The Chicago Board Options Exchange’s (CBOE) Volatility Index (INDEXCBOE: VIX) is commonly known as the VIX, which is also its ticker symbol. It is a popular measure of the stock market’s expectation of volatility based on options activity in the S&P 500 index (SPX).

The VIX is a financial benchmark operating in real-time. It gives investors an indication of volatility expectations in the market for the coming 30 days.

CBOE and Goldman Sachs Group Inc (NYSE:GS) updated the VIX Index in 2003. This incorporated a new method for measuring expected volatility based on the S&P 500 Index. The 2003 update was a joint development by the CBOE and Goldman Sachs, replacing the original 1993 model (based on S&P 100 options) with a model using S&P 500 options and a new variance swap-based formula.

Often referred to as the "fear gauge" on Bloomberg TV, CNBC, and other financial media.

#What is Volatility?

Volatility refers to the degree of variation in the price of a financial asset over time. It is often quantified by standard deviation and reflects the level of uncertainty or risk in the market. Volatile markets can offer larger price swings, which some traders view as profit opportunities. However, volatility also increases risk.

For instance, the potential for particularly sharp retracements dissuades some traders from taking part in an extremely volatile market because the risk for losses is high.

The VIX offers a window into the state of volatility in the markets, which can help investors gauge the level of fear, risk, or stress in the market.

Having an idea of the volatility in relation to a steady market helps investors in their investment decisions.

Traders use the VIX to help turn their understanding of volatility to their advantage.

Introduced in 1993, the VIX is now the leading benchmark for US stock market volatility.

#How is the VIX calculated?

In 2014, the VIX was enhanced once again to include a series of SPX Weeklys. A third of all SPX options traded are Weeklys, at close to 350k contracts a day. This update ensured a new level of precision in matching the 30-day timeframe the VIX represents.

The CBOE Volatility Index is calculated using standard SPX options and weekly SPX options with Friday expirations.

The reason for Friday Options is to act as a barometer. SPX Options expire on the third Friday of each month, while the Weekly SPX Options expire on the remaining Fridays.

These SPX options with Friday expirations are weighted to yield a constant maturity 30-day measure of the expected volatility of the S&P 500 Index.

Only SPX options with more than 23 days and less than 37 days to the Friday SPX expiration are used in the calculation.

The VIX is calculated by using the midpoint of the real-time bid/ask quotations of SPX options. With this knowledge, it considers the level of volatility in the upcoming 30 days. That makes the VIX a forward-looking measure rather than historical.

VIX Index values are often described as indicative or spot values. That’s because they are based on intraday snapshots of SPX option bid/ask quotes. CBOE disseminates VIX values every 15 seconds during trading hours using SPX option midpoints.

The CBOE calculates the VIX Index values between set times.

CBOE Global Trading Hours (GTH) Session: 3:15 a.m. ET and 9:15 a.m. ET

CBOE Regular Trading Hours (RTH) Session: 9:30 a.m. ET and 4:15 p.m. ET

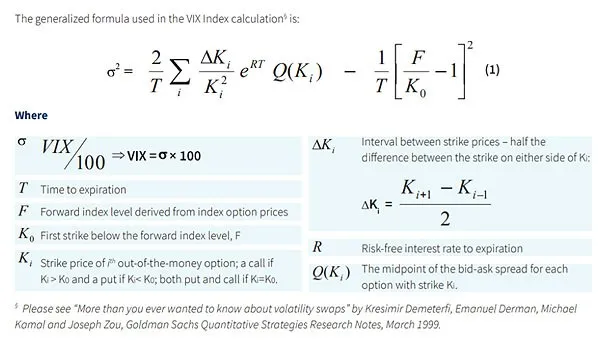

The CBOE VIX White Paper sets out its VIX Index formula calculation and details its history.

VIX Index Calculation

#How is the VIX Index used?

Traders find the VIX Index helpful in managing risk, which helps guide their investment decisions.

Historically, a high VIX reflects increased investor fear, and a low VIX suggests contentment. For this reason, it can be a useful tool in predicting bull and bear cycles.

For instance, the VIX traded above 80 in 2008 when market fear went parabolic.

Investors begin to worry when the VIX is approaching or trading above 20. Below 20 is less concerning.

For much of 2019, the VIX traded below 15. Market fear then shot up around March 2020 as the Covid-19 pandemic was making itself known. At this point, the VIX once again briefly exceeded 80. However, for most of 2020, it traded around the 20-mark.

#CBOE: Master of Volatility

The VIX Index is not the only CBOE volatility index. The CBOE also calculates volatility over 9-day, 3-month, 6-month, and 1-year periods, among others:

The CBOE Short Term Volatility Index (VIX9DSM), reflecting the 9-day expected volatility of the S&P 500 Index.

CBOE S&P 500 3-Month Volatility Index (VIX3MSM)

The CBOE S&P 500 6-Month Volatility Index (VIX6MSM)

The CBOE S&P 500 1-Year Volatility Index (VIX1YSM)

The Nasdaq-100 Volatility Index (VXNSM)

CBOE DJIA Volatility Index (VXDSM)

The CBOE Russell 2000 Volatility Index (RVXSM)

#Can you buy the VIX?

The S&P 500 Index and other stock market indices are made up of a portfolio of stocks. Therefore, the price of the index is based on the return percentage of each constituent.

For instance, an index containing three stocks would function in this manner. If Stock A has risen 25%, Stock B has risen 15%, and Stock C has risen 20%, the index price would be up 20%, or (25 + 15 + 20)/3.

But the price of the VIX Index varies on a constantly changing portfolio of SPX options. These change on a minute-by-minute basis, so it can’t be bought by stock market investors or traders.

Nevertheless, the VIX Index settlement process is tradable, and those interested can buy Volatility Derivatives.

Although the prices of Volatility Derivatives are linked to SPX options, individually, their valuations expire at various points along the term structure. Therefore, these reflect constantly changing portfolios of SPX options.

Plus, investors and traders have no way of knowing which SPX calls and puts will be out-of-the-money on a future date. But SPX options expiry dates are known, along with the VIX Index formula for a given date, so that traders can estimate the price of the VIX Index. This helps drive VIX futures and options prices.

#Buying VIX Futures and Options

VIX Futures are traded on the CBOE Futures Exchange (CFE), while VIX options are traded on the CBOE Options.

A final settlement value for VIX futures and VIX options is revealed on the morning of their expiration date (usually a Wednesday). This is calculated through a Special Opening Quotation (“SOQ”) of the VIX Index.

However, the SOQ of the VIX Index differs from the calculation of the VIX Index at all other times.

The SOQ calculation uses SPX options or SPXW (weekly) options from a single expiration of 30 calendar days in the future. Unlike the standard VIX calculation, which blends near- and next-term options to maintain a constant 30-day horizon, the SOQ uses a single set of SPX options expiring exactly 30 days out.

The strike range of an SOQ calculation also differs from that of the VIX Index calculation at other times.

To determine the strike range of the SOQ calculation, options with consecutive strikes do not have to have zero bid prices, which they do in calculating the VIX Index at other times.

CBOE Options uses an algorithm to detect the call with the highest strike and the put with the lowest strike to be used in the SOQ calculation.

#Where’s the value?

The CBOE VIX operates in real-time showing market expectations for volatility in the next 30 days.

Traders and investors use the VIX as an indication of risk, fear, and stress in the market. It helps their trading decisions.

It is possible to trade the VIX using derivatives. Traders can access volatility exposure through standard and weekly VIX options and futures, available via the CBOE Options Exchange and CBOE Futures Exchange.

#Q&A

Q: What is the VIX?

A: The VIX, or Volatility Index, is a real-time market index published by the Chicago Board Options Exchange (CBOE). It measures the market’s expectation of volatility over the next 30 days based on S&P 500 index (SPX) options prices. Often called the "fear gauge," the VIX rises during times of market uncertainty.

Q: What is the VIX Index?

A: The VIX Index is a benchmark that reflects expected short-term volatility in the US stock market. Calculated using SPX options, it gives traders and investors insight into potential market turbulence. The ticker symbol is simply VIX, and it is tracked widely by financial professionals and the media.

Q: What does INDEXCBOE: VIX mean?

A: INDEXCBOE: VIX is the formal ticker used by financial data platforms to represent the CBOE Volatility Index. “INDEXCBOE” refers to the exchange, and “VIX” is the symbol for the volatility index itself.

Q: What is the CBOE Volatility Index?

A: The CBOE Volatility Index is the full name of the VIX. Created by the Chicago Board Options Exchange, it is the most recognized gauge of expected volatility in the US equity markets. It is calculated using both standard and weekly SPX options.

Q: What is a Volatility Index?

A: A volatility index measures market expectations for future volatility. While the VIX is the most well-known, other volatility indices exist, such as VIX9D (9-day), VIX3M (3-month), and VIX6M (6-month), each reflecting different time horizons.

Q: What does “What is VIX” refer to?

A: This question is commonly asked by new investors looking to understand how volatility is measured in the stock market. VIX provides a snapshot of the market's fear or complacency and helps traders make risk-adjusted decisions.

Q: What is the Vol Index?

A: "Vol Index" is shorthand for the VIX or other volatility-related benchmarks. It refers broadly to indices that measure market volatility expectations.

Q: What are VIX Futures?

A: VIX futures are derivative contracts that allow traders to speculate on or hedge against future volatility. They are traded on the CBOE Futures Exchange and are based on the expected value of the VIX on a future settlement date.

Q: What is VIX3M or the 3-Month Volatility Index?

A: VIX3M is a CBOE index that tracks the market’s expectation of volatility over the next 3 months. It’s useful for investors seeking a longer-term view of potential market swings.

Q: What is the International VIX?

A: While “International VIX” is not a formal index, the term is often used to describe non-US volatility benchmarks inspired by the VIX. Many global exchanges have created their own versions to track expected volatility in regional markets.

_.jpg?w=1200&fm=webp&s=0d8bc373370c7239573a3aa6e322f242)