Growth stocks are shares in an organisation that an investor expects will increase in value at a rate that’s higher than the average growth of the market. Alongside value investing, growth investing is one of the two main investing strategies that investors employ.

Some examples of tech stocks on a growth trajectory include Apple Inc (NASDAQ: AAPL), Facebook (NASDAQ: FB), NetGear (NASDAQ: NTGR), and NVIDIA Corp. (NASDAQ: NVDA).

#What Is the Technology Sector?

In relation to the stock market, the technology sector covers stocks involved in the research, development, and supply of technologically geared goods and services.

This includes companies involved in electronics, hardware, software, computer components, Information Technology solutions, and any computing-related products and services.

In recent years, the technology sector has seen explosive growth as technological advancements make waves. 5G, Augmented Reality, Artificial Intelligence, Electric Vehicles, and Internet Security are all areas of tech gaining momentum.

But the technology sector also covers a wide array of business-to-business (B2B) and business-to-consumer (B2C) products and services.

For instance, Apple makes personal computers, mobile devices, wearable technology, and much more. Meanwhile, Peloton (NASDAQ: PTON) makes state-of-the-art fitness equipment.

The technology sector covers six primary industries. These are hardware, software, semiconductors, technology, and IT services. According to market intelligence consultancy IDC, it’s the most significant stock market sector of all, with an estimated global market value of around $5 trillion.

#Q3 2021 tech growth stocks by EPS

EPS stands for earnings per share. This is a financial ratio, relating the earnings generated by the business, to the number of shares in issue. The EPS refers to earnings generated during a specific time frame.

A high EPS growth rate is attractive to investors because it will potentially provide outsized returns.

So, the best tech growth stocks sorted by EPS today include the following:

Amkor Technology

Founded in 1968, Amkor Technology is a semiconductor product packaging and test services provider. It primarily serves integrated device manufacturers, fabless semiconductor companies, original equipment manufacturers, and contract foundries.

The world is in the midst of a semiconductor shortage, but Amkor is confident its strong position in Advanced Packaging will enable it to outgrow the semiconductor market in 2021.

Amkor’s price-to-earnings ratio (P/E) is 13.6, and its EPS has a compound annual growth rate (CAGR) of 45.3%. In Q1 this year, Amkor enjoyed net sales of $1.33bn, up 15% year-over-year.

Amkor recently paid a quarterly dividend of $0.04 per share, giving it a dividend yield of 0.7%. AMKR stock is present in 105 exchange-traded funds (ETFs). Analysts 12-Month average share price target is $27.

NetGear Inc

Founded in 1996, multinational computer networking company NetGear produces networking hardware for B2C and B2B clients. NetGear also focuses on pro-gaming, including wired and wireless technology. It is a major player in the WiFi space and provides premium networking gear currently enjoying demand momentum.

The pandemic accelerated the shift to home working, increased gaming activity, and enhanced streaming. All of which are dependent on fast internet speeds and the goods and services provided by NetGear.

In Q1, NetGear posted a non-GAAP EPS of $0.99, and it enjoyed revenue growth of 38.3% year-over-year. It also added 44,000 subscribers and forecasts, 650,000 subscribers, by the end of the year.

NetGear has a P/E of 13.5 and analysts 12-Month average share price target is $48.75.

Turtle Beach Corp

The Turtle Beach Corporation makes popular gaming headsets for mobile devices and leading gaming consoles such as Xbox, PlayStation, PC, and Nintendo Switch.

Again, the rise in gaming has lifted sales in Turtle Beach headsets, and the company has plans to extend its product line.

Its main competitors are Corsair Gaming (NASDAQ: CRSR) and Logitech (SWX: LOGN). Turtle Beach owns Roccat, a gaming accessories manufacturer, and it also acquired Neat Microphones, another product seeing demand rise.

Turtle Beach has a P/E of 10.5 and while its share price is volatile, it’s up 92% in a year and 644% in five years. Analysts 12-Month average share price target is $40.50.

#Q3 2021 tech growth stocks by sales growth

Sales growth is an important financial metric for any business to track. If sales are increasing, the company should be thriving, whereas if sales are declining, the business may be in trouble.

To calculate the sales growth rate year over year, simply divide the current sales by the prior year’s sales. Sales growth = this year’s sales / last year’s sales

The best tech growth stocks, sorted by sales growth today, include the following:

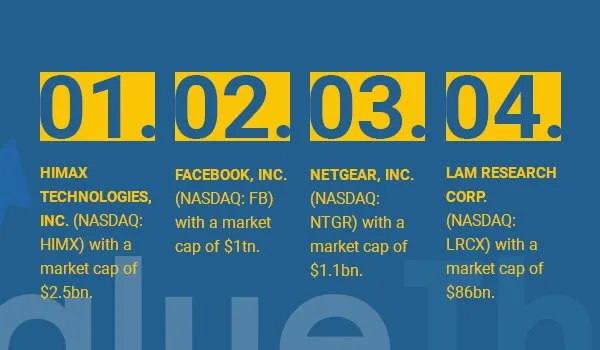

Himax Technologies, Inc.

Himax Technologies operates in the semiconductor space and is based in Taiwan.

Himax is a global market leader in various components used in consumer electronic goods. It also designs touch sensor displays and a myriad of micro-displays and sensors for AR, tech, and automotive industries.

Himax has a P/E of 13, and its dividend yield is 1.8%. Its stock is held in 6 ETFs and analysts 12-Month average share price target is $18.75.

Facebook, Inc.

Facebook is so much more than just a social media network. It has such an extensive reach that almost half the world’s population is connected via Facebook’s various assets, including Instagram and WhatsApp.

Facebook is also a tech company involved in many exciting areas of development.98% of Facebook’s income comes from advertising revenues, but it’s also involved in AR, VR, AI, and helping small businesses realize their potential online.

Facebook’s P/E is 29, but it doesn’t offer a dividend. Analysts 12-Month average share price target is $384.76.

For more information, check out ‘Is Facebook still a good investment?’

NetGear Inc.

See above in EPS Growth.

Lam Research Corp.

Lam Research is another semiconductor company. It designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used to fabricate integrated circuits worldwide.

The global chip shortage is fuelling growth in demand, which Lam Research stands to benefit from. However, geopolitical tensions are running high with China, so this poses a risk.

Its P/E ratio is 25, and its dividend yield is 0.8%, LRCX stock is also held in 239 ETFs. Analysts 12-Month average share price target is $740.

#Q3 2021 tech growth stocks by NAV

Net asset value, or NAV, equates to the value of a business or fund’s total assets minus its liabilities. The NAV is commonly used to measure the value of all the equity holdings in an exchange-traded fund (ETF), investment trust, or mutual fund.

So, here are some of the best tech growth stocks sorted by NAV today:

Cambium Networks Corp.

Cambium Networks sells wireless broadband solutions globally. Last month Cambium shipped the ten-millionth radio since it began a decade ago. It serves enterprises and small businesses from big cities to far-flung locations.

Last month Cambium Networks issued new shares for sale in a secondary public offering. These 2 million shares were priced at $48 each.

CMBM appears in 46 ETFs and its P/E is 32. Analysts 12-Month average share price target is $68.

Turtle Beach Corp.

See above in EPS Growth.

Rada Electronic Industries Ltd.

Rada Electronic Industries markets and sells defense electronics. Its primary focus is on radar solutions and legacy avionics systems.

These include military avionic systems, data recording for fighter and trainer aircraft, a range of head-up displays, and various ground debriefing solutions.

Rada received $32m worth of new orders in Q2, 2021, achieving year-over-year growth of 37% in the first half of this year.

The company has a P/E of 58 and analysts 12-Month average share price target is $17.

Ichor Holdings Ltd.

Ichor Holdings is another company operating in the semiconductor space. It supplies critical gas and chemical delivery subsystems to semiconductor equipment manufacturers.

In Q1, 2021, Ichor brought in revenues of $265 million. This was up 20% year-over-year and its eighth consecutive quarter of revenue growth.

With industry growth expected to continue, Ichor believes it is well-positioned for solid revenue growth and operational leverage.

Ichor has a P/E of 27 and 67 ETFs Hold ICHR stock and analysts 12-Month average share price target is $69.6.

Overstock.com Inc.

American retailer Overstock.com was founded in 1999. It is a widespread holding among institutional investors and appears in 71 ETFs.

Overstock.com sells home furnishings and has three main segments, namely Retail, tZERO, and Medici Ventures.

tZERO is its division gaining the most hype. It operates in the cryptocurrency/blockchain space, offering an alternative trading system (ATS) and tokens. There are rumors it will be sold or spun out via a SPAC.

Overstock.com has a P/E of 45 and doesn’t offer a dividend. Analysts 12-Month average share price target is $135.00.

#Conclusion

Investing in growth stocks is a popular investing strategy.

Growth investors tend to look for young or small companies with earnings they expect will rise at an above-average rate compared to industry peers and the sector as a whole.

Seeking out popular areas of growth or niche markets is a good starting point for investors looking for growth stocks.

For instance, the green revolution is putting demand pressure on the semiconductor industry. Meanwhile, AI, 5G, VR/AR, and machine learning are at the cutting edge of new niche developments.

Although some of these stocks are not young or small, they are operating in groundbreaking areas of technological development.