Vancouver, B.C. (February 18, 2026) – Canterra Minerals Corporation (TSXV: CTM) (OTCQB: CTMCF) (FSE: DXZB) (“Canterra” or the “Company”) is entering a high-impact discovery phase in 2026 with the launch of a fully funded, up to 15,000-metre diamond drill program across its 100%-owned projects in central Newfoundland. Drilling has commenced at the Company’s Buchans Project, one of the world’s most prolific past-producing high-grade VMS districts, where modern deep-seeking geophysics has generated multiple untested targets.

The 2026 campaign marks a transition from target generation to systematic drill testing across three areas: (i) drill-test high-priority targets at Buchans identified by modern deep-seeking geophysics and integrated geological modelling, (ii) prioritize selective follow-up drilling across Canterra’s broader Victoria Lake Supergroup (“VLSG”) portfolio, as potential satellite deposits to the Buchans Project; and (iii) advance gold targets at the Wilding Gold Project along the same structural corridor that hosts Equinox Gold’s producing Valentine Mine.

2026 Program Highlights:

Up to 15,000 metres of fully funded diamond drilling across Buchans, the Victoria Lake Supergroup portfolio and Wilding:

- Buchans (~5,000m planned): 2,000m winter program has commenced, targeting 3DIP anomalies and structural corridors prospective for Buchans-style massive sulphide mineralization, plus expansion drilling at the Lundberg deposit and Two Level zone. Additional ~3,000m follow-up testing later in 2026.

- VLSG Portfolio (up to ~5,000m): Belt-wide target ranking across multiple VMS deposits (Bobbys Pond, Daniels Pond, Boomerang, Lemarchant, Long Lake & Tulks deposits) and prospects to prioritize 2026 prospecting, geophysics, and targeted diamond drilling.

- Wilding Gold Project (~5,000m planned): Initial field program consisting of ~250 percussion drill holes (basal till and top-of-bedrock sampling) has commenced along the 55 km Valentine structural trend, with follow-up diamond drilling scheduled for H2 2026.

Chris Pennimpede, President and CEO of Canterra, commented: “2026 marks the beginning of a true discovery-driven phase for Canterra. At Buchans, winter drilling is already underway as we apply modern deep-seeking geophysics to one of the world’s most prolific high-grade VMS districts and systematically test targets that previous operators could not effectively evaluate at depth.

In parallel, we are advancing our Wilding gold Project along the same structural corridor that hosts the producing Valentine Mine, where we control a 55-kilometre extension of this gold-bearing trend. Our Q1–Q2 program is designed to refine and prioritize targets ahead of diamond drilling in the second half of the year.

With a fully funded 15,000-metre program and successive drill results anticipated throughout 2026, we believe we are positioned to demonstrate the broader district-scale potential of our Newfoundland land package.”

2026 Exploration Program Overview

Buchans Project – Winter drilling underway; follow-up on 3D induced polarization results and integrated targeting

Objective: Advance discovery and resource growth potential at Buchans by drill-testing high-priority targets generated from the Company’s 2025 deep-seeking 3DIP program and subsequent integrated interpretation. In addition, Canterra intends to undertake additional drilling for resource expansion at the Lundberg deposit and at the high-grade Two-Level zone as follow-up to positive drilling results achieved in 2025.

2026 work program – Buchans project:

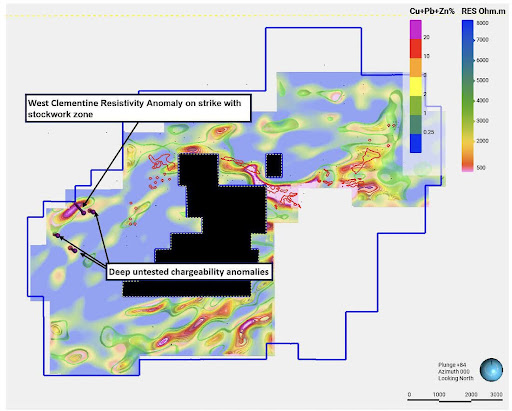

- Approximately 5,000 metres of drilling, beginning with an initial ~2,000 metre winter program currently in progress at the West Clementine target (Figure 1).

- Winter drilling will test priority targets interpreted from 3DIP chargeability/resistivity responses, integrated with geology, structure, historical drilling, and ongoing targeting work to refine vectors toward Buchans-style massive sulphide mineralization.

- Results from the winter program will be used to update target rankings and refine follow-up drill plans later in 2026.

Figure 1. Buchans Project: 2026 winter drilling plan and resistivity plan map (200 m depth slice) with resistivity isoshells. Red lines outline previously mined deposits and areas of known mineralization projected vertically to surface.

Victoria Lake Supergroup portfolio – Target Ranking

Objective: Unlock additional discovery and expansion potential across Canterra’s consolidated VMS land package by systematically ranking and drill-testing the highest-priority deposits and prospects within the Victoria Lake Supergroup. The 2026 program is designed to focus capital on targets with the strongest geological indicators for Buchans-style massive sulphide mineralization and resource growth within a proven, district-scale mining belt.

2026 work program – Victoria Lake Supergroup portfolio:

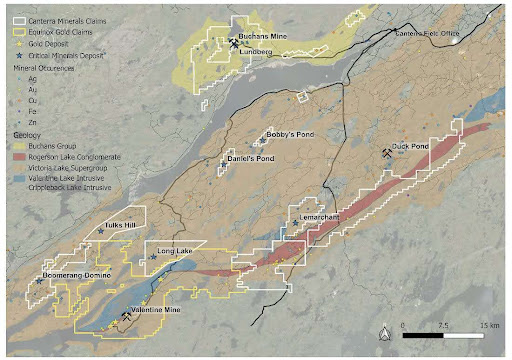

- Belt-wide target ranking initiative across VLSG deposits and prospects, including Boomerang, Lemarchant, Long Lake, Tulks, Daniels Pond, Bobby’s Pond, and additional prospects (Figure 2).

- Develop a prioritized list of field activities, including prospecting, ground geophysics, and drill targeting.

- Anticipate up to ~5,000m of targeted diamond drilling, focused on the highest-ranked opportunities for discovery and/or expansion.

Figure 2. VLSG Portfolio and Canterra Minerals projects with key geology units and known mineral occurrences.

Wilding Project – Q1 basal till and top-of-bedrock drilling to build drill-ready gold targets

Objective: Advance district-scale gold discovery potential along the 55-kilometre structural corridor contiguous with the producing Valentine Mine by refining and prioritizing high-confidence bedrock targets for diamond drill testing in 2026. The program is designed to systematically vector toward structurally controlled orogenic gold mineralization along an underexplored extension of a proven gold-bearing trend.

2026 work program – Wilding Project

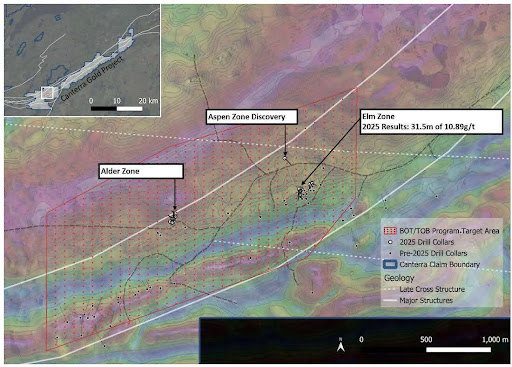

- A combined basal till and top-of-bedrock percussion drilling program has commenced (Figure 3).

- Phase 1 is expected to include ~250 percussion drill holes, focusing on priority areas that are proximal to known gold occurrences and gold-bearing regional structures including areas recently returning favourable results from 2025 drilling (news release dated January 20, 2026).

- The program is designed to identify coherent gold-in-till patterns and multi-element vectors to help prioritize follow-up work and define the strongest bedrock targets for drilling.

- Subject to results, additional basal till sampling may be completed later in 2026 to expand coverage or tighten spacing over emerging trends.

- Anticipates follow-up diamond drilling of approximately ~5,000m in the summer/fall on the highest-priority targets, along with prospecting and mapping across the broader property.

Figure 3. Wilding Project: Phase 1 base-of-till (BOT) and top-of-bedrock (TOB) drilling plan area. Magnetics Tilt Derivative as basemap.

Regional Context

Canterra’s central Newfoundland land position provides optionality across multiple commodity exposures and deposit styles, supported by year-round access corridors, established mining communities, and proximity to key infrastructure.

Newfoundland and Labrador Junior Exploration Assistance

Canterra would like to acknowledge financial support it may receive from the Government of Newfoundland and Labrador’s Junior Exploration Assistance Program related to completion of portions of its 2026 exploration activities.

Qualified Person

Paul Moore, MSc., P.Geo. (NL), Vice President of Exploration for Canterra Minerals Corporation, a Qualified Person within the meaning of National Instrument 43-101, has reviewed and approved the technical disclosure in this news release.

About Canterra Minerals

Canterra is a diversified minerals exploration company focused on critical minerals and gold in central Newfoundland. The Company’s projects include seven mineral deposits located in close proximity to the world-renowned, past-producing Buchans Mine and Teck Resources’ Duck Pond Mine, which collectively produced copper, zinc, lead, silver and gold. Several of Canterra’s deposits support current and historical Mineral Resource Estimates prepared in accordance with National Instrument 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards for Mineral Resources and Mineral Reserves. Canterra’s gold projects are located on trend of Equinox Gold’s Valentine mine currently in production and cover a ~55 km extension of the same structural corridor that hosts mineralization within Equinox Gold’s mine project. Past drilling by Canterra and others within the Company’s gold projects intersected multiple occurrences of orogenic-style gold mineralization within a large land position that remains underexplored.

ON BEHALF OF THE BOARD OF CANTERRA MINERALS CORPORATION

Chris Pennimpede

President & CEO

Additional information about the Company is available at www.canterraminerals.com

For further information, please contact: +1 (604) 687-6644

Email: [email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation, including statements with respect to estimated mineral resources, the opening of avenues for substantial discoveries within the belt, the Buchans Project being ripe for a modern approach with significant exploration potential for high-grade VMS mineralization, the Company anticipating being strongly positioned to unveil the next mineral discovery in central Newfoundland. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include risks associated with possible accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company’s exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that might interfere with the Company’s business and prospects.; as well as those risks and uncertainties identified and reported in the Company's public filings under its SEDAR+ profile at www.sedarplus.ca. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.