#Top Rising Brands of 2025 Show Strong Momentum

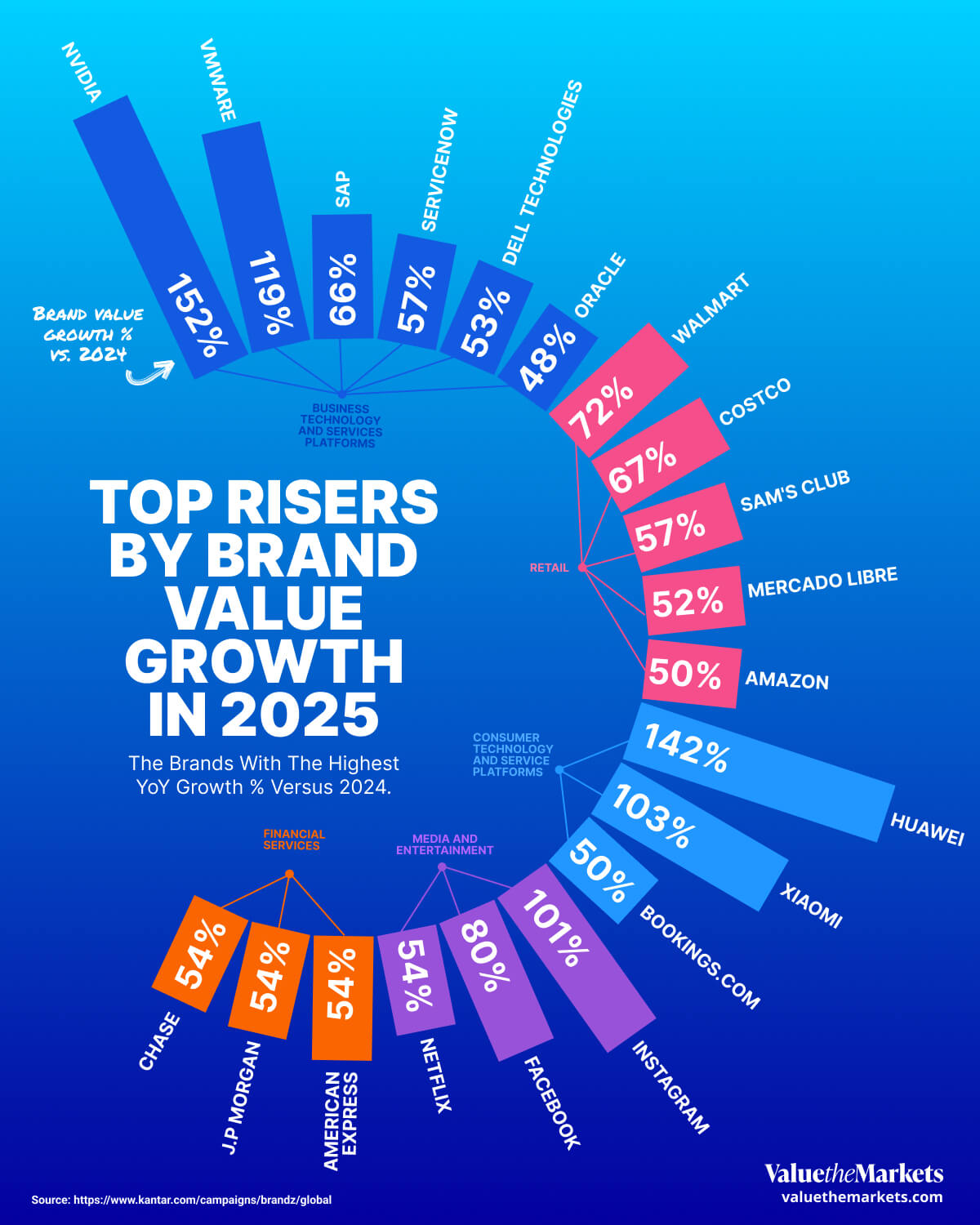

In 2025, the brands posting the fastest growth in brand value collectively share one common trait: they are aggressively adapting to volatility. According to Kantar’s latest BrandZ report, which tracks brand value performance across sectors, companies in business tech, consumer tech, and retail led the way with outsized gains. @NVIDIA Corporation (NASDAQ:NVDA) topped the list with a 152% surge in brand value over the past year. Huawei followed closely at 142%, showing how global sentiment around AI, semiconductors, and digital infrastructure is reshaping consumer and enterprise demand.

Retail names like @Walmart Inc (NYSE:WMT), Costco, and Sam’s Club are also on the rise. Their strong performance highlights the value of operational efficiency and customer trust in times of economic uncertainty.

#Strong Brands Beat the Market in Tough Times

Over the past 20 years, the Kantar BrandZ portfolio has consistently outperformed the S&P 500 and MSCI World Index. During both the 2008 financial crisis and the 2020–2022 pandemic, strong brands in the portfolio experienced less decline and bounced back faster, ultimately reaching higher values. This shows that strong brands help protect businesses and deliver better returns, even in uncertain markets.

#Why This Matters for Retail Investors

Brand strength drives shareholder returns: Companies with stronger brand equity have consistently outperformed the S&P 500, especially during downturns.

Growth under volatility signals resilience: Brands that are rising now are proving their ability to adapt, innovate, and expand —key indicators of future profitability.

AI and digital transformation are market catalysts: Many top risers are tech-driven firms benefiting from demand in AI, cloud, and digital ecosystems.

Retail remains a stable performer: The inclusion of Walmart, Costco, and Amazon among the top risers confirms that retail still offers dependable upside.

Financial services are leaning into trust and relevance: Amex, JPMorgan, and Chase made the list, suggesting that trusted incumbents are gaining ground by focusing on customer experience and digital access.

| Brand | Category | Brand Value Growth % vs. 2024 |

| Nvidia | Business Technology and Services Platforms | 152% |

| Huawei | Consumer Technology and Services Platforms | 142% |

| VMware | Business Technology and Services Platforms | 119% |

| Xiaomi | Consumer Technology and Services Platforms | 103% |

| Media and Entertainment | 101% | |

| Media and Entertainment | 80% | |

| Walmart | Retail | 72% |

| Costco | Retail | 67% |

| SAP | Business Technology and Services Platforms | 66% |

| American Express | Financial Services | 66% |

| J.P. Morgan | Financial Services | 57% |

| ServiceNow | Business Technology and Services Platforms | 57% |

| Sam's Club | Retail | 57% |

| Netflix | Media and Entertainment | 54% |

| Chase | Financial Services | 54% |

| Dell Technologies | Business Technology and Services Platforms | 53% |

| Mercado Libre | Retail | 52% |

| Amazon | Retail | 50% |

| Booking.com | Consumer Technology and Services Platforms | 50% |

| Oracle | Business Technology and Services Platforms | 48% |

#Tech and Enterprise Platforms Power Ahead

Tech brands have outpaced others not just in value but in perception. Nvidia’s 152% growth reflects more than just market capitalization; it shows the brand has become a dominant force in the AI space, top-of-mind for both consumers and industry decision-makers. With chips powering everything from data centers to autonomous cars, Nvidia has positioned itself as a foundational brand for the next decade.

VMware and SAP also showed strong double-digit growth, up 119% and 66% respectively, highlighting demand for cloud and enterprise platforms. Oracle, despite ranking lowest among this group at 48%, still demonstrates the enduring value of legacy platforms transitioning into hybrid cloud providers.

ServiceNow and Dell Technologies both posted solid gains (57% and 53%) in brand value, indicating that business efficiency, automation, and IT resilience are high on the enterprise priority list.

#Consumer Tech and Media Brands Rebound

Xiaomi and Huawei surged 103% and 142%, respectively, as Chinese consumer brands recapture global attention. Instagram and Facebook are back in growth mode, with Meta’s platforms gaining 101% and 80% in brand value. This is notable given the crowded social media landscape and increased regulatory scrutiny.

Netflix posted a 54% rise, reinforcing the strength of direct-to-consumer streaming models. Similarly, Instagram’s revival shows how rapid content evolution, such as the success of Reels, can significantly improve user engagement and monetization.

#Retail and Financial Brands Anchor Stability

Walmart (72%), Costco (67%), and Sam’s Club (57%) underline a critical takeaway for investors: brick-and-mortar retail with strong digital integration remains competitive. These companies have focused on efficiency, pricing, and membership value in a high-inflation environment.

American Express, JPMorgan, and Chase all reported brand growth between 54% and 66%. These results align with broader consumer shifts toward financial providers that offer digital services, transparent fees, and loyalty programs. By consistently investing in marketing and building strong customer trust, these brands are perceived as reliable and easy to deal with, both for personal and business banking. That strong connection has helped keep them popular and stand out in the crowded US market.

#Key Takeaways for Investors

For retail investors, the message is clear: brand strength matters. The companies posting the biggest gains in brand value this year, spanning tech, retail, media, and financial services, are not just riding short-term trends; they are building long-term resilience. These brands are adapting quickly, investing in digital capabilities, and deepening customer trust.

History shows that strong brands not only weather downturns better, but they also recover faster and outperform broader markets over time. For investors seeking durable growth in uncertain conditions, brand power is a signal worth watching.

#FAQs

Which sector led brand value growth in 2025?

Business technology and services platforms led, with multiple firms like Nvidia, VMware, and SAP showing major gains.

Is brand value correlated with stock performance?

Yes, historically, companies with strong brand equity outperform market indices, particularly in volatile periods.

Why are retail brands still growing?

Retailers that combine price competitiveness with digital convenience are well-positioned to retain and expand their customer base.

Are Chinese brands becoming more valuable again?

Yes, Huawei and Xiaomi posted massive brand value gains, reflecting global demand and strong positioning in consumer electronics.

What does this mean for long-term investors?

Brands that continue to innovate and align with consumer needs, especially in tech and retail, have rewarded patient investors.