Polygon’s cryptocurrency token $MATIC continues to outperform other cryptocurrencies. In fact, the price of MATIC has risen 11,150% since the end of October, proving to be a fantastic success story out of India. So why is this? It sports real-world use cases and is being widely adopted by developers creating DeFi (decentralized finance), Dapps (decentralized apps) and NFTs (non-fungible tokens).

Ethereum, Bitcoin, Dogecoin and a few more popular coins, including Polygon, appear to be staging a volatile comeback after a crypto rout in mid-May. But Polygon is displaying strength and gaining popularity from some interesting investors.

#Ethereum bolt-on

The power of Polygon is that it bolts on to the Ethereum network effectively enhancing Ethereum’s blockchain capabilities. This is classed as a layer 2 protocol, giving developers a chance to create blockchain apps with increased speed and cheaper processing costs.

At the time of writing Polygon has an $11.5 billion market cap. This brings it in at number 15 on CoinMarketCap’s list of top cryptocurrencies sorted by market cap value.

#Mark Cuban invested

American billionaire entrepreneur Mark Cuban has openly invested in $MATIC and is singing its praises. That’s because since discovering Polygon he’s found he’s using it more and more. This includes adopting it for his website Lazy.com, where users can show off their NFT portfolios.

🔥 @mcuban is one of the most prolific and insightful investors with investments in top startups and he is also one of the Sharks on @ABCSharkTank.

🙌🏻 We’re proud to share that @0xPolygon is now part of the Mark Cuban company portfolio!

🌐 Visit: https://t.co/RZg0oIomFS

— Polygon (previously Matic) (@0xPolygon) May 25, 2021

Polygon $MATIC mentions Mark Cuban investment on Twitter

But that’s not all.

#What are DAOs?

DAO stands for decentralized autonomous organizations. It’s open source in nature and has the potential to provide a decentralized business model for commercial or non-profits. DAOs are created on Ethereum and increasingly on Polygon. Here lies another opportunity for the popularity of this network to soar.

Mark Cuban recently tweeted about DAOs, saying:

“The future of corporations could be very different as DAOs take on legacy businesses. It’s the ultimate combination of capitalism and progressivism. Entrepreneurs that enable DAOs can make $. If the community excels at governance, everyone shares in the upside. Trustless can pay”

He then went on to say:

“There are so many features and processes in any given company that can be more efficient and productive using a decentralized, trustless approach. As companies are built on this approach we will see some incredibly disruptive businesses built.”

The future of corporations could be very different as DAOs take on legacy businesses. It’s the ultimate combination of capitalism and progressivism. Entrepreneurs that enable DAOs can make $. If the community excels at governance, everyone shares in the upside. Trustless can pay

— Mark Cuban (@mcuban) May 31, 2021

Mark Cuban on DAOs

The amount Cuban has invested in Polygon remains a secret.

Polygon co-founder Sandeep Nailwal told CoinDesk:

“We have spoken to many investors but the discussion with Mark Cuban was truly mind blowing,”

#Polygon integrating with Google BigQuery

In addition to the Mark Cuban investment, Polygon’s distributed ledger is now available on Google’s BigQuery, giving it further credibility.

Google Cloud’s BigQuery data warehouse creates a highly scalable and affordable space for businesses to monitor their usage statistics and activity. This includes gas costs, smart contract calls, multi-chain analysis and much more.

Polygon integrated on Google Cloud – Photographer: Kai Wenzel | Source: Unsplash

Polygon’s datasets are now fully integrated on Google Cloud and available from the Google Cloud Marketplace. Users can access them from the public financial services category. This gives developers, data analysts, and crypto enthusiasts a clearer insight into the Polygon blockchain.

It will help analysts determine which applications, tokens and contracts are most active on Polygon.

Cheap and Fast

According to a MATIC network explorer, Polygon is processing over 6.1 million transactions a day. And the Polygon network has processed over 163 million transactions to date. It’s so much cheaper to use than Ethereum at only a few cents, compared to over $60 on Ethereum. Plus, the average block processing time on Polygon is around 2 seconds, whereas on Ethereum it’s 13.25 seconds.

The Polygon SDK framework supports chains like Plasma, Optimistic Rollups, zkRollups, and Validium along with its own Polygon Proof of Stake (PoS). There are now over 250 Dapps, 76 milion tokens and 790,000 unique users on the Polygon network.

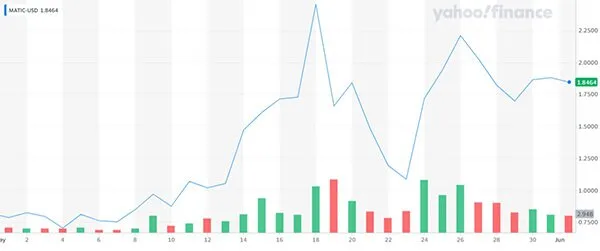

Polygon $MATIC price chart – Source: Yahoo Financ

Polygon’s supply is 10 billion tokens. So far there are 6.2 billion in circulation. Investors need to remember this because a large pool can dilute and suppress the price. Bitcoin was the original cryptocurrency and its ongoing appeal and high price lies in its limited circulation of 21 million coins.

As news of cryptocurrencies facing the threat of increased pressure from China sent investors into a panic, the result was May’s crypto dip. This could present an ongoing problem unless more certainty can be brought to the sector.

Nevertheless, with central banks now looking to adopt their own central bank digital currencies (CBDC) there appears to be a global shift into the world of crypto. As it stands MATIC appears to have a clear advantage with its ease of use, lower costs, and scalability.