Amazon (NASDAQ: AMZN) reports its FY21 Q3 Earnings on 28 October. After a better than expected Q1, sales growth slowed in Q2. So, what can investor’s expect as the year rolls on?

General chatter towards its upcoming Q3 results is once again mixed. Amazon is never short of news coverage, and this is currently swinging from concerns its executives misled Congress to its ability to hire en masse as Christmas approaches.

#What are analysts predicting?

Amazon is experiencing ongoing issues with its supply chain. This includes delays due to a lack of drivers and shipping containers stuck in ports. Furthermore, the company is likely to have endured heightened operational costs as a surge in electricity and fuel costs plague the globe.

While its intention to hire 150k seasonal workers is welcomed, Amazon has been under mounting pressure to improve working conditions and hike wages. Indeed, it is offering sign-up bonuses in busy areas to help attract staff.

These rising costs are likely to affect its bottom line. Thus analysts are increasingly bearish on Q3 earnings results.

Several recent broker estimates have reduced their targets. But the long-term consensus on AMZN stock still remains a buy, with a target price higher than it is today.

#Q3 Predictions

Amazon included some earnings guidance for Q3 in its Q2 report. This included wage pressure remaining and difficult year-over-year comparisons to periods of exceptionally high growth.

Net sales guidance for Q3: between $106 billion and $112 billion (10% to 16% growth year-over-year). This guidance anticipates a favorable impact of approximately 70 basis points from foreign exchange rates.

Operating income guidance for Q3: between $2.5 billion and $6 billion ($6.2 billion Q3 2020). This guidance assumes approximately $1 billion of costs related to COVID-19.

Amazon also made clear its guidance could be adversely affected by fluctuations in any of the following: foreign exchange rates, changes in global economic conditions and customer spending, world events, the rate of growth of the Internet, online commerce and cloud services, and the various factors detailed in its regular filings with the SEC.

Amazon owns physical fulfillment centers and assets such as delivery trucks, drones, and stores, meaning it operates a cost-intensive business. Indeed, capital expenditure of property and equipment rose considerably in 2020 to $40.1 billion, versus $16.9 billion in 2019.

Nevertheless, sales were also up considerably, going from $280.5 billion in 2019 to $386 billion in 2020.

Most of Amazon’s 2021 budget on building openings is planned for the second half of this year. Therefore these costs will be evident in Q3 earnings. This is part of a multi-year investment.

#What can investors expect?

There are rumors Amazon is struggling to deliver packages as efficiently as consumers are used to, thanks to supply chain problems. Plus, semiconductor shortages may affect Amazon’s seasonal sales in consumer discretionary tech items.

While Amazon is trying to avoid disgruntled consumers, dealing with late deliveries will not necessarily lead to Prime-subscription churn. Canceling a Prime membership means giving up Prime video, music, photo storage and kindle unlimited as well as next-day deliveries. Therefore, it would take more than a few late deliveries for most members to cancel.

There are clear signs inflation isn’t transitory, and it is making investors nervous. Inflation will increase the cost of conducting business, which may hurt Amazon’s share price.

#Will Amazon’s Q3 earnings results spell a good investment opportunity?

It’s only natural that Amazon should have a period of downturn after such an exceptional 2020. But long-term investors don’t concern themselves with the intermittent fluctuations of the market.

Amazon’s Q3 earnings results will only be an issue if they spell long-term doom for the company. Going by its previous success and some of its ongoing projects that seems unlikely.

Amazon’s revenue streams include online stores, physical stores, third-party seller services, subscription services, and Amazon Web Services (AWS). The company has mastered an incredible balance in its ability to target both consumers and enterprise customers.

Like its Big Tech peers, Amazon’s free cash flow is enormous, and the potential for this to keep growing is real. Having a mountain of cash on hand should help see it through challenging periods with relative ease.

Does Amazon pay a dividend?

Amazon doesn’t offer dividends to cushion the fall in a downturn. Therefore, long-term shareholders are banking on future growth. Going by Amazon’s track record and prominence in society, it’s easy to believe future growth will continue.

Companies often bring in dividends once they believe peak growth has been achieved. So, Amazon dividends could be a future perk some shareholders are holding out for.

#Shareholder risks

Inflation is a growing concern, and like its peers, Amazon is facing antitrust lawsuits.

Like all US tech stocks, some consider Amazon overvalued. Therefore, if the market experiences a significant correction or crash, it could take a long time to retrace previous highs.

#Antitrust investigation

A 16-month antitrust investigation into Amazon and its peers Apple (NASDAQ: AAPL), Facebook (NASDAQ: FB) and Google (Alphabet (NASDAQ: GOOGL)) recently concluded they are anti-competitive. However, there’s now disagreement in Congress as to how Big Tech should be handled. Some believe new laws should be created, while others think regulatory agencies and government departments should be funded to deal with Big Tech under existing laws.

Amazon amasses nearly 40% of all US e-commerce sales. The antitrust report states it unfairly uses its third-party sellers to hijack their successful business practices for its own financial gain. It can also up its fees on a whim due to its overreaching dominance.

From a shareholder perspective, Amazon is still increasing revenues and growing its market share. However, a crackdown could thwart this and damage its share price potential down the line.

#Bezos criminal probe

Amazon is now facing a further investigation into whether its top executives, including founder Jeff Bezos, misled Congress. The company has a short time to provide “exculpatory evidence,” proving that it does not use seller data to copy popular third-party products and manipulate marketplace search.

#Amazon share price overview

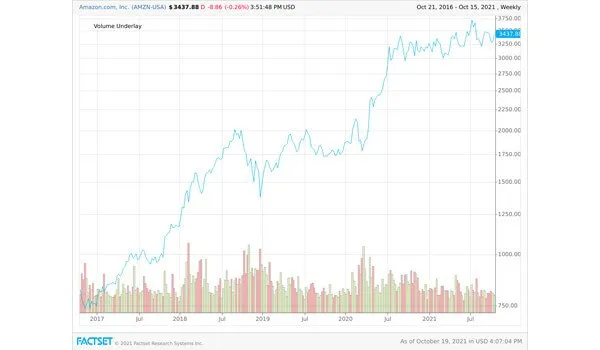

The AMZN share price has risen over 320% in the past five years. It is up 7% in the past year and down 3% in the past three months.

According to FactSet data, the 12-month average share price target is $4,153. This gives a 20% upside from here. The majority of brokers mark AMZN stock as a Buy or Strong Buy.

Many analysts see considerable growth potential ahead from Amazon’s cloud division, AWS. Nevertheless, it does have competition from Microsoft Azure, Google Cloud, IBM Cloud, Oracle, Alibaba, and several more. Plus, some contrarians think the growing interest in public blockchain and the so-called rise of ‘Web 3.0’ may suppress demand for cloud computing.

A dip in the Amazon share price is normal, and investors will only be concerned if the previous highs cannot once again be achieved in the future.