After much hype and excitement, Cathie Wood’s ARK Space Exploration & Innovation exchange-traded fund (ETF) (ARKX) launched last week. It raised a spectacular $281 million on day one, and more than a week later the fund is still attracting significant sums. In fact, within its first five days it had achieved $536 million. That well and truly thrashes the industry average of $100 million in three years.

#Embarking on a space revolution

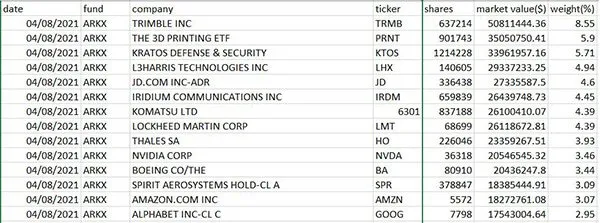

But it’s not just the fund’s popularity that’s got investors talking. It’s the unexpected mix of holdings. While analysts speculated on obvious additions such as Boeing (NYSE:BA), Lockheed Martin (NYSE:LMT), Virgin Galactic (NYSE: SPCE), and several space tipped SPAC offerings, few predicted the final line-up.

The buzz and excitement soon dissipated into ridicule and memes as the holdings were revealed. John Deere (NYSE: DE) and Netflix (NASDAQ: NFLX) in particular raised eyebrows. But it’s all light-hearted fun, and Wood is laughing all the way to the bank.

— John Deere (@JohnDeere) March 30, 2021

John Deere in Space ETF ARK Invest

#Benefits of space exploration

The benefits of space exploration include improving our scientific knowledge of the universe, as well as improving our connectivity. When astronauts arrive in space, they often carry out experiments to help better understand life on earth. This can include our health, our climate and measuring pollution. Many companies are now working in this sector, and investors are keen to get involved.

The main pure-space competitor to ARKX is another existing Space ETF called the Procure ETF (UFO). It doesn’t have the same prestige as ARK Invest, but it’s still benefiting from the media interest that ARK is generating. Besides, there are other Aerospace & Defense ETFs on the US markets. The largest is the iShares U.S. Aerospace & Defense ETF with around $3 billion in assets.

#Smoke and mirrors

Could it be that this fund was launched quickly to boost ARK’s inflow, as its other holdings were beginning to lose their lustre? After a depressing first quarter, the buzz around the Space ETF is hugely exciting for ARK shareholders. So, some speculate this is simply a marketing tactic to take advantage of the growing interest in the new frontier.

While Cathie Wood appears to have the Midas Touch, how long can it last? Her other funds took a lot longer to reach $1 billion in inflow.

Jim Cramer on Mad Money stated:

“One look at the newly launched ARK Space Exploration ETF tells you everything you need to know about how managers can’t resist creating new funds, even if there’s no reason for them to exist,”

#ARKX holdings are a mixed bag

The ETF’s largest weighting at 8% is Trimble (NASDAQ: TRMB). This NASDAQ-listed tech stock is a hardware, software, and services company. Its clients cover a range of sectors including Agriculture, Building & Construction, Geospatial, Natural Resources and Utilities, Governments, Transportation and more.

The second biggest weighting is ARK’s own 3D Printing ETF (PRNT). The reason for this one is rocket parts are sometimes 3D printed to save money, keep them lightweight and durable. It’s not as strange as it might at first seem, because placing ETFs within ETFs is fairly common practice among fund managers.

Shareholders were concerned they’d be paying fees twice for the same product, but ARK will be returning the 0.66% management fee of the ARK 3D Printing ETF back to ARKX investors.

#Are these really space stocks?

Many companies benefit from aerospace activities (satellites provide images). And that’s ARK’s reason for including Deere. But with this argument anything that depends on navigation and GPS, could potentially be added to the fund.

Alphabet (NASDAQ: GOOGL) is an artificial intelligence (AI) leader and NVIDIA (NASDAQ: NVDA) manufactures the microchips needed in rockets. So these big tech plays also appear in the fund. As do Amazon (NASDAQ:AMZN), JD.com (NASDAQ:JD) and Alibaba (NYSE:BABA) because they use drones.

Netflix (NASDAQ:NFLX) is another random inclusion generating backlash. But the reason ARK gives for including Netflix in its Space ETF is that if Elon Musk’s Starlink and other satellite broadband enablers make progress, then Netflix stands to benefit. There are currently 42 million Americans without access to broadband and 3 billion people globally. That’s a lot of potential Netflix customers.

Starlink and Space X are two companies shareholders would love to see in the Space ETF but until they are publicly listed they can’t be included.

The ETF breaks down into the following tech spaces, 6% suborbital aerospace, 40% aerospace beneficiaries, 25% enabling technology and 29% orbital aerospace. The aerospace beneficiaries are the ones raising eyebrows.

#What next?

ARK rebalances its holdings daily, so it’s normal for the weightings to change. By April 7 it was selling shares in Deere and Teradyne to make way for shares in Atlas Crest Investment Corp (NYSE: ACIC), Jaws Spitfire Acquisition Corp (NYSE: SPFR), Iridium Communications (NASDAQ: IRDM) and Reinvent Technology Partners (NYSE: RTP).

Some of the undeniably authentic space stocks that were tipped to appear but don’t, include Astra and Rocket Lab USA. These are launch service companies already sending commercial payloads into low Earth orbit. Their SPAC targets that have not yet merged, so perhaps when the time comes, they’ll be added. We could say the same for earth imaging businesses BlackSky and Spire Global. If ARK wanted to add them before acquisition, then it would take a risk on the merger going through.

The fund has 40 holdings and Virgin Galactic only accounts for 1.8% of its weighting. When news of the ARKX ETF began circulating in January, Virgin Galactic’s stock price soared above $46. Now it’s around $29.So how much exposure do ARKX holders actually have to the space sector? It’s debatable, but one notable difference is the higher number of profitable companies in this ETF, compared with ARKs other offerings. It also contains less overvalued stocks.

Receiving such a massive amount of money from the outset could flood the limited number of pure space plays and make them overvalued. So that could be another reason for the random appearance of the initial holdings. Perhaps it will be rebalanced as time goes on.

Cathie Wood has proven her doubters wrong on several occasions. And if ARK continues to buy new space plays as the launch via SPAC or IPO, then it may well pay off in the long run.