#Capital Flows Into Energy and AI Are Shaping the Next Decade

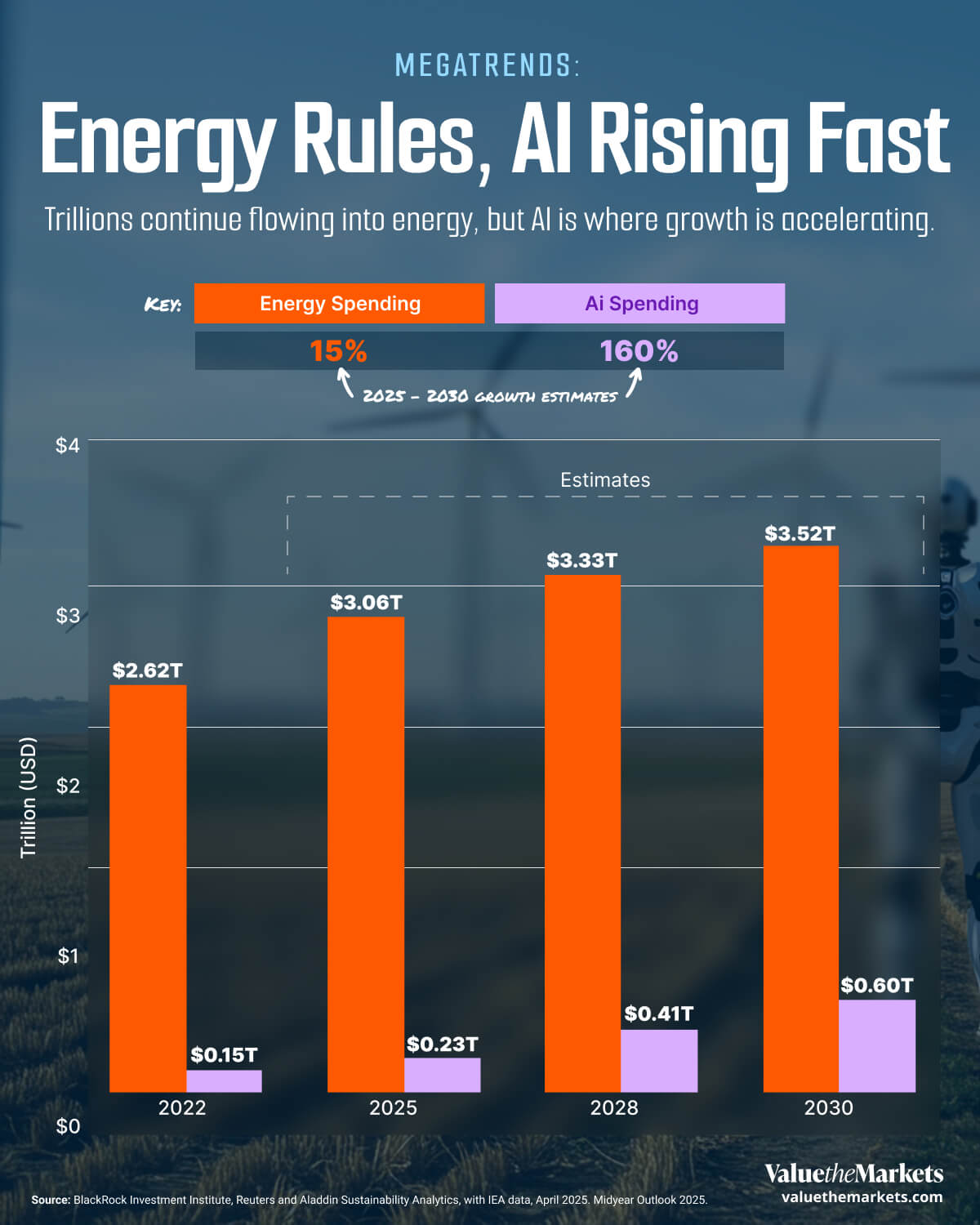

Between now and 2030, two megatrends are taking shape: the steady rise of energy investment and the explosive growth of artificial intelligence. While energy spending remains far larger in dollar terms, AI is attracting capital at a much faster rate. For retail investors, this chart highlights where the market is placing its long-term bets and why these sectors matter more than ever.

In 2022, global capital spending on energy stood at $2.62 trillion. By 2030, that’s projected by BlackRock Investment Institute to reach $3.52 trillion. AI, in contrast, started at just $150 billion in 2022, but it’s projected to hit $600 billion by 2030. That’s a 300% increase in eight years, compared to a 34% increase for energy.

Between 2025 and 2030, those growth rates ease to 160% for AI and 15% for energy, still strong given the scale of both sectors. Even as growth moderates, AI continues to outpace every major industry in capital intensity, while energy remains the backbone of global infrastructure and transition spending.

For investors, this divergence signals two complementary opportunities: exposure to the innovation driving productivity gains across every sector, and participation in the foundational buildout required to power that innovation.

The takeaway? One sector is large and stable, the other is growing fast. Both are attracting serious capital.

| Energy and AI-Related Capital Spending, 2022-2030 | ||

| Year | Energy | AI |

| 2022 | $2.62T | $0.15T |

| 2025 | $3.06T | $0.23T |

| 2028 | $3.33T | $0.41T |

| 2030 | $3.52T | $0.60T |

#Why Energy and AI Matter for Retail Investors

Together, energy and AI account for two of the most influential capital flows shaping the global economy this decade.

Energy still dominates global capital flows: With trillions invested annually, energy remains the backbone of the global economy.

AI is scaling rapidly across industries: A 160% growth rate from 2025 to 2030 signals rising adoption and innovation.

These sectors support each other: AI needs massive power, and energy is being reshaped by AI-driven tools and automation.

Capital flows indicate confidence: Institutions are backing both sectors heavily, suggesting long-term growth opportunities.

You don’t have to pick one: Diversifying across both can offer exposure to growth (AI) and resilience (energy).

#Energy Spending Stays on a Stable Growth Path

According to BlackRock’s estimates, the rising need for energy investment reflects continued demand for power across all economies, especially as electrification spreads to transportation, heating, and manufacturing.

But it’s not just traditional fossil fuels driving growth. Renewables, power grid modernization, and energy storage are seeing rising allocations. Much of this investment supports modernization rather than expansion, as grids, renewables, and storage systems replace aging infrastructure. For retail investors, this translates to potential opportunities in utility stocks, infrastructure funds, and clean energy ETFs. Energy may not be flashy, but it’s consistent and crucial.

👉 Global copper demand from clean technologies is set to grow 122% by 2050. This is a trend that could open new investing opportunities in mining, materials, and green infrastructure.

#AI Is the Fastest Growing Spend Category

A 160% growth rate is impressive for any sector, especially one already embedded in enterprise workflows. That pace underscores how quickly AI is scaling from innovation to infrastructure. AI remains a revolutionary megatrend.

From automation in manufacturing to predictive analytics in finance and diagnostics in healthcare, AI continues to reshape industries. As investment accelerates, companies enabling or deploying AI, such as chipmakers, cloud platforms, and specialized software developers, are likely to benefit.

For investors, the message is clear: AI may still be smaller in absolute size, but its growth trajectory points to outsized return potential.

Discover which cloud AI leaders are driving growth and strong returns in 2025.

#Look at the Long-Term Capital Allocation

The scale and direction of capital spending help investors understand what the next decade could look like. Trillions moving into energy and hundreds of billions into AI reflect not hype, but conviction. These aren’t short-term plays. They are long-term themes that will shape global supply chains, national policies, and corporate earnings.

Smart investors are tracking not just performance, but where capital is being committed.

#FAQs

Is AI investment too early for retail investors?

Not necessarily. While still in early growth, many AI-focused companies are already public or part of broader tech ETFs.

What are practical ways to gain exposure to energy?

Look at diversified energy ETFs, infrastructure funds, or dividend-paying utility stocks.

Can energy and AI work together?

Yes. AI is being used to improve energy efficiency, forecast demand, and manage smart grids. And AI’s growing compute needs are increasing electricity demand.

Is energy investment still about oil and gas?

Partially, but a growing share is going into renewables, nuclear, and grid upgrades.

Which sector has more upside?

AI has higher growth potential, but also higher volatility. Energy offers scale and stability. Many investors may benefit from exposure to both. The bottom line: both sectors are attracting structural investment, not speculative flows. Retail investors who align early with these megatrends could benefit from their decade-long expansion.