#Why Premium Domains Still Command Top Dollar

Premium domain sales have consistently commanded multi-million-dollar price tags, underscoring the enduring value of prime digital real estate. These transactions span technology, travel, finance, health, and iGaming, showing that both established and emerging industries see domains as core to brand strategy.

The market has evolved from the dot-com boom to today’s era of AI, blockchain, and niche digital services. While overall transaction volumes are lower than in the early 2000s, the upper end of the market remains strong, particularly for short, memorable names tied to high-growth sectors. Scarcity, brand recognition, and the ability to drive direct traffic keep premium domains in demand, making them a strategic asset for corporations and a speculative opportunity for investors.

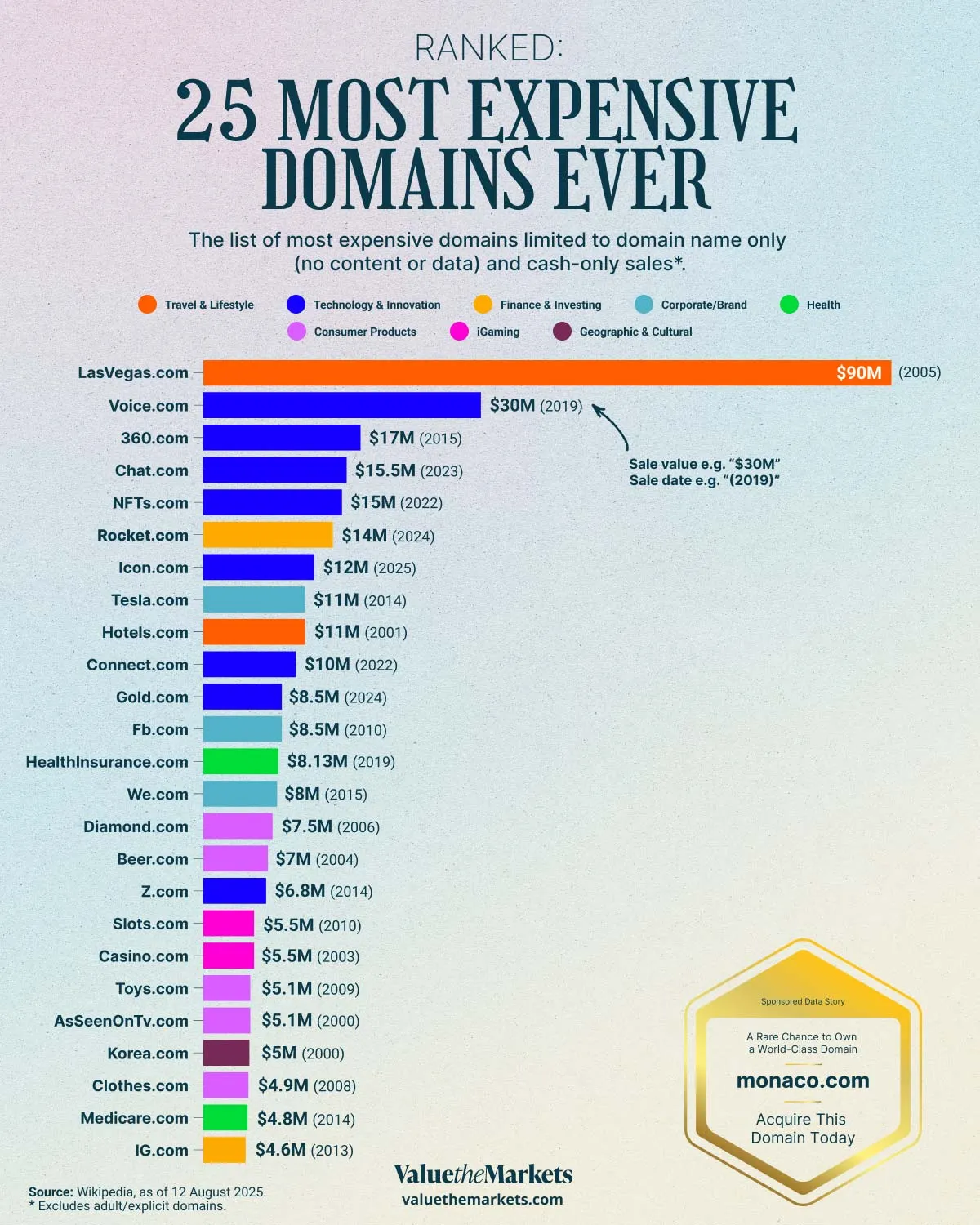

| Domain | Price | Category | Sale date | |

| 1 | LasVegas.com | $90 million | Travel & Lifestyle | 2005 |

| 2 | Voice.com | $30 million | Technology & Innovation | 2019 |

| 3 | 360.com | $17 million | Technology & Innovation | 2015 |

| 4 | Chat.com | $15.5 million | Technology & Innovation | 2023 |

| 5 | NFTs.com | $15 million | Technology & Innovation | 2022 |

| 6 | Rocket.com | $14 million | Finance & Investing | 2024 |

| 7 | Icon.com | $12 million | Technology & Innovation | 2025 |

| 8 | Tesla.com | $11 million | Corporate/Brand | 2014 |

| 9 | Hotels.com | $11 million | TTravel & Lifestyle | 2001 |

| 10 | Connect.com | $10 million | Technology & Innovation | 2022 |

| 11 | Gold.com | $8.5 million | Technology & Innovation | 2024 |

| 12 | Fb.com | $8.5 million | Corporate/Brand | 2010 |

| 13 | HealthInsurance.com | $8.13 million | Health | 2019 |

| 14 | We.com | $8 million | Corporate/Brand | 2015 |

| 15 | Diamond.com | $7.5 million | Consumer Products | 2006 |

| 16 | Beer.com | $7 million | Consumer Products | 2004 |

| 17 | Z.com | $6.8 million | Technology & Innovation | 2014 |

| 18 | Slots.com | $5.5 million | iGaming | 2010 |

| 19 | Casino.com | $5.5 million | iGaming | 2003 |

| 20 | Toys.com | $5.1 million | Consumer Products | 2009 |

| 21 | AsSeenOnTv.com | $5.1 million | Consumer Products | 2000 |

| 22 | Korea.com | $5 million | Geographic & Cultural | 2000 |

| 23 | Clothes.com | $4.9 million | Consumer Products | 2008 |

| 24 | Medicare.com | $4.8 million | Health | 2014 |

| 25 | IG.com | $4.6 million | Finance & Investing | 2013 |

#Why Domain Sales May Interest Retail Investors

Premium domains can generate long-term returns similar to physical real estate.

Strong domain names boost brand recognition and customer trust.

Rising adoption of AI, Web3, fintech, and blockchain growth is driving demand for relevant domains.

Short, memorable domains often retain value through market cycles.

Sales trends can hint at emerging industries and investment themes.

#Technology Leads Big Ticket Sales

Technology-related domains dominate high-value transactions. Voice.com sold for $30 million in 2019 during the rise of voice assistants. 360.com changed hands for $17 million in 2015 amid China’s tech boom. More recently, Chat.com sold for $15.5 million in 2023 as AI-driven chatbot adoption accelerated, and NFTs.com brought in $15 million in 2022 during the peak of Web3 enthusiasm. In 2025, Icon.com sold for $12 million, ranking as the seventh largest publicly reported domain sale ever, highlighting sustained demand for premium one-word .com names.

This trend suggests that retail investors should watch for domain sales tied to tech-driven sectors, as these transactions often signal where companies expect future user engagement to grow.

#Travel And Lifestyle Domains Still Command High Prices

While tech leads, travel and lifestyle names like LasVegas.com — the most expensive domain sale in history at $90 million — and Hotels.com ($11 million) show the staying power of established destinations. Even decades-old sales such as AsSeenOnTv.com at $5.1 million in 2000 prove that category-defining domains maintain relevance.

The commercial potential for premium location-based domains remains strong. High-profile sales such as LasVegas.com and Korea.com at $5 million show how cities and destinations with global recognition can command substantial valuations. For businesses in travel, luxury, or entertainment, securing a domain tied to a prestigious location can provide instant credibility and long-term brand equity. As it happens, Monaco.com is currently available for purchase, see below for details.

#Finance, Health, and iGaming Are Strong Niches

Fintech-focused domains like Rocket.com ($14 million in 2024) and IG.com ($4.6 million in 2013) show that trusted, concise web identities are essential in industries where consumer trust drives transactions. HealthInsurance.com ($8.13 million in 2019) and Medicare.com ($4.8 million in 2014) demonstrate similar demand in health care.

The iGaming sector also appears repeatedly, with Slots.com and Casino.com each selling for $5.5 million. These sectors tend to be resilient because they are built around recurring customer engagement and high-value transactions, making their best domain names a long-term branding asset. Location-based names can also carry crossover appeal in these industries, and Monaco.com — currently available for purchase — is a prime example of a domain that could serve both luxury travel and online gaming markets.

These sales, spanning 25 years, demonstrate that premium domains continue to hold strong appeal and command high prices in today’s market.

#FAQs

What makes a domain valuable?

Length, memorability, keyword relevance, and industry demand all influence a domain’s worth.

Are domains a good investment?

They can be, but returns depend on timing, market trends, and the quality of the domain.

Do older domains hold more value?

Often yes, especially if they are short, generic, or tied to enduring industries.

How do domain sales reflect market trends?

High-value sales often align with emerging technologies or industries entering growth phases.

Can retail investors buy premium domains?

Yes, through domain marketplaces or brokers, but competition and pricing can be steep.