, and global competition in satellite infrastructure.

Meanwhile, the global space economy is projected to reach $1.8 trillion by 2035, according to McKinsey estimates, reflecting sustained growth in commercial space ventures3.