The Consumer Staples (Consumer Defensives) sector is comprised of companies which provide the goods that consumers use day-to-day. The toothpaste on your brush, the shirt on your back, the peanut butter on your bread. All of these goods are consumer staples.

As a sector, it can be resilient to the kind of market volatility which might trouble others. This is because the demand for these goods is steady throughout the year and throughout dips in economic prosperity. Most people do not need to stop purchasing key everyday items like soap if money is a bit tight.

The trade-off for this resilience is generally slower and steadier returns. In other words, the sector outperforms in times of recession but can seem flat-footed in more affluent times.

Key industry players in the US Consumer Staples sector include:

Costco (NASDAQ: COST)

PepsiCo (NASDAQ: PEP)

Altria (NYSE: MO)

Colgate-Palmolive (NYSE: CL)

Coca-Cola Company (NYSE: KO)

Procter & Gamble Co (NYSE: PG)

#Q4 Consumer Staples momentum stocks

Momentum refers to the speed or rate of change in stock price. Healthy price trends tend to exhibit strong momentum, and price weakens when momentum subsides. The following stocks have been enjoying a rise in momentum in recent weeks. Can their streak continue through Q4?

SpartanNash Co. engages in the distribution of grocery products through the Military, Food Distribution, and Retail segments. SPTN stock has strong business fundamentals, a 3.5% dividend yield, and the potential for further growth.

United Natural Foods, Inc. engages in the distribution of natural, organic, and specialty foods and non-food products. Q4 earnings came in better than expected sending the stock price soaring.

National Beverage Corp., through its subsidiaries, develops, produces, markets, and sells a portfolio of sparkling waters, juices, energy drinks, and carbonated soft drinks primarily in the United States and Canada. The company’s Q1 earnings beat analyst expectations boosting the FIZZ share price.

#Q4 Consumer Staples growth stocks

Growth in sales and/or earnings per share indicates a business that is growing. Growth stocks can make very lucrative investments when the share price rises in time with the business expansion. But growth stocks are also risky as investment analysis is based on future price action rather than historical price performance. Famous growth investors include Philip Fisher, T. Rowe Price, and Jim Slater.

Seneca Foods Corp. engages in the processing and sale of packaged fruits and vegetables. SENEA stock has a low Price/Book value of 0.8x and noticeable growth in earnings per share.

Darling Ingredients Inc. develops, produces, and sells natural ingredients from edible and inedible bio-nutrients. Analyst estimates indicate a bullish stance on DAR stock. Darling Ingredients is popular with ESG enthusiasts and can be considered an inflation hedge.

FitLife Brands, Inc. provides nutritional supplements for health-conscious consumers in the United States and internationally. The company has little debt and a low P/E ratio. FitLife Brands is a micro-cap stock and, therefore, a highly speculative investment.

#Q4 Consumer Staples value stocks

Value investing is a very popular type of stock market investing advocated by Billionaire investor Warren Buffett. When growth stocks are in favor, value stocks tend to be less popular and vice versa. Value stocks should be trading for less than their intrinsic or book value.

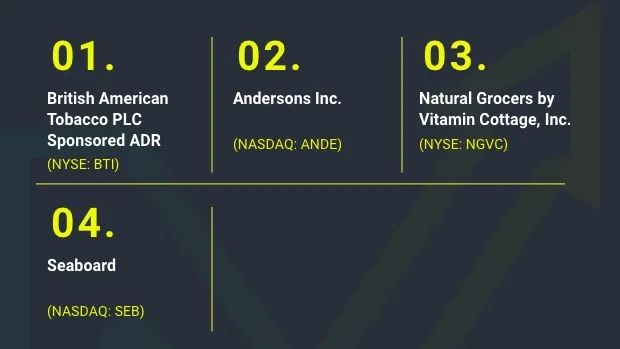

British American Tobacco plc is a holding company, which engages in the manufacture and distribution of tobacco products. Being a sin stock, BTI does not appeal to everyone. Nevertheless, it's a long-established business with a sticky customer base, well-loved brands, and a generous 8% dividend yield.

The Andersons, Inc., an agriculture company, operates in trade, ethanol, plant nutrient, and rail sectors in the United States and internationally. Andersons recently acquired Capstone Commodities for an undisclosed sum. This is a speculative investment.

Natural Grocers by Vitamin Cottage, Inc. engages in retailing natural and organic groceries and dietary supplements. According to FactSet, Natural Grocers by Vitamin Cottage scores very well in its ESG Rank.

Seaboard Corporation operates as an agribusiness and transportation company worldwide. It operates through six segments: Pork, Commodity Trading and Milling (CT&M), Marine, Sugar and Alcohol, Power, and Turkey. Its price-to-earnings, price-to-sales, and price-to-book values are low.