Kavango Resources’ (LSE:KAV)

The latest expert analysis of exploration data has confirmed potential for a massive, transformational nickel and copper discovery at AIM-listed Kavango Resources’ (LSE:KAV) vast Kalahari Suture Zone project in Botswana.

This could be the motherlode for the small London-listed explorer.

CEO Michael Foster said the review ”provides further strong evidence that Kavango is on target for a major base metal discovery.”

Now Kavango will confirm its highest-priority targets for the next phase of field exploration, with ground-based EM surveys starting before the end of the year. Drill target selection and the first drill programme is scheduled for early 2021.

This new intelligence on the highly prospective Kalahari Suture Zone lit a fire under the company’s share price on Friday. The stock surged 16.45% on the news. But insiders believe the impact of the dramatic data has yet to be fully felt.

3D modelling results released in September confirmed “significant similarities” between the northern section of the KSZ and the gigantic Norilsk mining centre in Siberia.

The Karoo-age gabbro horizontal sills and vertical dykes here bear a remarkable resemblance to those containing large, rich deposits of copper, nickel and Platinum Group Metals (PGMs) under Norilsk. And because they lie just 400m under the surface, it makes them extremely promising exploration targets.

Norilsk, by the way, is one of the world’s most profitable mines. It produces 55% of Russia’s supply of copper, 90% of its nickel and virtually all of its PGMs.

Now this new data further supports the conclusion that Kavango has a Norilsk-style resource on its hands.

Kavango has confirmed conditions were right about 180 million ago in the Kalahari Suture Zone to create highly concentrated pools of super valuable and sought-after base metals, such as nickel and copper.

It’s hard to overestimate what this could do to a £6m market cap company. Some commentators are calling this the best opportunity on AIM today.

Kavango’s supporters see a nearly 400% rise in market cap since May as just the beginning of a long upward trend, with material upside in play here.

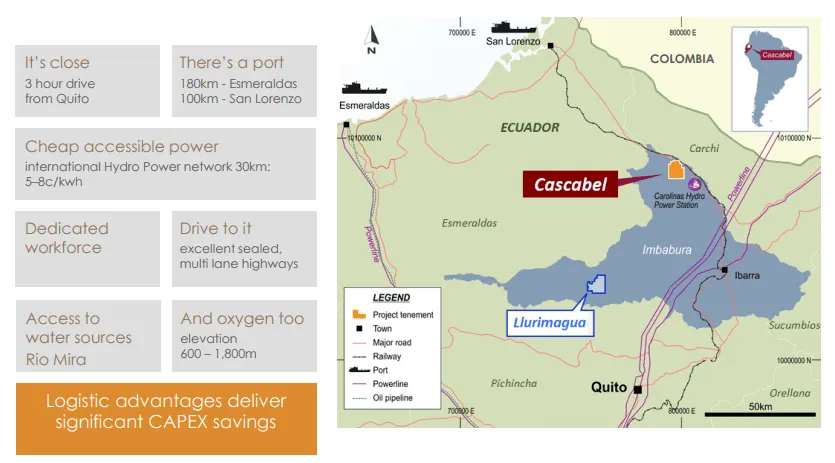

With this confirmed data in hand Kavango can move to exploit this virgin territory, 12 licences stretching nearly 7,000km2 across the southwest of mining-friendly Botswana.

Under the Kalahari sands lie vast rock formation (see image, marked in red) where huge pools of molten metal could have been trapped over time.

This is a territory that has never been explored. Results from Kavango’s three years of field work and laboratory testing have consistently pointed to a Norilsk-size Nickel project. Now the company has the analysis that seems to conclude it.

Massive sulphides

Kavango’s geoscientists have long tipped the Kalahari Suture Zone as home to massive metal sulphide deposits within the earth’s crust. But no mining company has ever moved to exploit these pools, lacking the information needed to target drill zones. Kavango has gathered more exploration evidence on the KSZ than any other company.

The company’s analysis of the northern section of the KSZ, called Hukuntsi, has so far revealed the potential for substantial mineral deposits.

Dr David Holwell, an internationally recognised expert at the University of Leicester, performed a mineralogical study and lab examination of rock samples taken from Kavango’s November 2019 drill campaign at Hukuntsi, through his company D&D Geoconsultants.

This new review confirms strong evidence of magmatic sulphides in the 50-metre thick gabbro sills.

But more importantly — and this is the kicker — Dr Holwell found evidence of sulphur saturation alongside the presence of cumulate rocks. These are the exact formations that produce vast pools of metal sulphides that come together as massive sulphides in trap zones underground.

As a leading expert on how sulphide deposits come together in magmatic plumbing systems, Dr Holwell was able to confirm that there could be sufficient quantities of massive sulphides to form mineable mineral deposits.

Over thousands of years during the Karoo Age (about 180 million years ago), millions of cubic feet of magma flowed over coal shale rock to form nickel and copper metal sulphides.

This the company already knew. What it didn’t have before today is hard evidence of how magma could have pooled together to create vast accumulations of massive sulphides. Knowing this would create the possibility to home in on drill targets for the largest of these potential deposits.

Confirmation from Dr Holwell that cumulate rocks were present in the system has provided Kavango one of the last pieces in this complex jigsaw. These kinds of formations form a permeable, web-like lattice that allowed liquid metal sulphides to sink through as the magma cooled.

And a reminder: these metal sulphides could well contain huge amounts of copper-nickel-PGMs. This is what Kavango is now hunting.

It’s the culmination of years of work. It’s the reason why AIM-listed fellow explorers Power Metal Resources (LSE:POW) formed a JV with Kavango in Botswana. Everybody wants a piece of this. It’s the kind of fortune-making find that will could down in history.