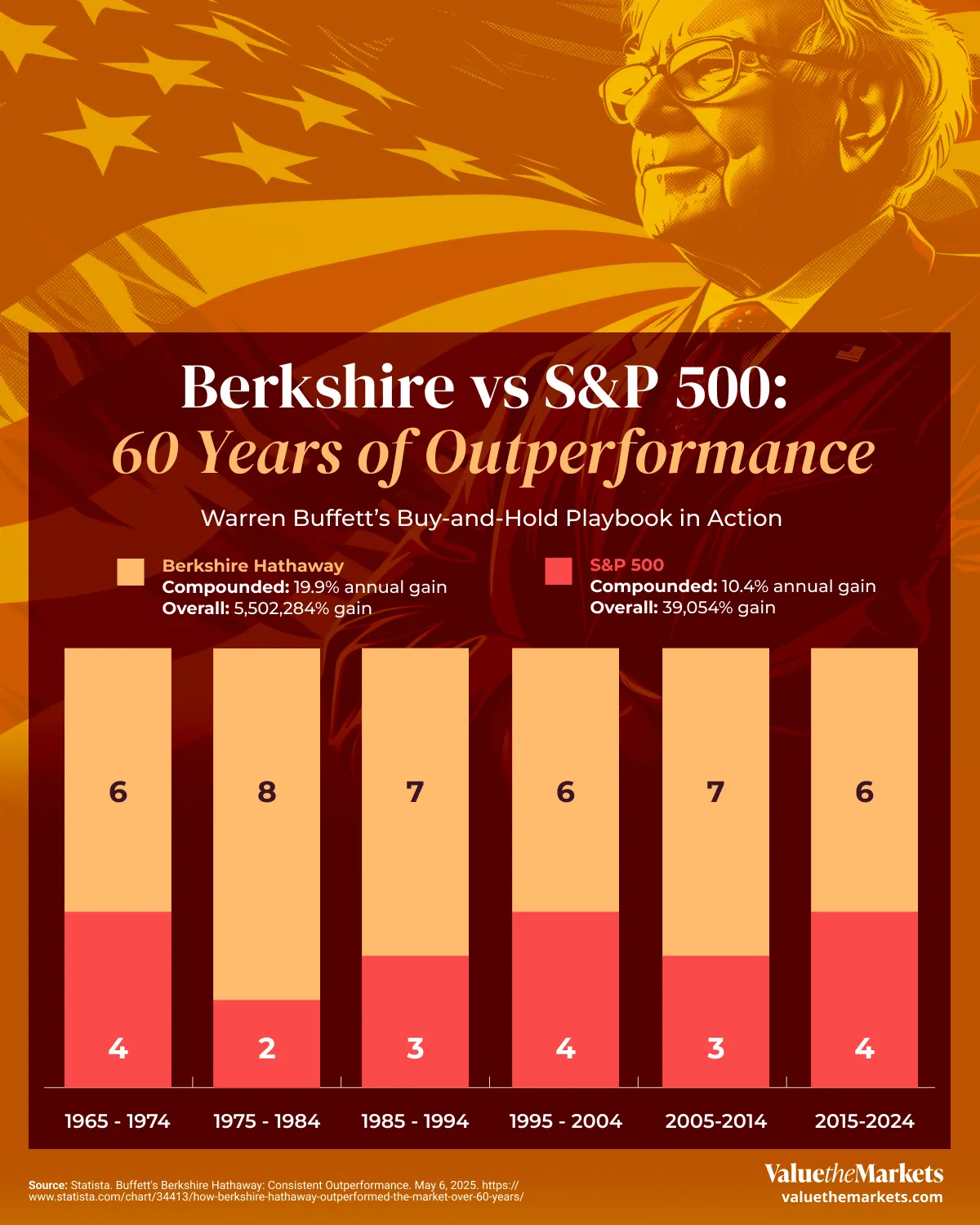

Berkshire Hathaway stock performance is one of the clearest examples of disciplined, long-term investing in modern financial history. From 1965 through 2024, Berkshire Hathaway delivered a compounded annual return of 19.9%, almost double the S&P 500’s 10.4%. This historical return shows why many retail investors compare Berkshire Hathaway vs the S&P 500 as a benchmark for long-term growth.

#Why Berkshire Hathaway Outperformed the Market

Warren Buffett built this performance by focusing on business fundamentals, not market trends. Berkshire Hathaway’s investment strategy has always centered around buying companies with durable competitive advantages, predictable cash flows, and strong management. This approach powered the compounded returns investors enjoyed for decades.

Here’s what made it work:

Business Quality Over Stock Price

Buffett didn’t chase momentum. He invested in businesses like Coca-Cola (NYSE: KO), American Express Co (NYSE: AXP), and later Apple (NASDAQ: AAPL), strong brands with pricing power. These Warren Buffett stock picks weren’t necessarily exciting picks at the time, but they had pricing power, brand strength, and strong returns on capital, all the while delivering consistent results.

Reinvested Cash Flow

Despite being a trillion-dollar stock, Berkshire doesn’t pay a dividend. Instead, it uses its operating profits to buy new businesses and add to existing holdings. This has undoubtedly helped BRK.A and BRK.B stock grow steadily over time, with no dilution and no need for outside funding.

Low Turnover, Low Costs

Unlike many mutual funds, Berkshire Hathaway avoided excessive trading. This minimized taxes and transaction fees, helping to compound gains more efficiently. Uninterrupted market exposure lets gains earn gains, turning good years into great decades as Buffett has consistently proven.

Insurance Float as Investment Capital

Berkshire’s insurance operations, including GEICO, generated float, money collected from premiums before claims were paid. That float was invested in stocks and businesses, essentially giving Berkshire Hathaway free capital. This float strategy became a core part of how Buffett invests in stocks.

#How You Can Use the Same Principles

You may not have billions of insurance float or the ability to buy whole companies, but the principles are accessible. Here’s how you can apply lessons from Berkshire Hathaway’s stock strategy:

Focus on quality companies with real competitive advantages

Hold through cycles instead of reacting to market noise

Let compounding work by reinvesting your profits and dividends

Avoid high-fee strategies or frequent trades

Think in decades, not quarters

Ask yourself, is your portfolio designed to grow steadily like Berkshire Hathaway Class B shares, or is it reacting to daily headlines?

#Berkshire Hathaway’s Performance Over Time

Berkshire Hathaway outperformed the market in 40 out of the past 60 years. That includes periods when it lagged the S&P 500, such as during speculative tech booms. But over time, the results speak for themselves:

Total return, 1965 to 2024

Berkshire Hathaway: 5,502,284%

S&P 500 with dividends: 39,054%

Few companies have matched the historical returns of Berkshire Hathaway stock over time. That’s why many investors still ask, is Berkshire Hathaway a good investment?

#What's Next for Berkshire Hathaway

With Warren Buffett stepping down and Greg Abel becoming CEO, many are watching how the Berkshire Hathaway portfolio will evolve. Abel has been involved in operations for years and is expected to follow the same value-investing philosophy. Berkshire Hathaway holdings in 2024 still reflect Buffett’s approach, focusing on solid businesses over speculative growth.

Investors reading the annual shareholder letter from Berkshire Hathaway often look for clues about long-term direction. But the core strategy hasn’t changed: buy smart, hold patiently, and let compounding do the work.

If you’re wondering how Berkshire Hathaway beat the market, or how to apply those lessons to your investing, start by focusing less on stock charts and more on the quality of businesses you own.