News Provided By – SUMMA SILVER CORP (CSE:SSVR | OTC:SSVRF | FRA:48X)

First Three Holes Drilled High-Grade Silver and Gold

at Past-Producing Belmont Mine

Summa Silver Corp. (“Summa” or the “Company”) (CSE:SSVR) (OTCQB: SSVRF) (Frankfurt:48X) is pleased to announce a high grade silver discovery from the initial results from its ongoing 7,500 m drill program at the Hughes Property in Tonopah, NV. Each of the three holes reported in this news release encountered high-grade silver and gold within vein zones over a broad area around the Belmont Mine (see attached figures). Extensions to the drilled high-grade zones remain open in multiple directions in all areas drilled.

#Key Highlights:

Rescue Veins

3,760 g/t silver equivalent (1,762 g/t Ag and 19.99 g/t Au) over 2.5 m from 347.1 m within

596 g/t silver equivalent (286 g/t Ag and 3.10 g/t Au) over 18.5 m from 347.1 m in SUM20-06

725 Veins

2,423 g/t silver equivalent (1,870 g/t Ag and 5.53 g/t Au) over 0.8 m from 215.8 m within

1,182 g/t silver equivalent (805 g/t Ag and 3.77 g/t Au) over 2.3 m from 215.8 m in SUM20-01

I.O.U. Veins

4,630 g/t silver equivalent (2,370 g/t Ag and 22.6 g/t Au) over 0.2 m from 340.4 m and

1,329 g/t silver equivalent (625 g/t Ag and 7.04 g/t Au) over 0.2 m from 369.1 m in SUM20-07

Assays Pending and Drilling Continues: Results are pending for ten additional holes. Two core rigs are fully operational on the property with follow up holes planned.

Note: AgEq based on 100 (Ag):1 (Au), True widths are estimated to be 70-80% of downhole lengths

“Summa Silver’s first drill results represent an important moment for the Company and our shareholders. We have intersected grades exceeding 2,000 g/t silver equivalent in unmined extensions of veins in the first three areas drilled. With multiple holes pending and drilling ongoing at both the Murray and Belmont targets, the entire team is looking forward to aggressively exploring the Hughes property to unlock its full potential for shareholders.”

– Galen McNamara, CEO

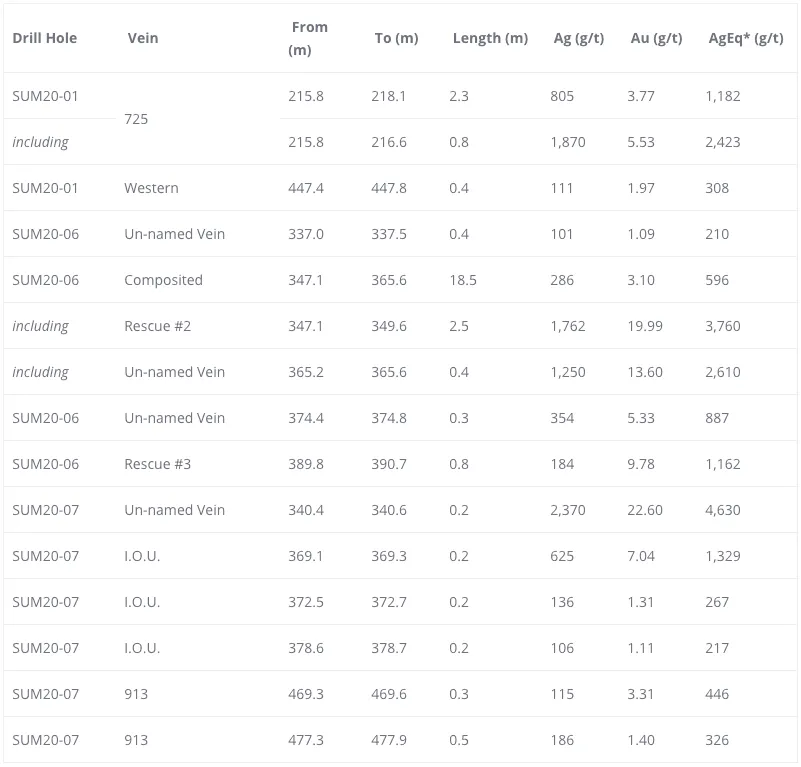

Table 1: Hughes Property Assay Results, Belmont Mine Area

-AgEq based on 100 (Ag):1 (Au), True widths are estimated to be 70-80% of drilled lengths, based on a 200 g/t AgEq cut-off grade with no minimum width, except for SUM20-06 between 347.1 and 365.6m which is based on a cut-off grade of 20 g/t AgEq and may include 3.5m of internal dilution.

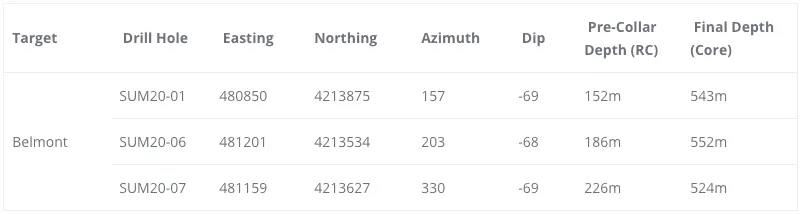

Table 2: Drillhole Information

-Coordinates in NAD27, Zone 11N

#Belmont Mine Area

Rescue Veins – Hole SUM20-06 was drilled in the footwall of the Belmont Vein to test for new zones of dilation down-dip from mapped underground workings and modeled veins. Silver and gold mineralization was intersected in unmined extensions of the Rescue #2, Rescue #3 and un-named veins.

725 Veins – Hole SUM20-01 was drilled to test both strike and dip extensions of mapped veins in the northern portion of the Belmont Mine. Silver and gold mineralization was intersected in unmined extensions of the 725 and Western veins.

I.O.U. Veins – Hole SUM20-07 was drilled to test down-dip extensions of the I.O.U. and related veins at the far northeastern end of the Belmont Mine. Two high-grade, albeit narrow zones of silver and gold mineralization were intersected in the hole, along with several zones of lower grade mineralization.

#Geology

Completed drill holes intersected a mix of porphyritic andesite, rhyolite, rhyolite fragmental, and a series of interbedded ash-flow tuffs, volcanic breccias, and tuffaceous sedimentary rocks. Fault zones, quartz veining, hydrothermal breccias, and signs of strong to intense hydrothermal alteration were intersected intermittently throughout each hole.

Silver and gold mineralization on the property is often found in zones of sulfide-bearing quartz veins, breccias, and stockworks with thicknesses varying from centimeters to greater than 10 m. Mineralized zones are typically closely associated with faults, as well as silicification and potassic alteration (adularia-sericite). Alteration zonation is present with silica/potassic alteration typically giving way to argillic alteration (white clay) and then propylitic alteration (chlorite-epidote+-pyrite) with increasing distance from the mineralized zones. Where strongest all three styles of alteration have been observed completely replacing the original host lithologies.

#Drilling Methods

Drilling is being carried out by National Drilling EWP of Elko, Nevada. Holes were drilled with a combination of reverse circulation (“RC”) and coring methods. Holes SUM20-01, -06 and -07 where pre-collared to depths between 152 m and 226 m via RC drilling and then completed to their final depths via coring. RC drilling recovers gravel sized chips of overburden and bedrock over 10-foot intervals. Core drilling recovers drill core samples of bedrock and allows for precise sampling of veins, structures, and other geological areas of interest. In general, target zones were drilled via coring and areas thought to be barren are drilled via RC. Downhole deviation surveys were completed on each hole after the completion of drilling.

#Note on Hole Sequencing

In general, holes were not completed in the same sequence as they were pre-collared. Therefore, holes with higher identification numbers were completed before holes with lower identification numbers (e.g. SUM20-06 was completed before SUM20-05). Hence in many cases, holes with higher identification numbers were analyzed first and assays from holes with lower identification numbers remain pending and will be reported as results are received and compiled.

#Analytical and QA/QC Procedures

All samples were sent to ALS Global Ltd. (“ALS”) in Reno, NV for preparation and analysis. ALS meets all requirements of International Standards ISO/IEC 17025:2005 and ISO 9001:2015 for analytical procedures. Samples were analyzed for gold via fire assay with an AA finish (“AU-AA23”), and 48 other elements, including silver, via a combination of atomic emission spectroscopy and mass spectroscopy after four-acid digestion (“ME-MS61”). Samples that assayed over 10 ppm Au via AU-AA23 were re-run via fire assay for Au with a gravimetric finish (“AU-GRA21”). Samples that assayed over 100ppm Ag via ME-MS61 were re-run via fire assay for Ag with a gravimetric finish (“AG-GRA21”). In addition to ALS quality assurance / quality control (“QA/QC”) protocols, Summa Silver implements an internal QA/QC program that includes the insertion of sample blanks, duplicates and certified reference materials at systematic and random points in the sample stream.

#Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

#EXCLUSIVE REPORT DOWNLOAD – FULLY-FUNDED FOR AN AGGRESSIVE DRILL CAMPAIGN, SUMMA SILVER CORP’S (CSE:SSVR | OTC:SSVRF | FRA:48X) HOT PURSUIT OF MAJOR SILVER DISCOVERY

About Summa Silver Corp

Summa Silver Corp is a Canadian junior mineral exploration company. The Company has options to earn 100% interests in the Hughes property located in central Nevada and the Mogollon property located in southwestern New Mexico. The Hughes property is host to the high-grade past-producing Belmont Mine, one of the most prolific silver producers in the United States between 1903 and 1929. The mine has remained inactive since commercial production ceased in 1929 due to heavily depressed metal prices and little to no modern exploration work has ever been completed.

Follow Summa Silver on Twitter: @summasilver

LinkedIn: https://www.linkedin.com/company/summa-silver-corp/

ON BEHALF OF THE BOARD OF DIRECTORS

“Galen McNamara”

Galen McNamara, Chief Executive Officer

Vancouver, BC, Canada

Galen McNamara, Chief Executive Officer

[email protected]www.summasilver.com

INVESTOR RELATIONS CONTACT:

Kin Communications

Arlen Hansen

604-684-6730

[email protected]

The CSE has neither approved nor disapproved the contents of this news release. Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note regarding forward-looking statements

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. These forward‐looking statements or information relate to, among other things: the exploration and development of the Company’s mineral exploration projects.

Forward-looking statements and information include, but are not limited to, statements in respect of the Offering including the proposed use of proceeds and receipt of regulatory and stock exchange approvals.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual actions, events or results to be materially different from those expressed or implied by such forward-looking information, including but not limited to: the requirement for regulatory approvals; enhanced uncertainty in global financial markets as a result of the current COVID-19 pandemic; unquantifiable risks related to government actions and interventions; stock market volatility; regulatory restrictions; and other related risks and uncertainties.

Forward-looking information are based on management of the parties’ reasonable assumptions, estimates, expectations, analyses and opinions, which are based on such management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect.

The Company undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.