#TSX's Top 30 Growth Stocks from 2022 to 2025

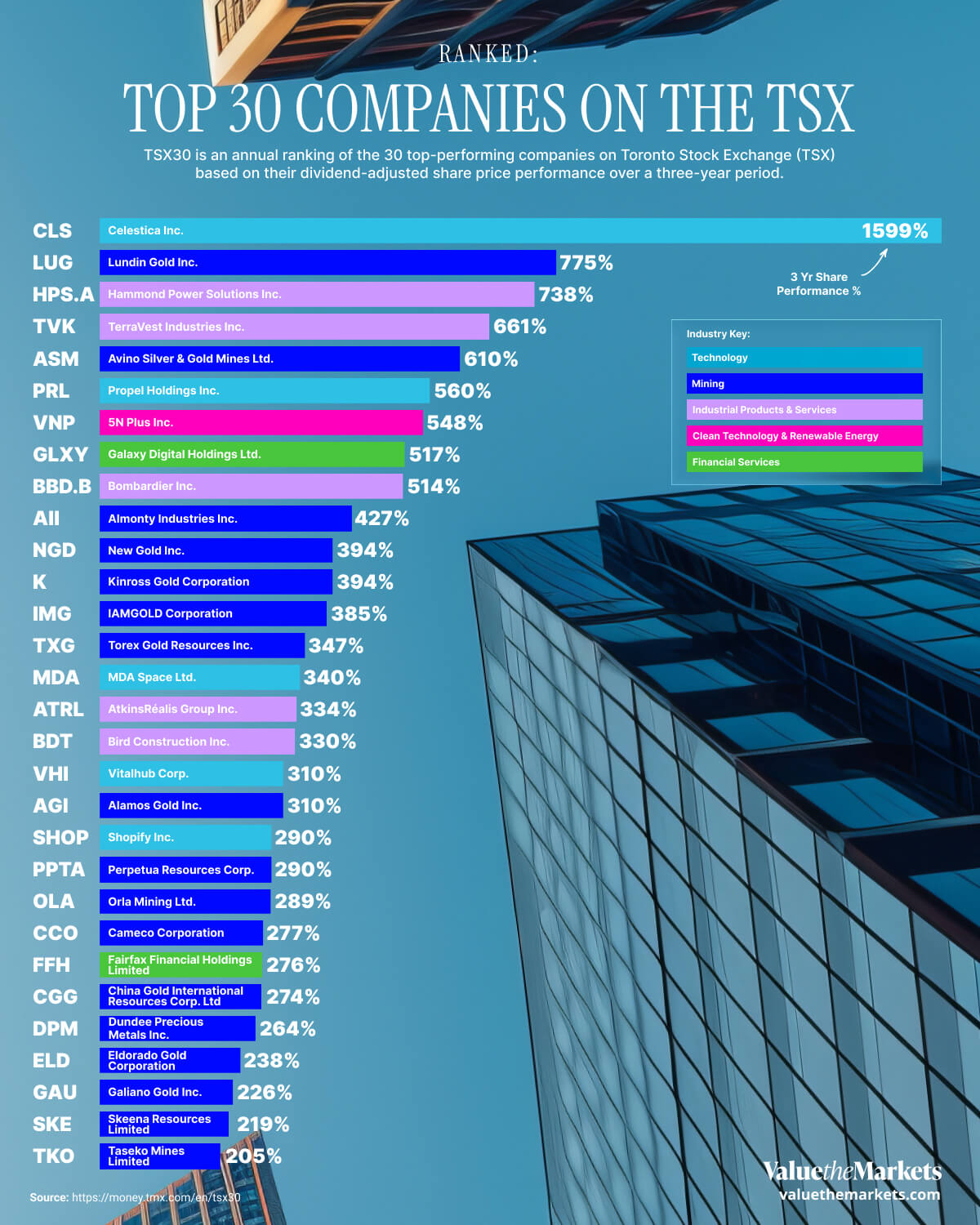

Retail investors looking for market-beating returns often chase high-growth stocks. Over the past three years, some TSX-listed companies have delivered massive share price gains, far outpacing the broader index. The TSX, or Toronto Stock Exchange, is Canada’s main stock exchange and home to many of the country’s largest public companies. From established tech firms to mining upstarts, the top 30 performers from June 2022 to June 2025 reveal where momentum and capital have been flowing. At the top of the list, tech-enabler Celestica saw a 1,599% gain, with companies like Lundin Gold and Hammond Power also delivering returns of over 700%. Beyond price gains, technology and industrials were leaders in total market cap creation, contributing over $100B in combined value. For example, the combined market cap of top-performing tech companies rose from $6.4B to $33.4B, while industrials grew from $30.9B to $144.4B.

| Ranking | Ticker | Company Name | Share Price Performance | Sector | TSXV Graduate |

|---|---|---|---|---|---|

| 1 | CLS | Celestica Inc | 1599% | Technology | |

| 2 | LUG | Lundin Gold Inc | 775% | Mining | ✔ |

| 3 | HPS.A | Hammond Power Solutions Inc | 738% | Industrial Products & Services | |

| 4 | TVK | TerraVest Industries Inc | 661% | Industrial Products & Services | |

| 5 | ASM | Avino Silver & Gold Mines Ltd | 610% | Mining | ✔ |

| 6 | PRL | Propel Holdings Inc | 560% | Technology | |

| 7 | VNP | 5N Plus Inc | 548% | Clean Tech & Renewable Energy | |

| 8 | GLXY | Galaxy Digital Holdings Ltd | 517% | Financial Services | ✔ |

| 9 | BBD.B | Bombardier Inc | 514% | Industrial Products & Services | |

| 10 | AII | Almonty Industries Inc | 427% | Mining | ✔ |

| 11 | NGD | New Gold Inc | 394% | Mining | ✔ |

| 12 | K | Kinross Gold Corporation | 394% | Mining | |

| 13 | IMG | IAMGOLD Corporation | 385% | Mining | |

| 14 | TXG | Torex Gold Resources Inc | 347% | Mining | ✔ |

| 15 | MDA | MDA Space Ltd | 340% | Technology | |

| 16 | ATRL | AtkinsRéalis Group Inc | 334% | Industrial Products & Services | |

| 17 | BDT | Bird Construction Inc | 330% | Industrial Products & Services | ✔ |

| 18 | VHI | Vitalhub Corp | 310% | Technology | ✔ |

| 19 | AGI | Alamos Gold Inc | 310% | Mining | ✔ |

| 20 | SHOP | Shopify Inc | 290% | Technology | |

| 21 | PPTA | Perpetua Resources Corp | 290% | Mining | |

| 22 | OLA | Orla Mining Ltd | 289% | Mining | ✔ |

| 23 | CCO | Cameco Corporation | 277% | Mining | |

| 24 | FFH | Fairfax Financial Holdings Ltd | 276% | Financial Services | |

| 25 | CGG | China Gold Intl Resources | 274% | Mining | ✔ |

| 26 | DPM | Dundee Precious Metals Inc | 264% | Mining | |

| 27 | ELD | Eldorado Gold Corporation | 238% | Mining | |

| 28 | GAU | Galiano Gold Inc | 226% | Mining | ✔ |

| 29 | SKE | Skeena Resources Ltd | 219% | Mining | ✔ |

| 30 | TKO | Taseko Mines Ltd | 205% | Mining |

#Why TSX Growth Stocks Matter to Retail Investors

These stocks showcase sectors and companies capable of outsized returns in a short timeframe.

High-growth names can significantly improve portfolio performance with relatively small allocations.

Many of these companies started small, showing the potential of small- and mid-cap investing.

Identifying trends across top performers helps uncover where capital is concentrating.

They highlight opportunities on the TSX beyond the usual blue-chip names.

#Celestica Leads with a 1,599% Gain

Celestica (CLS) turned heads with a staggering 1,599% increase in share price, taking its market cap from $1.3 billion to $24.5 billion. Celestica is a behind-the-scenes partner for some of the world’s biggest tech, healthcare, aerospace, and industrial companies. Its established role in AI infrastructure, supply chain efficiency, and hardware integration gained new recognition as investor interest surged in these areas. For retail investors, the takeaway is that companies with steady execution in the right industries can see outsized gains when market trends align with their strengths. Celestica wasn’t a flashy name in 2022, but strong execution and tech tailwinds changed that.

#Mining Still Matters

Of the top 30, more than half are mining companies. Lundin Gold (775% gain), Avino Silver & Gold Mines (610%), and New Gold (up 394%) are standout names, each delivering impressive returns. With gold prices strengthening and capital shifting into hard assets, miners benefited from both fundamental and speculative factors. Companies like Kinross Gold Corp (394%) and IAMGOLD (385%) also gained as institutional interest returned to the sector. Retail investors often overlook Canadian miners, but the data shows this sector remains a core source of high-growth potential.

#Industrial Surge in Canada

Industrial products and services companies like Hammond Power, TerraVest, and Bombardier also posted massive returns. Hammond Power grew 738%, driven by electrification and energy infrastructure demand, ranking #3 on the TSX30 2025 list. TerraVest’s 661% gain reflects strength in niche manufacturing and energy equipment, ranking #4 on the TSX30 2025 list. These businesses, while not in the spotlight, capitalized on steady demand and macro tailwinds. Investors paying attention to industrial trends had multiple chances to catch this wave. The Industrial Products & Services sector as a whole saw an average share price return of 515%, according to the TSX30.

#Technology and TSXV Graduates Gaining Ground

Beyond Shopify’s well-known 290% surge, mid-cap tech names like Propel Holdings (560%) and Vitalhub (310%) show there’s life beyond the big names. As a whole, the technology sector on the TSX30 posted an average share price return of 620%, the highest among all sectors. Several of these firms graduated from the TSX Venture Exchange (TSXV), reinforcing the value of keeping an eye on that space. In fact, 14 of the top 30 were TSXV grads. It shows that strong execution and market traction can lead to massive gains for early investors. The strong showing of TSXV graduates, especially in tech, underscores the TSX Venture Exchange's role as a launchpad for high-growth public companies.

#📌 Quick Takeaways:

• Top Gainer: Celestica (+1,599%)

• Sector Leader: Technology (+620% average)

• Most Represented Sector: Mining (15 of 30)

• Notable TSXV Grads: Propel, Vitalhub, Avino

• Hidden Gems: Hammond Power, TerraVest

For retail investors, the TSX30 offers not just a snapshot of past winners, but a roadmap for spotting tomorrow’s outperformers.

#FAQs

What is the TSX?

The Toronto Stock Exchange is Canada’s primary stock exchange for larger, established companies.

What does TSXV graduate mean?

It refers to companies that started on the TSX Venture Exchange and graduated to the main TSX due to growth and maturity.

Are high-growth stocks riskier?

Yes. While they offer higher upside, they often come with more volatility and operational risk.

How can I invest in these types of companies?

You can buy shares directly or invest through ETFs that track small-cap or growth-focused Canadian stocks.

What sectors saw the most growth from 2022 to 2025?

Mining, technology, and industrial products led the pack in terms of total returns.