#Asset Performance Snapshot: Who’s Ahead, Who’s Lagging

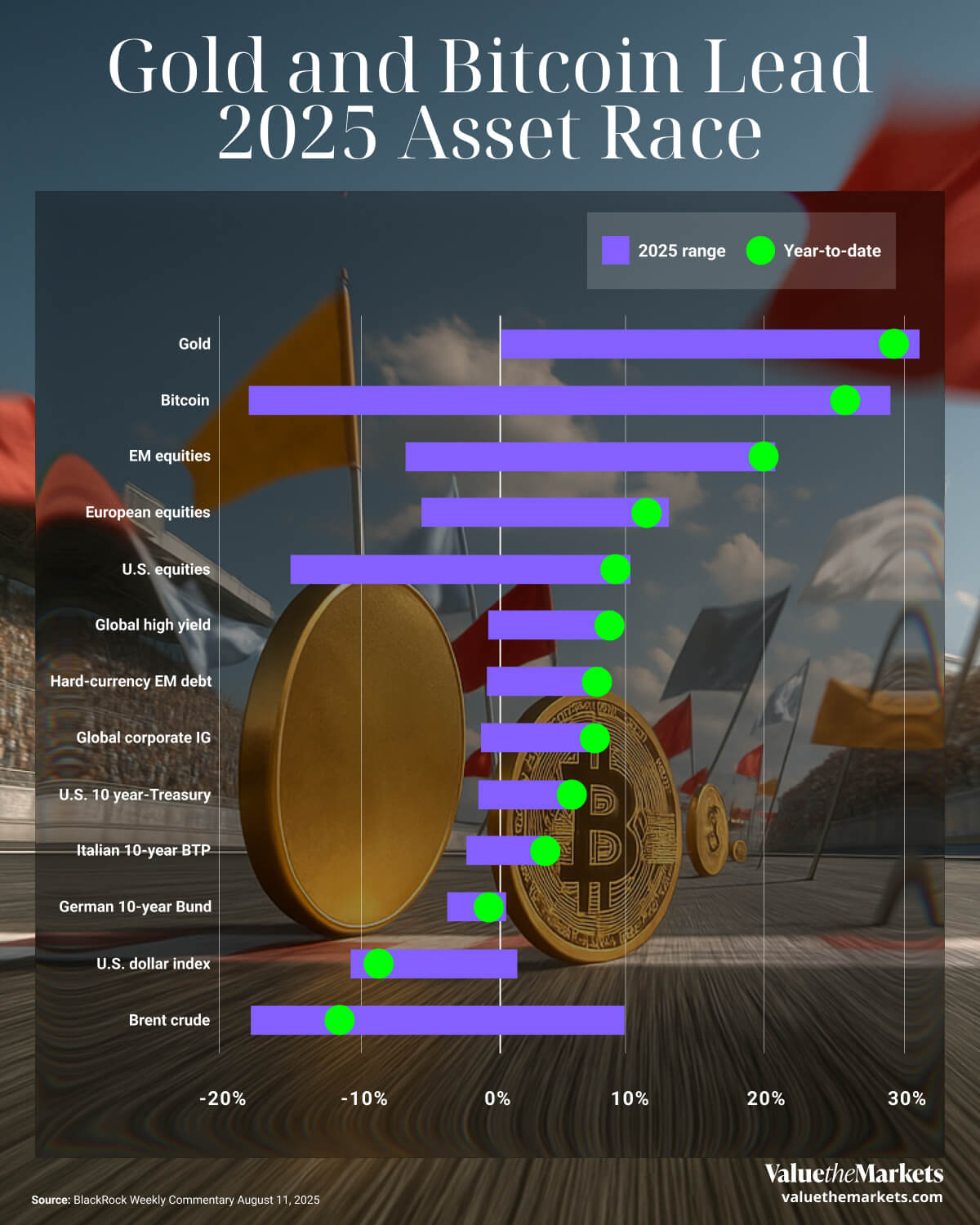

So far in 2025, two assets stand out from the rest: gold and Bitcoin. Both have delivered the highest year-to-date returns across a wide range of asset classes. Gold, often seen as a safe haven during market uncertainty, is leading the pack, with Bitcoin not far behind. But these returns have come with volatility.

For retail investors, this snapshot offers more than just bragging rights for crypto and commodity bulls. It demonstrates how a diversified portfolio, one that includes alternatives beyond stocks and bonds, is performing well in an environment that still feels uncertain.

Who really owns Bitcoin? Check out its fascinating ownership trends

| Asset | YTD Return (approx) 2025 | Range (approx) |

| Gold | 30% | 0% to 31% |

| Bitcoin | 26% | -19% to 30% |

| EM Equities | 20% | -7.7% to 20% |

| European Equities | 11% | -7% to 11.3% |

| U.S. Equities | 8% | -15.5% to 9% |

| Global High Yield | 7.9% | -1% to 7.9% |

| Hard-currency EM Debt | 7.7% | -1.4% to 7.7% |

| Global Corporate IG | 7.7% | -1.6% to 7.7% |

| U.S. 10-Year Treasury | 5% | -1.6% to 5% |

| Italian 10-Year BTP | 2.4% | -2% to 2.4% |

| German 10-Year Bund | 0% | -3% to 0.5% |

| U.S Dollar Index | -9% | -10% to 1% |

| Brent Crude | -10% | -18% to 10% |

#Why This Matters for Retail Investors

Alternative assets are delivering while traditional assets lag.

Volatility is a major factor; timing and risk management are crucial.

Non-US equities are outperforming US equities so far in 2025.

Fixed income assets have delivered relatively modest returns so far in 2025, offering stability but limited upside in the current environment.

Dollar weakness and falling oil prices may impact inflation expectations and global trade exposure.

#Gold and Bitcoin: Strong Returns, Big Swings

Gold’s year-to-date return is the highest among all assets shown, with Bitcoin ranking second. But both have experienced wide ranges in 2025. The gap between their lowest and highest returns highlights just how volatile these markets can be. Bitcoin, in particular, saw a deep drawdown earlier in the year before recovering. For gold, persistent geopolitical uncertainty and falling real yields may be driving demand.

For investors, the takeaway is clear. Exposure to alternative assets like gold and crypto has been beneficial this year, but these aren’t “set-and-forget” plays. Risk control, position sizing, and understanding entry points are key to market success.

Read more about the gold price and how it’s sustained a steady uptrend over the past five years.

#Global Equities Are Beating US Stocks

Some international equity markets, including emerging markets and Europe, are currently outperforming U.S. stocks, pointing to the benefits of global diversification. That’s notable, especially given the strong US market dominance in recent years. The chart suggests global diversification is rewarding investors who look beyond domestic markets.

Emerging market equities, despite being volatile, are showing better year-to-date returns than US equities. European stocks are also ahead. These moves suggest global growth pockets or valuation gaps are being recognized and capitalized on.

Retail investors focused solely on US stocks may be missing out. That’s because a more globally balanced equity strategy is paying off in 2025.

#Bonds Are Offering Stability, Not Growth

Fixed income assets like Treasuries, investment-grade corporate debt, and emerging market bonds are all hovering around low single-digit returns. Their ranges are narrow, meaning they’ve seen little price movement throughout the year.

This stability might be attractive for income-focused investors, but it also highlights a lack of upside. If rate cuts stall or inflation remains sticky, fixed income could struggle to deliver meaningful gains. For bond-heavy portfolios, reinvestment strategy and credit quality selection will matter more in the second half of the year.

#Oil and the Dollar Are Lagging

Oil and the U.S. dollar have shown weaker performance compared to other major asset classes in 2025. Crude has posted negative returns, and the dollar index is slightly underwater. This underperformance could affect sectors tied to global demand, energy, and imports.

For retail investors, it also suggests inflationary pressures could be easing slightly. A weaker dollar can support international returns for US investors but may signal economic softness.

Explore the four layers of crypto investing, from pure plays like Bitcoin to companies shaping the future of blockchain infrastructure and adoption.

#FAQs

Is gold still a safe investment in 2025?

Yes, gold is performing well this year. It remains a strong hedge during uncertain periods but can be volatile in short timeframes.

Why is Bitcoin doing well despite volatility?

Bitcoin rebounded from earlier losses. Increased institutional adoption and macro uncertainty are likely boosting demand.

Should I shift away from US stocks?

Not necessarily, but diversifying into international markets has shown better returns so far in 2025. A global mix could help balance risk.

Are bonds still worth holding?

Yes, for income and diversification. But don’t expect much capital appreciation this year unless rates fall sharply.

What does oil’s decline mean for inflation?

Falling oil prices could ease inflation, but this depends on broader economic trends. It might also impact energy sector earnings.