Amazon (NASDAQ:AMZN) needs no introduction. We all know it and we either love or hate it. Memberships in both camps are strong but with a soaring share price, it seems the love of Amazon outweighs the hate.

Is Amazon a good investment in 2021? – Photographer: Christian Wiediger | Source: Unsplash

#From bookseller to everything store

In its infancy, it was an online bookseller. And this was at a time when books were already going out of favour. Since then, it pioneered the kindle, a way to digitally enjoy books without having to cart them around. And it did the same thing with audio books. There was no big announcement, fanfare or warning that these life-enhancing products were coming, they just gradually crept into our existence and have become integral to many everyday lives.

In essence, Amazon has kept the love of reading, and the joy of books, alive and kicking into the 21st century. And of course, we can still buy physical books, both new and used and have them delivered to us within a few hours.

But aside from its hold on the book industry. Amazon has come to dominate our lives in a multitude of other ways. Through its Amazon Web Services arm, it helps power millions of websites and businesses we interact with on a daily basis. Its AWS cloud computing unit was flourishing even before the pandemic stepped it up a gear. With businesses speeding up digitalization, remote capabilities and the rapid transition into enhanced tech, AWS has been happy to oblige.

In fact, Amazon Web Services is the biggest part of its business now, and it brings in a steady stream of revenue to help power the company’s other innovations.

Take its Alexa technology. Based on a mixture of machine learning and artificial intelligence, Alexa is built into many of Amazon’s tech offerings from the Firestick to the Kindle, as well as the actual Alexa devices. And it’s designed to bring entertainment into our lives seamlessly. Playing a song, reading a book, ordering shopping. All activated by the power of speech.

.@Alexa99, where can I get a COVID-19 vaccine? ?

Alexa can now help find a vaccination site near you. https://t.co/YRwDKAdhPp pic.twitter.com/dWyWTwGEca

— Amazon (@amazon) April 21, 2021

Alexa, where can I get a Covid-19 vaccine?

#Prime time

Amazon’s Prime subscription business offers so many perks it’s hard for users to give up. Unlike Netflix (NASDAQ: NFLX), which is simply streaming TV, Amazon’s subscription service also includes a music service to rival Spotify (NYSE:SPOT), next day parcel delivery and even Kindle books.

Amazon Fire TV

For instance, Amazon Prime is investing heavily in top quality content. Not just run-of-the-mill reality TV, but truly addictive, immersive TV. It’s paying over $465m to make a Lord of the Rings TV series to rival Game of Thrones. That’s a big outlay, but the rewards could bring in multiples of that sum for many years to come. And unlike Netflix, it doesn’t include all its offerings in the subscription cost. Therefore, users must pay extra to watch a lot of additional content on its servers.

It’s moving into healthcare and prescription drug distribution, with its online pharmacy division.

And to stay ahead in the ESG environment, Amazon is joining forces with electric vehicle maker Rivian to power an electric van fleet. Plus, it’s got its drones in training to take parcel delivery to a new level.

There’s a new vehicle delivering smiles in San Francisco!

Keep an eye out for the electric delivery vans coming to 16 cities in 2021. #ClimatePledge pic.twitter.com/swH7GnRreP

— Amazon (@amazon) March 22, 2021

Amazon electric van fleet

And it’s commandeering the British high street, just as it has contributed to forcing traditional retailers to close their doors.

Then there’s its foray into groceries. It’s teamed up with Morrisons (LON:MRW) in the UK and it’s cornering the health food market with its Whole Foods acquisition in the US.

Amazon’s cashless grocery stores are the future of convenience store shopping. Big Brotheresque in their design, but accessible and easy to use, just like all Amazon’s best products so far.

Amazon Dash Cart ?

No checkout lines ⏳

Amazon Fresh’s seamless shopping ??: IG/itsmelgracee pic.twitter.com/bSW6QAyJrc

— Amazon (@amazon) February 23, 2021

Cashless Grocery Store – Amazon Fresh

There are so many strings to Amazon’s bow, it’s hard to keep track of them all. But what impresses investors is the way it’s kind of sneaked up on us with many of its creations.

Ordering groceries on a subscription basis is convenient and simple. It can be set up once, with the click of a few buttons, and a big box of goodies arrives at the door each month. Cancelling or exchanging products is also surprisingly simple and satisfying.

The pandemic has been driving contactless payments, and Amazon is responding with its Amazon One payment system. This allows customers to link the palm of their hand with their payment card and future shopping trips mean they can pay with their palm! It can be used with or without the perks of Prime. So far it’s just being trialled in Seattle, but may well become a part of everyday life.

#Risks to Amazon shareholders

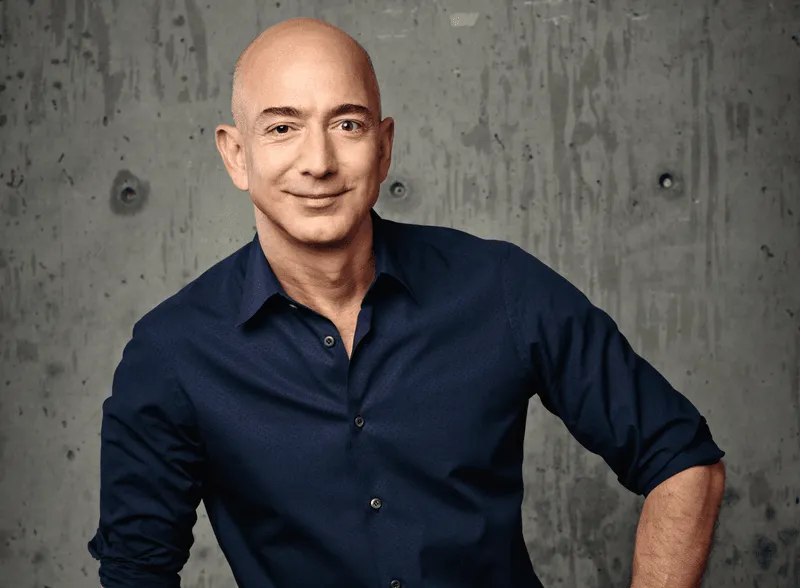

There are some risks to investing in Amazon. It has come under fire for how it treats employees and the way it displaces smaller businesses. The regulators are taking a closer look and CEO Jeff Bezos is stepping down to focus on his Blue Origin space business. Does this mean its light is dimming? Not necessarily.

Jeff Bezos, Amazon CEO steps down

Amazon is now a mature business, at a new point in its evolution, but with so much cash at its disposal and infinite insight into our lives, it may continue to innovate and infiltrate our existence for many years to come. There’s not some nefarious world domination plan in the works, it’s simply next-level capitalism.

The pandemic poses a risk to all companies. It’s not yet under control in many countries, and the economic impact it’s leaving on the US and UK is profound. Many believe inflation is not far off, while others think it will be years, if ever, before interest rates are hiked. It stands to reason if consumers have less to spend, then Amazon will suffer. But it’s quick to adapt and better positioned to weather the storm than many of its counterparts.

Amazon delivery driver

Competition improves productivity, encouraging innovation and new ideas. A monopolistic company can destroy that and give one entity the power to raise prices and abuse their position of control. There’s already an element of manipulation in the way Amazon apparently tricks non-prime users into signing up. And it’s one-click ordering although convenient when intended, can lead to accidental purchases in the hands of children or less tech savvy consumers. This leaves a bad taste and louder calls for regulation.

Nevertheless, Amazon is not as monopolistic as one might think. Other than in AWS which even serves the US military as a customer, its other areas of business still have considerable competition.

Amazon’s share price may fall if the S&P 500 slides, but it wouldn’t be the first time. The Amazon share price has had many peaks and troughs over the years, but overall, it’s climbed.

#Amazon’s financial ups and downs

After the Dot-com bubble burst in 1999, Amazon shares plunged nearly 95%! And didn’t begin their recovery until late 2001. They fell again between 2003 and 2006. But any shareholders that sold during this time will be kicking themselves. Because for the last 11 years, Amazon shares have been enjoying a bull run like no other.

Amazon share price chart 2 year Yahoo Charts $AMZN

The pandemic has taken its toll on many S&P 500 companies, but the Amazon share price soared 71% in 2020. It’s up 4.8% year-to-date. Yet despite this impressive streak, it lagged many other big tech growth names, in what was undoubtedly a sensational year for US tech stocks.

Nevertheless, its returns haven’t disappointed. Sequential growth in AWS international climbed from 33% in Q3 to 50% in Q4. That was due to the UK and European lockdowns driving e-commerce. The US results were less marked.

Amazon now has a $1.68 Trillion market cap, earnings per share are $47.46 and its price-to-earnings ratio is above 70.

Of course, at over $3,340 a share, this is not an affordable stock. But thanks to apps like Robinhood, Trading 212 and others, retail investors can buy fractional shares, which levels the investing playing field.

Now, it’s no longer a start-up with obvious growth opportunities ahead. But that doesn’t put everyone off because that’s the thing about Amazon, its growth opportunities have never been obvious. In fact, there are times in the past Amazon looked like it could fail.

#Q1 Earnings Call 2021

Amazon’s Q1 earnings call will take place on April 29. Fellow FAANG stock Netflix (NASDAQ: NFLX) disappointed investors last week with its underwhelming Q1 results. So, will Amazon also disappoint?

Analysts expect Q1 revenues to top $100 billion. Amazon is now the third biggest digital advertising stock after Google-owned Alphabet (NASDAQ: GOOGL) and Facebook (NASDAQ: FB).

Company sales climbed 38% last year to an almighty $386 billion. Clearly buoyed by the pandemic, this was its strongest top-line growth since 2011’s 40% jump. Is it really possible for this kind of momentum in revenues to continue?

Analysts speculate if Q1 revenues come with the growth of anything under 30%, it will disappoint.

But optimism prevails. Wall Street analysts estimate Amazon’s FY21 sales to soar another 23%, equating to a further $87 billion, reaching $472.8 billion and an earnings hike of 18%. These are phenomenal numbers, but Amazon massively beat the Wall Street consensus for the past three quarters on both the top and bottom lines, so investors have reason to be hopeful.

The stock closed Friday nearly 6% below its 52-week high so shareholders could be exercising that hopeful streak with further investment.

Whether the Q1 numbers are good or not is largely irrelevant, as it’s the future outlook that really matters going forward. What will the strategy look like without Bezos at the helm, and can growth momentum continue once the pandemic is reigned in? All this remains to be seen, but there’s no doubt Amazon is a force to be reckoned with.