Sponsored by: Canterra Minerals. Download the company’s latest investor overview.

#Copper Juniors Surge Ahead in 2025 Rally

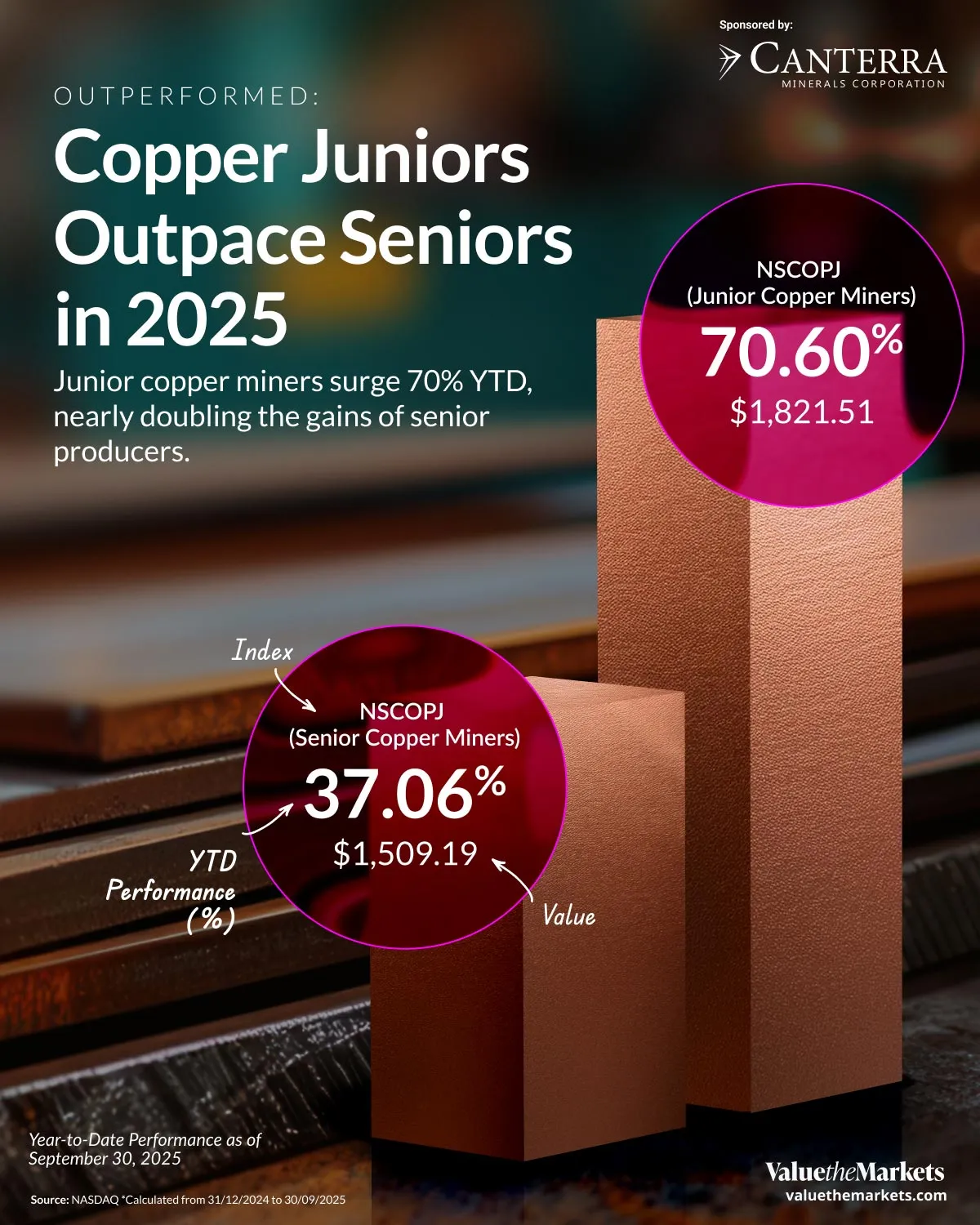

Junior copper miners are having a standout year. The Nasdaq Sprott Junior Copper Miners Index (NSCOPJ) has surged 70.6% year-to-date through September, nearly doubling the 37.1% return of the Nasdaq Sprott Copper Miners Index (NSCOPP), which tracks senior producers. While both indexes followed a similar path through Q1, the juniors began to separate from the pack in mid-April and have led ever since.

#Year-to-Date Performance as of September 30, 2025 | ||

| Index | YTD Performance (%) | Value |

| Nasdaq Sprott Junior Copper Miners Index (NSCOPJ) | 70.60% | $1,821.51 |

| Nasdaq Sprott Copper Miners Index (NSCOPP) | 37.06% | $1,509.19 |

Copper’s role in powering electric vehicles, renewable energy infrastructure, and data centers has driven bullish sentiment. But it’s the smaller-cap names, the juniors, that are leading the charge. These early-stage exploration and development companies are typically more volatile, but in a bull market, that risk often translates into higher returns.

#Why Copper Juniors Matter for Retail Investors

Stronger Upside Potential: Junior miners offer higher torque to copper prices. When the market moves up, juniors typically move further.

Exploration and Acquisition Targets: Many juniors hold high-quality copper assets that can become acquisition targets for larger miners, offering a potential premium for shareholders.

Early-Stage Access: Investing in juniors allows retail investors to access copper projects in earlier phases, before production ramps up and valuations increase.

Diversification Beyond Majors: Juniors provide exposure to different geographies, project types, and management teams, adding diversity to a mining-heavy portfolio.

Speculative But Informed Bets: With the right research, retail investors can identify juniors with strong balance sheets and high-potential projects, turning speculation into strategy.

#What’s Driving the Outperformance

The NSCOPJ’s 70.6% rally through September shows investors chasing stocks that move more dramatically than the market. Junior miners often climb faster when copper rises, but can also fall harder when it dips. As the chart shows, junior miners have consistently widened their lead over seniors since spring, signaling a shift in where capital is flowing within the copper mining space.

Unlike senior miners, which are often valued based on cash flow from existing operations, juniors are valued on potential. As copper prices push higher, market interest naturally rotates into smaller players that can expand or be acquired.

Recent exploration results, permitting progress, and offtake agreements have also helped boost sentiment around several junior names in the index. For investors willing to stomach the volatility, this segment has become a preferred way to ride the copper rally.

#What Retail Investors Should Watch

Funding Momentum: Junior miners often raise capital to advance projects. Well-structured financings can strengthen balance sheets and position companies for growth.

Project Progress and Jurisdiction Advantage: Exploration-stage assets take time to develop, but successful permitting and stable jurisdictions can add long-term value.

Commodity Cycles: Copper prices move in cycles. Juniors tend to amplify the upside, offering outsized returns during bull markets.

M&A Catalysts: Rising merger and acquisition activity could unlock premiums for shareholders as larger miners look to acquire high-quality junior projects.

Index Leaders: Tracking the holdings of NSCOPJ helps investors spot which juniors are driving performance and gaining market attention.

#Canterra Minerals Expands Exploration in Newfoundland Copper-Gold Belt

Canterra Minerals Corp. (TSX-V: CTM) (OTCQB: CTMCF) has reported a series of impressive shareholder updates recently, most notably high-grade copper success at its Clementine prospect, along with the latest prospecting results from its Wilding Gold Project. Wilding adjoins Equinox Gold's Valentine Mine, encompassing 55 km of the gold-bearing corridor that hosts Equinox’s new mine in the central Newfoundland Mining District.

Clementine Prospect Initial Highlights Include:

1.72% CuEq over 16m, including 3.15% CuEq over 2m

2.64% CuEq over 3m, including 4.02% CuEq over 1m

Confirms high-grade, classic Buchans-style mineralization in an underexplored area

Results include gold and silver credits, which are common in Buchan-style mineralization

Expands prospectivity south of the prospect where newly generated 3D IP geophysical anomalies identify priority targets for follow-up drilling.

Wilding Gold Project Highlights include:

Exceptionally high-grade results, exceeding 500 g/t Au, were found around the original discoveries. These are the highest-grade gold results ever reported on the project, confirming the strength of the Wilding gold system and comparing favourably with top intercepts from adjacent deposits at Valentine during its exploration phase.

6 g/t Au 14km from the original discoveries

1 g/t Au 4km further demonstrates strong gold mineralization across the 55km strike length Wilding covers

Canterra’s position in this emerging district places it early in the exploration cycle, as Newfoundland experiences renewed interest driven by recent high-grade gold discoveries. With backing from known mineral investors Eric Sprott and Michael Gentile, Canterra Minerals is consolidating Newfoundland’s copper-gold potential.