Completion of Pre-Feasibility Study Advances the Ampasindava Rare Earth Project

Harena Rare Earths Plc (LSE: HREE) (OTCQB: CRMNF), the rare earths company focused on the Ampasindava ionic clay rare earth project in Madagascar (the "Ampasindava Project"), is pleased to announce the highlights from its completed pre-feasibility study ("PFS"). The PFS represents an important advancement in the development of the Ampasindava Project, confirming its technical viability and providing a robust economic and operational framework to support the next phase of project progression.

The PFS was compiled by the Company with leading global engineering group SGS engaged to support technical inputs to the PFS and also to conduct an update of the 2023 Mineral Resource Estimate to JORC 2012 standard.

PFS HIGHLIGHTS

Robust technical and economic viability for long life heap leach operation

Total rare earth oxide (TREO1) of ~71kt, over a measured 20-year life of mine (LOM)

Plant throughput set at 5Mtpa (dry) at average grade at 1,500 ppm TREO supported by independent metallurgical test work

Pre-production capital cost estimate of US$142 million, including 25% in EPCM (engineering, procurement and construction management) and funding costs

Annual TREO production estimate of 4,000 tonnes per year

Annual oxide (NdPr + DyTb) production of 1,700t per year (29,670t for 20 years)

Ratio of magnetic rare earth oxide (Magnet REO2) yielded to TREO despatched at 41%

Excellent economic returns modelled using analyst sourced long term pricing

Undiscounted LOM free cashflow of US$1.0 billion post-tax

Pre Tax NPV10 of US$343.7 million

Pre Tax IRR of 34%

Post Tax NPV10 of US$249.6 million

Post Tax IRR of 30%

Payback period of 4 years

Outstanding financial metrics based on current publicly sourced consensus rare earth pricing

Undiscounted LOM free cashflow of US$2.6 billion post-tax

Pre Tax NPV10 of US$616.1 million

Pre Tax IRR of 30% (Consensus pricing more optimistic in later years)

Post Tax NPV10 of US$464.3 million

Post Tax IRR of 27%

Payback period of 5 years

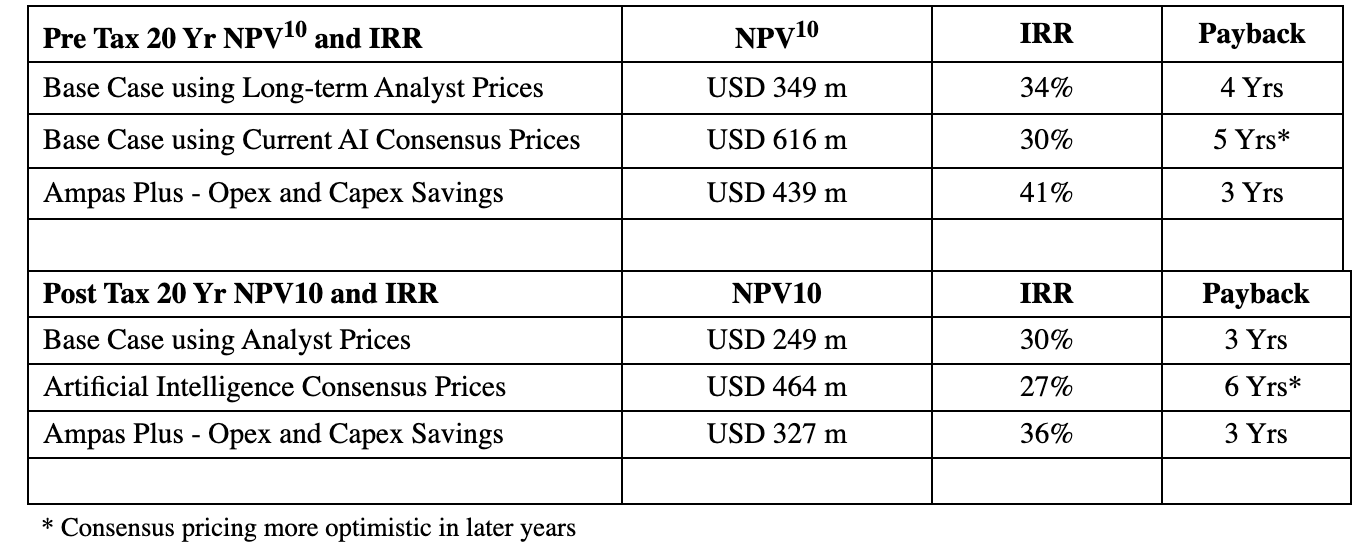

Economic outcome summary

The Company has modelled the Ampasindava Project's economics using two sets of rare earth oxide price forecasts. The base case uses a price deck sourced from a recognised Minerals Analyst for the years between 2025 and 2044. The Consensus Price deck is sourced using artificial intelligence (AI) applications that scrape web information on publicly available REO pricing forecasts between 2030 and 2049. In addition, the Company has modelled a situation, called Ampas Plus, using the base case price deck with a 10% reduction in opex and capex applied throughout.

Ampasindava Project rapidly advancing and progressively de-risked

Planning for a phased "Proof of Concept" plant at site is underway:

Initial establishment of a permanent on-site laboratory

Establishment of on-site test cribs and columns

Opportunity to optimise flowsheet and test downstream rare earth separation at a pilot scale

Selection of specialists to compile DFS and upgrade PFS to reduce cost and process risk

Commence targeted cost reduction and optimisation initiatives including:

Selection of high-grade zones for initial inclusion in mine plan

Optimising supply chain options

Strong national government support

Strong engagement with Malagasy national and regional governments

Environmental and social studies continue to support permitting and local validation

Permitting on track to allow construction to commence in 2027

Social programs will focus on suitable and appropriate land compensation, job creation, education of youth, individual technical skills development, and local business creation and readiness

Allan Mulligan, Executive Technical Director of Harena, said:

"The completion of the PFS represents a significant step forward for Harena and the Ampasindava Project. With significant previous investment in resource development, process testwork and environmental programs, we have an excellent understanding of the Ampasindava Project where we can now further optimise the asset as we move into the final piloting and studies phase.

The Ampasindava Project hosts a world-class scale ionic absorption rare earths mineralisation, particularly amenable to low cost and high yield recoveries. The sustainable and rapid remediation heap leach extraction model will serve to enhance the local, regional and national economy with no lasting impacts on the environment.

Our confidence in the results of the PFS and the underlying PFS process more broadly is based on the enormous previous works and current understanding of the orebody, and the inclusion of the Proof-of-Concept plant in 2026 will allow a smooth and organised mobilisation into construction with reduced start up risk."

Ivan Murphy, Executive Chairman of Harena, said:

"We are extremely pleased to be releasing the excellent results of this pre-feasibility study to the market. The key metrics presented here clearly highlight the exceptional scale, quality and strategic significance of the Ampasindava Project, reinforcing its position as a world-class heavy rare earth asset and marking a major milestone in its progression towards development.

I would like to sincerely thank Allan Mulligan, our Executive Technical Director, for his dedication over the recent months, as well as the wider internal and external teams whose expertise and commitment have been instrumental in delivering this important result."

Click here for the full release and Summary Report