In today's world, demand for copper and other minerals is accelerating. The global surge in electric vehicle production and renewable energy systems has created an enormous demand for copper, while many other industries require a constant supply of other essential minerals. Major mining companies have stepped up their efforts to increase production and expansion in response to this demand. This article will look at some companies involved: Southern Copper Corporation (NYSE: SCCO), Capstone Copper Corp (OTCMKTS: CSCCF), and Kavango Resources (OTC: KVGOF) (LON: KAV).

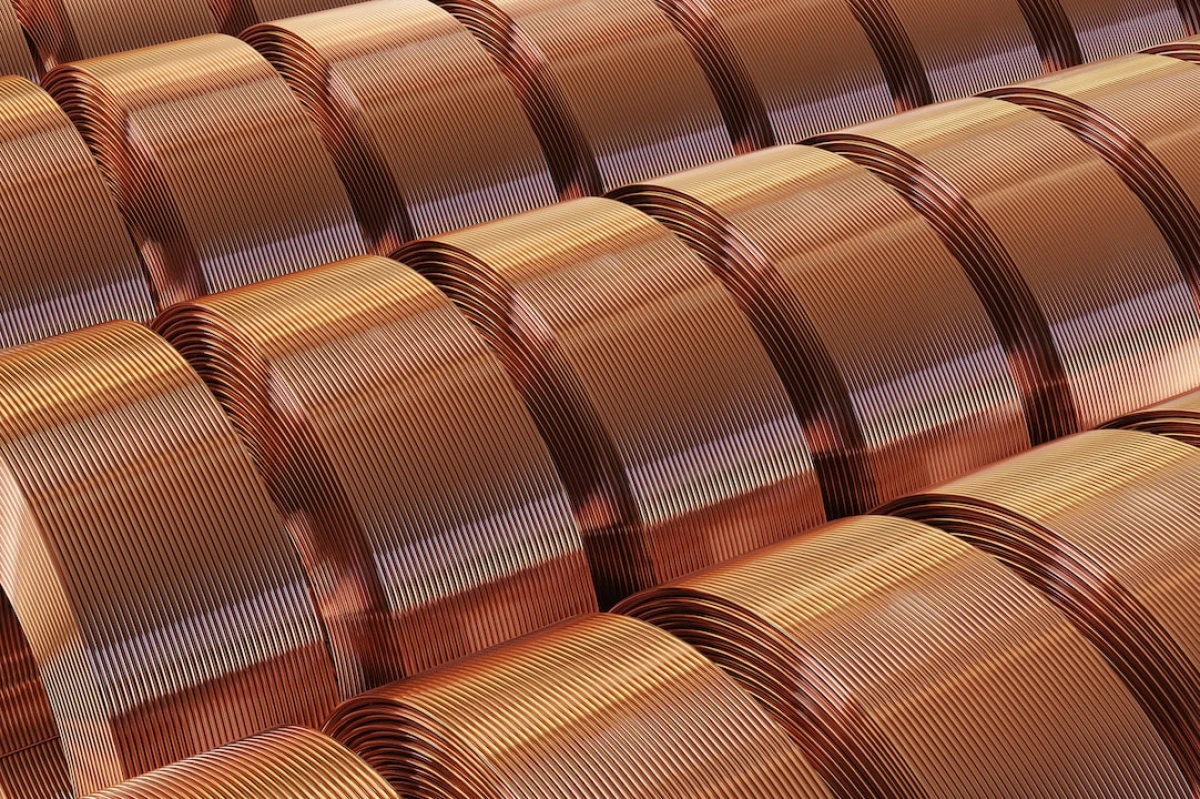

Copper, an ancient metal, now stands at the heart of the modern world's efforts toward sustainability and technological innovation. Its excellent conductivity, durability, corrosion resistance, and unique antimicrobial properties render copper indispensable in various industries, from infrastructure and construction to electronics and healthcare. Acknowledging this potential, companies like Southern Copper and Capstone Copper Corp are significantly investing in expanding their foothold in emerging markets. This strategic move is poised to not only maximize their profit margins but also contribute to global efforts in achieving a sustainable, copper-dependent future.

#Southern Copper: Expanding with High-Quality Reserves

Southern Copper Corporation (NYSE: SCCO) has established an ambitious capital investment program exceeding $15 billion this decade. The company boasts significant high-quality copper reserves that provide a robust foundation for long-term production capacity and growth.

The company has invested in various projects across Mexico and Peru. These projects encompass a range of operations, such as new concentrators, open-pit mines, and copper cathode production, with impressive annual production capacities.

Aside from reserves, the company is aggressively expanding with ongoing projects aimed at increasing production capacity and the final product's quality. For instance, the Buenavista project in Mexico is expected to double zinc production. Furthermore, the El Arco and Los Chancas projects in Mexico and Peru will significantly bolster the company's copper and other minerals production.

The financial health of Southern Copper is also promising. Southern Copper Corp saw its expenses rise in Q1 2023 due to various factors but still saw a 4% increase in net income.

Southern Copper Corp. is also dedicated to enhancing its ESG report and has formed a Sustainable Development Committee. The company's unit in Ilo, Peru, achieved recognition for its outstanding performance in the Smelter and Refinery category of the National Competition for Mining Safety. Moreover, Southern Copper Corp. actively contributes to environmental preservation, including efforts to protect the Mexican grey wolf from extinction.

#Capstone Copper Corp: A Growing Force

Capstone Copper Corp’s (OTC: CSCCF) (TSX: CS) financial performance has also been robust, with growing revenues, healthy profit margins, and consistent cash flow generation. The company's production of copper has soared since the addition of Mantos Blancos and Mantoverde production from Chile following the merger with Mantos Copper in 2022.

This combined business is focusing heavily on expansion. Capstone Copper Corp is seeing significant progress in its Mantoverde Development Project (MVDP), which is currently on track and within budget. The completion of MVDP construction, expected in Q4, is anticipated to double the company's consolidated cash flow and lay a solid foundation for future growth.

In terms of labor relations, Capstone Copper Corp has successfully reached new collective agreements with the labor unions providing stability for the next three years across the company's operations.

Looking ahead, Capstone Copper Corp expects a sequential increase in production accompanied by decreasing costs. The company envisions substantial growth in copper production, reaching approximately 260,000 tonnes after the MVDP ramp-up, with further expansion opportunities through the Santo Domingo project and potential district consolidation.

With significant catalysts planned over the next two years, including studies on increasing throughput at MVDP and Mantos Blancos, as well as an updated feasibility study for the Santo Domingo project, Capstone Copper Corp is determined to execute its growth plans.

#Kavango Resources

OTC and London-listed Kavango Resources (OTC: KVGOF) (LON: KAV) specializes in uncovering world-class base and precious metal deposits. The company's operations are based in Botswana, a country that has established its place as the 11th most attractive investment destination globally according to the 2020 Fraser Institute annual mining survey.

Kavango's portfolio is diversified and includes three ambitious projects. The Kalahari Suture Zone Project (KSZ) explores an under-investigated structural zone with similarities to the massive Norilsk deposits in Russia, that is rich in Nickel (Ni), Copper (Cu), and Platinum Group Elements (PGE). Notably, academic reviews affirm that the KSZ meets many criteria for Ni-Cu-PGE Sulphide Deposits' formation.

The Kalahari Copper Belt Project (KCB) is equally impressive, where Kavango boasts one of the most extensive prospecting license holdings within the burgeoning Kalahari Copper Belt.

Finally, the Ditau Camp Project (DITAU) underscores Kavango's commitment to innovation and diversity. This project is located in an area known for carbonatites, a primary source for several critical metals including rare-earth elements, niobium-tantalum, thorium, uranium, vanadium, and copper.

Meanwhile, Botswana is seeing rising investor interest as the country is carving out a global position in the technology sector.

Kavango Resources, with its strategic focus and diversified portfolio, presents an exciting investment opportunity in an emerging market.

While each of these companies presents different strengths, they all have one thing in common: they are positioned to take advantage of the booming demand for copper and other minerals. Southern Copper Corporation, with its high-quality reserves and ambitious expansion projects, is set for long-term growth. Capstone Copper Corp's strong financials, increased copper production, and ambitious expansion plans make it a force to be reckoned with in the copper market. And Kavango Resources, situated in up-and-coming Botswana presents a compelling small-cap.