Sponsored by: Brazil Potash. Download the company’s latest investor overview.

#Global Food Demand is Driving a Relentless Need for Potash in Brazil

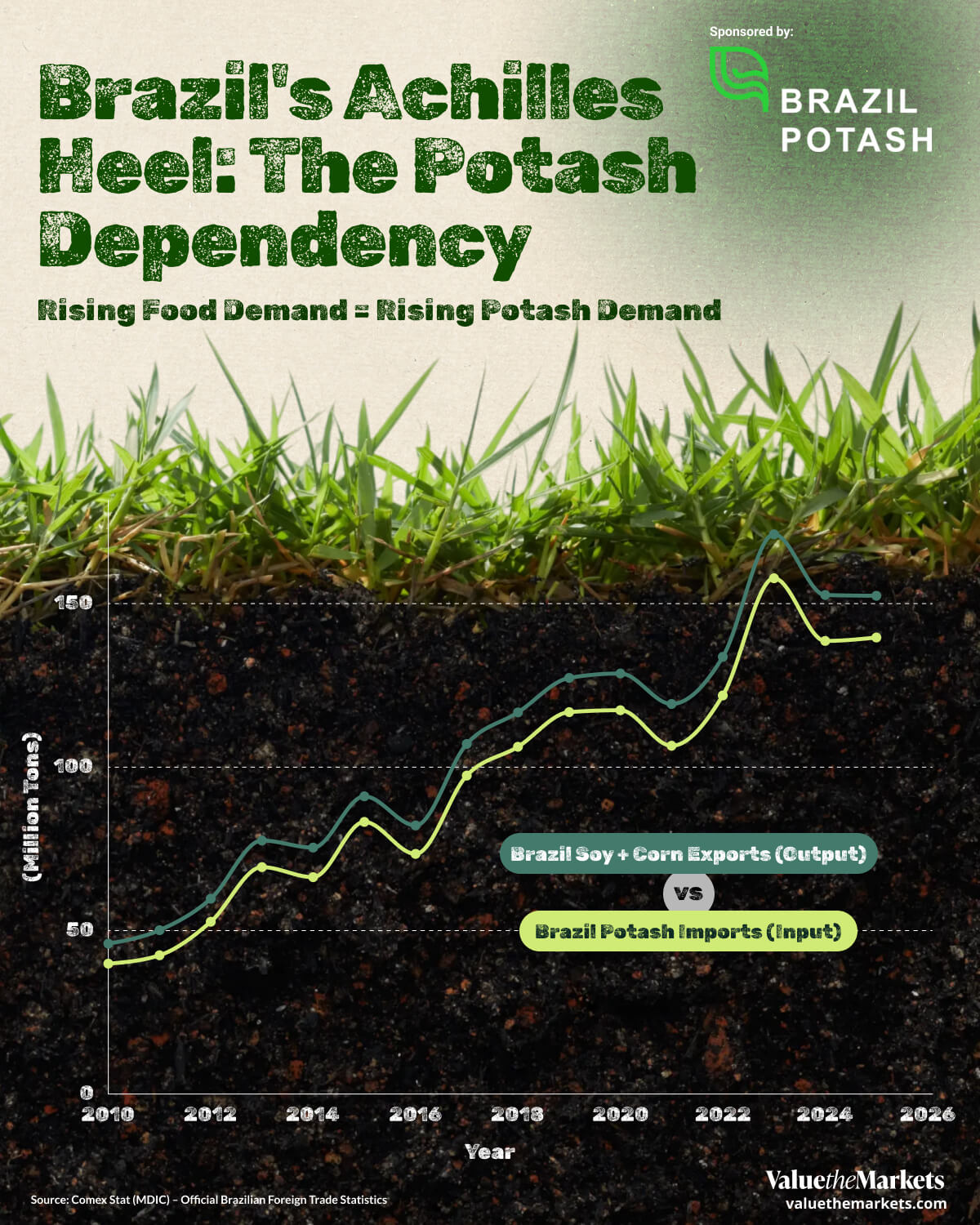

Brazil's agricultural sector continues to demonstrate its role as a critical engine of global food production. In 2025, crop exports are expected to total around 140 million tons, below the 2023 record of 157.7 million tons, but well above long-term averages. And despite a modest dip in potash imports this year, volumes remain historically high.

This reinforces a key insight for investors: the relationship between fertilizer input and food output is not cyclical; it is structural. Brazil cannot sustain massive exports of soybeans and corn without replenishing its soil. That replenishment depends on imported potash, as the country currently sources more than 95% of its potash needs from abroad. For investors seeking exposure to agricultural commodities or fertilizer producers, this linkage strengthens the long-term case for steady potash demand.

Brazil’s Soybean, Corn Exports

| Year | Net Weight (kg) |

| 2025 | 139,648,104,450 |

| 2024 | 138,597,683,328 |

| 2023 | 157,767,825,284 |

| 2022 | 121,919,806,927 |

| 2021 | 106,539,361,789 |

| 2020 | 117,405,360,881 |

| 2019 | 116,825,156,181 |

| 2018 | 106,222,215,625 |

| 2017 | 97,420,480,777 |

| 2016 | 73,455,184,424 |

| 2015 | 83,248,117,248 |

| 2014 | 66,346,603,204 |

| 2013 | 69,420,154,936 |

| 2012 | 52,707,724,637 |

| 2011 | 42,457,620,137 |

| 2010 | 39,891,889,004 |

| Grand Total | 1,529,873,288,832 |

Source: Comex Stat (MDIC) – Official Brazilian Foreign Trade Statistics

Brazil’s Potash Imports

| Year | Net Weight (kg) |

| 2025 | 12,759,204,792 |

| 2024 | 14,048,332,994 |

| 2023 | 13,439,274,202 |

| 2022 | 11,806,513,690 |

| 2021 | 12,779,639,509 |

| 2020 | 11,235,691,330 |

| 2019 | 10,452,737,230 |

| 2018 | 10,520,886,352 |

| 2017 | 9,673,651,861 |

| 2016 | 8,711,260,206 |

| 2015 | 7,821,588,895 |

| 2014 | 9,051,318,434 |

| 2013 | 8,135,845,384 |

| 2012 | 7,043,157,145 |

| 2011 | 7,679,194,239 |

| 2010 | 6,123,851,003 |

| Grand Total | 161,282,147,266 |

Source: Comex Stat (MDIC) – Official Brazilian Foreign Trade Statistics

#Why Potash Matters for Investors

- Potash is a core input in global food production, especially in export-heavy markets like Brazil.

- Fertilizer demand is not cyclical like consumer goods. Farmers must apply nutrients every planting season, even after weak harvests. That can be multiple times a year.

- The tight relationship between crop output and potash imports shows consistent, recurring demand.

- Supply disruptions or trade shifts can create short-term volatility, but the structural need remains unchanged.

- Investing in potash producers offers exposure to food security trends and growing global population needs.

#2025 Still Strong Despite Slight Dip in Imports

In 2025, potash import volume dipped to about 12.8 million tons from roughly 14 million tons in 2024. This likely reflects a normalization after elevated purchases in 2024, rather than a structural decline in demand. Inventory carryover and timing effects can shift import volumes from year to year, even as underlying fertilizer dependence remains unchanged.

Crop exports remained high, reinforcing the idea that nutrient availability stayed sufficient despite lower reported imports. This underscores the “sticky” nature of potash demand. Farmers cannot afford to let soil nutrient levels fall. Even when purchases pause or normalize in a given year, they typically follow periods of exceptionally strong output, as seen after 2023.

#2023's Harvest Explains the Spike

The record-setting 157.8 million tons of crop exports in 2023 stand out on the chart. This spike required a corresponding surge in fertilizer use, which is why potash imports rebounded sharply in 2023 and 2024.

This replenishment cycle is critical. When farmers push the land hard for a big harvest, the nutrients have to be replaced. Potash is essential for root development and crop strength, especially in Brazil's tropical soils, which naturally lack potassium.

#Inputs vs Outputs Show Structural Demand

The most useful insight from this chart is how well the green line (exports) and blue bars (potash imports) move together. While crop exports are several times larger in volume, the correlation proves that potash is not a nice-to-have; it is a must-have.

Even during the 2021 drought year, potash imports remained resilient. Farmers cannot skip fertilization just because of lower market prices or bad weather. They are already preparing for the next planting cycle. This durability in demand adds weight to the long-term investment case for potash producers.

#Securing Brazil’s Potash Supply at Home

With Brazil importing nearly all its 14 million tonne potash demand1, Brazil Potash (NYSE-A: GRO) is developing the country’s first large-scale domestic mine near its main farming region2. The Autazes Project targets a critical gap in a US$30 billion global market3, aiming to deliver reliable local supply and strengthen Brazil’s agricultural independence.

The company enters 2026 with 91% of its future production already committed through binding offtake agreements, a strengthened leadership bench, and key site preparation activities completed.

2026 Goals

- Complete Mine Shaft and Processing-Plant Engineering to Enable Debt Financing

- Secure a Strategic Project-Level Equity Partner to Help Fund Construction With Limited Dilution

- Obtain Third-Party Funding for Key Infrastructure (Port, Steam Plant, Construction Power, Trucking)

- Expand Community Training Programs to Prepare the Local Workforce

- Order Long-Lead Equipment and Begin Early Civil Works Following Engineering and Financing Completion

Brazil Potash has also recently begun an advanced Artificial Intelligence X-ray Transmission (XRT) ore sorting trial to assess pre-concentration technology that could materially reshape the project’s construction and long-term operating costs.

Permitted for construction, the Autazes Project, if completed, is designed to produce up to 2.4 million tonnes of locally supplied potash per year, supporting Brazil’s agricultural heartland and helping reduce the country’s heavy reliance on imported fertilizer.

Led by former Nutrien and Rio Tinto executives, the company is aligned with Brazil’s national food security objectives and operates under rigorous environmental standards. The project features an underground mine with dry-stacked tailings, a process that removes water from waste material, minimizing water use and surface impact while being developed entirely on non-rainforest cattle farmland.