Aluminum is used in everything from cans to beer kegs, consumer electronics, window frames and airplane parts. It's also hugely important to the auto industry. An average car uses around 180kg of aluminum. Thanks to its lightweight form, it's increasingly popular in electric vehicles, environmentally friendly buildings and power lines.

However, aluminum production is a ridiculously carbon-intensive industry as high levels of electricity are needed in smelting. Plus, much of the world's smelters are still coal-fired. Europe and South America are the greenest to date, and China is reducing its production by importing the metal instead.

The price of aluminum has risen around 25% year-to-date. In fact, the official Aluminum Cash price on the London Metals Exchange (LME) is considerably higher than recent analyst estimates.

It's not just demand from green initiatives sending the aluminum price sky-high. Industrial uses for the commodity are countless, and its soaring cost will have a knock-on effect on many markets.

In recent news, Australia banning the export of aluminum ores to Russia sent the spot price of aluminum soaring. It rose 4.8% on the LME and similar in Shanghai. This move is in retaliation to the Russian invasion of Ukraine. Of course, geopolitical uncertainties and supply chain disruption also contribute to volatility in commodity pricing.

If you're considering investing in aluminum companies, here is a selection of publicly-listed stocks.

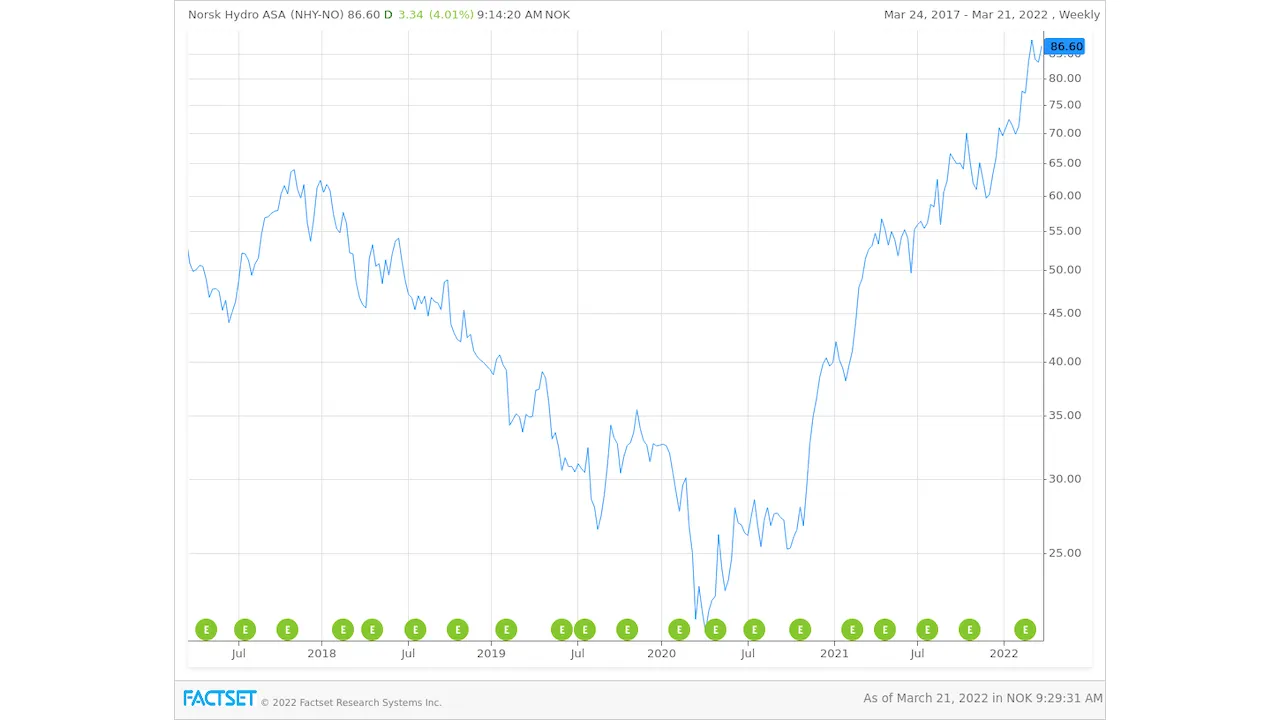

#Norsk Hydro (OTCMKTS: NHYDY, OTCMKTS: NHYKF, NOK: NHY)

Norsk Hydro ASA deals in aluminum. It produces and supplies alumina and primary aluminum. Norsk Hydro serves the building and construction, transportation, and engineered products industries. It also has an energy division managing captive hydropower production external power sourcing arrangements to the aluminum business.

Norsk Hydro is a winner when it comes to decarbonization. The company produces most of its aluminum from hydropower. This gives it a carbon footprint around 80% lower than coal-based producers, commonly found in China.

The NHYDY stock price is up 56% in the past year. According to FactSet, the consensus rating is Overweight with a share price target of $9.96.

#Alcoa Corp (NYSE: AA)

Alcoa Corp (NYSE: AA) is the world's sixth-largest aluminum producer. The company has global bauxite mining operations. It has a refining segment that processes bauxite into alumina, and it operates a smelting and casting division to molten aluminum into ingot products.

Last year Alcoa was 81% powered by renewables, according to Edison research.

Alcoa was founded in 1886 and is headquartered in Pittsburgh, PA.

#Arconic Corp (NYSE: ARNC)

Arconic Corp (NYSE: ARNC), Alcoa Corp, and Howmet Aerospace were once a single entity. In 2016, Alcoa was spun off, followed by Arconic in 2020. The remaining company became Howmet Aerospace which now operates independently. Meanwhile, Arconic specializes in lightweight metal engineering and manufacturing focusing on rolled aluminum products for industrial, transportation, aerospace, packaging and construction industries.

Arconic has paused its contracts in Russia but continues to conduct business related to fulfilling existing obligations in the country. Arconic has a facility in Samara, Russia, that produces sheets, plates, extrusions and forgings.

ARNC stock is down 24% year-to-date.

#Century Aluminum Co (NASDAQ: CENX)

Century Aluminum Co (NASDAQ: CENX) is a $2bn US-based producer of primary aluminum, with aluminum plants in Kentucky, South Carolina and Iceland. It operates three smelters in the US and one in Iceland.

The mining industry is heavily criticized for its emissions, and Century Aluminum is working to combat this. It is working with an Icelandic wind farm to capture carbon dioxide for use at a hydrogen plant and hopes to drastically reduce its carbon footprint using wind power.

However, Century's Kentucky smelters still generate around 70% of their electricity from coal.

CENX stock is up over 65% year-to-date.

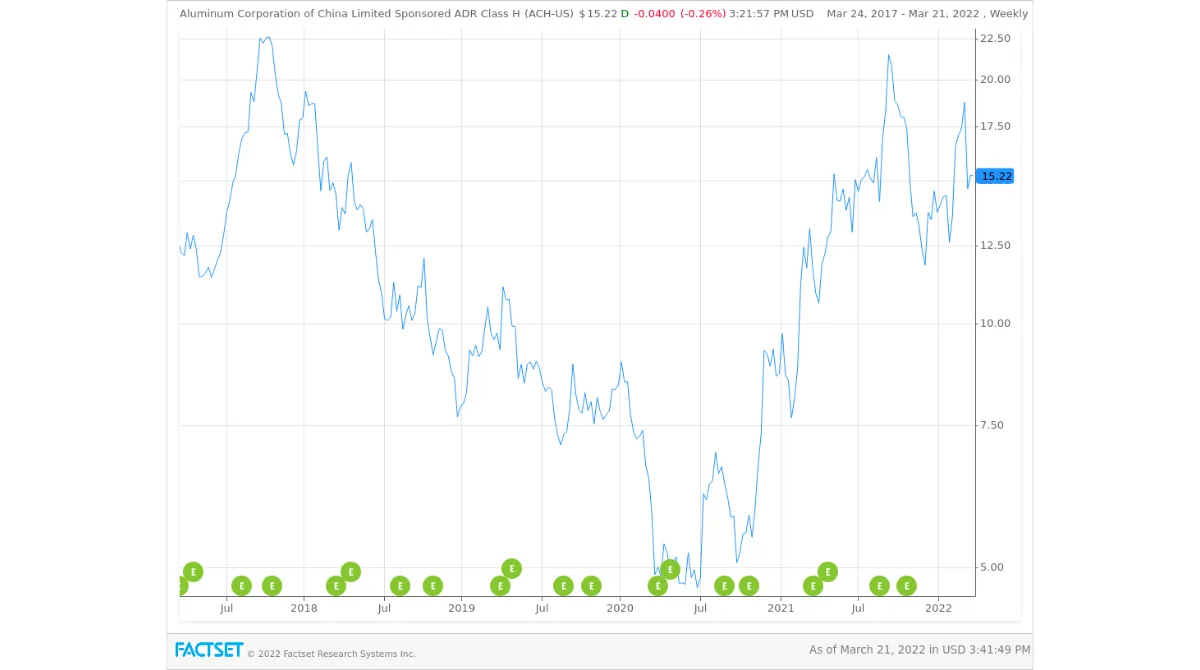

#Aluminum Corp of China Ltd (NYSE: ACH)

Aluminum Corp of China Ltd (NYSE: ACH) is listed in Hong Kong and New York. It is the world's second-largest alumina producer and third-largest primary aluminum producer.

China used to be a net exporter of aluminum, but this changed a few years ago when the price was low. China saw this as an opportunity to boost its stockpiles, and it became a net importer. The main goal was to reduce its emissions from coal. As the price rises, this may not be so appealing.

ACH stock is up 8% year-to-date.

#Rio Tinto (NYSE: RIO)

Rio Tinto (NYSE: RIO) is a significant exploration and mining company focused on extracting iron ore, aluminum, copper, diamonds, energy and other minerals. The aluminum segment produces bauxite, alumina and primary aluminum.

Rio Tinto was founded in 1873 and is headquartered in London, the United Kingdom.

RIO stock is up nearly 16% year-to-date.

#South32 Ltd (ASX: S32)

South32 Ltd (ASX: S32) is an Australian metal and mining company. Its business operations focus on aluminum and coal in several global jurisdictions.

This includes a bauxite mine and alumina refineries in Western Australia and Brazil. South32 also operates aluminum smelters in South Africa and Mozambique.

The company was founded in May 2015 and is headquartered in Perth, Australia.

S32 stock is up close to 20% year-to-date.

#Vedanta Ltd (NSE: VEDL)

Vedanta Ltd (NSE: VEDL) is a diversified natural resource company. Its segments include copper, aluminum, iron ore, power, and oil & gas. The aluminum segment comprises a refinery and a captive power plant at Lanjigarh and a smelter, a thermal coal-based captive power facility at Jharsuguda, both situated in Odisha in India.

The company was founded in 1965 and is headquartered in Mumbai, India.

VEDL stock is up 12% year-to-date.

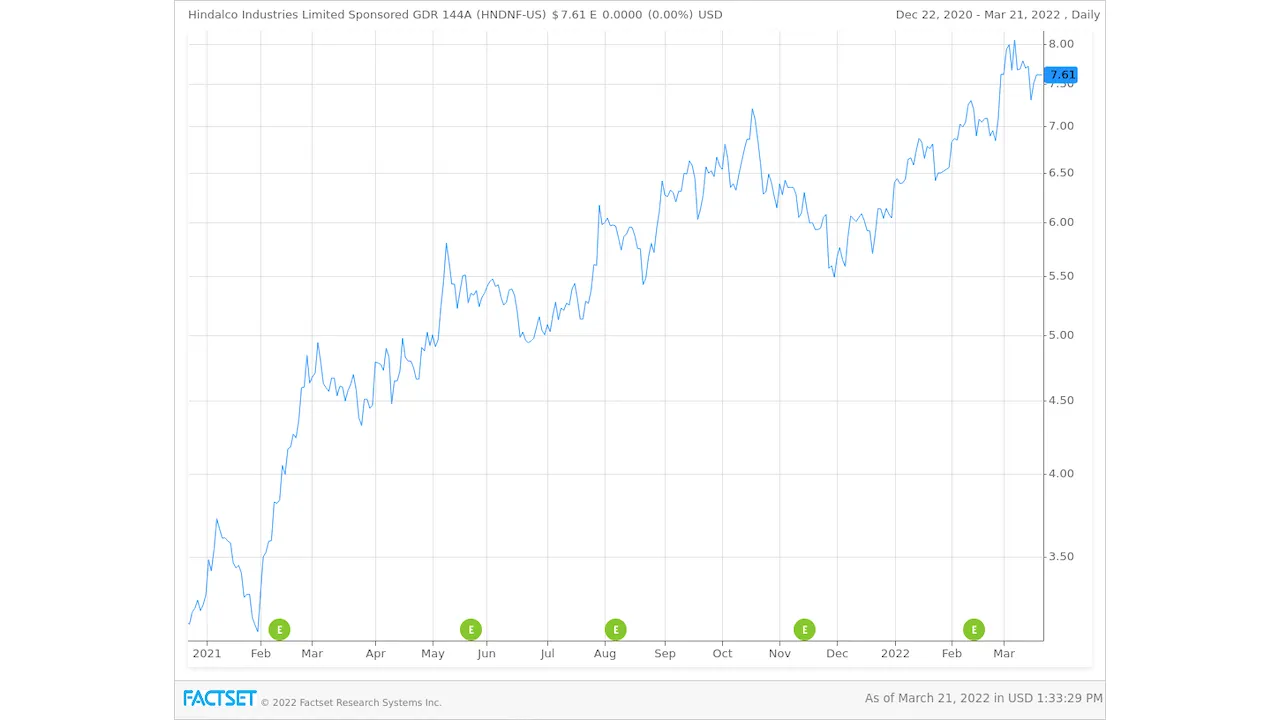

#Hindalco Industries Limited (OTCMKTS: HNDNF, NSE: HINDALCO)

Hindalco Industries Limited (NSE: HINDALCO) is an Indian aluminum and copper manufacturing company. Its Novelis segment is engaged in producing and selling aluminum sheet and light gauge products.

The company was founded in 1958 and is headquartered in Mumbai, India.

#Is there an Aluminum ETF?

Exchange-traded funds (ETFs) are often deemed a safer way of investing in a sector than investing directly in individual stocks. That's because when you invest in an ETF, you buy shares in a basket of stocks related to that sector or index being tracked.

There are a few ways to invest in aluminum via ETF.

iShares US Basic Materials ETF (NYSEARCA: IYM)

The iShares US Basic Materials ETF (NYSEARCA: IYM) includes various raw materials producers including gold, chemicals and more. As far as aluminum goes, this fund includes Alcoa and Reliance Steel & Aluminum Co (NYSE: RS).

Barclays iPath Bloomberg Aluminum Subindex ETN (NYSEARCA: JJU)

ETNs are riskier than ordinary unsecured debt securities and have no principal protection. Therefore it differs from an ETF, but Barclays iPath Bloomberg Aluminum Subindex ETN (NYSEARCA: JJU) specializes in aluminum specifically.

#Risks to Investing in Aluminum

With the price of aluminum soaring, it can be tempting to buy shares in the miners of this useful metal. However, as with any stock, there are risks to consider. Some believe the aluminum rally is already overbought and therefore ready for a fall, but some of these stocks have already endured a pullback.

War creates uncertainty, and price hikes inevitably follow when there is supply tightness.

China could reduce its reliance on imports and revert back to producing its own supplies. But to meet its ambitious emissions targets, analysts believe it will continue to import.

Mining companies are a naturally risky investment at the best of times. They face multiple headwinds and may also see their margins squeezed by rising commodity costs such as the oil and gas needed to run their machinery.

After oxygen and silicon, aluminum is the third-most abundant element in Earth's crust. Therefore, it's unlikely to run out, but logistical challenges continue.

For instance, the world's largest bauxite reserves, the principal ore in aluminum, comes from Guinea in West Africa. China sources close to half its bauxite from Guinea. But Guinea can be unstable, with political unrest a common occurrence.

Other risks include geopolitical tensions, geological conditions, operational and technical challenges, industrial and environmental accidents, government regulations, weather, illegal mining, etc. It seems volatility in the price of aluminum is set to continue.