#AI and Analytics Stocks Are Dominating the Market in 2025

Enterprise tech names focused on artificial intelligence and data analytics are powering sector growth in 2025. These companies are capturing investor interest and outperforming broader market indices thanks to surging demand for automation, predictive intelligence, and cloud-driven data solutions.

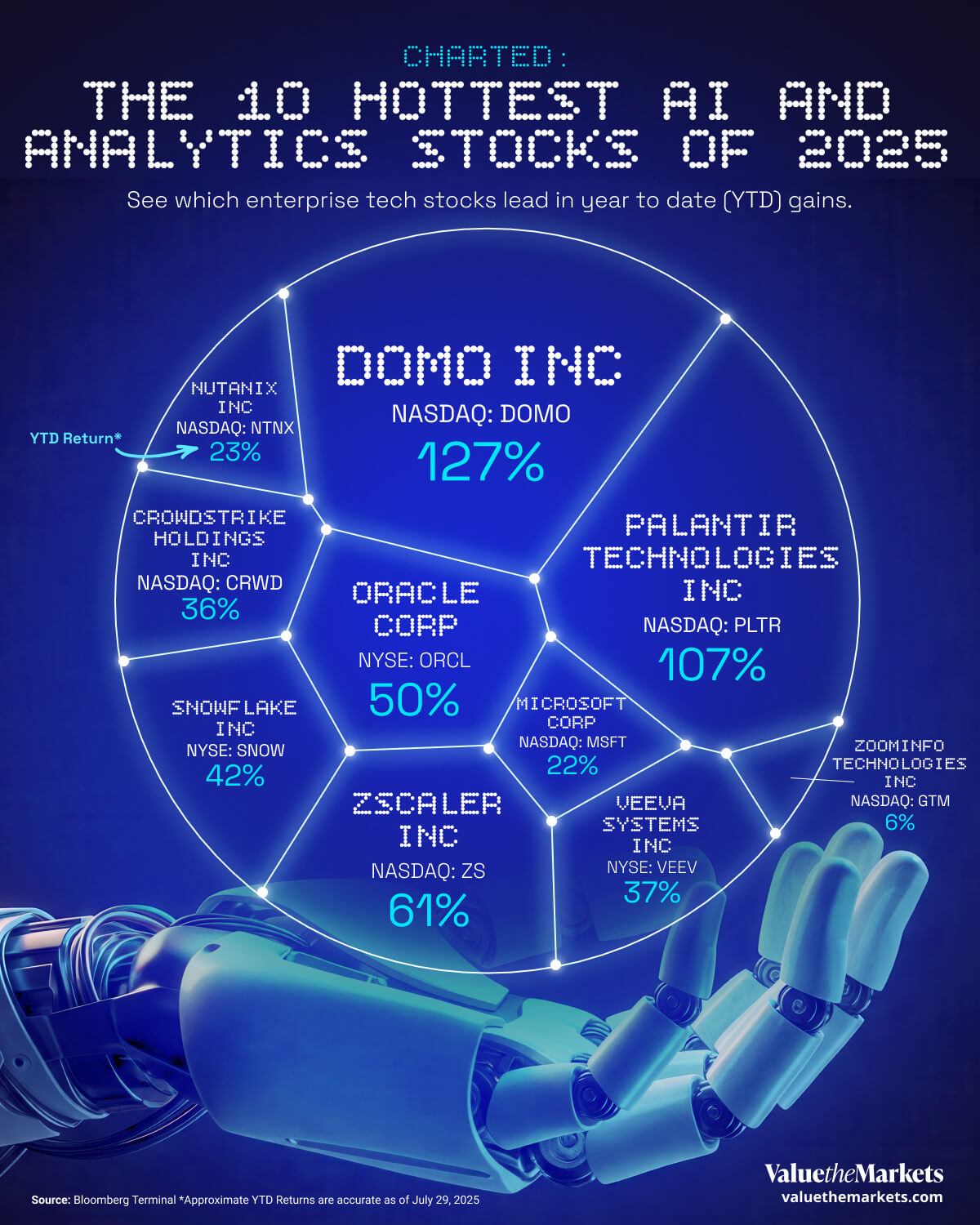

The standout performers include Domo, Palantir, and Zscaler, all posting double-digit year-to-date gains, with Domo up a staggering 127%. While mega-cap names like Microsoft are delivering solid returns, it’s the mid-cap innovators that are generating the biggest upside.

#Why AI and Analytics Stocks Matter to Retail Investors

Massive Growth Tailwinds

AI and data analytics are expanding across industries, from healthcare and finance to logistics and marketing. Companies that enable this shift stand to benefit from multi-year revenue growth.

New Product Cycles

Many enterprise tech firms are rolling out new AI-driven tools that can unlock additional value, helping them secure larger deals or upsell existing customers.

Margin Expansion Potential

Software companies often have high gross margins. AI and automation can drive operational efficiencies, leading to even better profitability over time.

Acquisition Targets

Smaller players with niche AI capabilities may become takeover targets for larger tech giants looking to build out their AI stack.

Diversification in Tech Exposure

Investing across AI software, cloud infrastructure, and cybersecurity allows retail investors to gain a broader exposure to different layers of the AI value chain.

#Domo and Palantir Lead the Charge

Domo Inc (NASDAQ: DOMO) is the top-performing stock so far in 2025 with an approximate 127% return. The company has been gaining traction with enterprise customers seeking scalable, user-friendly data visualization and business intelligence tools. As companies aim to democratize access to AI-driven insights, Domo's low-code, intuitive platform has helped it stand out.

Palantir Technologies (NASDAQ: PLTR) is close behind with a return of around 107%. Its focus on government and defense contracts, combined with expanding demand for its AI platform in the private sector, has driven momentum. Palantir's narrative is resonating with investors looking for sticky, high-value contracts in an increasingly complex world.

#Cybersecurity and Cloud Names Are Seeing Renewed Interest

Zscaler (NASDAQ: ZS), up 61% year-to-date (YTD), continues to benefit from the shift toward cloud-based security architectures. With companies embracing hybrid work and decentralized IT systems, Zscaler’s zero-trust model is becoming more relevant.

Crowdstrike (NASDAQ: CRWD) is also performing well, with a 36% return, signaling ongoing demand for endpoint security solutions that use AI to detect and respond to threats in real time.

Nutanix (NASDAQ: NTNX), up 23%, is seeing renewed interest as companies prioritize hybrid cloud setups. Its software-defined approach helps enterprises manage workloads across public and private environments with greater efficiency.

#Large Caps Offer Steady Performance

Oracle (ORCL) and Microsoft (MSFT) are both solid performers, returning 50% and 22% respectively. Oracle’s push into AI-powered database automation and Microsoft’s investment in copilots and Azure AI services are fueling steady growth. These companies offer more stable exposure for investors who want AI upside with less volatility.

Snowflake (SNOW) and Veeva Systems (VEEV), posting 42% and 37% gains respectively, are expanding their analytics offerings. Snowflake’s focus on data sharing and application deployment using its platform is resonating with large enterprise clients. Veeva is seeing strength from AI-enhanced CRM solutions in life sciences.

#One Laggard Amid the Rally

ZoomInfo (GTM), with only a 6% YTD return, is underperforming the group. While the company continues to push AI in sales intelligence, concerns over customer churn and slowing new client acquisition have kept gains in check. It’s a reminder that not all AI narratives automatically lead to strong returns.

| Company | Ticker | YTD Return* |

| Domo Inc | NASDAQ: DOMO | 127% |

| Palantir Technologies Inc | NASDAQ: PLTR | 107% |

| Zscaler Inc | NASDAQ: ZS | 61% |

| Oracle Corp | NYSE: ORCL | 50% |

| Snowflake Inc | NYSE: SNOW | 42% |

| Veeva Systems Inc | NYSE: VEEV | 37% |

| Crowdstrike Holdings Inc | NASDAQ: CRWD | 36% |

| Nutanix Inc | NASDAQ: NTNX | 23% |

| Microsoft Corp | NASDAQ: MSFT | 22% |

| ZoomInfo Technologies Inc | NASDAQ: GTM | 6% |

Source: Bloomberg Terminal *Approximate YTD Returns are accurate as of July 29, 2025.

#FAQs

What sectors are driving demand for AI and analytics software?

Industries like healthcare, finance, logistics, and retail are investing heavily in AI tools to improve efficiency, cut costs, and deliver better services.

Are these stock returns sustainable?

While some names may continue to outperform, high-flying stocks like Domo and Palantir carry volatility risk. Investors should assess business fundamentals and not just momentum.

Is now a good time to invest in AI stocks?

If you're investing with a long-term horizon, AI remains one of the most promising growth themes. However, valuation discipline is essential.

What’s the risk in buying smaller AI-focused companies?

Mid-cap names can be more sensitive to execution missteps, customer churn, or competitive threats. But they also offer greater upside if they scale successfully.

How can I get diversified exposure to this theme?

Consider ETFs that focus on AI, cloud, and analytics, or build a portfolio with a mix of software, cybersecurity, and cloud infrastructure names.