The Tesla (NASDAQ: TSLA) share price has soared 67% year-to-date. It's up 190% in the past year and 3,140% in the past five years. In between, it has seen extreme share price volatility and many investors have made and lost fortunes along the way.

It’s fair to say Tesla is a company that divides opinion. Indeed, there have been Tesla bulls versus bears for years now, and so far, the bulls have won. Tesla is now a $1.2 Trillion Company, exceeding the value of all other car companies combined and even all the energy companies in the S&P 500 combined. This is an astonishing feat, but there's no getting away from the fact Tesla is overvalued.

Even its controversial founder Elon Musk has admitted as much.

Nevertheless, Tesla bulls are determined in their conviction. They believe in the business, the man, his vision for the future and undoubtedly the opportunity to make money. Lots, and lots of money.

There are the speculators, the gamblers, those keenly watching order flow, options chain activity and those dutifully reading the charts.

Combined, the momentum is unstoppable… until the bubble bursts.

Elon's latest move is either reckless or genius, depending on your point of view.

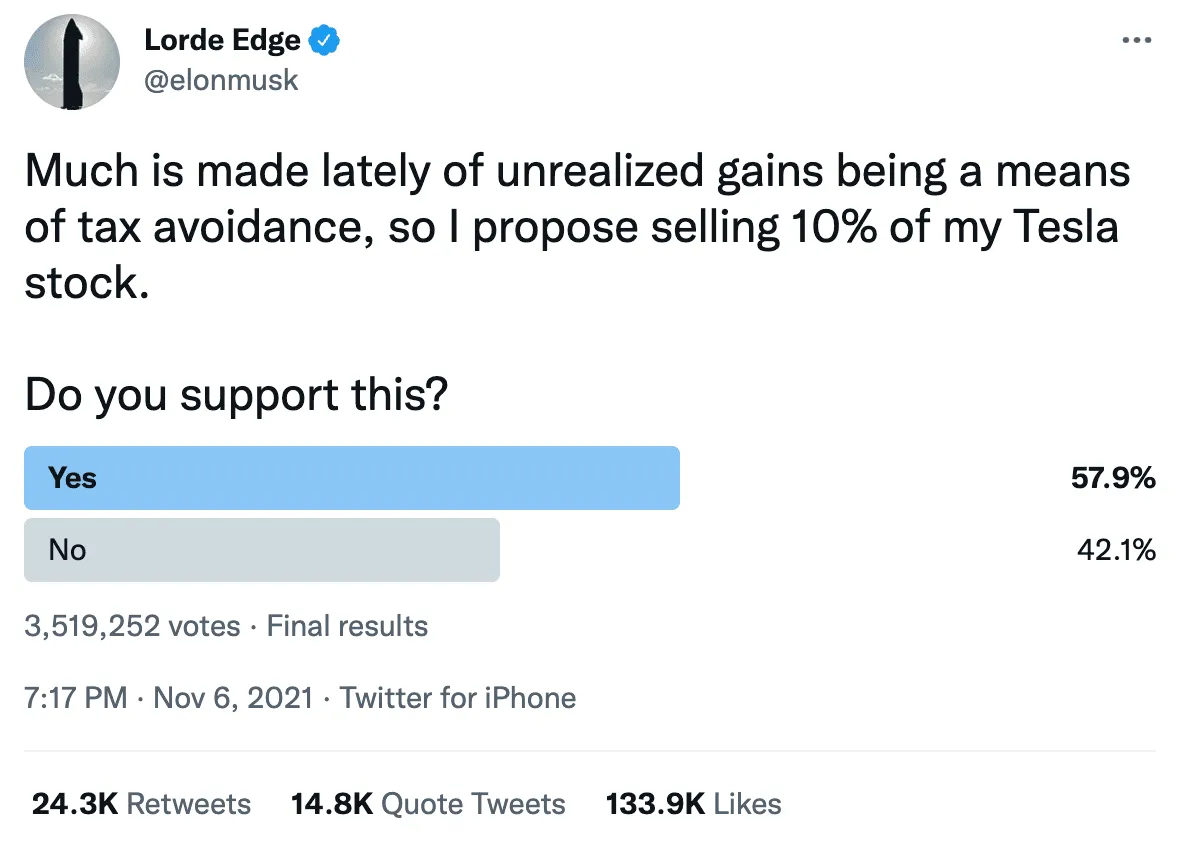

Over the weekend, Elon Musk tweeted a question to his 62.8 million followers:

The Twitter poll received a resounding YES with 57.9% in support and 42.1% against by the time the voting closed on November 6, 2021.

So, why would he do such a thing when he usually wants to keep shareholders onside?

His Twitter antics are legendary, and he's caused controversy many times with his surprising tweets.

But for those paying close attention to his financial position, this latest move may be particularly clever.

It became apparent weeks ago that Elon would soon be forced to sell shares. By conducting his Twitter poll, he's taking the decision out of his hands and letting the people decide if this is a good move.

#Why does Elon Musk have to sell Tesla shares?

Musk is Tesla's largest shareholder. Indeed, he owns over 170.4 million shares in the notorious EV company. Furthermore, he holds stock options that he received as a perk of the job.

Back in August 2012, Tesla awarded Musk an executive pay package mainly consisting of company stock options. There was an incentive attached, and if Tesla's stock market value grew in the coming ten years, along with rising Model 3 and Model S sales, Musk would be entitled to buy many more shares via stock options. As the ten-year period ends next summer, that's when the stock options expire.

Now Musk could ignore them, let them expire and take no additional stake in the company. But that would mean losing out on a substantial share of future wealth potential.

But here comes the twist in the tale. These Tesla stock options date back to a time when Tesla was little known and worth a lot less. Therefore, Musk can buy an additional 22.8 million Tesla shares for a mere $6.24 each if he chooses to exercise the options. This would cost him around $143 million. But, as the current Tesla share price is above $1,222 a share, he would owe over $14 billion in taxes.

Musk doesn't earn a corporate salary. He takes a minimal income and lives off bank loans guaranteed by his stock ownership. This has so far worked well in keeping his interests closely aligned with shareholders.

But if he wants to exercise the stock options and gain even more control of the company, he needs to find the billions of dollars required to pay the astronomical tax bill.

The most obvious way is to sell his Tesla shares. And this is why he's tweeted out this poll.

#Is the Tesla stock price sustainable?

As far as long-term value investors are concerned, Tesla has reached an astronomical valuation that is unsustainable. Therefore, with or without Musk's intervention, the bubble will inevitably burst.

By doing it this way, he can potentially offload his shares in a structured manner.

Twitter, being Twitter, there are all sorts of theories making the rounds. If selling 10% of his Tesla stock holding, other than paying his tax bill and buying his stock options, he would have money left over. So, what would he do with it?

Just last week, Musk said he'd happily donate $6 billion to the United Nations World Food Program if its director David Beasley could prove "exactly how" the money would feed humanity.

There's a lot to unpack in that statement and plenty of skepticism that Musk's generous donation could indeed end world hunger. Nevertheless, if he did sell his Tesla stock to do such a worthy act, then it would raise his profile considerably for the better.

He could buy Bitcoin, Dogecoin, Ethereum, or any other number of weird and wonderful cryptocurrencies that he's apparently alluded to in his stream of cryptic tweets.

For instance, after publishing the controversial Twitter poll, he changed his Twitter name to 'Lorde Edge,' which is apparently an anagram of Elder Doge. Potentially a secret message, signaling another rally in the original Shiba Inu coin.

Apparently even the innocuous little word ‘abide’ may refer to a cryptocurrency as abide(N) (ABIDE) is a cryptocurrency, deployed on Binance Smart Chain (BSC BEP-20).

Another theory is that he’ll announce a Tesla stock split before selling his 10% stake. Going by previous stock splits, that would be bullish for the share price.

Furthermore, by exercising his employee stock options and buying another massive chunk in the company, he will once again be aligned with shareholders, which is another bullish sign for Tesla stock.

Elon Musk may then announce Tesla will accept Bitcoin or even Dogecoin as a payment for EVs, which would also be bullish for both Tesla and the crypto in question if history repeats itself.

The rumor mill is rife with suggestions, and so the circus continues as Tesla and Bitcoin soar once more.

That's the optimistic view.

The alternative is the Tesla share price collapses, retail sells, everyone rushes to get out, and the entire S&P 500, Cathie Wood's ARK funds, and pension funds worldwide all come tumbling down.

There is no doubt Musk loves a joke, he's childish, and he loves to irritate the SEC. But he's aligned with shareholders and believes in solving humanity's problems with his cache of progressive companies.

Will his reckless side be the ruin of him, or will his genius prevail? We'll have to watch and wait... Probably not very long.